News > The new 2023 cooling measures' impact: Home sellers are selling at a loss

The new 2023 cooling measures' impact: Home sellers are selling at a loss

10 August 2023

In the ever-evolving real estate landscape, the recent changes to the Additional Buyer’s Stamp Duty (ABSD) have sent ripples across the industry, especially for foreigners who are looking to invest in Singapore’s property market. But what does this mean for local property sellers? With many speculating about declining profits, our deep dive into the aftermath of these adjustments seeks to answer a burning question: "Are sellers now predominantly selling at a loss after cooling measures?". Join us as we uncover the data-driven insights behind the market shifts, and discover how the cooling measures may have transformed property transaction dynamics.

The new cooling measures

In April 2023, Singapore's real estate landscape underwent a significant shift with the introduction of new property cooling measures. Aimed at tempering the heated property market and ensuring long-term stability, these regulations included an increase in the Additional Buyer’s Stamp Duty (ABSD). First-time Singaporean buyers saw their ABSD rates unchanged, but second property purchasers faced a hike of 3%, and 5% for their third and subsequent properties. Foreigners purchasing any property in Singapore had their rates DOUBLED from 30% to 60%.

This is the third round of cooling measures since December 2021 as Ministry of Finance (MOF), the Ministry of National Development (MND) and the Monetary Authority of Singapore (MAS) noted that the previous rounds of cooling measures in December 2021 and September 2022 have had a "moderating effect" on the property market. These changes, designed to deter speculative buying and curb excessive price growth, have had palpable impacts on both buyers and sellers, reshaping the dynamics of property transactions in the city-state.

