News > The Impact of Proximity to Reputable Schools for Smart Investments on Real Estate Decisions

The Impact of Proximity to Reputable Schools for Smart Investments on Real Estate Decisions

24 April 2023

In Singapore, the demand for properties in the vicinity of a reputable primary school tends to be higher, as parents place huge focus on education system and often prioritise enrolling their children in renowned schools to give them the best possible education. Given the competitive nature of securing a place in a reputable primary school, living near such a school is akin to winning a lottery. The nearer to reputable school, the higher the property price - as much as we believe this statement, we are still curious to see what the data says about this. In this article, we will use The Reserve Residences and Pei Hwa Presbyterian Primary School as the references to offer insights on how proximity to reputable schools can enhance the value on real estate investments.

About The Reserve Residence

The upcoming launch of The Reserve Residences located in the Bukit Timah district of Singapore, offers 732 units ranging from 1 to 5 bedrooms, including penthouses. As a 99-year leasehold tenure, The Reserve Residence is the newest leasehold project in the Beauty World area, with a significant 20 year age gap compared to existing developments. The expected TOP date is around 2028, with an estimated price per square foot around $2,400 to $2,600.

About Pei Hwa Presbyterian Primary School

The strategic location, being 1km from reputable school - Pei Hwa Presbyterian Primary School (”Pei Hwa”), makes it an attractive option for smart investors looking to maximise their returns. Pei Hwa is a highly-sought after non-GEP (Gifted Educated Programme) primary school in Singapore, with more applicants than available vacancies from Phase 2A onwards.

Primary 1 Registration Statistics for 2022:

- Phase 2(A): 255%

- Phase 2(B): 185%

- Phase 2(C): 212%

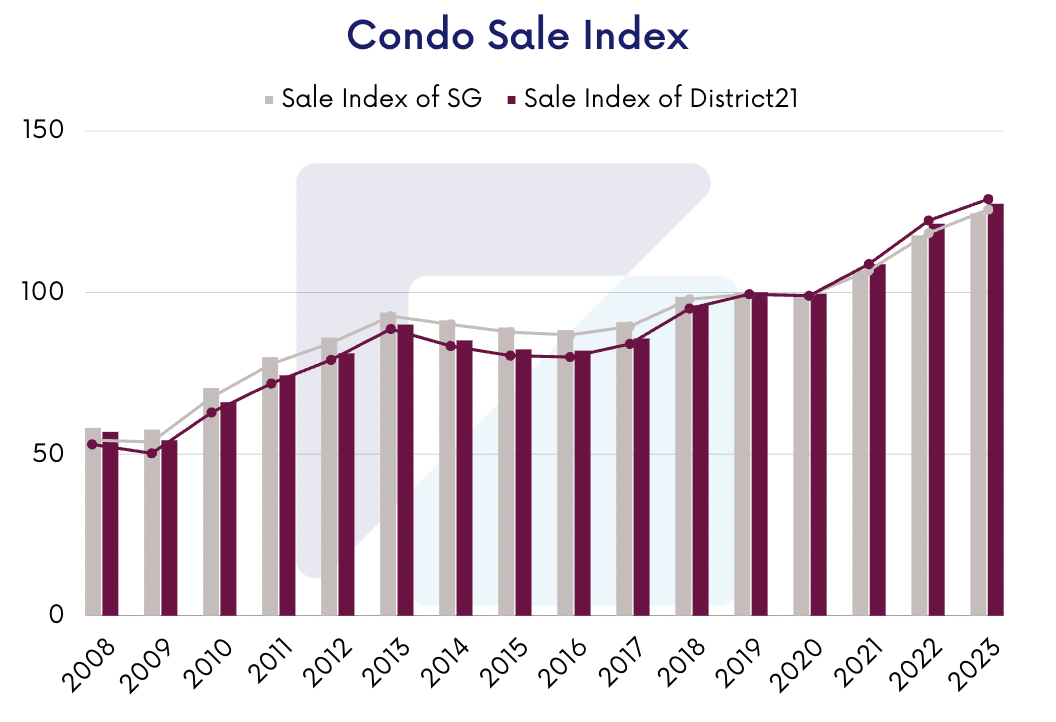

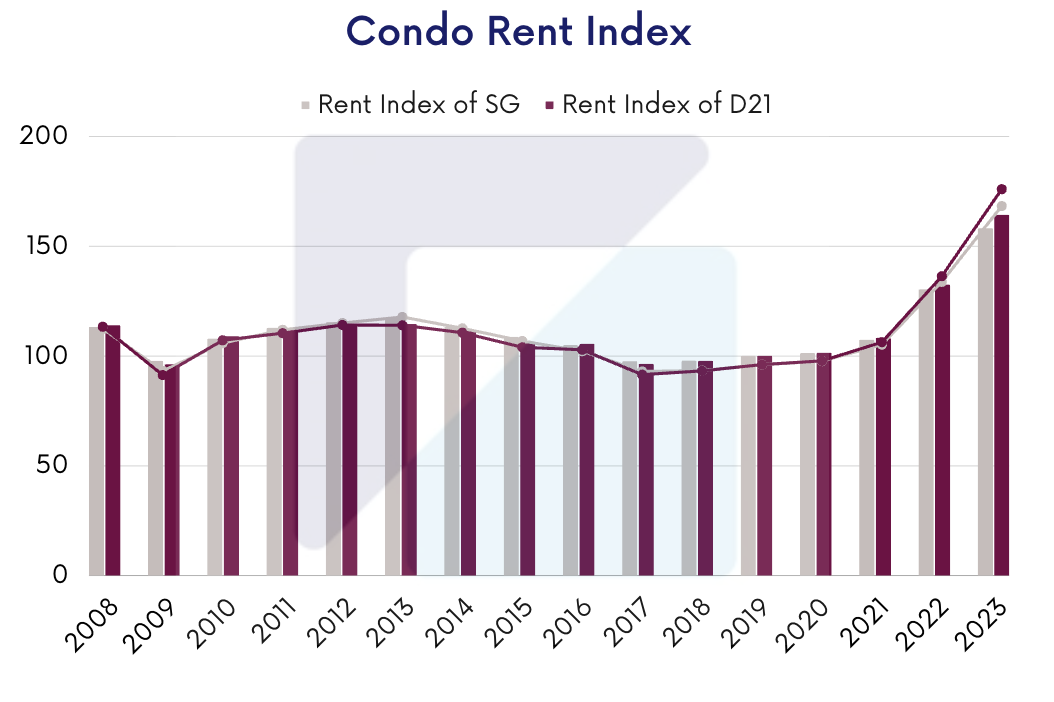

Housing Index of Singapore and District 21

The Residential Property Index of Singapore and District 21 enables us to monitor fluctuations in both property prices and sales, providing valuable information on the prevailing conditions of the housing market. By making such comparisons, we can gain valuable insights into the present state of affairs.

According to our Housing Index, since 2019, properties located in District 21 have a higher resale value compared to the average property in Singapore. This indicates that, on average, properties in District 21 are sold at a higher resale price compared to the average property in Singapore. With regards to the Rental Housing Index, from 2021, District 21 has a slightly higher rental value compared to Singapore. Please email corporate@rea-global.com if you wish to get housing indexes comparisons of other districts or custom areas.

Our Methodology

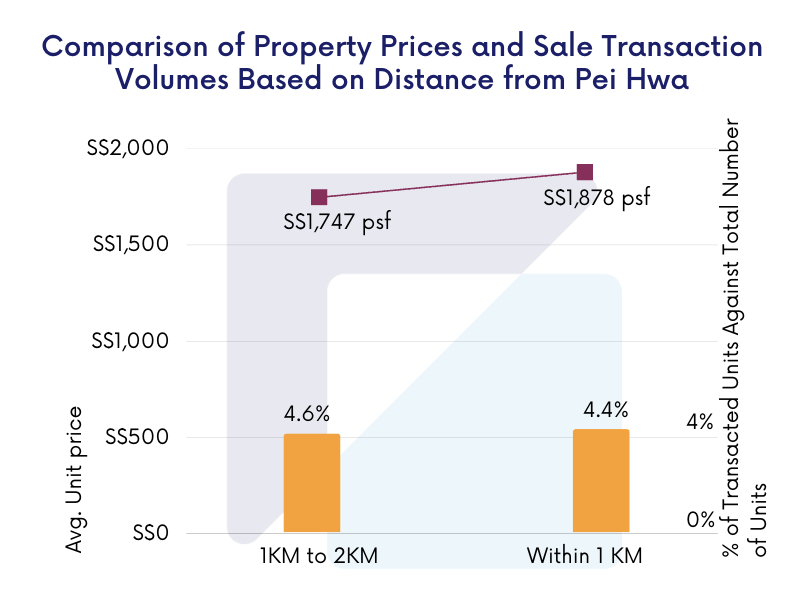

Within a 1KM radius of Pei Hwa, there are 41 condominium projects with a total of 5,578 units. In the 1KM to 2KM range, there are 31 projects and a total of 7,761 units. In the year 2022, 246 units were sold and 986 units were rented in the 1KM radius of Pei Hwa. As for the units located between 1KM and 2KM, 357 units were sold and 1,499 units were rented during the same period.

