News > Singapore Property Market Snapshot - July 2024

Singapore Property Market Snapshot - July 2024

15 August 2024

Another month of record-breaking transactions that set unprecedented heights for HDB resale price: $1.73 million for a 5-room flat at SkyOasis @ Dawson and $1.54 million for a 5-room flat at The Pinnacle@Duxton. What else happened in July 2024? Explore below:

Hot Topics in Singapore Property Market July 2024

1. Singapores Private Home Rentals Decline for Third Quarter, Market Shows Signs of Stabilisation.

Singapores private home rentals have declined for the third consecutive quarter, with a 0.8% drop in the second quarter of 2024. The rental market may be showing signs of stabilisation as demand is expected to improve. Despite slower growth in private housing prices, resale transactions are on the rise. Analysts predict stable growth in home prices for the rest of the year, with major projects expected to boost sales volume. Read more >>

2. HDB Resale Prices Expected to Surge by Up to 8% in 2024.

Resale flats over 40 years old see record transactions, driving market growth. Older flats gaining popularity with narrowing price gap compared to newer units. Demand for larger resale flats remains strong despite price increases. Experts predict up to an 8% price growth this year will be fuelled by robust demand and market conditions. Read more >>

3. Surge in Singapores HDB Transactions Exceeding $1.5 Million Mark Signals Rising Prices and Limited Availability in Prime Locations.

Singapore enters the era of $1.5 million HDB flats, with a surge in transactions surpassing this mark. Notable sales include units in Tiong Bahru, The Peak @ Toa Payoh, Natura Loft, and Pinnacle@Duxton. These high-priced flats are often located in mega-developments, centrally situated, and offer limited availability. Read more >>

4. HDB takes strict actions against lease infringements to maintain integrity of public housing.

HDB took back around 70 flats from 2019-2023 due to lease infringements, including breaking minimum occupation period rules and unauthorised rentals. In about 800 cases, actions ranged from warnings to fines up to S$50,000. Severe infringements led to compulsory acquisition of properties. Read more >>

