News > Less Space, More Cost: Have Condos become Smaller yet Pricier?

Less Space, More Cost: Have Condos become Smaller yet Pricier?

25 October 2023

Singapore's property market is constantly shifting, creating a unique landscape full of challenges and opportunities. A striking trend has surfaced over the years: private condominiums are decreasing in size, yet their prices per square foot are consistently rising.

This article examines the transformation of Singapore’s condos and executive condos in terms of price and size from 2008 to the present, emphasising how the trend of shrinking private property sizes contrasts sharply with their escalating prices per square foot.

Discover what these shifts could mean for your investments and decisions in Singapore’s vibrant real estate landscape.

Main Findings

Over the past 15 years (2008 - today)

- There has been a substantial 68% increase in the average price PSF for condominiums, highlighting a significant upward trend in market prices.

- The average price PSF for 1-bedroom and 3-bedroom executive condominiums has doubled.

- The average size of condominium units has decreased by 25%, indicating a trend towards smaller living spaces.

- The unit size of executive condominiums has seen an average decrease of 15%, with some fluctuations observed.

Analysis

(1) Property Size

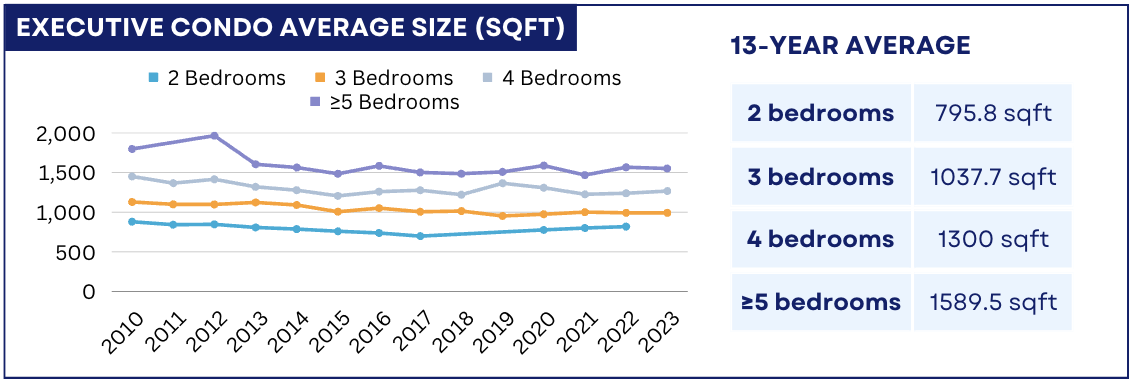

Over the last 15 years, the size of EC units has experienced slight fluctuations, with an overall reduction of approximately 15.5%. Units with 5 or more bedrooms saw the most pronounced decrease at 20%, while 2-bedroom units followed closely with a 17% reduction.

