News > High vs Low: Are high-floor units always more profitable?

High vs Low: Are high-floor units always more profitable?

6 July 2023

To unveil the truth behind the common assumption that higher floor units yield greater profitability than lower floor units, REA Team has leveraged on our database and strong analytical experience to examine the impact of a unit's vertical location within a condominium on its profitability. We dissect the financial landscape of condo investments, spotlighting the often overlooked high vs. low floor dynamic. We have focused our lens on condo projects by regions—OCR, RCR, and CCR—to bring you a comparative analysis of profitability. With robust data and discerning insights, we chart the financial terrain of each level, factoring in diverse attributing effects, to equip you with a firm foundation for your investment decisions. Whether you are a seasoned investor or a beginner stepping into the world of condo investments, this report refines your investment approach with our insightful analysis.

Summary of Main Findings

- In District 3, high-floor units witnessed lower premium compared to low-floor units

- The same trend exists for the whole RCR region

- In OCR, nearly all types of properties, regardless of bedroom count, outpace market performance in appreciation. The highest premium here is commanded by 4-bedroom units on lower floors.

- 3-bedroom condos in middle floor consistently show healthy investment outlook across all regions.

Definitions & Methodology

Definitions

For the purpose of this report, we have established the following classifications for high floor, low floor, and mid-floor units, based on the total number of floors in a condo project:

- High Floor Units: These are located on the top 30% of a condo project's total floors.

- Low Floor Units: These are located on the bottom 30% of a condo project's total floors.

- Mid-Floor Units: Any units that occupy the remaining floors.

Methodology

Ensuring an equitable comparison of profitability, while factoring in variables such as inflation and market growth, is essential. To this end, we have established a stringent set of criteria for selecting the condo projects for our study:

- Only condos with a minimum of 10 floors will be selected

- Only condos launched after 2013 and completed after 2017 will be selected

- Only include condo units that have undergone new sale to resale or sub-sale transactions.

To thoroughly probe the profitability differences between high and low floor units, we conducted two-pronged analysis: (1) at the district level and (2) at the regional level.

(1) We selected five condominiums in District 3 completed after 2017, each housing at least 400 units to capture a sufficient number of transactions that represent the market prices. We amassed a dataset comprising 405 transactions from these condos, focusing on new sale to resale or sub-sale transactions, occurring between 2013 and 2023.

Below is the list of selected condo projects, their completion year, number of floors, and number of units:

- Highline Residences (2018): 35 floors, 500 units

- Alex Residences (2018): 39 floors, 429 units

- Commonwealth Towers (2019): 43 floors, 845 units

- Queen's Peak (2020): 44 floors, 736 units

- ARTRA (2021): 43 floors, 400 units

(2) We assembled a comprehensive dataset comprising 7525 new sale to resale or sub-sale transactions across three regions: CCR, RCR, and OCR, in the period of 2013 - 2023.