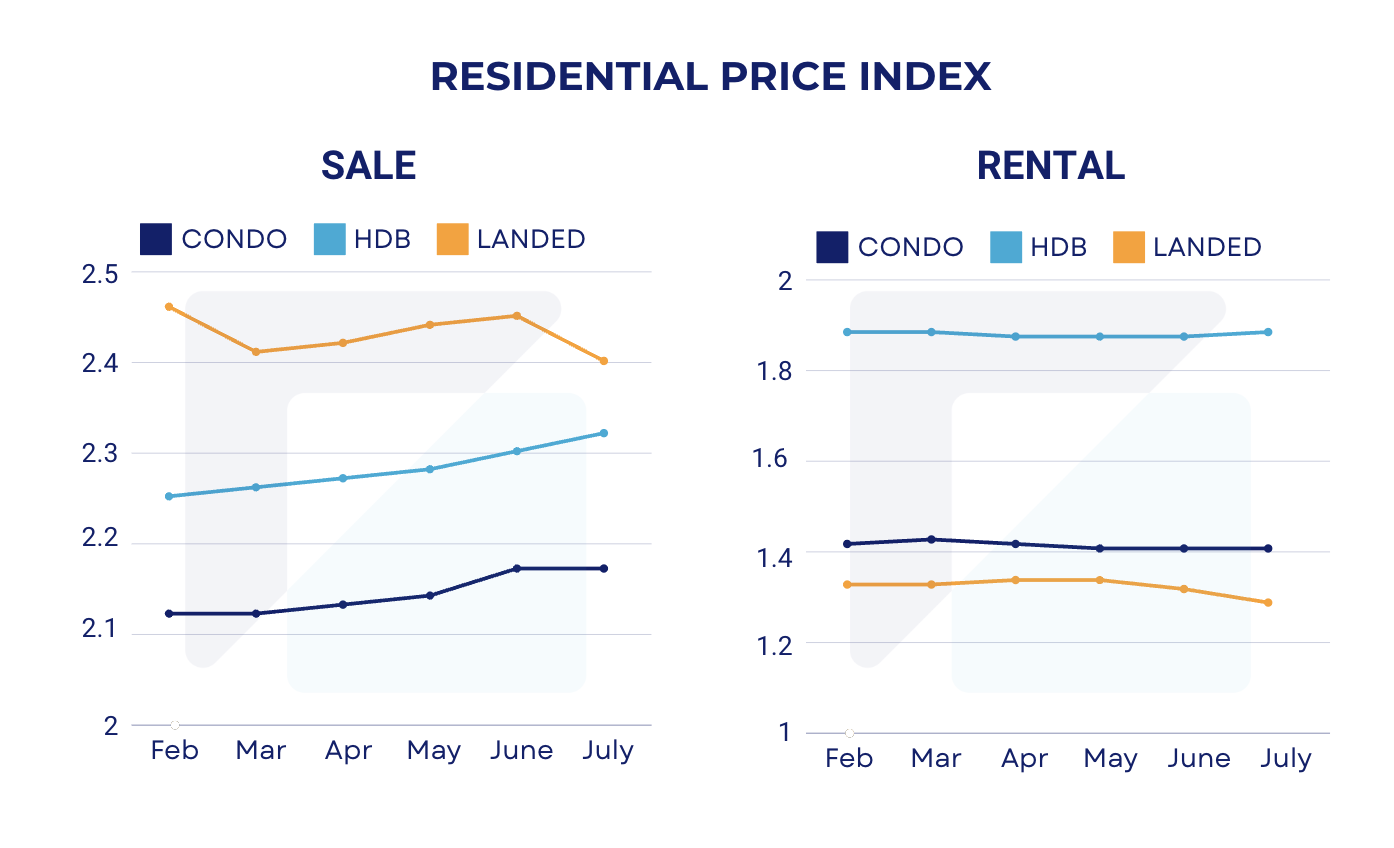

Price Indexes

*Index value is 1 at year 2008

Price Indexes shown are powered by REA Property Price Index - an accurate and objective indicator of the real estate market performance. Read more about our index here .

