News > Unlocking the Power of Big Data: REALValue - A Cutting-Edge AVM for Accurate Property Valuations

Unlocking the Power of Big Data: REALValue - A Cutting-Edge AVM for Accurate Property Valuations

26 May 2023

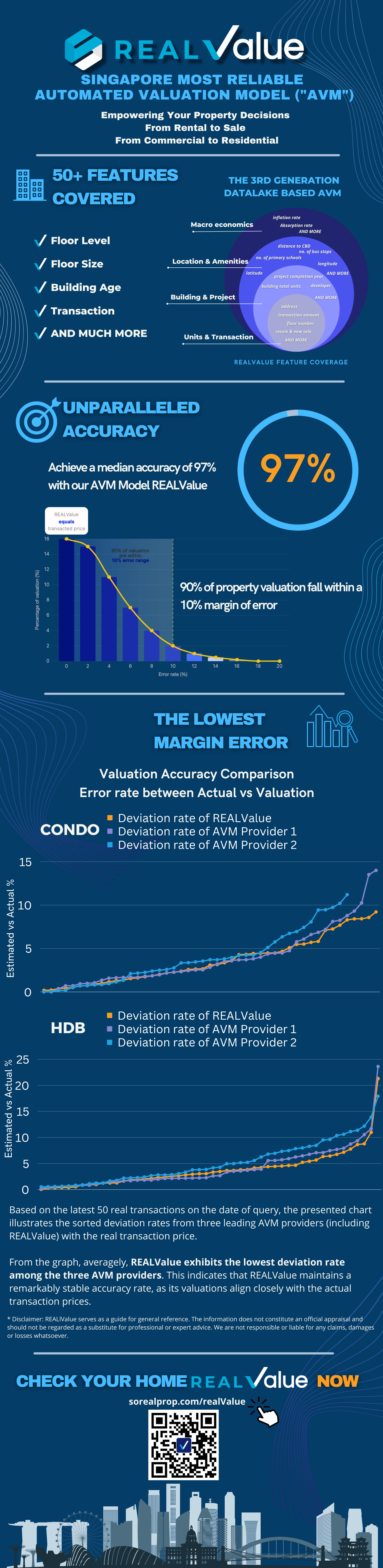

The Automatic Valuation Model (AVM) implemented by Real Estate Analytics (REA) draws upon an extensive repository encompassing millions of data points and images, constituting the 'Big Data Lake.' Through the extraction of imagery data and the integration of explicit and implicit models via a dynamic Artificial Intelligence algorithm, our proprietary AVM is classified as a cutting-edge third-generation approach, distinguishing it from more conventional models prevalent in the market. This AVM possesses the notable qualities of location agnosticism and adaptability, allowing it to assimilate and incorporate local attributes across various dimensions. By incorporating real-time transaction data, our AVM effectively captures systemic shocks, such as sudden property tax increases or legal changes, contributing to its resilience and responsiveness. It operates as an ever-evolving, self-learning system of statistical analysis, deviating from traditional valuation methods. Consequently, it is imperative to engage the expertise of a human professional for traditional valuations, as the AVM may yield misleading outcomes if the underlying data is inaccurate or incomplete or if the assessed property possesses extraordinary characteristics.

The results generated by REA's AVM exhibit an unbiased nature, as the error distribution demonstrates a lack of bias when compared to actual outcomes. It has been successfully deployed across multiple countries and regions, with the margin of error understandably varying based on the data quality in each respective market. The application of REA's AVM extends to both residential and commercial properties, encompassing sales and rental transactions, thereby offering a comprehensive and holistic view of the market. The systematic application of the AVM to all existing units enables the generation of real-time market indices.

The obtained results exhibit robustness, contingent on geographical location and property type. For instance, in Singapore and Hong Kong, the margin of error (defined as the disparity between observed transaction amounts and assessed values) for commonly traded properties such as condominiums and HDB flats falls within the range of 2% - 3% in Singapore and 3% - 4% in Hong Kong, depending on the specific definition and time frame. These figures are notably lower than the traditionally recognized "human error" margin of 5% or the standard acceptable deviation between two human experts. It is worth noting that when it comes to rental properties, the error margin tends to be slightly higher. Specifically, for condominiums and HDB flats in Singapore, we observe an error margin ranging from 5% - 12%. Similarly, for high-rise private residential properties in Hong Kong, the range falls within 5% - 6%. This disparity can be attributed to the significant variations in rental contract terms and the diverse types of furnishings offered in these respective markets. These compelling statistics underscore the reliability and accuracy of our valuation model. By consistently outperforming the benchmark error rates, our AVM proves to be a dependable and informed choice for assessing property values.

In order to assess the quality of REA's AVM, we routinely collect and compare all transaction data, including prices, for a specific time period. While certain deviations may be attributed to exceptional circumstances or even misreporting, we do not selectively filter them out. Furthermore, we conduct comparisons with other AVMs available in the market before the reported transactions become known, ensuring a comprehensive evaluation.

In conclusion, REALValue, developed by Real Estate Analytics (REA), introduces a revolutionary Automatic Valuation Model (AVM) that transforms property valuation. Drawing on a vast repository of data points and images, the AVM utilizes dynamic AI algorithms and location agnosticism to deliver accurate and adaptable valuations. By incorporating real-time transaction data and capturing systemic shocks, REALValue showcases resilience and responsiveness. While human expertise remains essential for traditional valuations, the AVM provides unbiased and reliable results, offering a comprehensive view of residential and commercial properties and empowering informed decision-making.