By applying our machine learning algorithms, we set out to test whether being situated in close proximity to a reputable school (being Pei Hwa for purpose of this assessment), will have an effect on the sale and rental of such properties.

Analysis

Comparisons of Proximity and sale Transactions

- The difference in the number of transactions recorded (as a percentage of total units in the specified area) is insignificant for properties within 1 km versus those between 1 km and 2 km of Pei Hwa;

- The transactional unit price of units within 1 km of Pei Hwa of approximately $1,878 psf represents a premium of approximately 7.5% over the transactional unit price of units within 1 km and 2 km of Pei Hwa of approximately $1,747 psf;

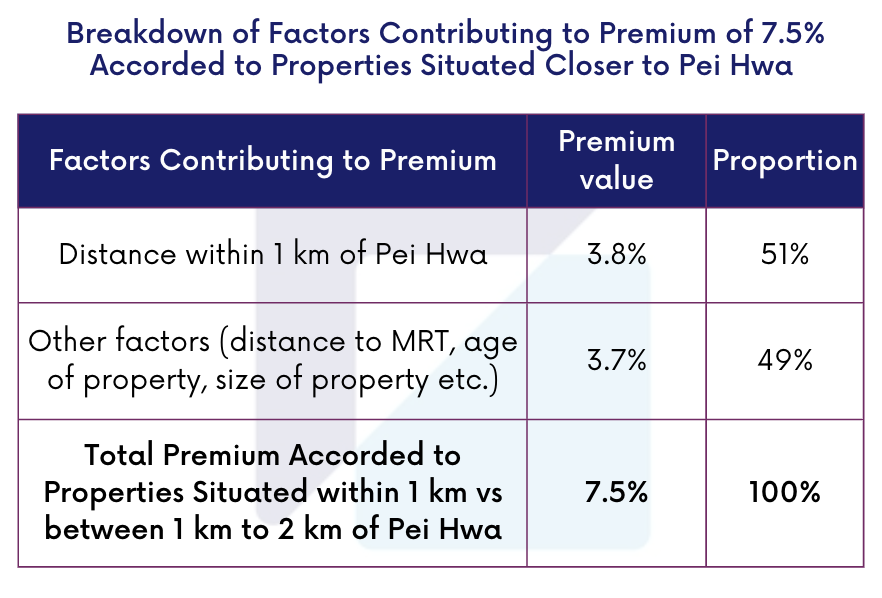

- The premium attributed to properties within 1km from Pei Hwa is 3.8%, with other factors (such as distance to MRT, age of property, size of property etc.) contributing to the remaining 3.7%, meaning that the factor properties within 1km from Pei Hwa itself accounts for over 50% proportion among all pricing impact factors.

