News > Singapore Property Market Snapshot - October 2023

Singapore Property Market Snapshot - October 2023

8 November 2023

October saw Singapore's property market adapting to a slower economic pace and reduced interest from expats. This shift reflects a market recalibrating to new global trends and local economic signals, presenting a nuanced picture for buyers and sellers alike. Dive into this month's market snapshot to see how these factors are reshaping Singapore's real estate scene.

Hot Topics in Singapore Property Market October 2023

1. Strong interest from developers in recently closed tender for Tampines EC site, with top bid reaching $721 psf PPR.

The Tampines location is expected to become even more appealing with the completion of the Cross Island line and a mixed-use development along Tampines Ave 11. However, the rising land prices of ECs may impact affordability for potential buyers. Read more >>

2. URA investigating urban farm at Good Class Bungalow linked to failed crypto fund co-founder.

The property is linked to Zhu Su, co-founder of failed crypto fund Three Arrows Capital. The URA is engaging with the operators of the farm to determine the nature and scale of their activities. Home-based businesses are allowed in private residential premises as long as they remain small-scale and primarily for residential use. Zhu and his wife bought the GCB for S$48.8 million last year. Read more >>

3. 20 Property Agents in Singapore Found Marketing Vacant HDB Flats, Council of Estate Agencies Takes Action.

Flat owners are required by HDB to physically occupy their flats for a minimum occupation period before selling them. CEA has concluded investigations on four cases reported in the media in December 2022, with two property agents found to have breached the Code of Ethics and Professional Client Care. HDB will repossess the two flats involved and may impose financial penalties or issue warnings for violations of the minimum occupation period rules. Read more >>

4. More debt defaults expected in Chinas property sector as developers struggle with weak sales and difficulty raising funds.

$124.5 billion (~S$168 billion) worth of bonds are now in default, with $60.5 billion (~S$81.8 billion) worth of Chinese property bonds due in the next 6 months. Country Gardens international bondholders are seeking urgent talks, while other companies like Sino-Ocean Group are also facing strains. Read more >>

5. Resale HDB flat sellers in Singapore raise prices near MRT stations and town centres, marketing them as potentially being in Plus classified locations.

Resale HDB flat sellers in Singapore are raising asking prices by up to S$10,000 ($7,300) for flats located near MRT stations or town centres. Property agents are marketing these homes as potentially being in Plus classified locations, which are close to amenities like transport nodes. Read more >>