1. Residential Price Index

2. Commercial Price Index

New Launches in July 2024

1. Kassia (Launched 20 July 2024)

Location: 31 Flora Drive, D17

TOP: 2029

Tenure: Freehold

Number of units: 276

Price range: S$1,851 ~ S$2,058 PSF

Image: Kassia Condo @ Flora Drive. Source: https://kassiacondos.sg/

2. Sora (Launched 7 July 2024)

Location: 9A Yuan Ching Road, D22

TOP: 2028

Tenure: 99-year

Number of units: 440

Price range: S$2,035 ~ S$2,308 PSF

Image: Sora Condo. Source: https://soraofficial.homes/

Residential Snapshot

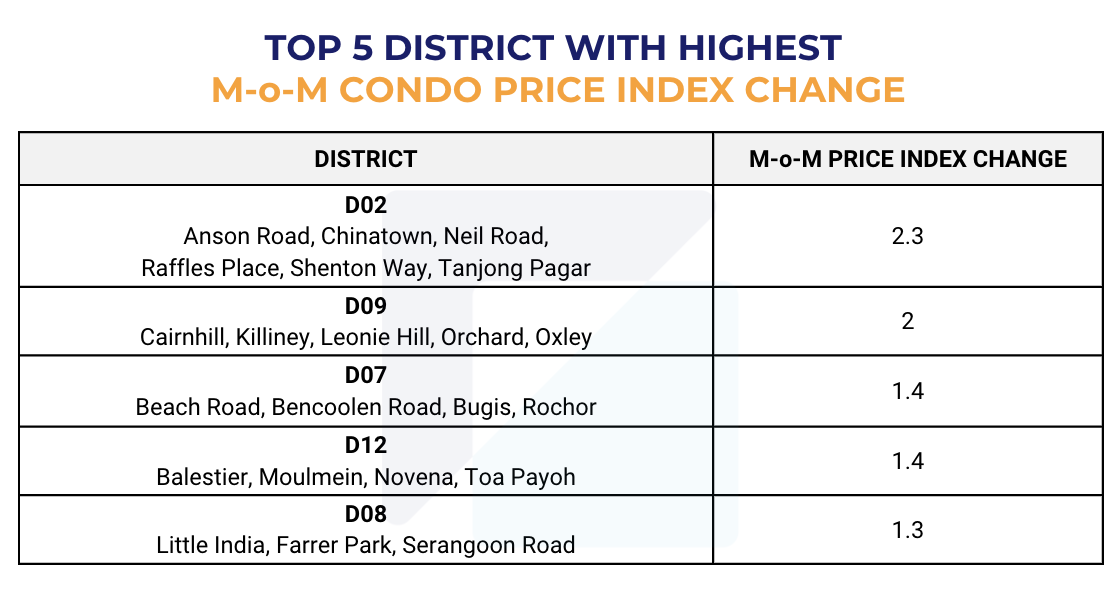

1. Top 5 Districts with highest Month on Month (M-o-M) Index Change

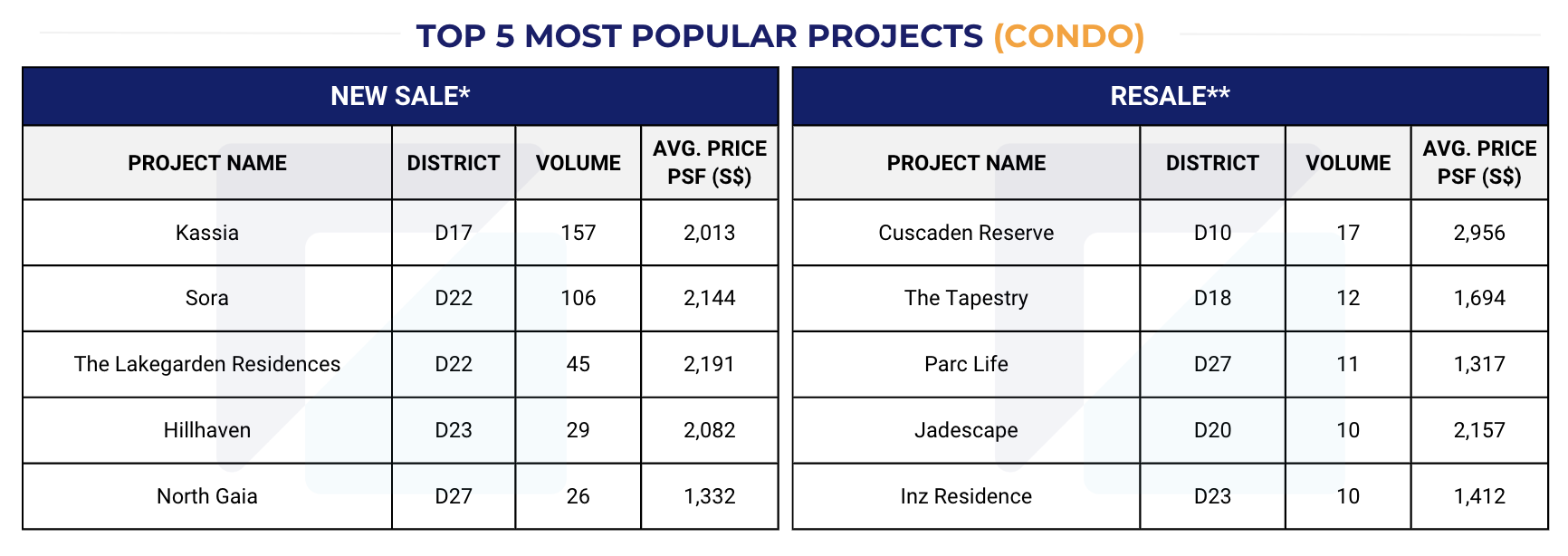

2. Top 5 most popular projects (Condo) in July 2024

*New Sale: The sale of a unit direct by a developer before the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

**Resale: The sale of a unit by a developer or subsequent purchaser after the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

