News > Singapore Property Market Snapshot - April 2024

Singapore Property Market Snapshot - April 2024

15 May 2024

Singapore Property Market has been active in April 2024, with many record-breaking transactions, especially the new records set for million-dollar HDB transactions at The Pinnacle@Duxton ($1.52M for a 5 room), Guan Chuan Street ($1.55M for a 3-room), and Tiong Bahru View ($1.59M for a 5-room - the most expensive HDB transaction in 2024).

So how was the market going performing in general? Explore the market with our report below:

Hot Topics in Singapore Property Market April 2024

1. Toa Payoh flats $2 million price tag raises eyebrows but highlights appeal of rare DBSS units in Singapores resale market.

A listing of a $2 million five-room flat in Toa Payoh mature estate could break the record for Singapores most expensive resale flat. The high-floor unit offers unblocked city views and proximity to amenities, according to the agent. Read more >>

2. China Property Investment Sees 9.5% Decline in Q1, Signaling Slow Sector Recovery.

Sales dropped by 19.4%, while new construction starts fell by 27.8%. Despite efforts to stimulate the property market, funds raised by developers decreased by 26.0%. The data suggests that China’s property sector still faces challenges in achieving a robust turnaround. Read more >>

3. Resale HDB flat prices in Singapore rise by 1.8% in Q1 2024 amidst increasing demand and reduced BTO launches.

Despite warnings of economic uncertainties, demand for resale flats is rising due to various factors like reduced BTO launches and completion of wait-out periods for downgrading. Rental market faces a slowdown as supply decreases and tenants shift to the private sector. Read more >>

4. Strong Demand for The Residences at W Sentosa Cove Surpasses Sales Expectations.

Cityview Place Holdings, an associate of CDL, sold 65 units at The Residences at W Sentosa Cove in just a week, surpassing the initial 58 units. The upscale condo in Singapores prime district saw strong demand with an average selling price of S$1,780 psf. Majority buyers were locals, with some from China, France, and the US. Read more >>