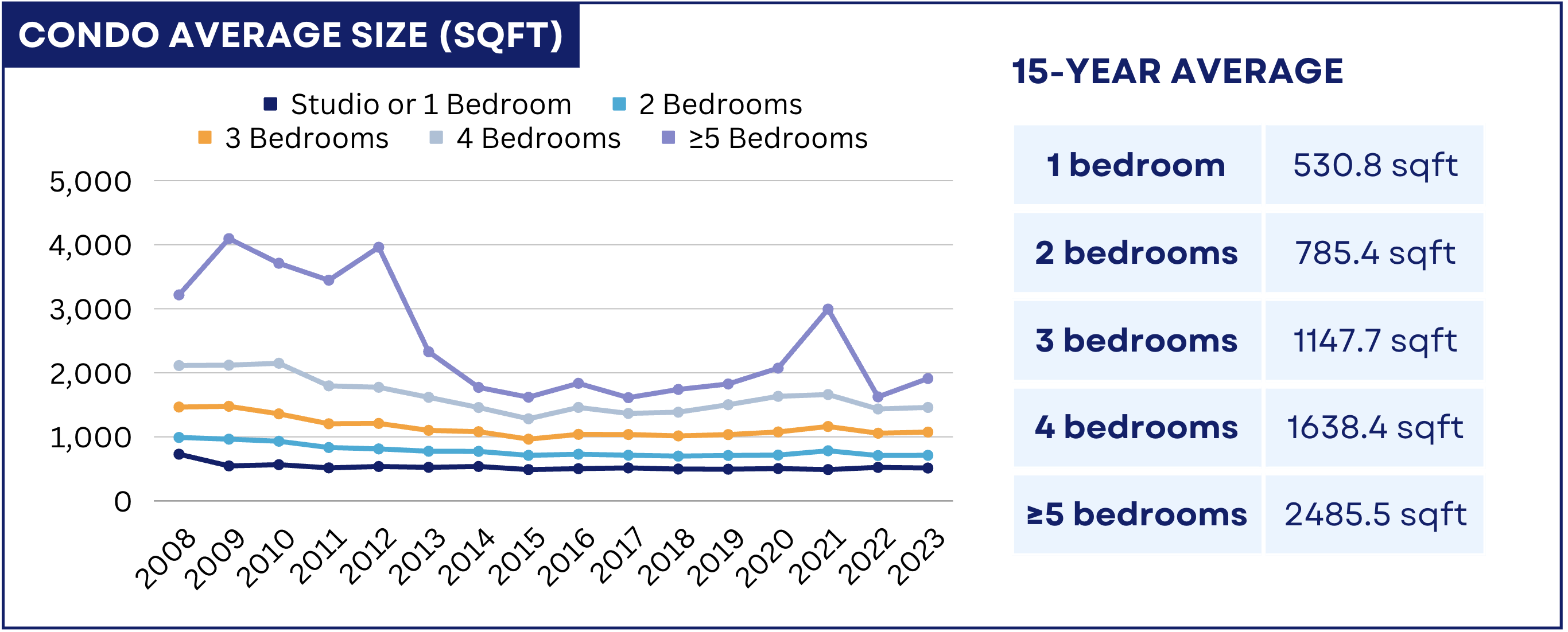

Even more striking is the 25% decrease in the size of Condo units during this period. 5-bedroom condos faced the steepest size cutback, contracting by an impressive 41%. Meanwhile, other unit sizes observed a decrease ranging between 27% to 30%.

This shift towards building smaller unit sizes can be attributed to various factors, including the surge in cost, rising demand from singles and smaller households, and preference from investors as smaller units are more appealing to foreigners working in Singapore. Buyers’ preference towards smaller units is also driving this shift as these properties have lower price quantum, serving as a more affordable option compared to larger units.

(2) Property PSF

Over the last 15 years, the average price per square foot (PSF) of EC and Condos has been increasing significantly. Condo units stood out in this trend, registering a 68% increase in their average PSF. Among these, 2-bedroom units led with an 84% surge in PSF, followed by 3-bedroom units at 77% and 4-bedroom units at 73%.