Analysis

(1) District level

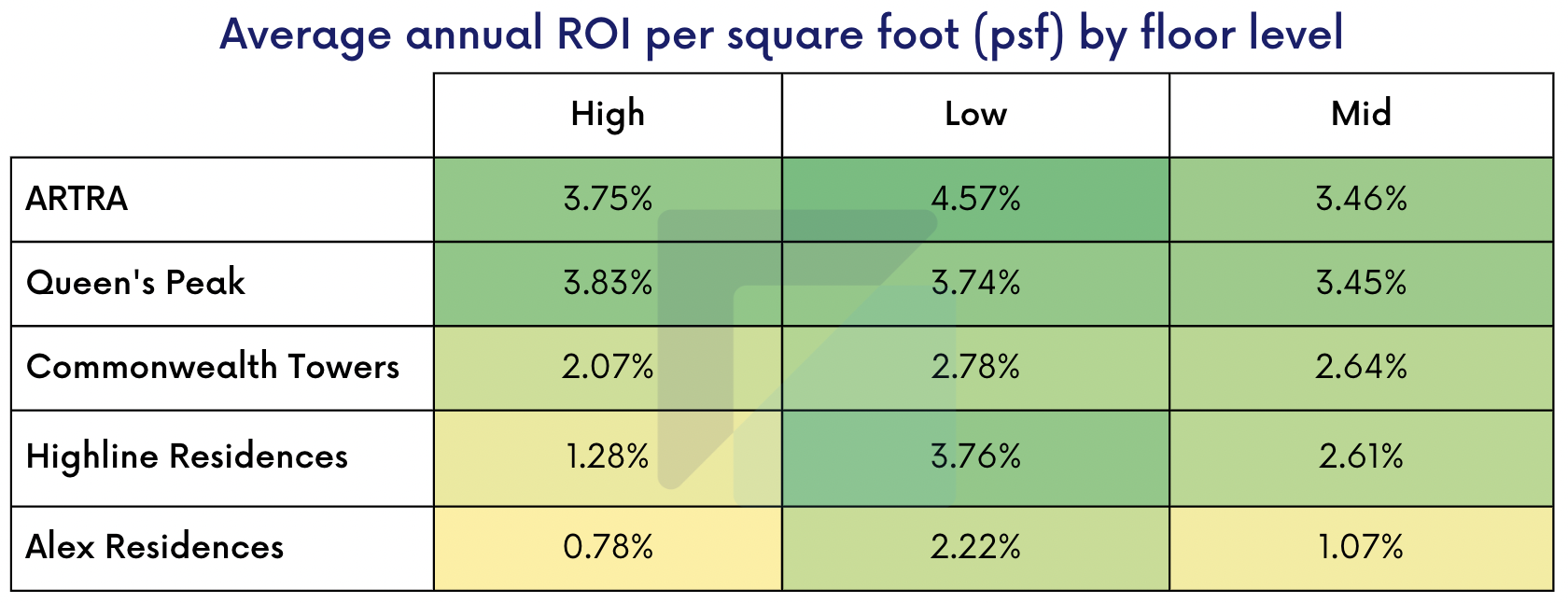

Our analysis challenges the common belief that high floor units offer higher returns, revealing that in four out of five selected condos, high floor units yield lower average ROI per square foot (psf) than low-floor units in District 3. The difference in ROI is significant in Highline Residences and Alex Residences, where the ROI of low floor units are almost 3 times higher than that of high floor units.

However, market conditions, influenced by factors such as government interventions and economic growth, can sway buyer sentiment, thereby affecting market performance over time. In response to these variations, we focus on the inherent profitability of each property, separating it from broader macroeconomic impacts. As such, we adjusted the annual ROI per square foot (psf) calculations of these transactions to account for the annual index return of the real estate market, enabling us to derive the average premium to index. Following this, we compare the average premium to index across high, mid, and low floor units to pinpoint any differences in profitability.

