News > Singapore Property Market Snapshot - December 2023

Singapore Property Market Snapshot - December 2023

12 January 2024

Singapore property market is showing signs of slowing down in December 2023, with the absence of significant new launch projects. However, 2024 is predicted to be optimistic for the market with exciting announcements from HDB and URA. Explore the what happened with our December 2023 Market Report below:

Hot Topics in Singapore Property Market December 2023

1. Singapore Property Market Shows Signs of Cooling Down, but Local Investors Remain Optimistic.

Analysts predict that property prices will continue to fall in 2024, making it a good time for investors who see the increased Additional Buyers Stamp Duty (ABSD) as an opportunity. Commercial real estate is also seen as an alternative investment option. Read more >>

2. HDB to launch 19,600 BTO flats in 2024 to meet housing demand.

In 2024, HDB will launch about 19,600 Build-To-Order (BTO) flats across three sales exercises in February, June and October. To meet the increased housing demand in recent years, HDB has ramped up the supply of BTO flats to offer more than 63,000 flats in the last 3 years - 17,100 flats in 2021, 23,200 flats in 2022, and 22,800 flats in 2023. With the launch of 19,600 BTO flats in 2024, HDB remains on track to offer 100,000 flats from 2021 to 2025. Read more >>

3. HDB and URA to relax occupancy cap for larger flats and private properties from 2024-2026.

From 22 January 2024 to 31 December 2026, HDB and URA will relax the occupancy cap for larger HDB flats and private residential properties. Read more >>

4. Private residential prices in Singapore rise by 2.7% in Q4 2023, but overall increase for the year is slower.

The private residential price index in Singapore increased by 2.7% in the fourth quarter of 2023, driven by sales transactions at newly-launched projects. However, the overall increase for 2023 was slower compared to the previous year. Sales of private residential properties also decreased, reaching their lowest level in seven years. Read more >>

