News > The Impact of The Latest Cooling Measure on New Launch & The Relationship Between Take-up Rate and Launch Price

The Impact of The Latest Cooling Measure on New Launch & The Relationship Between Take-up Rate and Launch Price

31 May 2023

This study focuses on learning the impact of the latest cooling measure on the price of new sale transactions and the take-up rate of new launch projects in District 15, specifically The Continuum - a newly launched project in May 2023.

Background & Methodololy

Information about The Continuum & Similar Projects

Table: Comparison of Take-up rates between The Continuum, Tembusu Grand, and Atlassia. Source: REA

Launched on May 6th, 9 days after the latest cooling measure came into effect, The Continuum sold 216 units(26.5% of all units)at an average price of $2732 psf throughout the first week. To articulate whether the take-up rate of 26.5% is satisfactory, we compare it with the take-up rate of a similar project.

Methodology of Similarity Analysis:

Our similarity analysis algorithm is designed to identify the best comparable properties for a subject property. The model takes into account attributes including price, unit size, project bedroom mix proportion and distance, etc, and assigns them different weightage to ensure the accuracy of the model.

Our Findings

- The average price psf of condos in D15 has been higher than the price psf of condos in Singapore since Sep 2022, suggesting the growing supply of high-end condo projects in D15.

- There is no clear linear relationship between launch price and take-up rate.

- Medium and big-size condo projects are showing strong sales performance, as all projects that are launched after 2018 and achieved above 50% take-up rate have more than 250 units.

Price Index of Resale and New Launch in SG & D15

Table: Number of resale and new sale transactions in Singapore and D15 after 2018. Source: REA

Chart: Comparison between Singapore vs D15 Resale and New Launch Price Index. Source: REA

The Price Index of SG v.s D15 shows:

- The Resale Price Indexes demonstrate high similarity as the two lines consistently move in parallel without any significant deviations.

- In comparison, the New Launch Price Indexes exhibit a more fluctuating trend over time. The D15 price index started surpassing the Singapore index significantly from September 2022, in Mar 2023, the price index of D15 new launches increased by 45.1%, compared to the base of 2018.

The relationship between Launch price & First-week Take-up Rate

Observing that the launch prices of D15 projects have been higher than launches in other areas for the past 9 months, while the first-week take-up rate of The Continuum is more than 20% lower than its similar projects in D15, we will further explore the relationship of first-week take-up rate and launch price, to discover whether their appears any correlations.

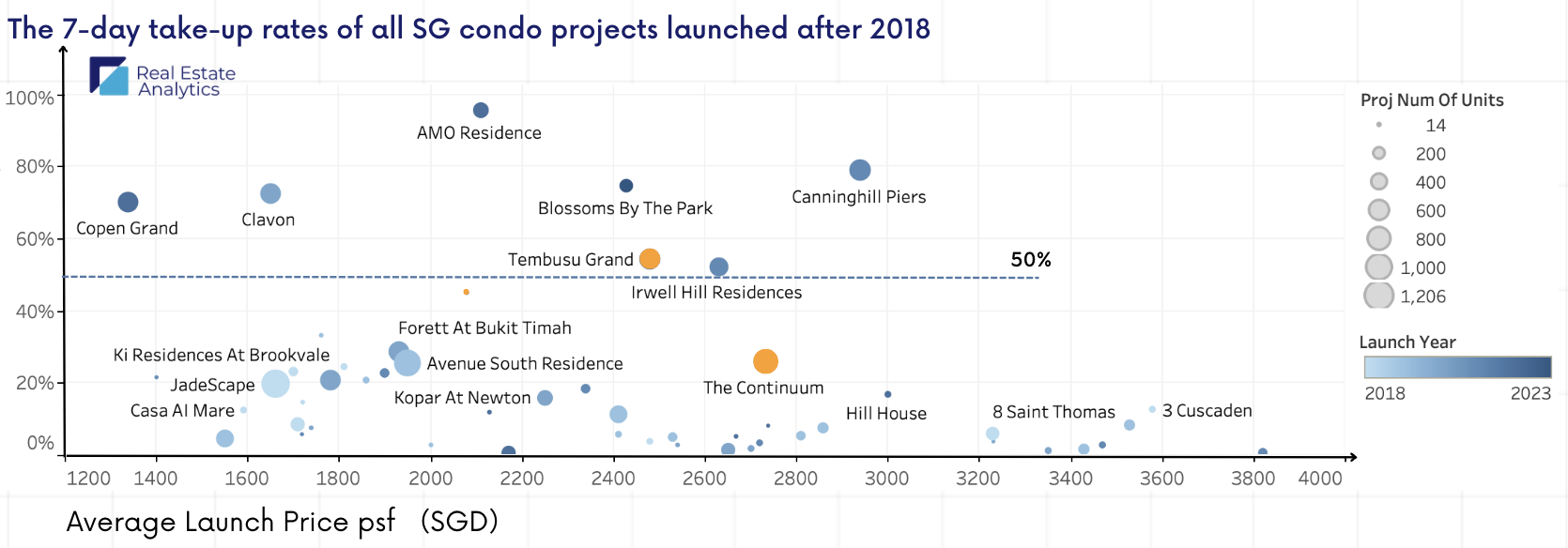

Chart: The 7-day Take-up Rates of all Condos in Singapore launched after 2018. Source: REA

By checking all condo projects launched after 2018, we observe that:

- There is no clear linear relationship between launch price and take-up rate . The sale performance is influenced by multiple factors including location, unit layout, developer reputation, timing, and competitive landscape. As different projects' positioning, the launch price has no significant impact on the take-up rate.