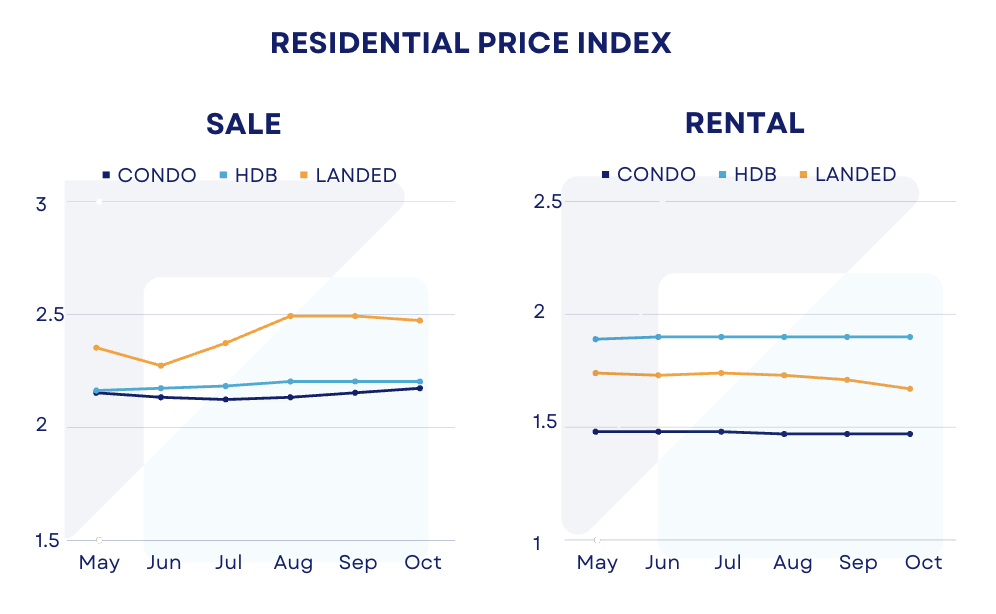

Price Indexes

*Index value is 1 at year 2008

1. Residential Price Index

2. Commercial Price Index

Residential Snapshot

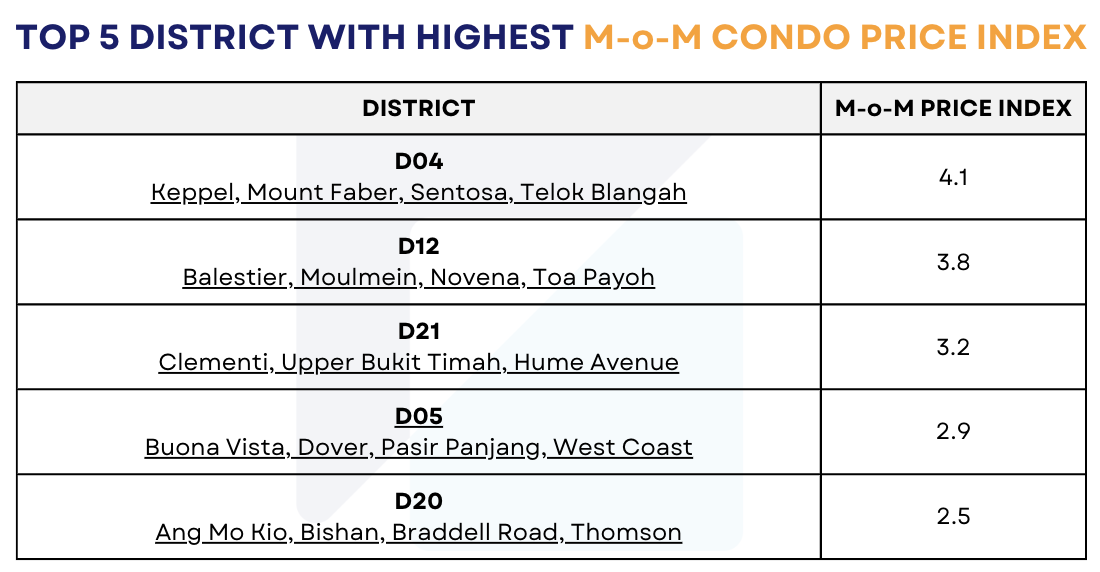

1. Top 5 Districts with highest Month on Month (M-o-M) Index

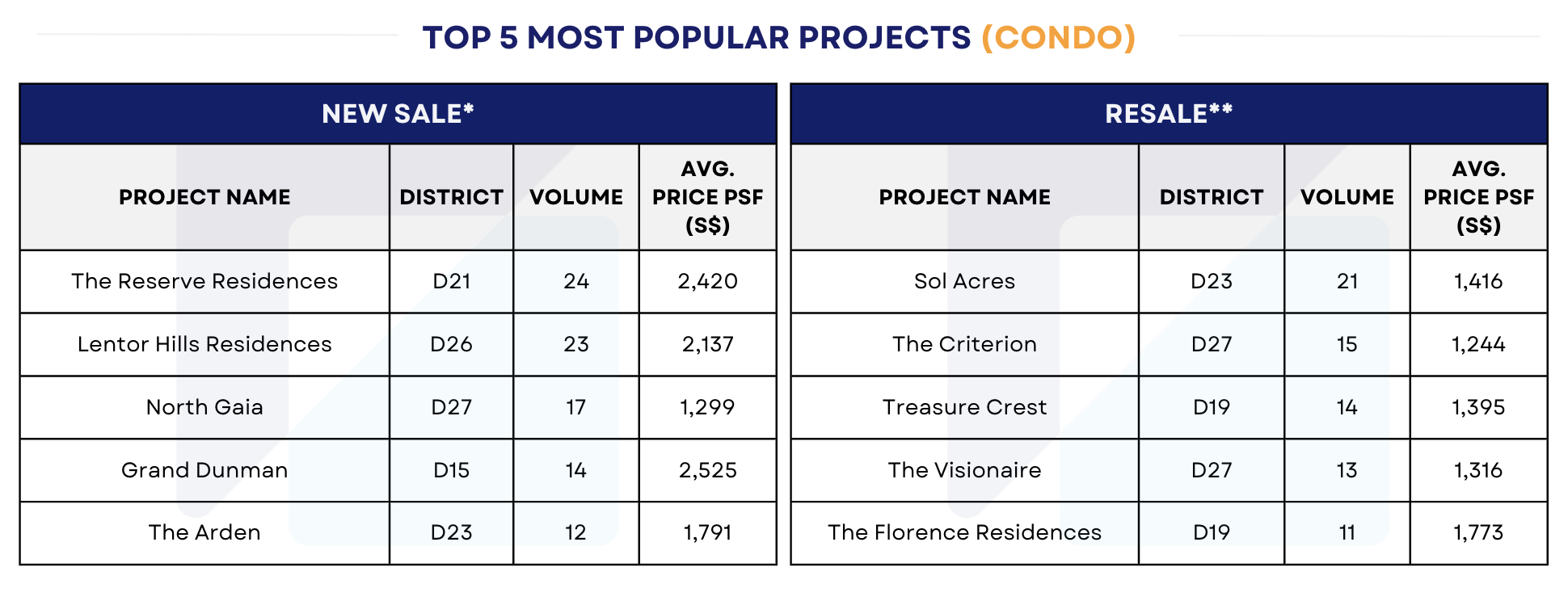

2. Top 5 most popular projects (Condo) in October 2023

The Reserve Residences - a new integrated development situated in the Beauty World neighbourhood, top the list of the most popular projects by sale volume this month - 5 months after its launch in May. Lentor Hills Residences - launched in early July 2023 - showed consistence performance by maintaining its position in the top 5 in the past 3 months.

*New Sale: The sale of a unit direct by a developer before the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

**Resale: The sale of a unit by a developer or subsequent purchaser after the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