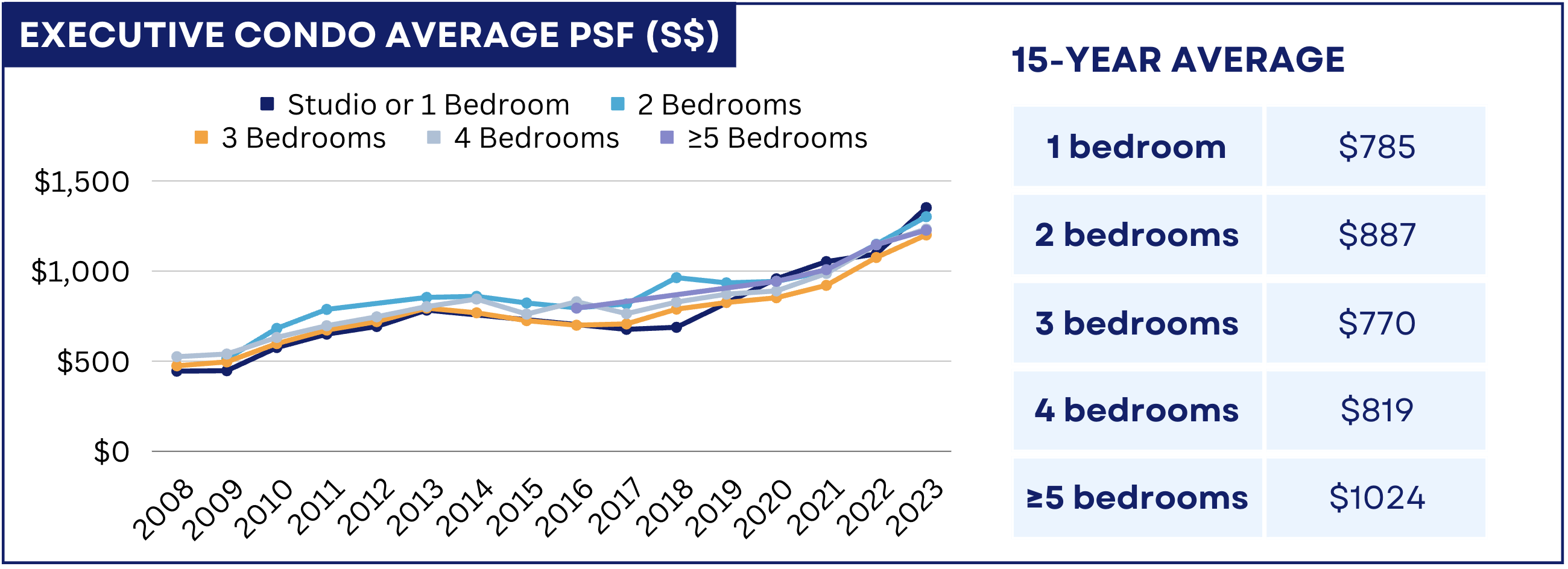

However, ECs showcased an even more impressive results. The average PSF for EC units has soared by a staggering 83% over the period. Here, studio or 1-bedroom units, along with 3-bedroom units, have experienced a doubling in PSF, marking a 100% growth.

This data underscores a robust property market, where values have been consistently appreciating, especially for smaller units. Several factors could be driving this growth: increased urbanisation, limited supply, or rising demand for smaller units from singles or foreigners working in Singapore.

Last Thoughts

In all, this analysis unveils a notable trend within the Singaporean property landscape. While the size of private properties have been on a consistent decline, their price per square foot (PSF) has witnessed a significant surge over the past 15 years.

For potential investors or homeowners, this trend indicates the lasting value and potential long-term returns in the Singaporean property market. It's also a sign of the nation's economic stability and growth prospects.

However, for new homebuyers, it poses challenges in terms of affordability, pushing them to be more discerning in their property choices.

All analytical and visually interpreted data in this a is powered by RealAgent, a comprehensive app for real estate professionals. It offers a blend of property information, real-time transaction data, and advanced analytics, ensuring accurate and up-to-date insights for our report. Find out more about RealAgent here .

Download the full report (PDF) here: Have Condos become Smaller yet Pricier.pdf

To know more about our data-driven real estate solutions, contact us here .

Continue to read our other data insights articles:

Singapore Property Market Snapshot - September 2023

Unprofitable Condos in Singapore: What do they have in common?

Million dollar HDB in August 2023 - A different story told by real-time data

The new 2023 cooling measures' impact: Home sellers are selling at a loss

High vs Low: Are high-floor units always more profitable?

Condo price surge after a new project launch in the surrounding area? Here’s what our data suggest

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics, we're revolutionising the real estate industry with our cutting-edge AI technology. By applying advanced data science in real estate industry, and providing customised services for people with various property needs, our market trends and insights, agent enhanced tools, and REA Developer Suite deliver realistic and reliable end-to-end solutions that enables everyone can make their informed decisions. Our solutions are available across Singapore, Malaysia, Hong Kong (China), Indonesia and Australia. Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.