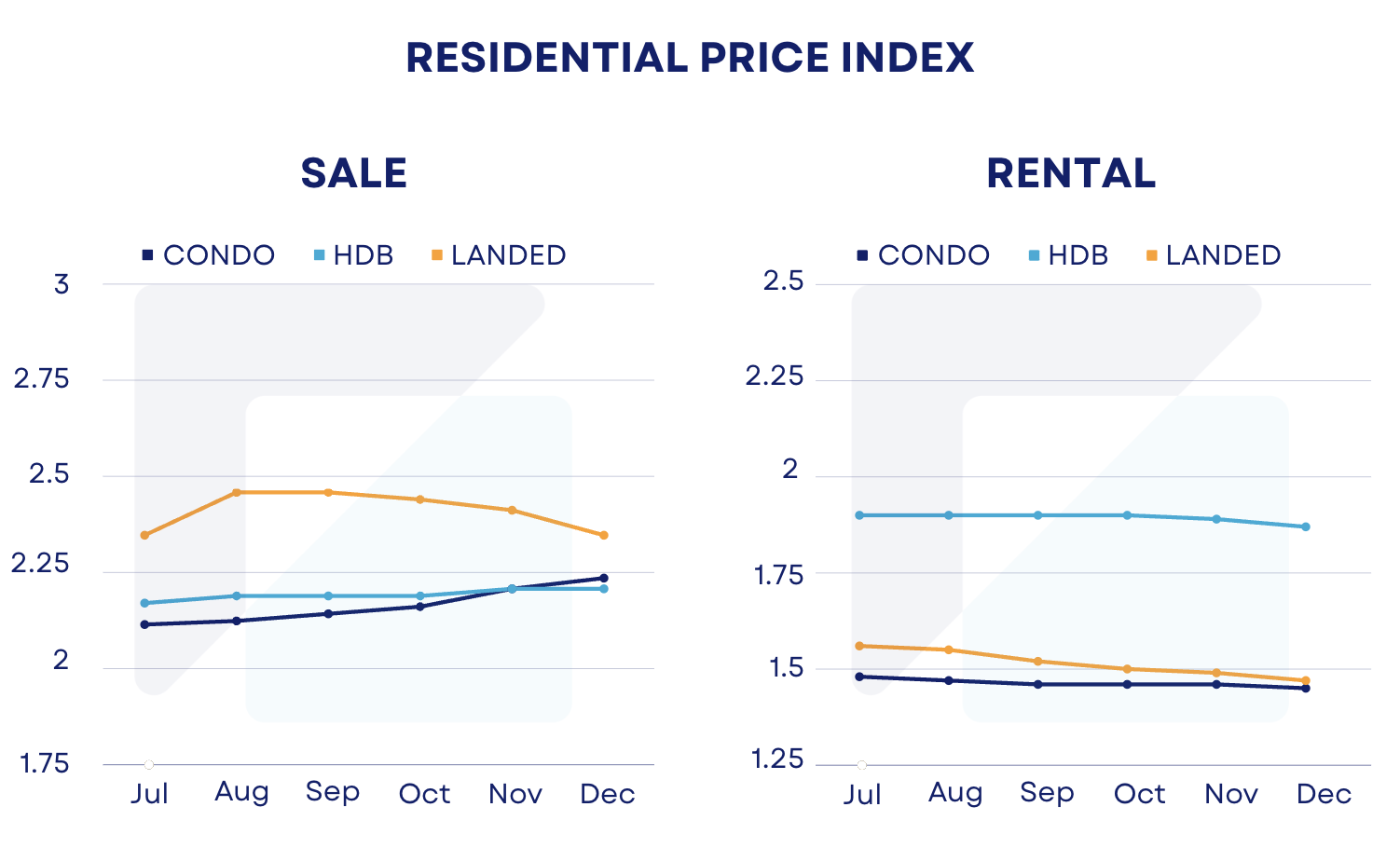

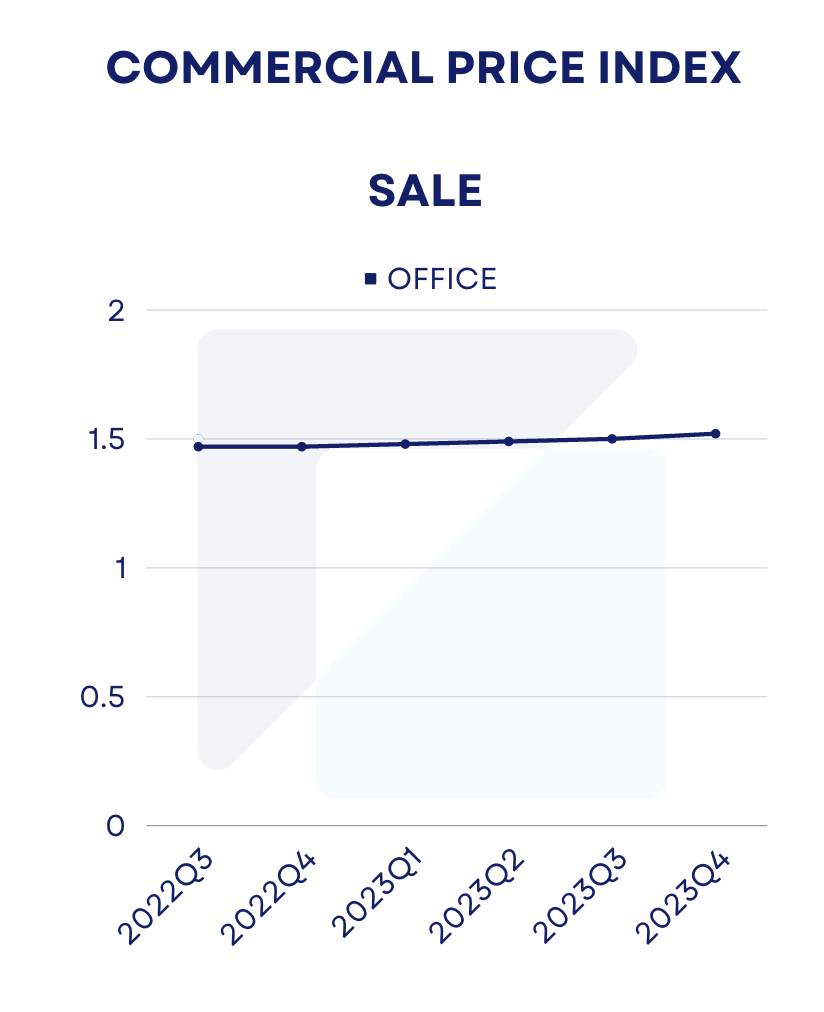

Price Indexes

*Index value is 1 at year 2008

1. Residential Price Index

2. Commercial Price Index

Residential Snapshot

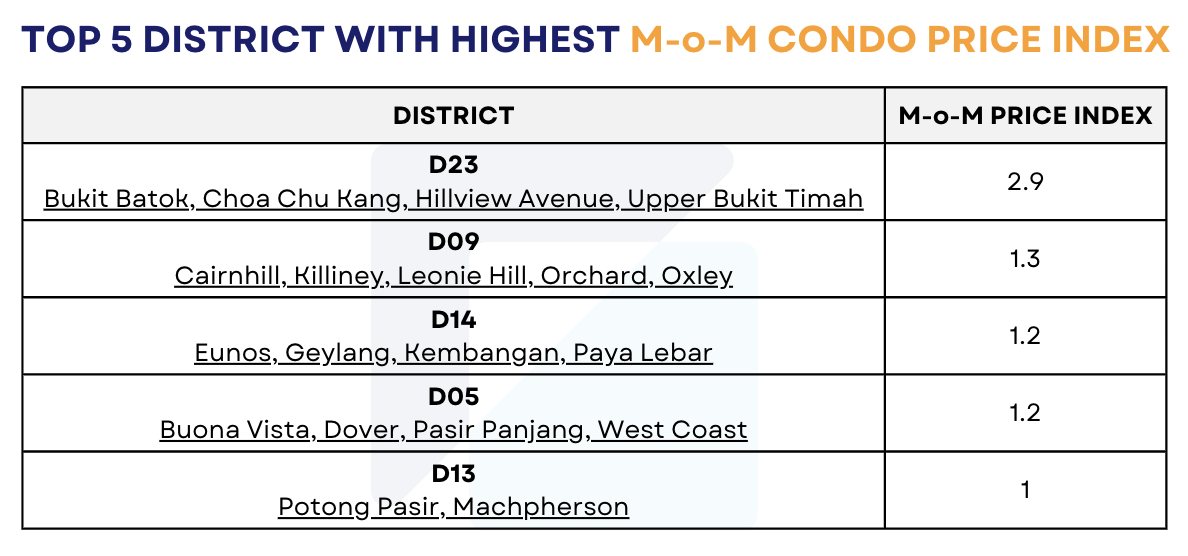

1. Top 5 Districts with highest Month on Month (M-o-M) Index

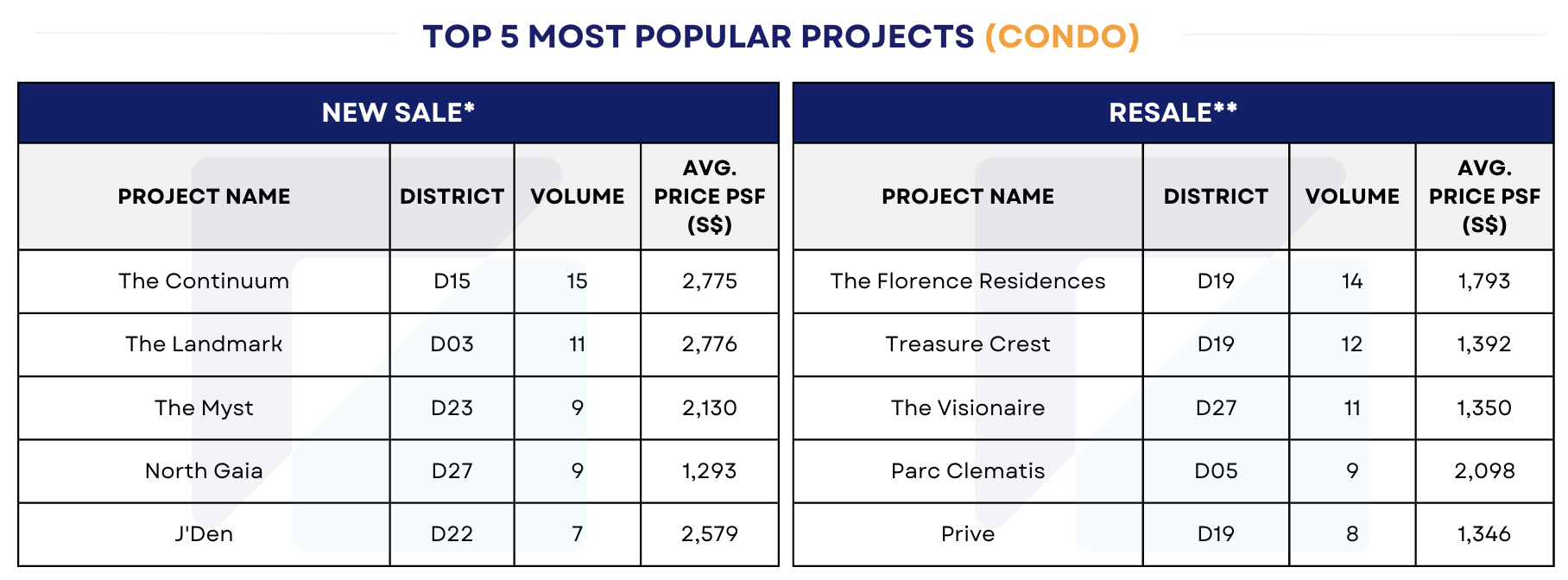

2. Top 5 most popular projects (Condo) in December 2023

December marked a month of the comeback of older new launch projects. The Continuum - launched in May 2023 - topped the list as the most popular project in terms of sales volume. Following up was 2 projects that were launched even earlier: The Landmark (launched November 2020) and North Gaia (launched April 2022).

*New Sale: The sale of a unit direct by a developer before the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

**Resale: The sale of a unit by a developer or subsequent purchaser after the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