Our Findings

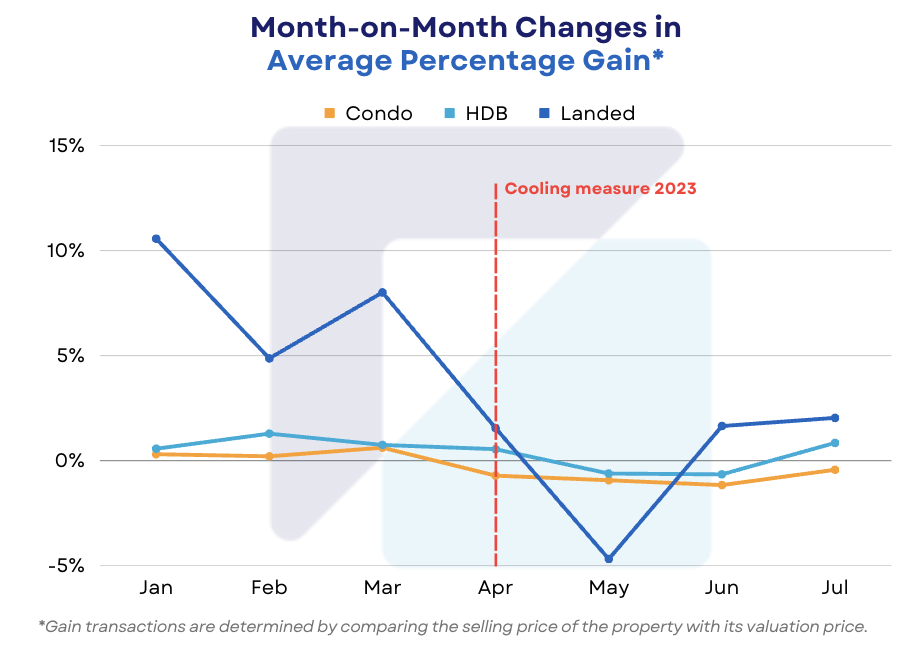

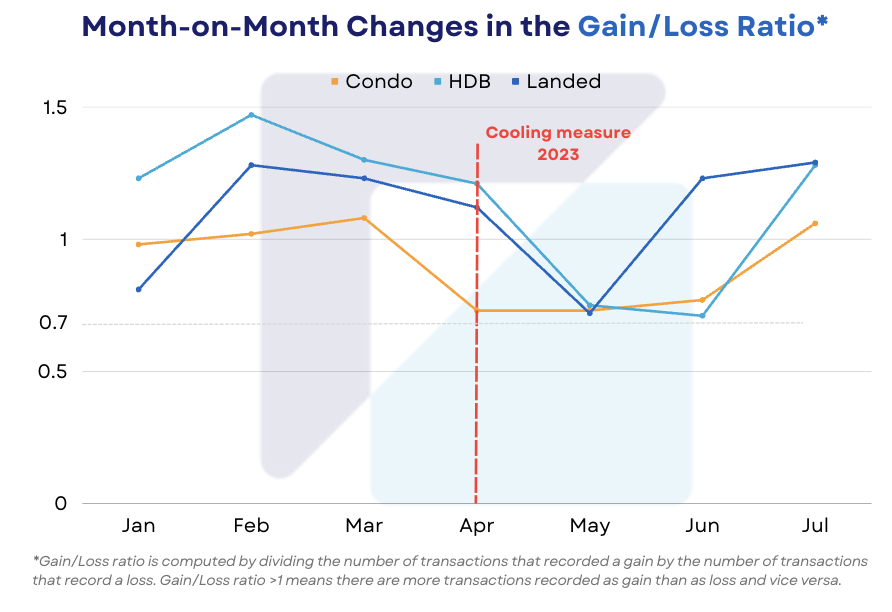

In May 2023, 1 month after the implementation of the new cooling measures, the average percentage gain of all property types dropped to below 0%, indicating that in general, home sellers suffered loss when trying to sell their home. Additionally, the number of gain transactions decreased significantly, making it lower than the number of loss transactions. From this, we can see that after the ABSD hikes, sellers are constantly selling at a loss.

Methodology

The analysis of the impact of the ABSD hike on Singapore real estate market was conducted using a comparative approach. We collected a dataset of 3-month pre and post-ABSD increase in April 2023, which covers the period of January - July 2023. This data encompassed sale transactions of all property types including landed properties, condos, and HDBs. Key metrics studied included average percentage gain/loss* of sale transactions and the Gain/loss ratio of gain versus loss transactions.

Trends and variances across property types were identified to spot out any variances of the impact of the cooling measures on different types of property, and the impact of the ABSD hike was evaluated.

It's important to note that this methodology allows for observing trends and patterns, but a direct cause-and-effect relationship between the ABSD increase and these changes requires further in-depth analysis and consideration of potential confounding factors.

*Gain or loss transactions are determined by comparing the selling price of the property with its valuation price - which is determined using our RealValue's Automated Valuation Model that achieves a median accuracy of 97%. You can also get a free valuation of your property here!

Analysis

The Additional Buyer’s Stamp Duty (ABSD) increase in April 2023 introduced turbulence in the real estate market. All property types were impacted, with the average percentage gain of sale transactions falling to below 0% in the following month (as can be seen from the chart below).

This signifies a distressing reality, where home sellers are consistently selling at a loss after the implementation of the new cooling measures.

The fallout from the ABSD increase was particularly severe for landed properties. While condo and HDB transactions suffered from a loss of 0.93% and 0.61% respectively in the following month, landed properties recorded an average percentage loss of 5%, a considerable amount compared to the other types.

Additionally, the overall number of loss transactions escalated significantly post-ABSD hike, reflecting a challenging market for sellers. In May, which is immediately after the new cooling measures, there was a significant surge in the number of loss transactions as can be seen from the Gain/Loss ratio depicting ~0.7, meaning there were ~30% more transactions that recorded a loss than those with a gain for all property types.

This phenomenon was not long-term, however, as the figures gradually increased in the next 2 months, where there were more gain than loss transactions. Although the percentage gain is still negative for most property types, this recovery indicates a potential stabilisation of the market as it adapted to the new ABSD regulations.

Last thoughts

Although the data shows that sellers are selling at a loss after the new property cooling measures, it's not entirely clear whether the new cooling measures directly led to these changes. There could be various factors driving this phenomenon, and further analysis is needed.

However, this report underscores the heightened caution required by potential sellers and the need for strategic planning to navigate this complex market scenario.

Download the full report (PDF) here: The new cooling measures' impact - Sellers are selling at a loss.pdf

To know more about our data-driven real estate solutions, contact us here.

Continue to read our other data insights articles:

High vs Low: Are high-floor units always more profitable?

Condo price surge after a new project launch in the surrounding area? Here’s what our data suggest

The impact of proximity to MRT stations for smart investments on real estate decisions

The effects of cooling measures on foreign investors in Singapore

The impact of proximity to reputable schools for smart investments on real estate decisions

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics, we're revolutionising the real estate industry with our cutting-edge AI technology. By applying advanced data science in real estate industry, and providing customised services for people with various property needs, our market trends and insights, agent enhanced tools, and REA Developer Suite deliver realistic and reliable end-to-end solutions that enables everyone can make their informed decisions. Our solutions are available across Singapore, Malaysia, Hong Kong (China), Indonesia and Australia. Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.

*Data updated as of 25 August 2023