News > The Effects of Cooling Measures on Foreign Investors in Singapore

The Effects of Cooling Measures on Foreign Investors in Singapore

5 May 2023

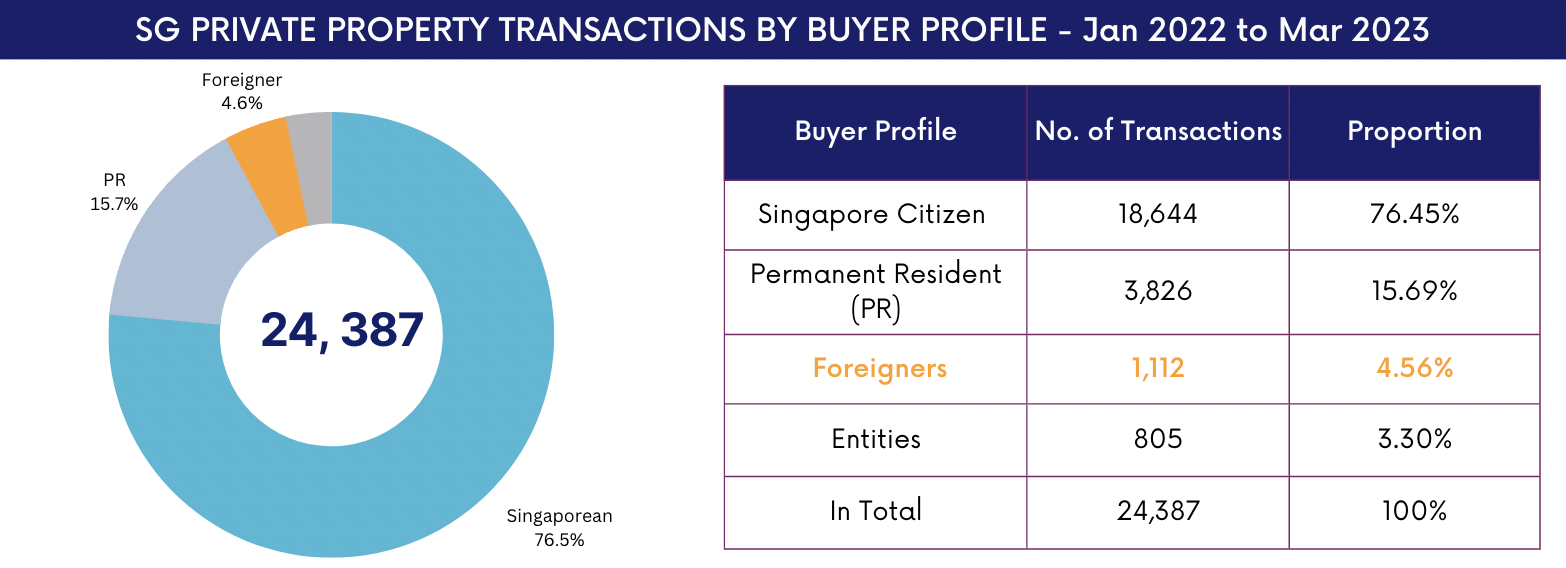

The most recent round of cooling measure in 27 April 2023, which increased the Additional Buyers' Stamp Duty (ABSD) of foreign buyers to 60%, has significant impact on the buying/investing decisions for foreigners looking to have their own property in Singapore. To discover how cooling measures are shaping the appetites of foreign investors in Singapore's private property market, our team at REA has analysed 24,387 private property transactions from 2010 onwards, with a focus on buyer profiles, district transactions, and foreign investors' transaction trends.

Summary of Main Findings

- Despite experiencing the most significant impact, foreign investors only represented 4.56% of all transactions from January 2022 to March 2023.