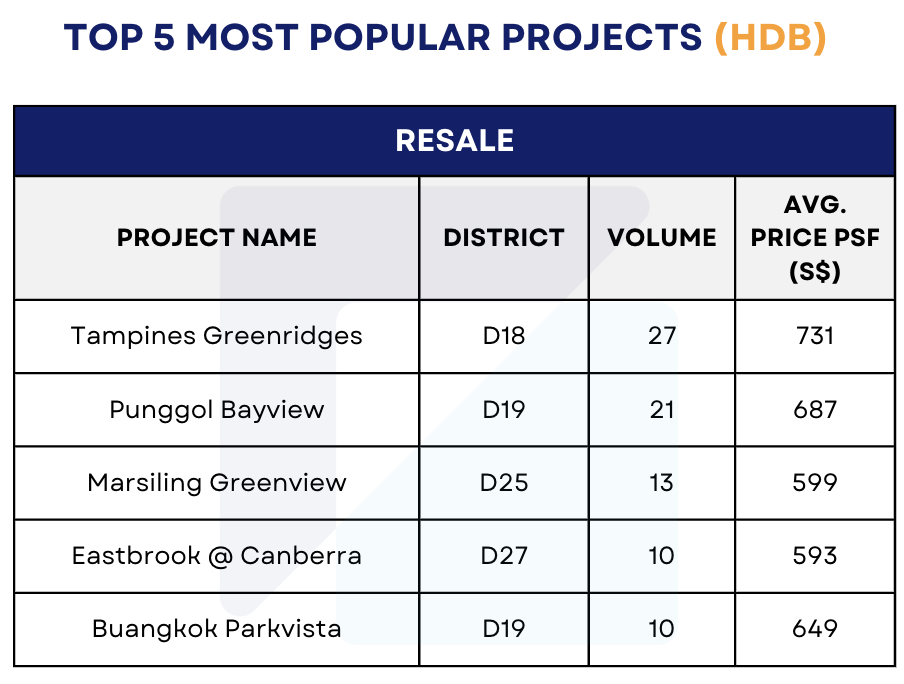

3. Top 5 most popular projects (HDB) in December 2023

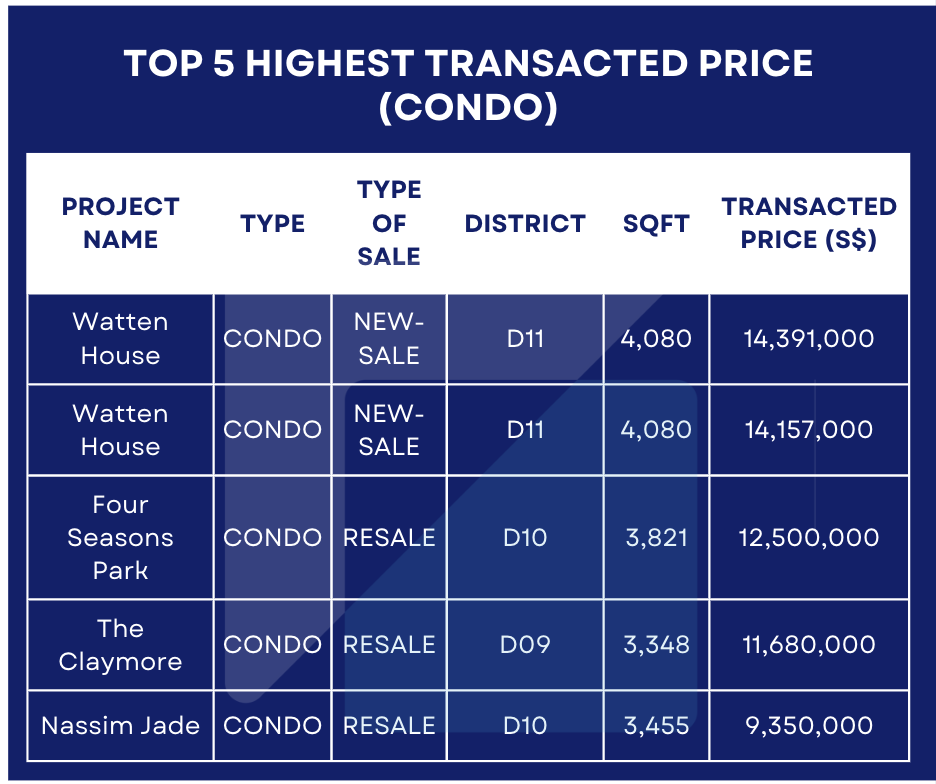

4. Top 5 highest transacted price (Condo) in December 2023