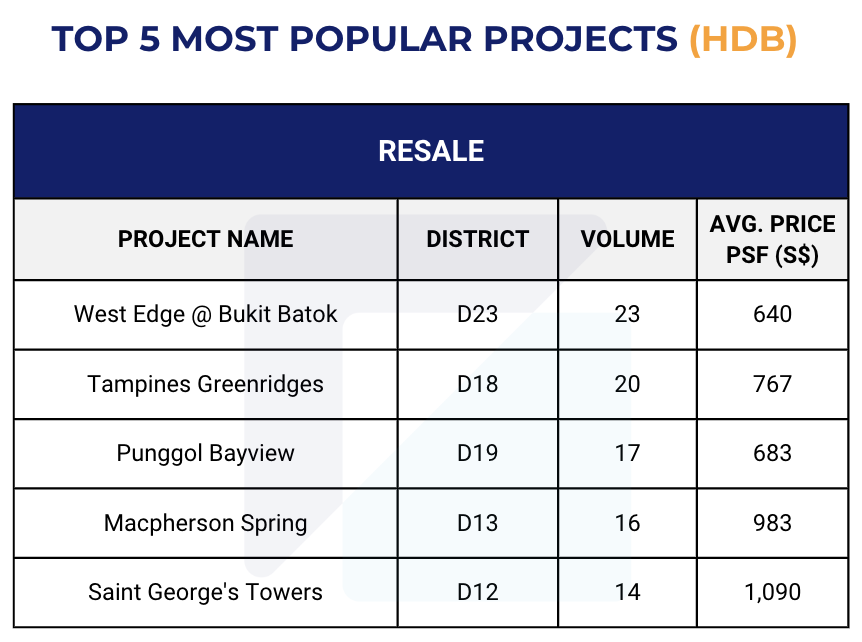

3. Top 5 most popular projects (HDB) in July 2024

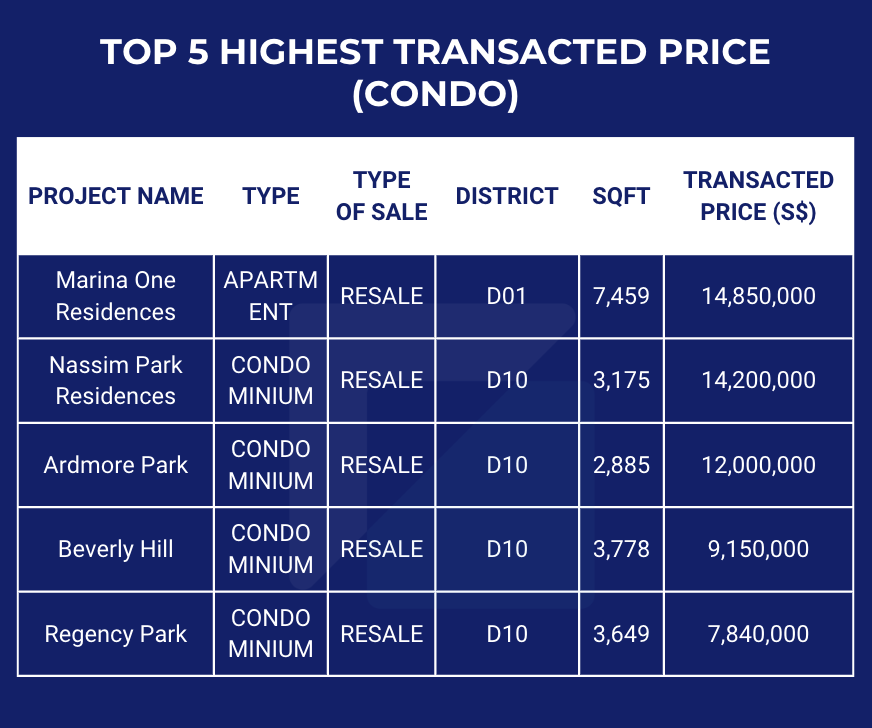

4. Top 5 highest transacted price (Condo) in July 2024