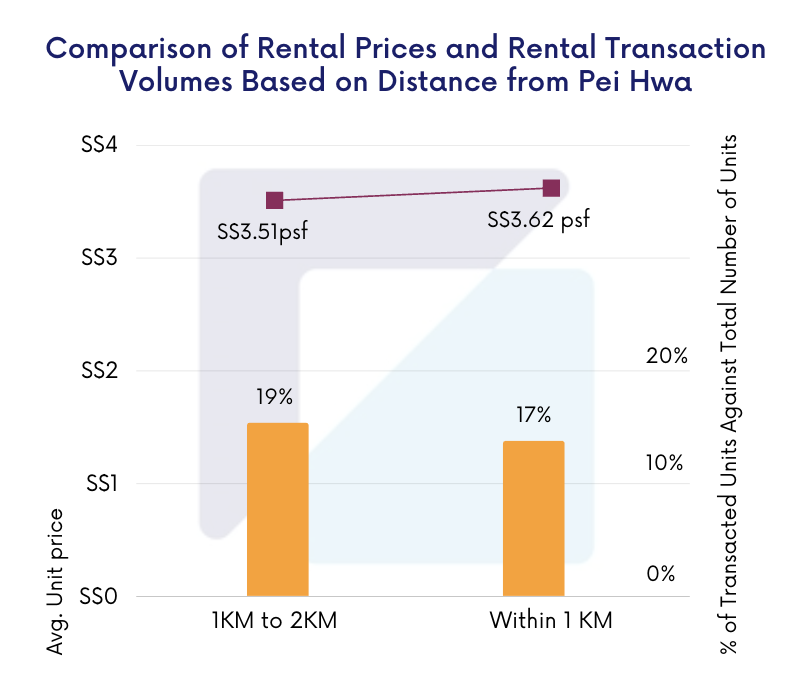

Comparisons of Proximity and rental Transactions

- Rental transactions volume (as a as a percentage of total units in the specified area) is lower for properties within 1 km (17%) versus those between 1 km and 2 km ( 19%) of Pei Hwa;

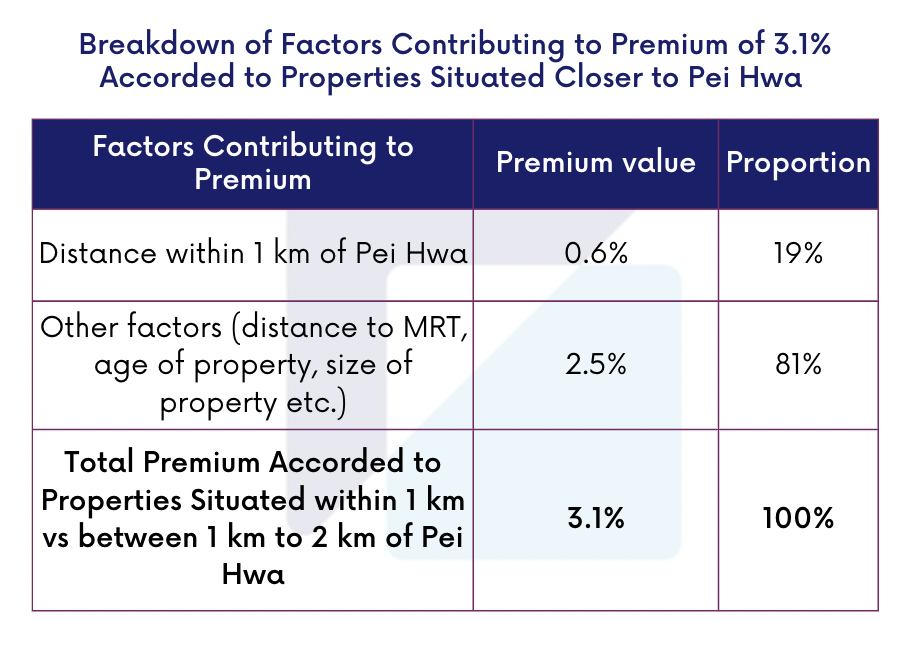

- The rental price of units within 1 km of Pei Hwa of approximately S$3.62 psf represents a premium of approximately 3.1% over the rental price of units within 1 km and 2 km of Pei Hwa of approximately $3.51 psf;

- Properties being within 1 km from Pei Hwa do not contribute to too much premium (0.6%) in relation to rental rates, which accounts for 19% proportion.

Our findings

For real estate investors with sale purpose,

- Properties located within 1km from Pei Hwa have an average resale price premium of 7.5% compared to those within 1km to 2km.

- A premium of 3.8% is attributed solely by being situated within 1 km of Pei Hwa.

- Proximity does not have a significant impact on transaction volume.

- In the case of Pei Hwa, approximately 51% of the premium was due to such properties being situated within 1 km of Pei Hwa.

As for real estate investors with rental purpose,

- Properties located within 1km from Pei Hwa have an average rental price premium of 3.1% compared to those within 1km to 2km.

- No premium is accorded for solely being situated within 1 km of Pei Hwa.

- Proximity does not have a significant impact on transaction rates in the case of Pei Hwa.

Download the full report here: The Impact of Proximity to Reputable Schools for Smart Investments on Real Estate Decisions.pdf

To know more about our data-driven real estate solutions, contact us here.

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics, we're revolutionising the real estate industry with our cutting-edge AI technology. By applying advanced data science in real estate industry, and providing customised services for people with various property needs, our market trends and insights, agent enhanced tools, and REA Developer Suite deliver realistic and reliable end-to-end solutions that enables everyone can make their informed decisions. Our solutions are available across Singapore, Malaysia, Hong Kong (China), Indonesia and Australia. Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.