Price Indexes

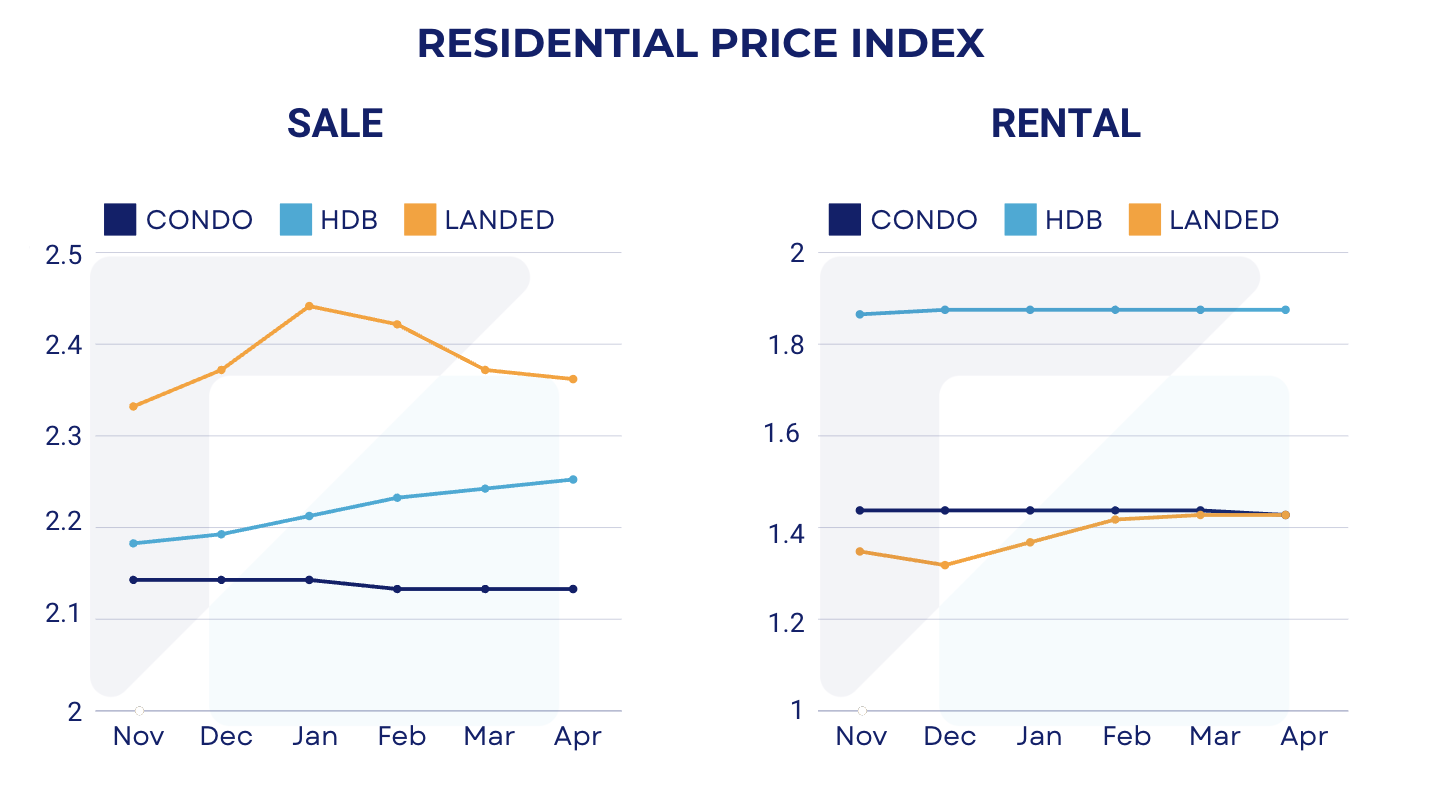

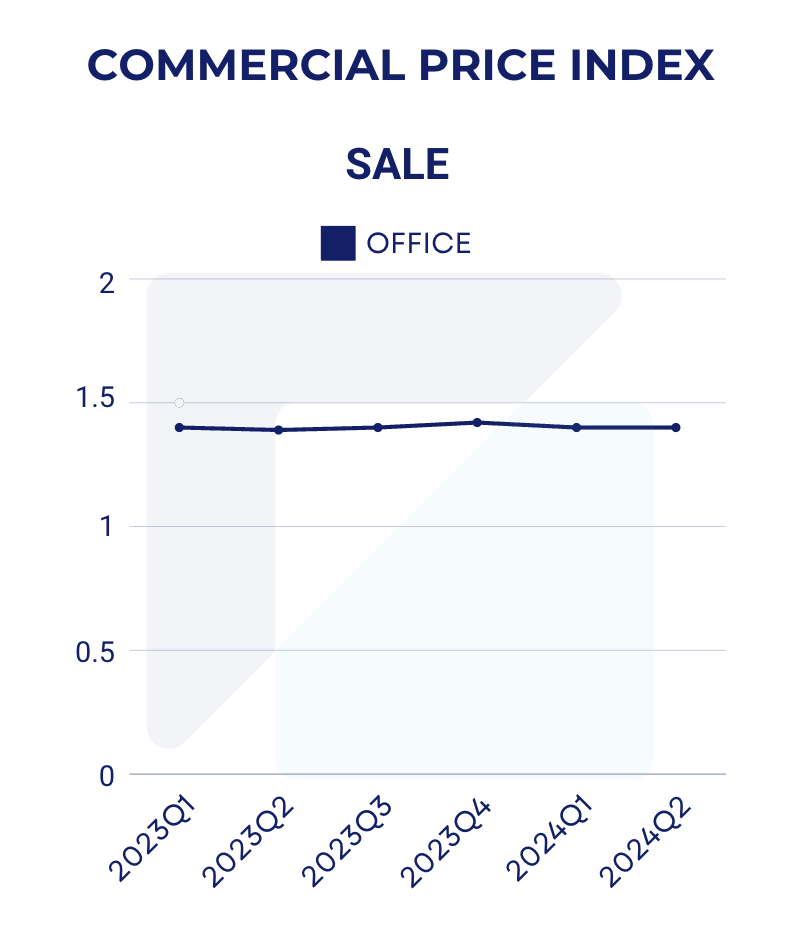

*Index value is 1 at year 2008

1. Residential Price Index

Sale Index for Condo and Landed saw a decline of 0.5% and 1.2% respectively between February and March 2024. In contrast, HDB Sale Index saw a slight increase of 0.5%.

Rental Index for Condo and HDB remained stable within the period. However, Landed saw a consistent upward trend since December 2023.