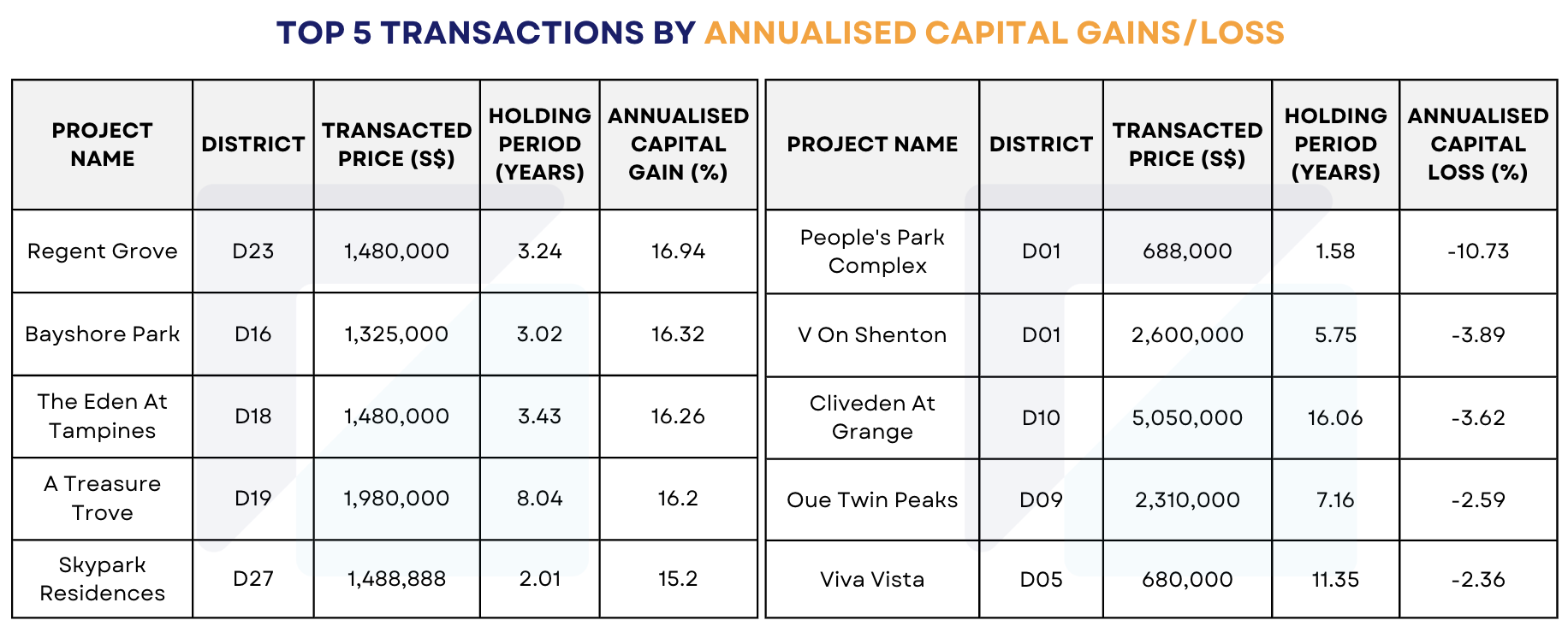

5. Top 5 Transactions by Annualised Capital Gain/Loss in December 2023

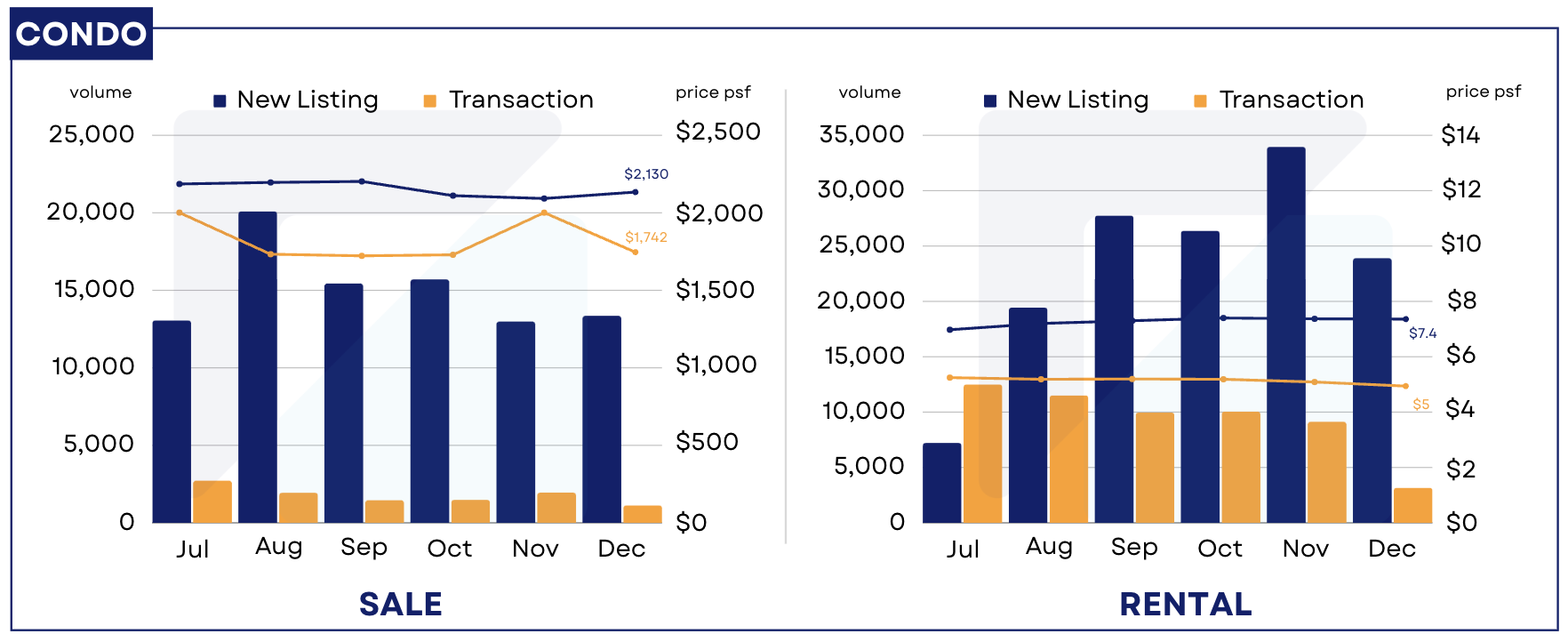

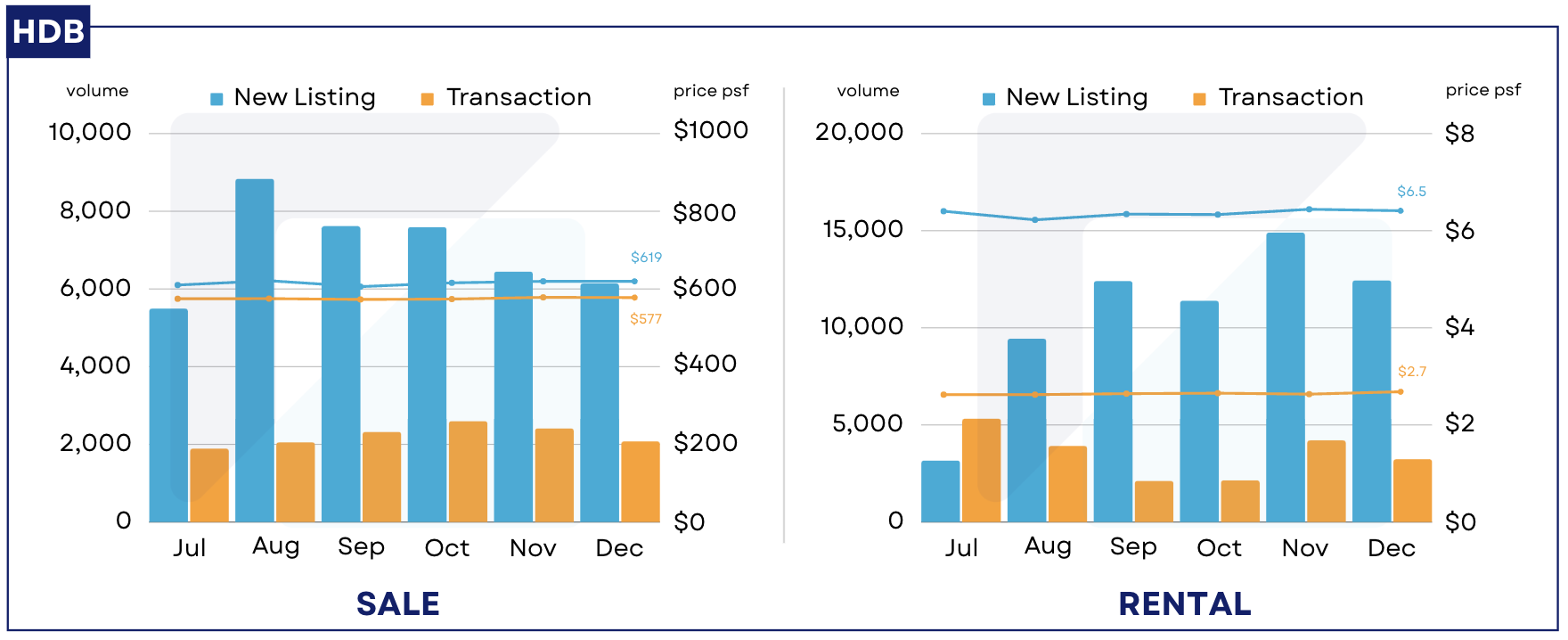