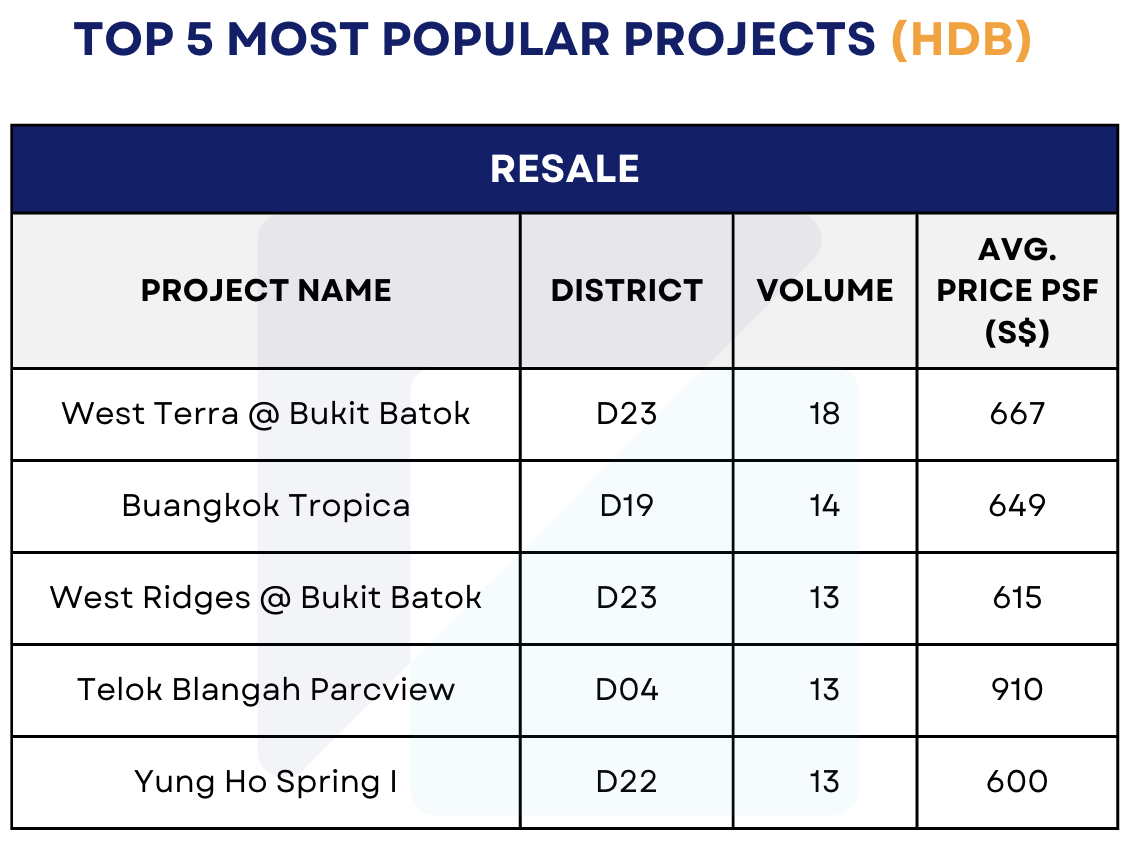

3. Top 5 most popular projects (HDB) in October 2023

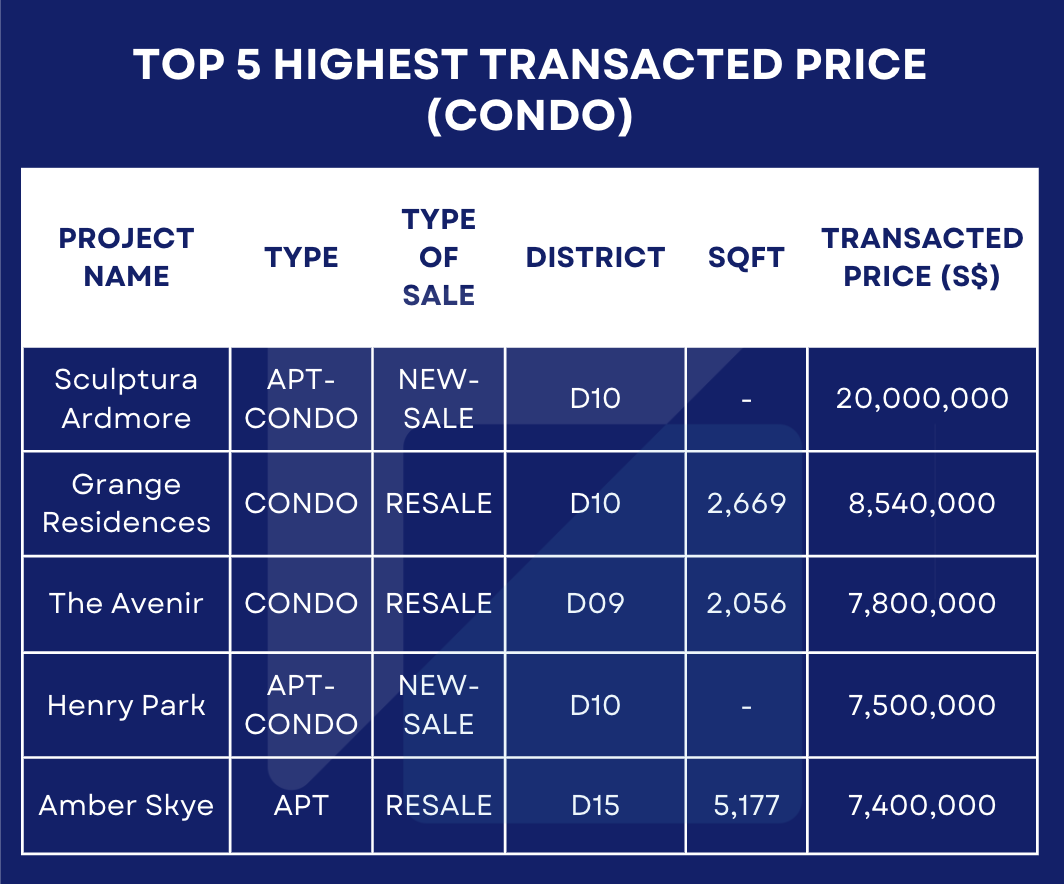

4. Top 5 highest transacted price (Condo) in October 2023