2. Commercial Price Index

New Launches in April 2024

1. The Hillshore (Launched 20 April 2024)

Location: 292 Pasir Panjang Rd, D05

TOP: 2027

Tenure: Freehold

Number of units: 59

Price range: S$ 1,965 - S$ 2,684 PSF

2. The Hill @ One North (Launched 20 April 2024)

Location: 15 Slim Barracks Rise, D05

TOP: 2026

Tenure: 99 year

Number of units: 142

Price range: S$ 2,034 - S$ 2,851 PSF

Residential Snapshot

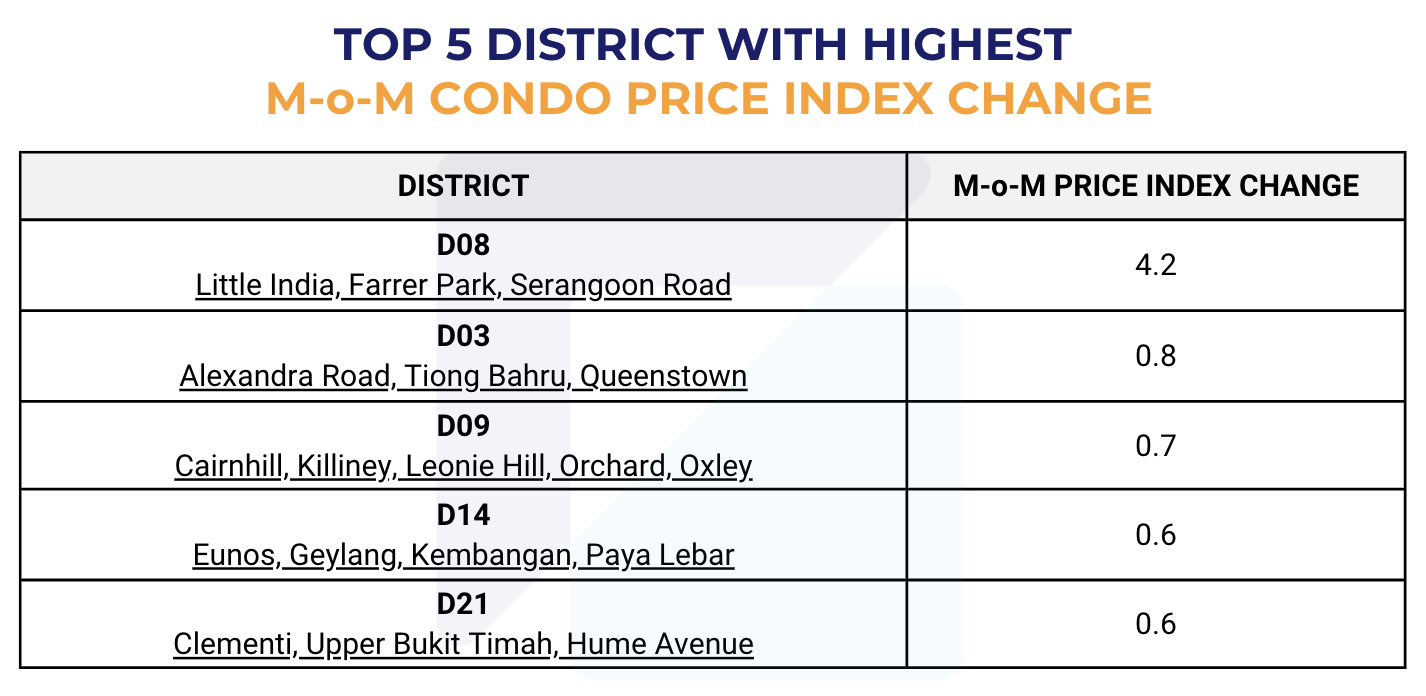

1. Top 5 Districts with highest Month on Month (M-o-M) Index Change

2. Top 5 most popular projects (Condo) in April 2024

*New Sale: The sale of a unit direct by a developer before the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

**Resale: The sale of a unit by a developer or subsequent purchaser after the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