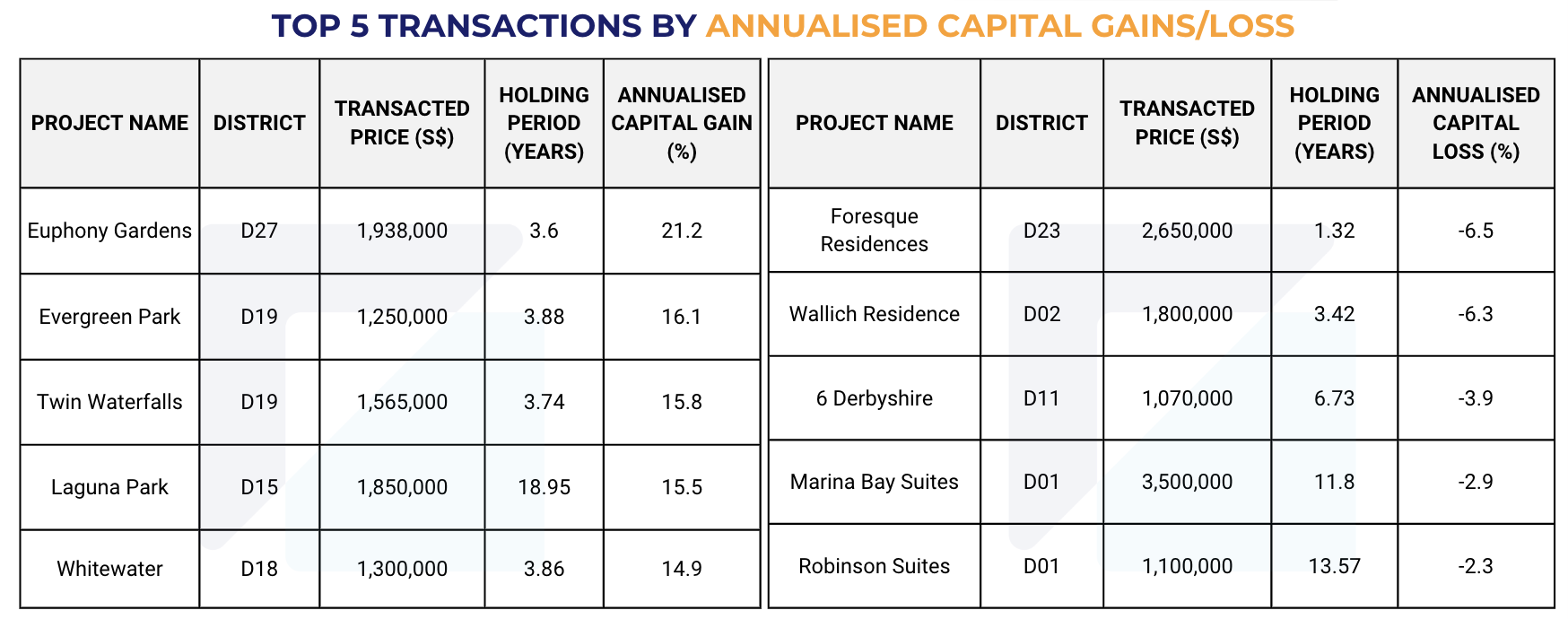

5. Top 5 Transactions by Annualised Capital Gain/Loss in July 2024

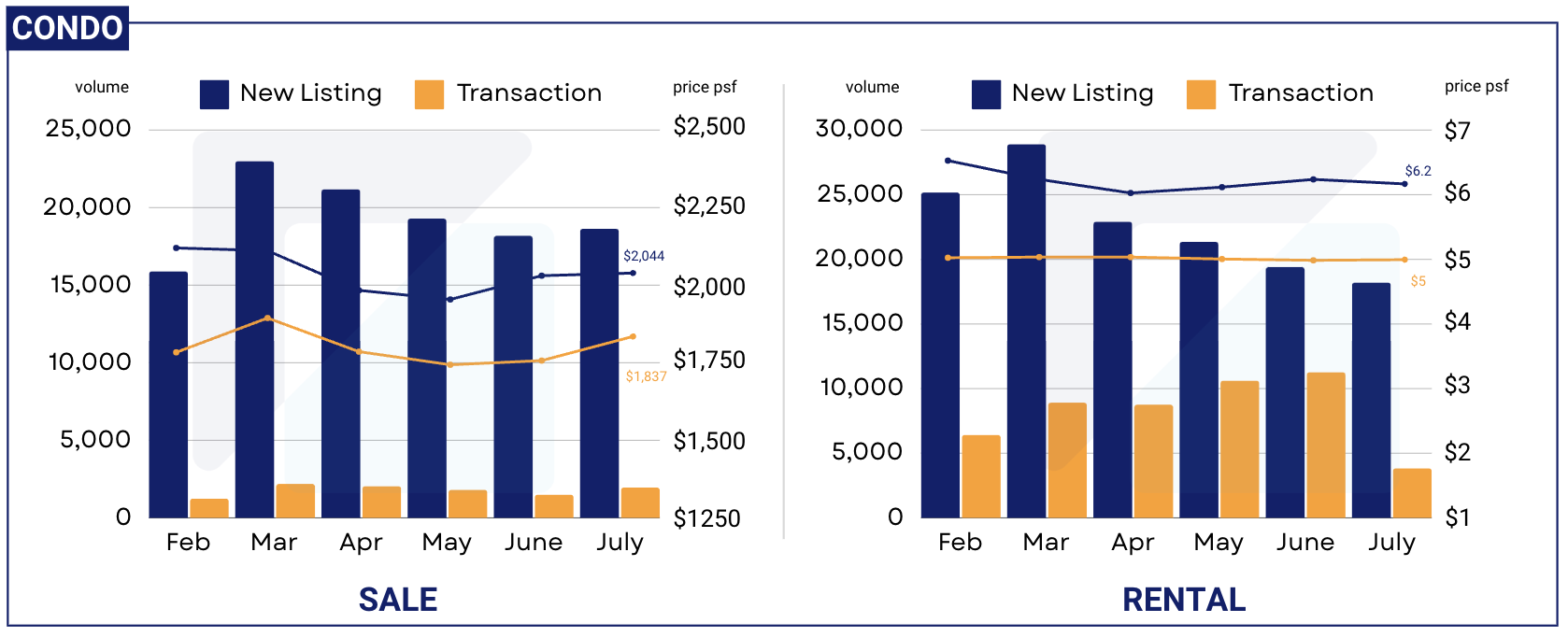

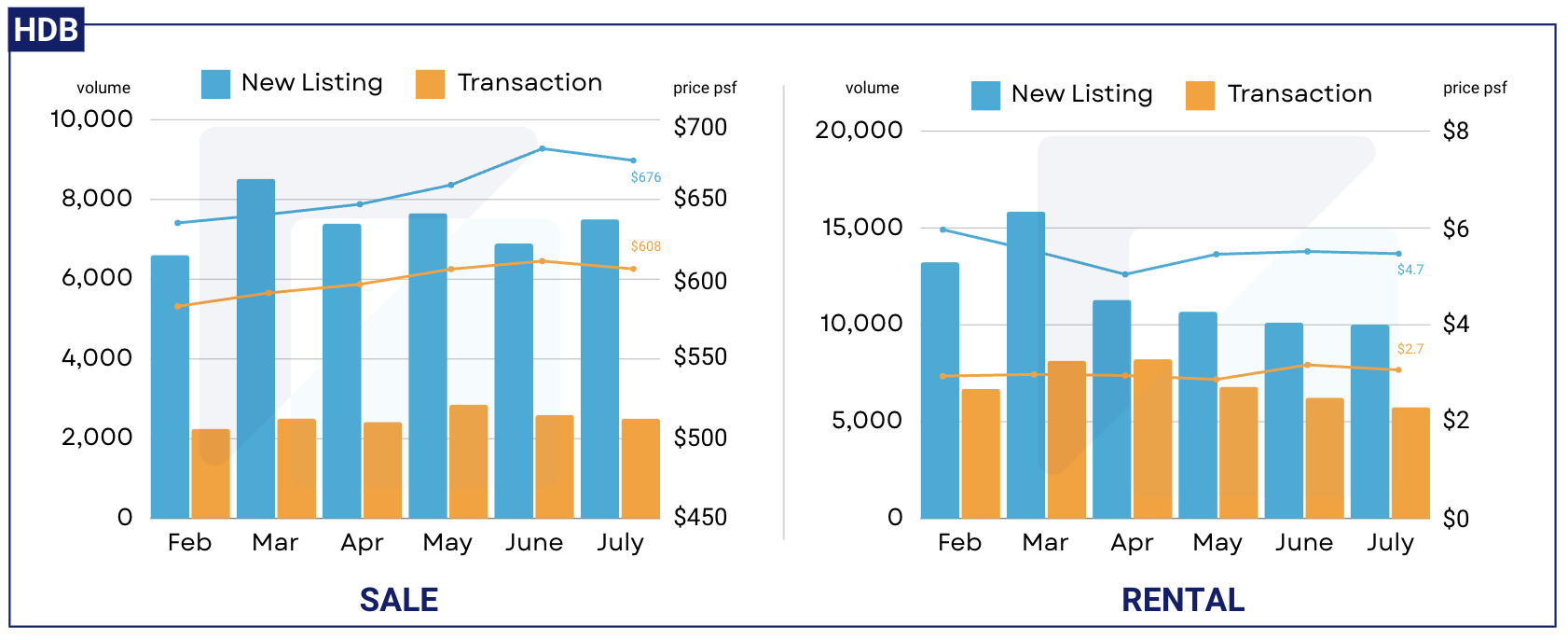