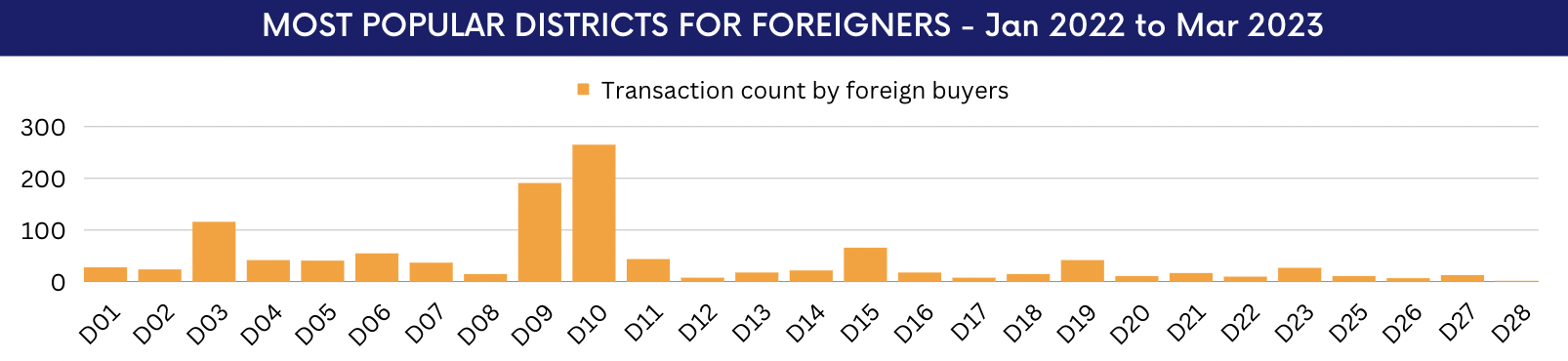

- Districts D10, D09, and D03 saw the highest number of transactions by foreign investors.

- District D06 boasted the highest percentage of foreign investor transactions, with 35% of its total.

- Foreign investors demonstrated a preference for high-end, more expensive projects, a trend different from the mass market's preference for 2-bedroom units over 3-bedroom ones.

- After the introduction of the first policy in 2011, a notable decline in transaction volume and foreign investor participation was observed. However, subsequent policy changes did not yield similar dramatic effects.

Analysis

Based on the Singapore private property transactions by buyer profile, with the recent hike, the Additional Buyer's Stamp Duty (ABSD) for foreigners have doubled to 60% (from 30% previously). From 2022 to the end of March 2023 , there has been a total of 24,387 private property transactions of which foreign purchasers account for approximately 4.56% (1,112 transactions).