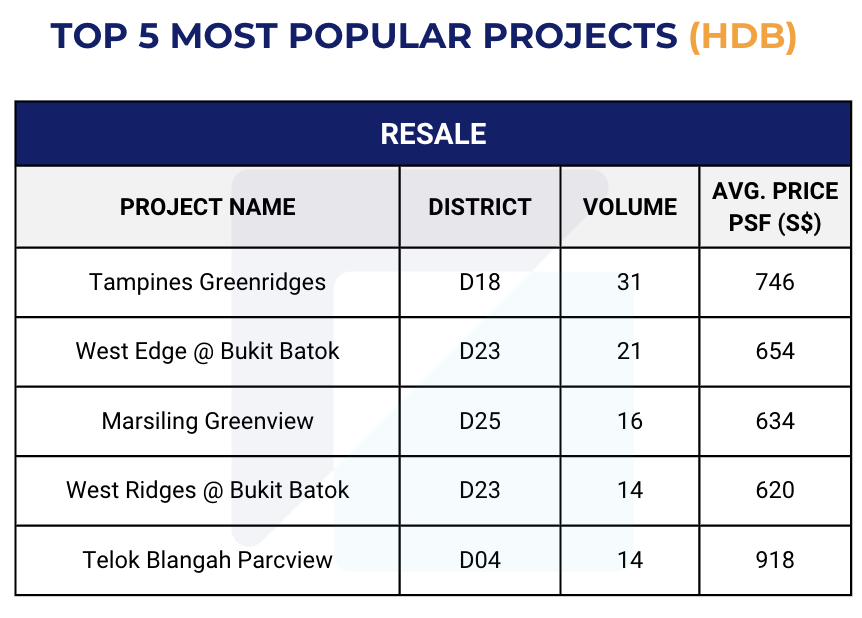

3. Top 5 most popular projects (HDB) in April 2024

4. Top 5 highest transacted price (Condo) in April 2024

5. Top 5 Transactions by Annualised Capital Gain/Loss in April 2024

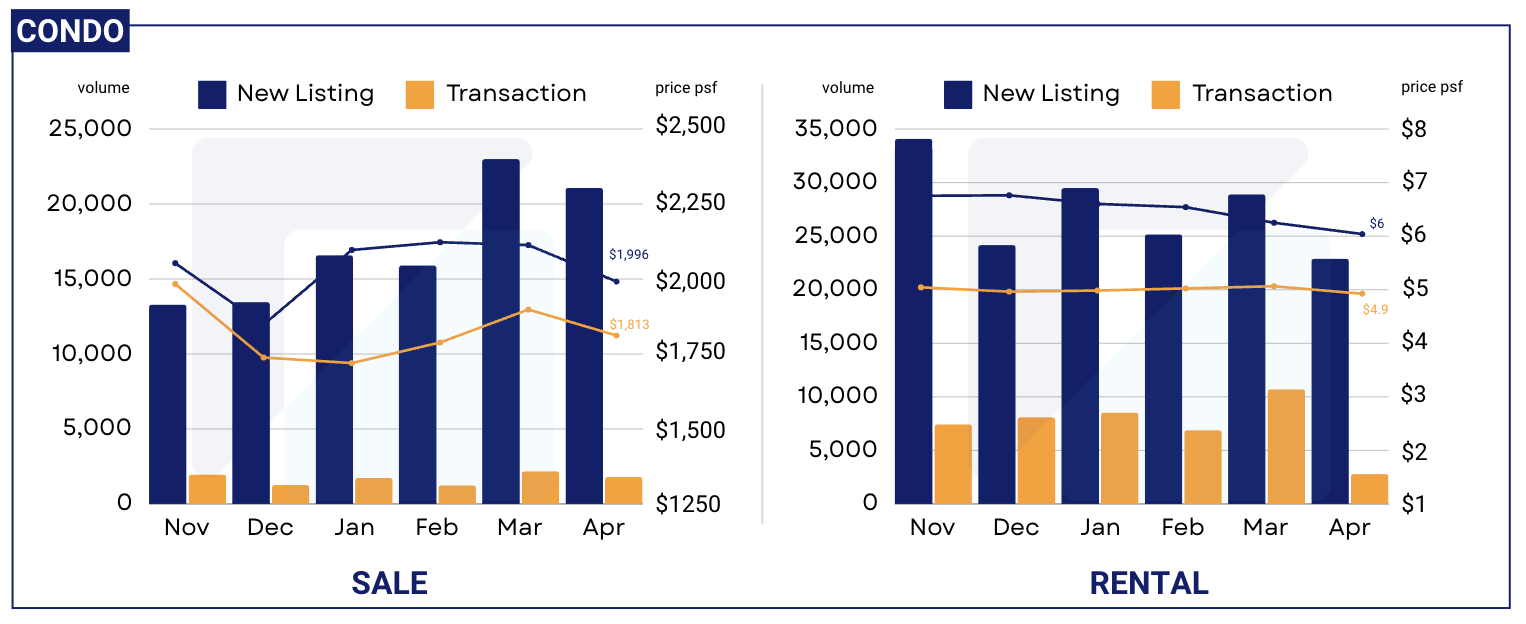

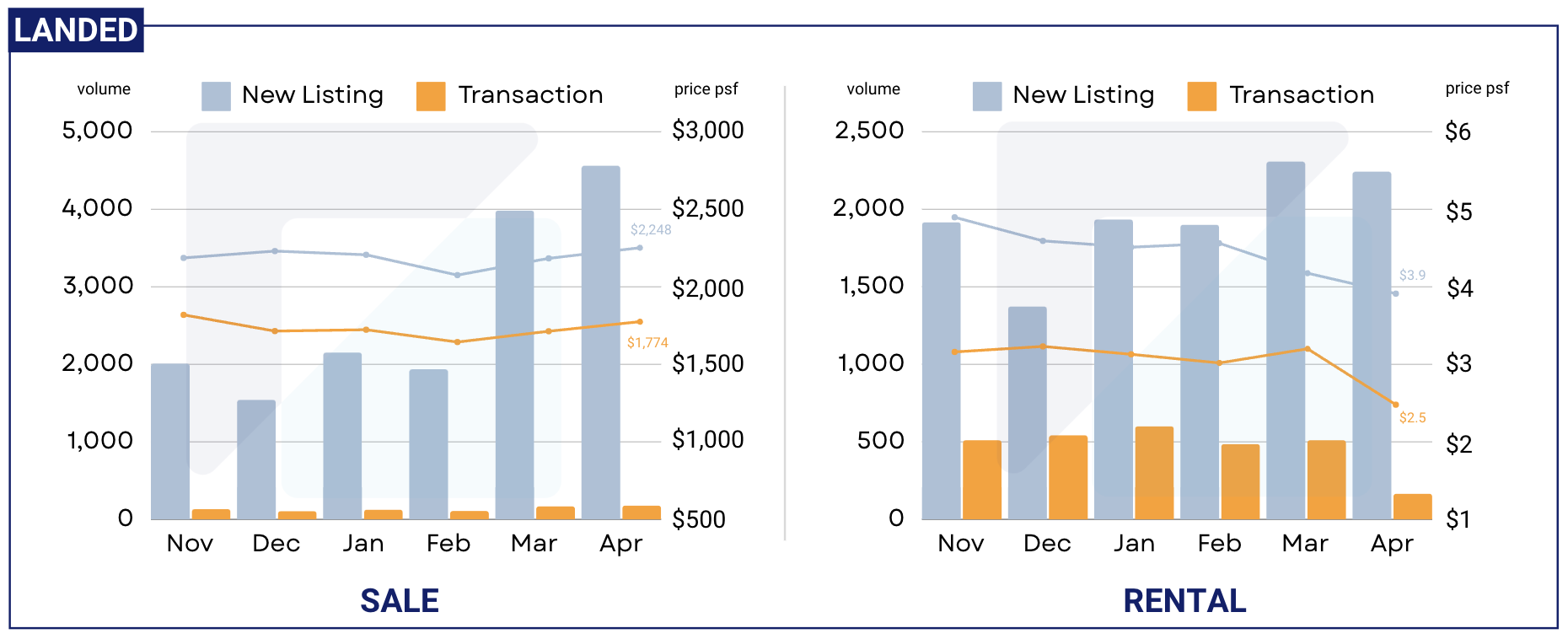

Residential Listings (Condo, HDB, Landed) November 2023 - April 2024

*New Listing: the total number of listings that are newly added in that particular time period

Sale listing volume saw a steep increase in March for all property types, specifically 44.5% for Condo, 28.8% for HDB, and 200% for Landed. Same trend was witnessed in the actual transaction volume, where Condo sale went up 62%, Landed sale went up 43%, with the exception of HDB which saw a slight decrease of 7% in volume.

The gap between Average listing psf and Average transacted psf remained significant for all types of property: Condos are transacted at 90% of the listing price, while that for HDB and Landed are 93% and 74% respectively.