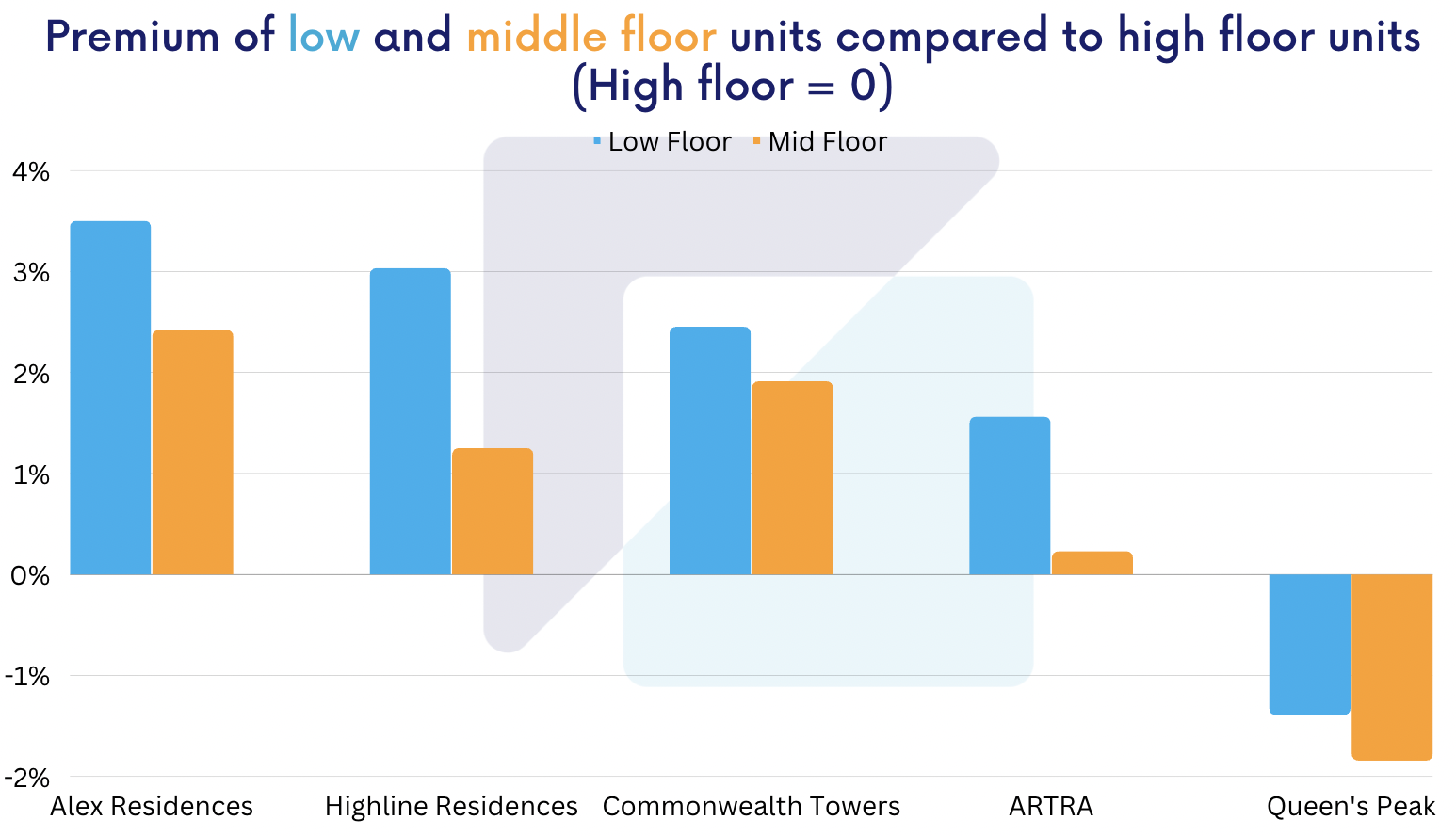

Interestingly, the data reaffirms the trend that units on lower floors tend to appreciate more than those situated on higher levels. High floor units in Alex Residences, ARTRA, Highline Residences, and Commonwealth Towers underperform their lower floor counterparts by about 1-3%. Meanwhile, Queen’s Peak Condominium stands as an outlier where high floor investments yield higher average premium than mid and low floor units, exceeding them by 1.84% and 1.39% respectively.

Overall, these findings contest the prevalent assumption that units located on higher floors command a higher profit when compared to those on lower floors. However, since the selected projects are confined to District 3, within the RCR region, there may be various other factors at play within this specific neighbourhood that could have impacted these results. This prompts us to further extend our analysis to other regions, seeking to explore whether this pattern is representative of the broader market to form a more comprehensive understanding of the relationship between a unit's floor height and its return on investment.