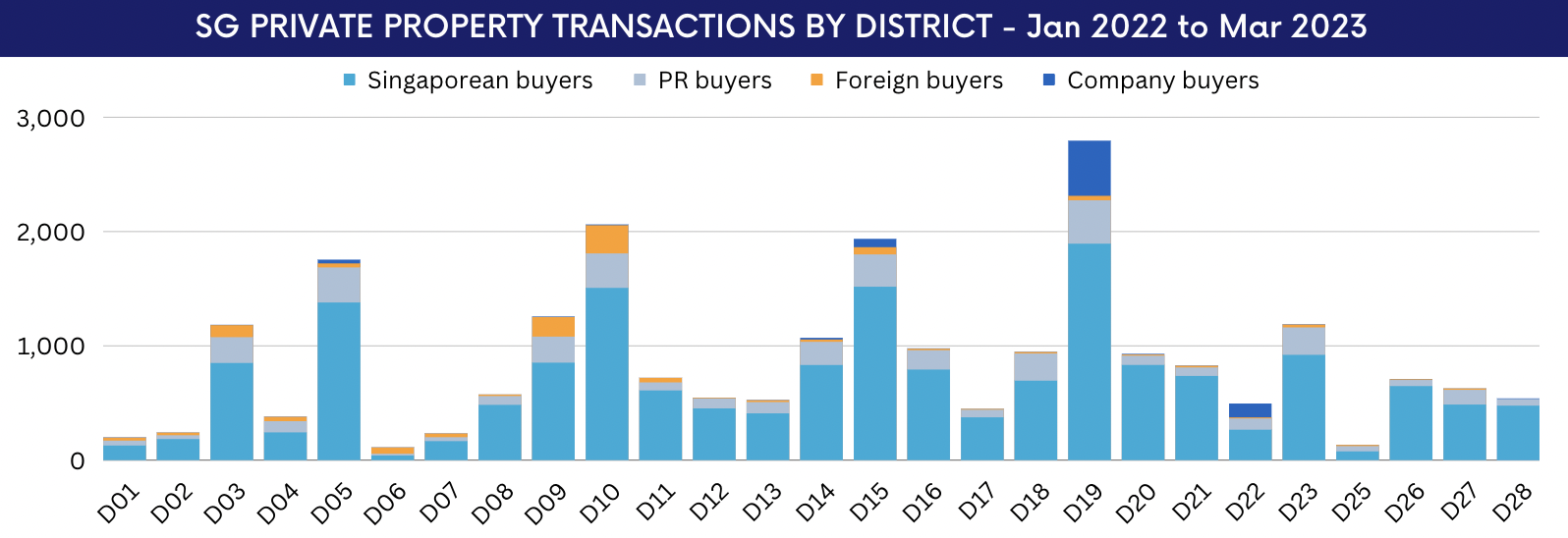

As for the different districts:

- Purchases of private properties by Singaporeans and PRs make up the majority of the total transactions across all districts.

- Among the 8 districts with a total transaction volume of more than 1,000 (D03, D05, D09, D10, D14, D15, D19 and D23), a relatively larger proportion of transactions are undertaken by foreign purchasers for D10, D09, D03.

We also gauge the number of transactions by foreign buyers in different districts to identify top performing districts in Singapore.

The transaction count of the top 3 popular districts among foreign purchasers are as follows:

- D10 (Tanglin, Holland): 264

- D09 (Orchard, River Valley): 190

- D03 (Alexandra, Commonwealth): 115

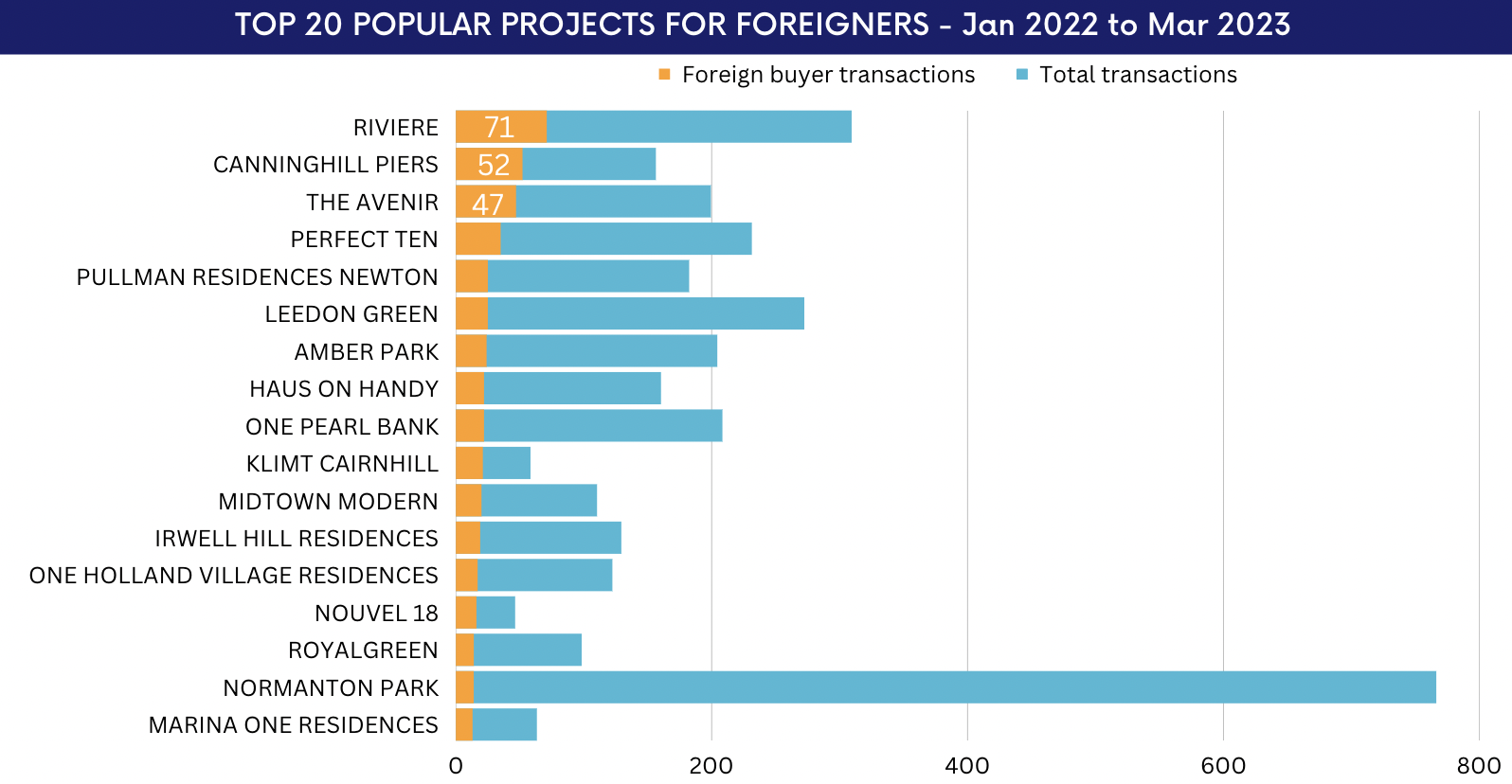

Besides, the ranking of projects based on number of transactions from foreign investors shows that the top 3 popular projects are Rivere, Canninghill Piers, and The Avenir, which recorded 71, 52, and 47 transactions respectively.

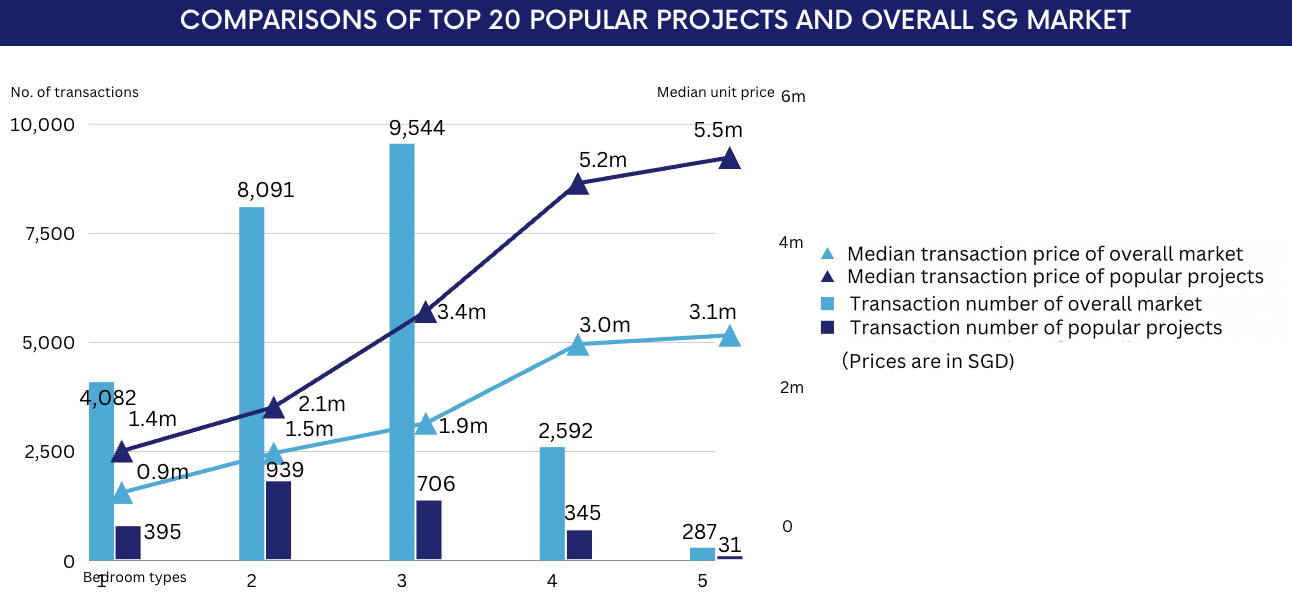

To discover whether the transaction volume and prices are influenced by different bedroom types, we compared the top 20 popular projects among foreigners with the overall Singapore real estate market:

- Transaction Volume: Top 20 projects show more transactions for 2-bedroom units than 3-bedroom units, unlike the overall market.

- Transaction Price: The median unit price of top 20 projects is higher compared to the overall market, and the price gap widens as number of bedrooms increases.