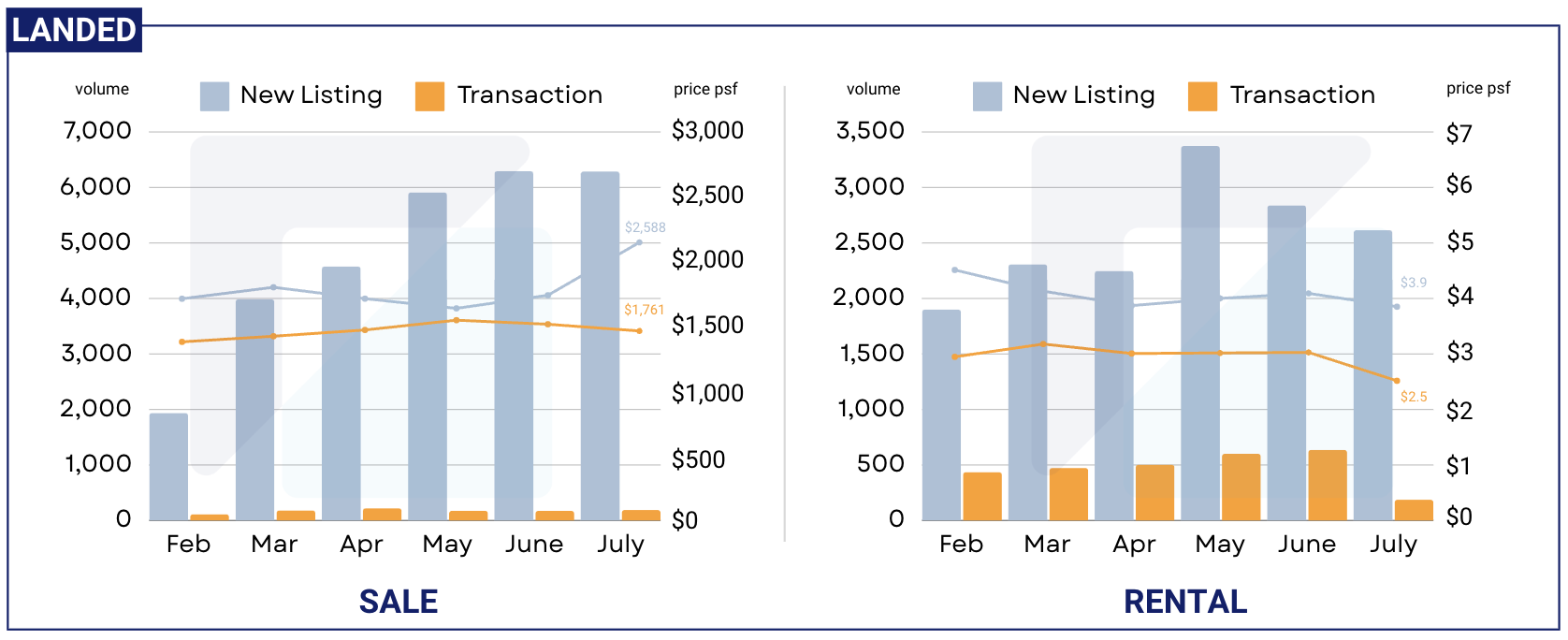

Residential Listings (Condo, HDB, Landed) February - July 2024

*New Listing: the total number of listings that are newly added in that particular time period