(2) Regional Level

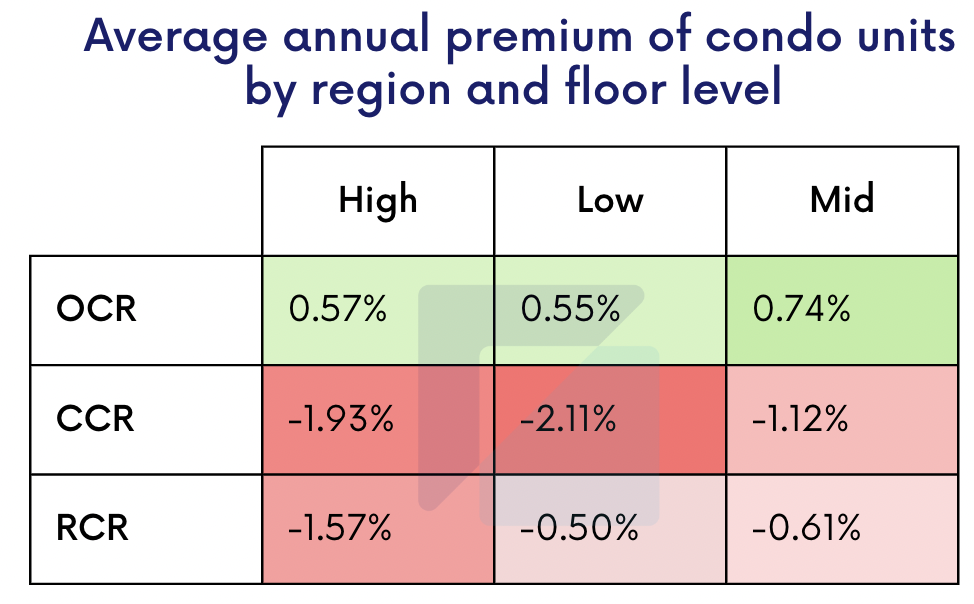

Our analysis offers a nuanced perspective on the common belief that high-floor condo units enjoy higher profitability than lower floor units. It appears this belief holds true in OCR and CCR, where high-floor units are better in terms of attaining a marginally greater premium than lower floor units, varying only between 0.02% to 0.2%. In contrast, RCR presents a distinct deviation from this trend. Low floor units here yield a premium about 1% higher than their high-floor counterparts, defying the usual presumptions.

Given the common perception that high floor units generally fetch higher prices, coupled with the robust demand for private homes within RCR (JLL Singapore, 2023), it is reasonable to anticipate that investing in high-floor units in this area would be a better option than investing in those on lower floors. However, our data presents a counter-narrative that opens up exciting avenues for further analysis.