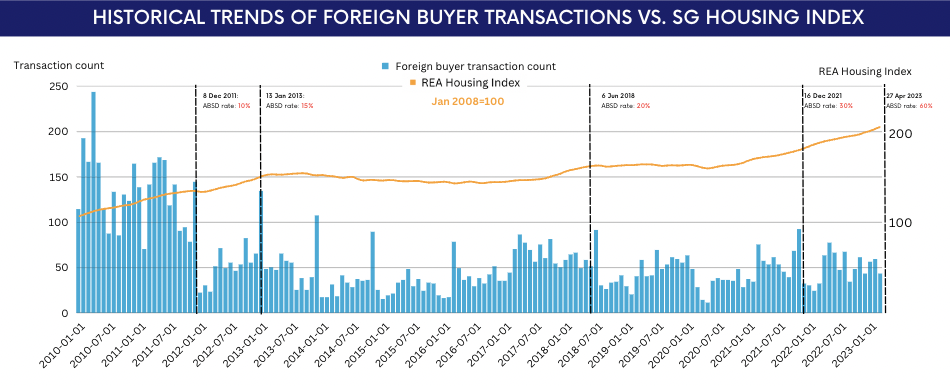

According to the historical trends of foreign buyer transactions and overall Singapore housing Index:

From 2010 onwards, there were 5 waves of ABSD rate increase. We can observe that:

- The first three ABSD hikes caused an immediate transaction count spike in the same month, likely due to the time gap between the announcement and the effective date. However, the 2021 increase, which happened at midnight, didn’t see such a spike in property sales;

- While the ABSD didn’t have huge impacts on the overall Singapore real estate market, the orange line - REA Housing Index, tracks residential market changes and indicates that the Index is gradually increasing.

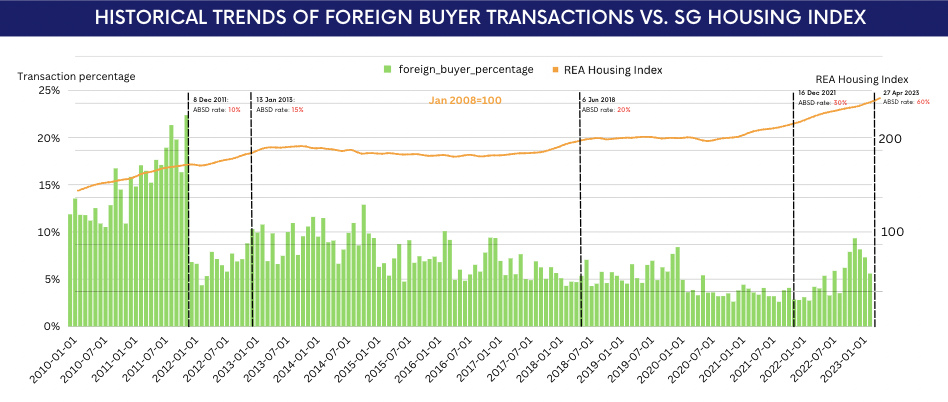

Below graph shows the percentage changes of foreign buyers with the continued tax increase policies:

- Overall, the percentage of foreign investors has decreased;

- The first rate increase on 8 Dec 2011 witnessed the biggest drop of foreign investors percentage, which decreased from 14.7% to 6.7%.

Download the full report (PDF) here: The Effects of Cooling Measures on Foreign Investors in the Singapore Private Property Market.pdf

To know more about our data-driven real estate solutions, contact us here.

Continue to read our other data insights articles:

Condo price surge after a new project launch in the surrounding area? Here’s what our data suggest

The impact of proximity to MRT stations for smart investments on real estate decisions

The effects of cooling measures on foreign investors in Singapore

The impact of proximity to reputable schools for smart investments on real estate decisions

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics, we're revolutionising the real estate industry with our cutting-edge AI technology. By applying advanced data science in real estate industry, and providing customised services for people with various property needs, our market trends and insights, agent enhanced tools, and REA Developer Suite deliver realistic and reliable end-to-end solutions that enables everyone can make their informed decisions. Our solutions are available across Singapore, Malaysia, Hong Kong (China), Indonesia and Australia. Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.