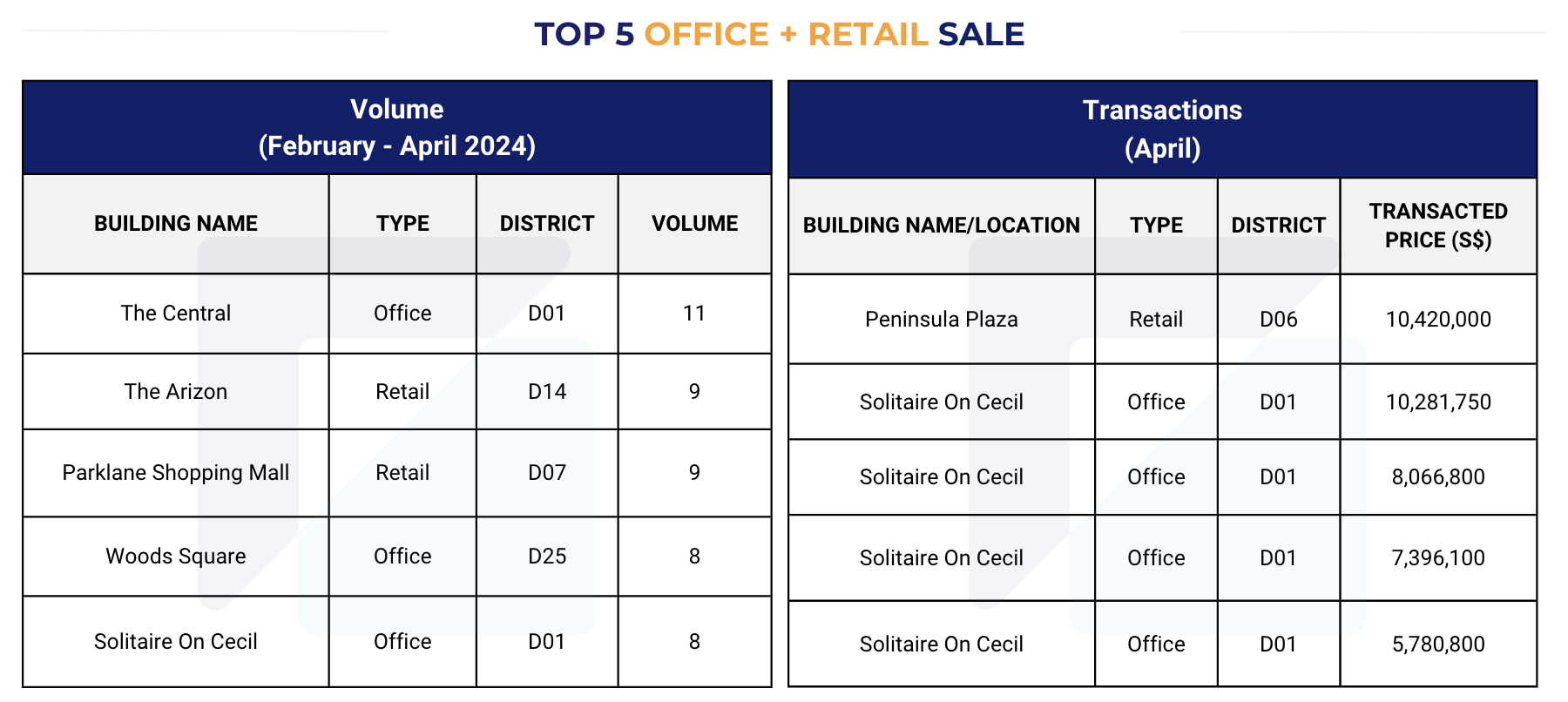

Commercial Snapshot

1. Top 5 Office and Retail Sale (by volume and transacted price) (February - April 2024)

2. Top 5 Shophouses with Highest Transacted Price (Sale and Rent) in April 2024

*The data presented in this monthly report is accurate as of 15 May 2024. While we strive to provide the most up-to-date information available, it is important to note that there may be a small percentage of transactions that experience delays in reporting from the respective agencies and government sources. Therefore, the data provided should be interpreted with this in mind, and you are encouraged to verify the latest information for their specific needs.

*All analytical and visually interpreted data in this report is powered by RealAgent, a comprehensive app for real estate professionals. It offers a blend of property information, real-time transaction data, and advanced analytics, ensuring accurate and up-to-date insights for our report. Find out more about RealAgent here.

Download the full report (PDF) here: 042024 - Singapore Property Market Snapshot.pdf

To know more about our data-driven real estate solutions, contact us here.

Continue to read our other monthly reports:

Singapore Property Market Snapshot - March 2024

Singapore Property Market Snapshot - February 2024

Singapore Property Market Snapshot - January 2024

Singapore Property Market Snapshot - December 2023

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics, we're revolutionising the real estate industry with our cutting-edge AI technology. By applying advanced data science in real estate industry, and providing customised services for people with various property needs, our market trends and insights, agent enhanced tools, and REA Developer Suite deliver realistic and reliable end-to-end solutions that enables everyone can make their informed decisions. Our solutions are available across Singapore, Malaysia, Hong Kong (China), Indonesia and Australia. Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.