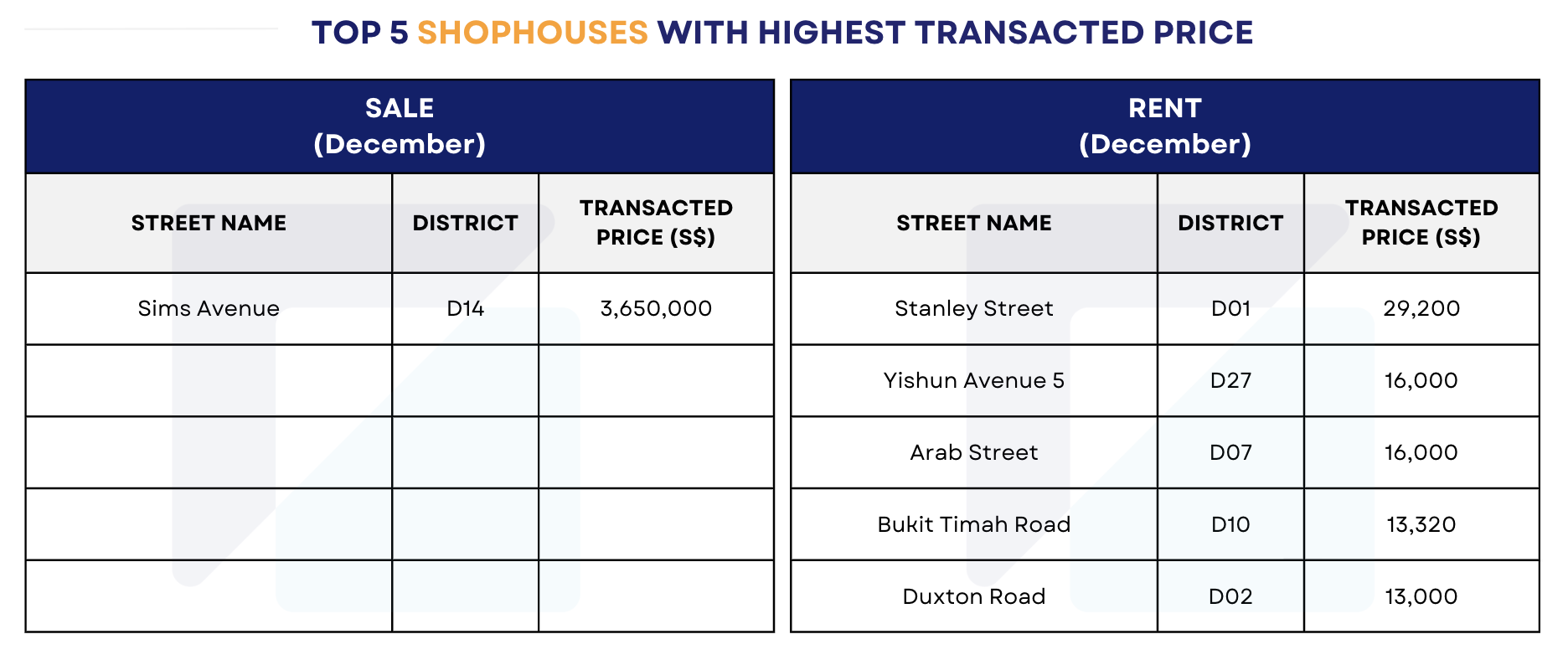

Residential Listings (Condo, HDB, Landed) July - December 2023

*New Listing: the total number of listings that are newly added in that particular time period