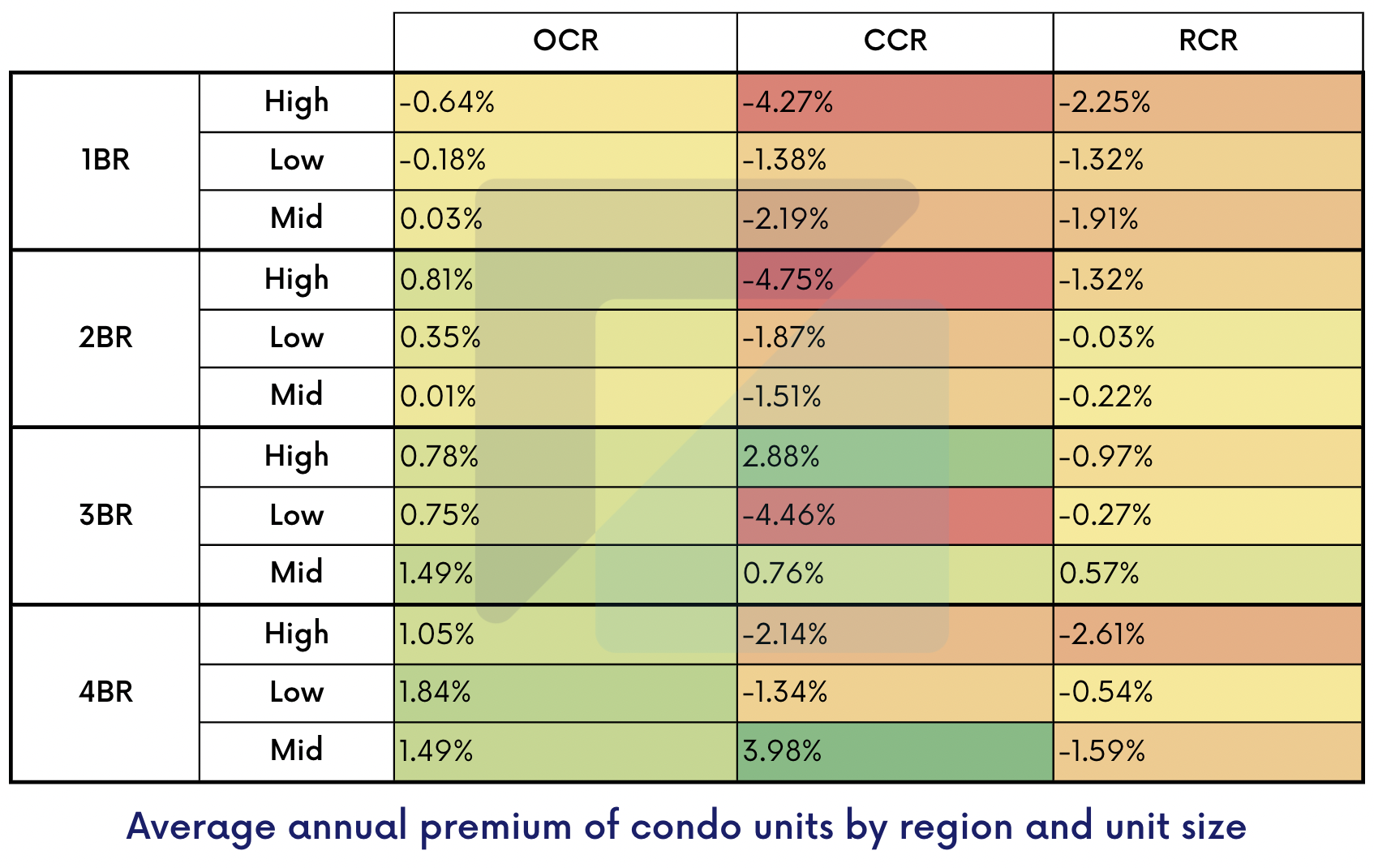

We delve further to assess if the size of the unit, defined by the number of bedrooms, plays a role in determining their profitability. Therefore, we explored the premium of 1, 2, 3, and 4-bedroom units situated at different floor heights across the three regions.

Our analysis suggests that 3-bedroom units on mid-floors across all regions enjoy a favourable investment prospect. A standout observation is the stellar performance of mid-floor 4-bedroom units in CCR, which surpasses the returns of all other property types across different regions.

In OCR, nearly all types of properties, regardless of bedroom count, outpace market performance in appreciation. The highest premium here is commanded by 4-bedroom units on lower floors. As for RCR, the trend remains in favour of 3-bedroom units located on mid-floors, echoing the patterns observed in other regions.

These findings suggest that 3-bedroom and 4-bedroom properties consistently generate more robust profits, which can be tied to a variety of factors, including family size, investment strategies, and external market dynamics.

- Family size can be a major factor influencing the demand for 3-bedroom and 4-bedroom units. Since these unit types provide ample space to accommodate typical family sizes, they naturally command a higher demand, leading to stronger rental or resale returns.

- Additionally, many investors who lease out their properties often find higher demand for larger units, improving rental yields and resale values as these can accommodate families, expatriates, or groups of working professionals looking for shared living arrangements.

- Location and accessibility can also significantly influence profitability. For example, the high premium one property enjoys can be attributed to its central location, easy access to public transportation, proximity to quality educational institutions, etc.

In all, our analysis serves as a potent reminder of the complex interplay of factors that can influence property returns. It is essential for investors to align their investment choices with broader market dynamics and demographic trends beyond merely vertical location or region. Therefore, a comprehensive understanding of these dynamics is crucial in making informed and profitable investment decisions in the real estate market.

Download the full report (PDF) here: High vs Low - Are high-floor units always more profitable.pdf

To know more about our data-driven real estate solutions, contact us here.

Continue to read our other data insights articles:

Condo price surge after a new project launch in the surrounding area? Here’s what our data suggest

The impact of proximity to MRT stations for smart investments on real estate decisions

The effects of cooling measures on foreign investors in Singapore

The impact of proximity to reputable schools for smart investments on real estate decisions

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics, we're revolutionising the real estate industry with our cutting-edge AI technology. By applying advanced data science in real estate industry, and providing customised services for people with various property needs, our market trends and insights, agent enhanced tools, and REA Developer Suite deliver realistic and reliable end-to-end solutions that enables everyone can make their informed decisions. Our solutions are available across Singapore, Malaysia, Hong Kong (China), Indonesia and Australia. Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.

Reference:

Peck, A. (2023, May 15). Private residential units sold by developers in April 2023. JLL Singapore. https://www.jll.com.sg/en/newsroom/private-residential-units-sold-by-developers-in-april-2023