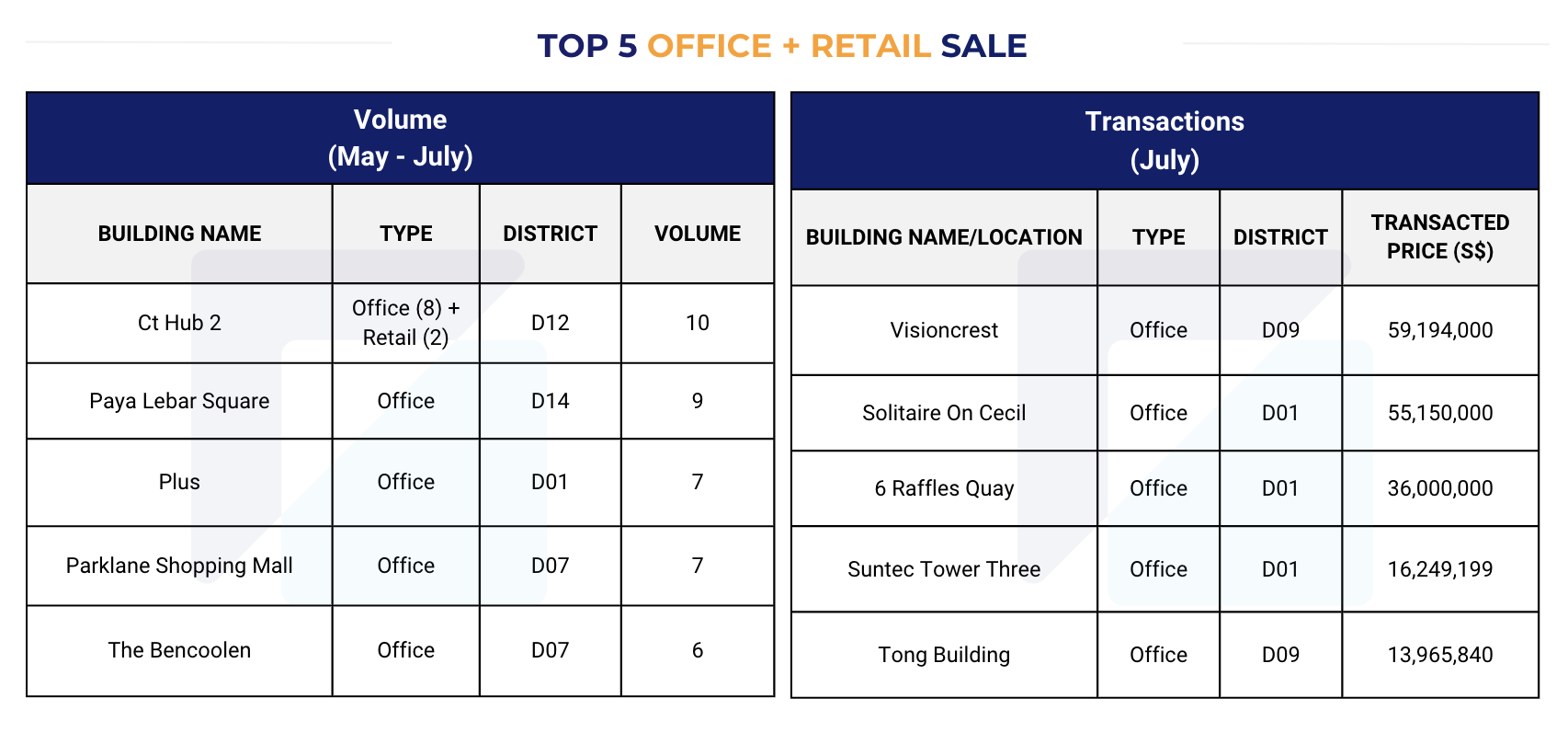

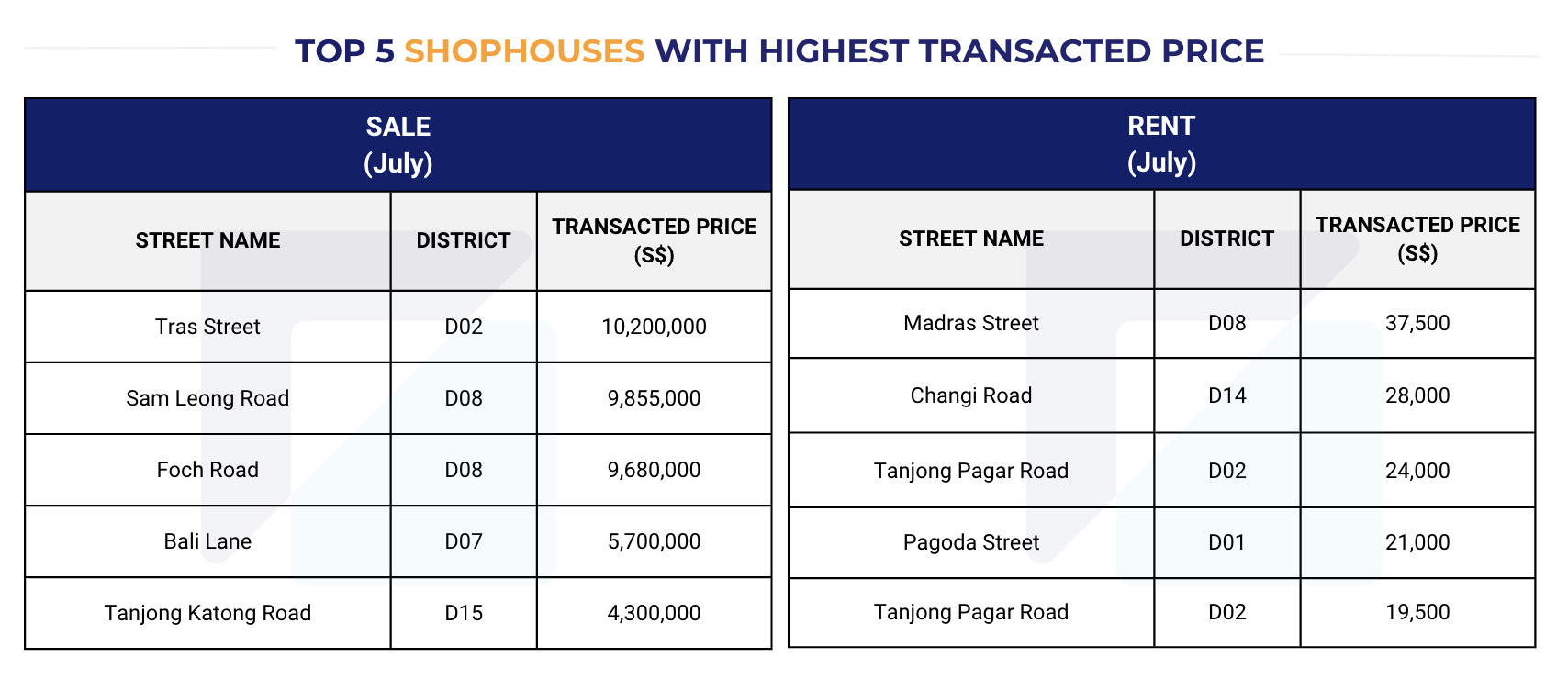

Commercial Snapshot

1. Top 5 Office and Retail Sale (by volume and transacted price) (May - July 2024)

2. Top 5 Shophouses with Highest Transacted Price (Sale and Rent) in July 2024

*The data presented in this monthly report is accurate as of 15 August 2024. While we strive to provide the most up-to-date information available, it is important to note that there may be a small percentage of transactions that experience delays in reporting from the respective agencies and government sources. Therefore, the data provided should be interpreted with this in mind, and you are encouraged to verify the latest information for your specific needs.

*All analytical and visually interpreted data in this report is powered by RealAgent, a comprehensive app for real estate professionals. It offers a blend of property information, real-time transaction data, and advanced analytics, ensuring accurate and up-to-date insights for our report. Find out more about RealAgent here.

Download the full report (PDF) here: 072024 - Singapore Property Market Snapshot.pdf

To know more about our data-driven real estate solutions, contact us here.

Continue to read our previous monthly reports:

Singapore Property Market Snapshot - June 2024

Singapore Property Market Snapshot - May 2024

Singapore Property Market Snapshot - April 2024

Singapore Property Market Snapshot - March 2024

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics (REA), we revolutionise the real estate industry with cutting-edge AI technology. Leveraging advanced data science and machine learning, we offer tailored data solutions for real estate professionals and enthusiasts. Our products, including market insights, RealAgent suite (for agents), and RealInsight (for developers, investors, institutional clients), provide end-to-end solutions for informed decision-making. Available across Singapore, Malaysia, Hong Kong (China), and Australia, our offerings ensure you always stay ahead in the dynamic real estate market.

Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.