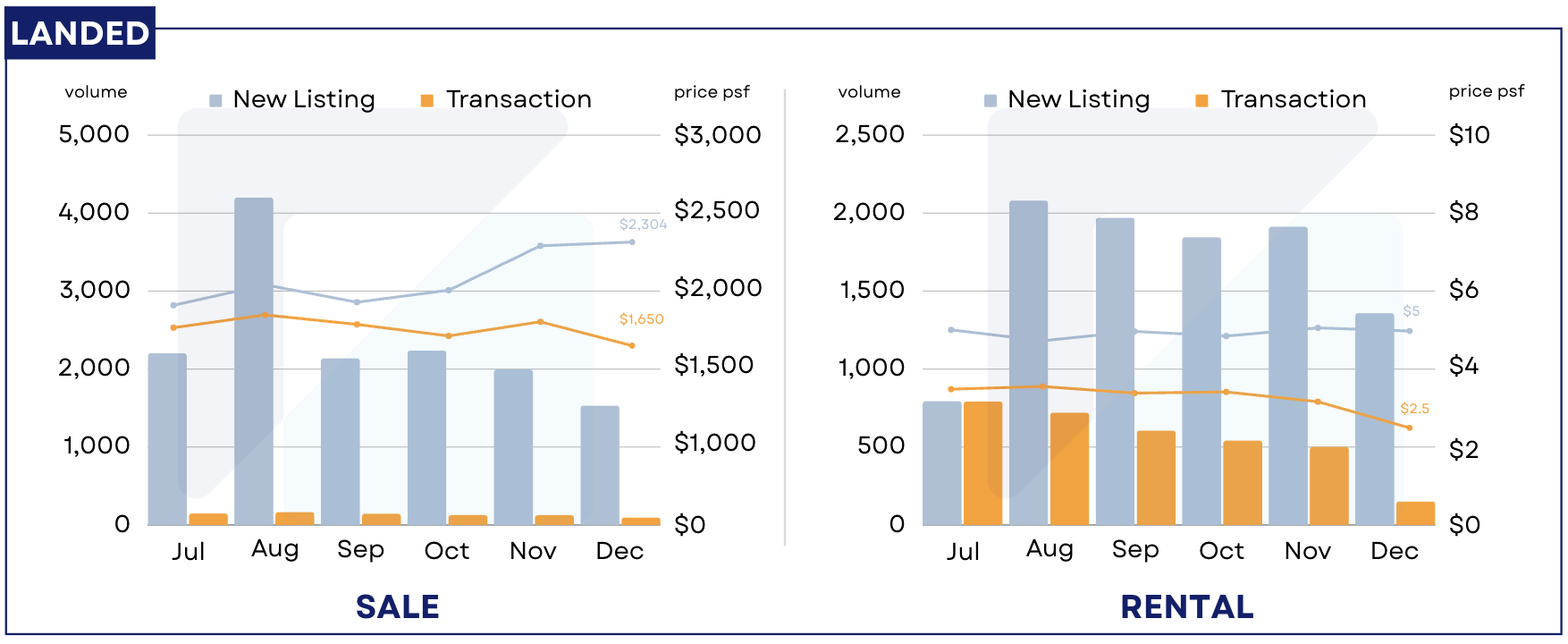

Commercial Snapshot

1. Top 5 Office and Retail Sale (by volume and transacted price) (October - December)

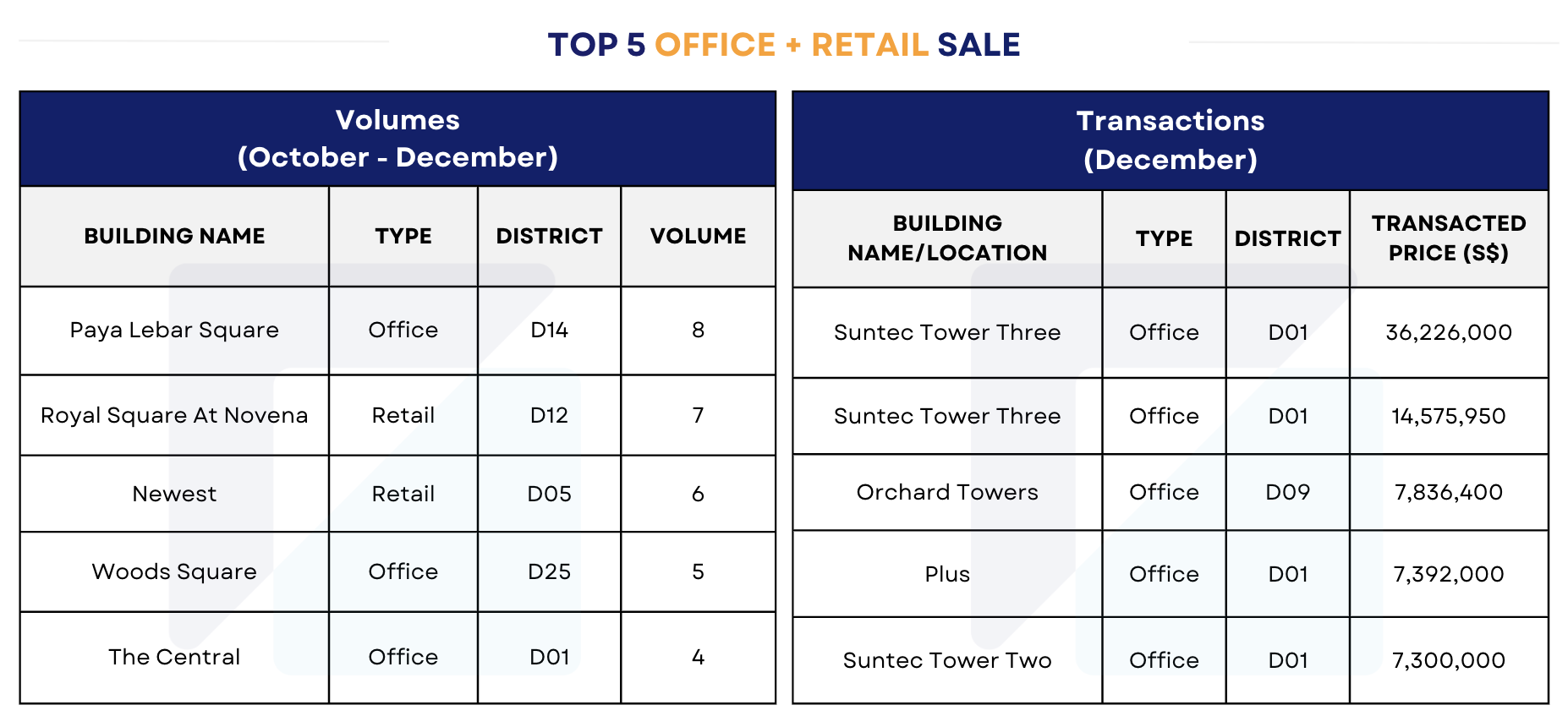

2. Top 5 Shophouses with Highest Transacted Price (Sale and Rent) in December 2023

All analytical and visually interpreted data in this report is powered by RealAgent, a comprehensive app for real estate professionals. It offers a blend of property information, real-time transaction data, and advanced analytics, ensuring accurate and up-to-date insights for our report. Find out more about RealAgent here.

Download the full report (PDF) here: December 2023 - Singapore Property Market Snapshot.pdf

To know more about our data-driven real estate solutions, contact us here.

Continue to read our other data insights articles:

Singapore Property Market Snapshot - November 2023

Less Space, More Cost: Have Condos become Smaller yet Pricier?

Singapore Property Market Snapshot - October 2023

Singapore Property Market Snapshot - September 2023

Unprofitable Condos in Singapore: What do they have in common?

Million dollar HDB in August 2023 - A different story told by real-time data

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics, we're revolutionising the real estate industry with our cutting-edge AI technology. By applying advanced data science in real estate industry, and providing customised services for people with various property needs, our market trends and insights, agent enhanced tools, and REA Developer Suite deliver realistic and reliable end-to-end solutions that enables everyone can make their informed decisions. Our solutions are available across Singapore, Malaysia, Hong Kong (China), Indonesia and Australia. Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.