- All projects that achieved above 50% take-up rate were launched after 2020 and have more than 250 units, this reflects the booming of SG real-estate market and the popularity of medium and big size projects .

- As the third biggest condo project launched since 2018, The Continuum achieved a take-up rate of 26.5 in the first week. Although it is lower than its similar projects (Tembusu Grand, Atlassia), it is slightly higher than projects of similar size (Jadescape: 20%, Avenue South Residence: 25%).

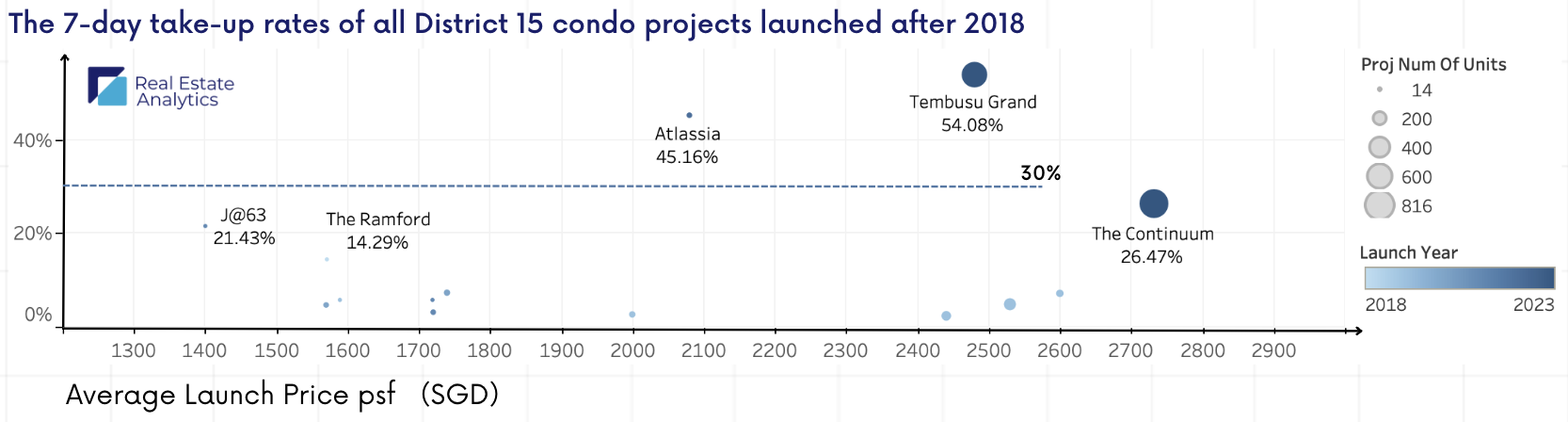

Chart: The 7-day Take-up Rates of all Condos in D15 launched after 2018. Source: REA

When focusing on D15 projects only, we observe that:

- Tembusu Grand and The Continuum are the biggest launched condo projects in D15, in terms of property units. Each of these two has units more than all other condo units combined;

- The Continuum is currently the most expensive launched condo project in D15. The average price psf of $2732 is $252 and $652 more expensive than similar projects, Tembusu Grand (99-year leasehold) and Atlassia (freehold);

- Launched 9 days after the ABSD rate increase and faced with more than 2 upcoming new launches in D15, The Continuum achieved a relatively lower take-up rate, compared to its similar projects.

Data is accurate as of the published date of this article.

*Disclaimer: Our real-time database is updated every time a transaction is submitted by an agency. While we strive to maintain the accuracy and completeness of the data, please note that transactions may not always be completed, and information provided may be subject to change or error.

Download the full report (PDF) here: The Impact of The Latest Cooling Measure on New Launch & The Relationship Between Take-up Rate and Launch Price.pdf

To know more about our data-driven real estate solutions, contact us here.

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics (REA), we revolutionise the real estate industry with cutting-edge AI technology. Leveraging advanced data science and machine learning, we offer tailored data solutions for real estate professionals and enthusiasts. Our products, including market insights, RealAgent suite (for agents), and RealInsight (for developers, investors, institutional clients), provide end-to-end solutions for informed decision-making. Available across Singapore, Malaysia, Hong Kong (China), and Australia, our offerings ensure you always stay ahead in the dynamic real estate market.

Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.