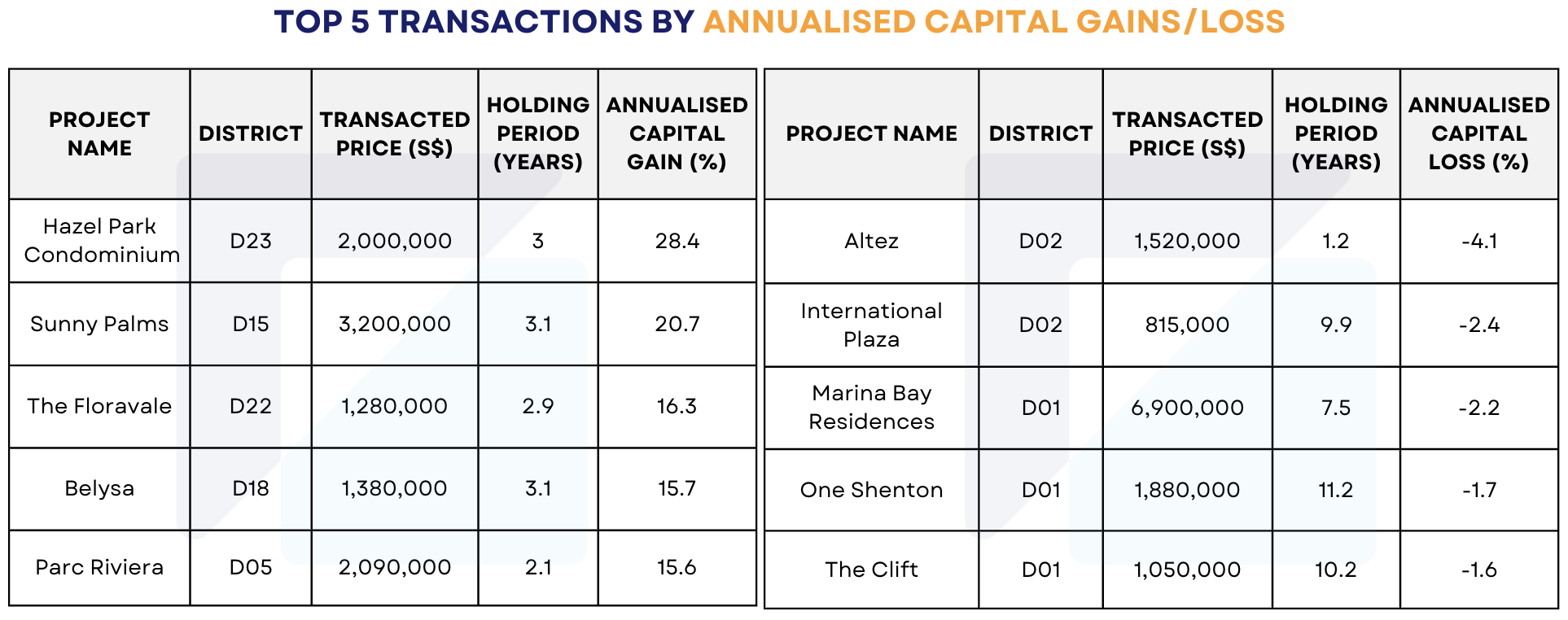

5. Top 5 Transactions by Annualised Capital Gain/Loss in October 2023

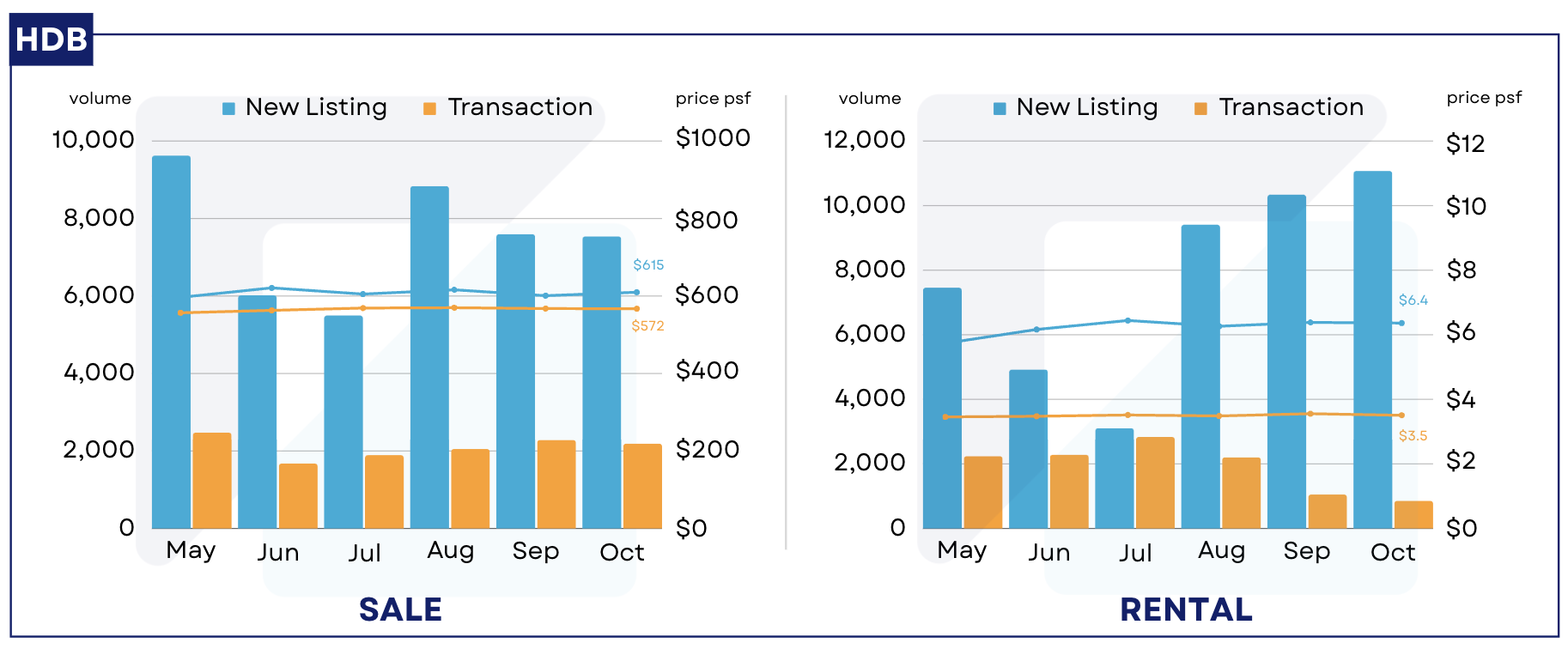

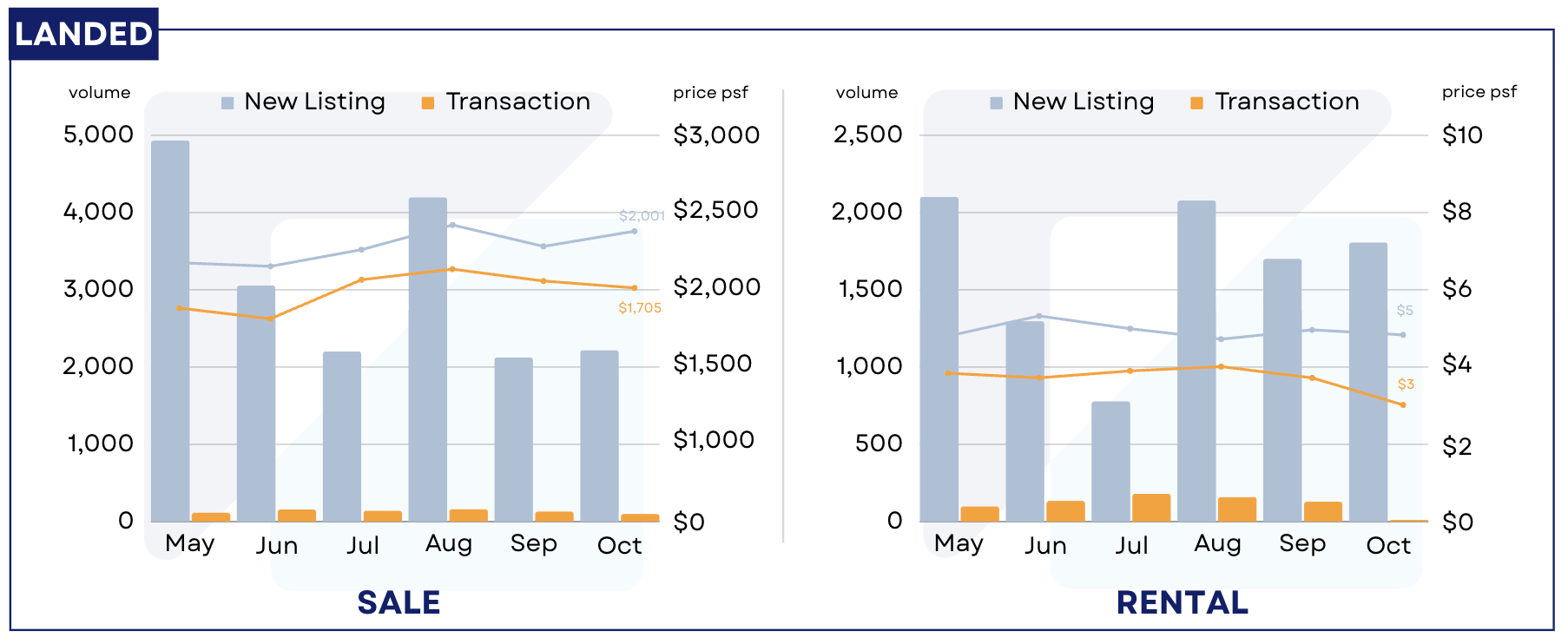

Residential Listings (Condo, HDB, Landed) April - October 2023

*New Listing: the total number of listings that are newly added in that particular time period

*Data updated as of 17 Oct 2023

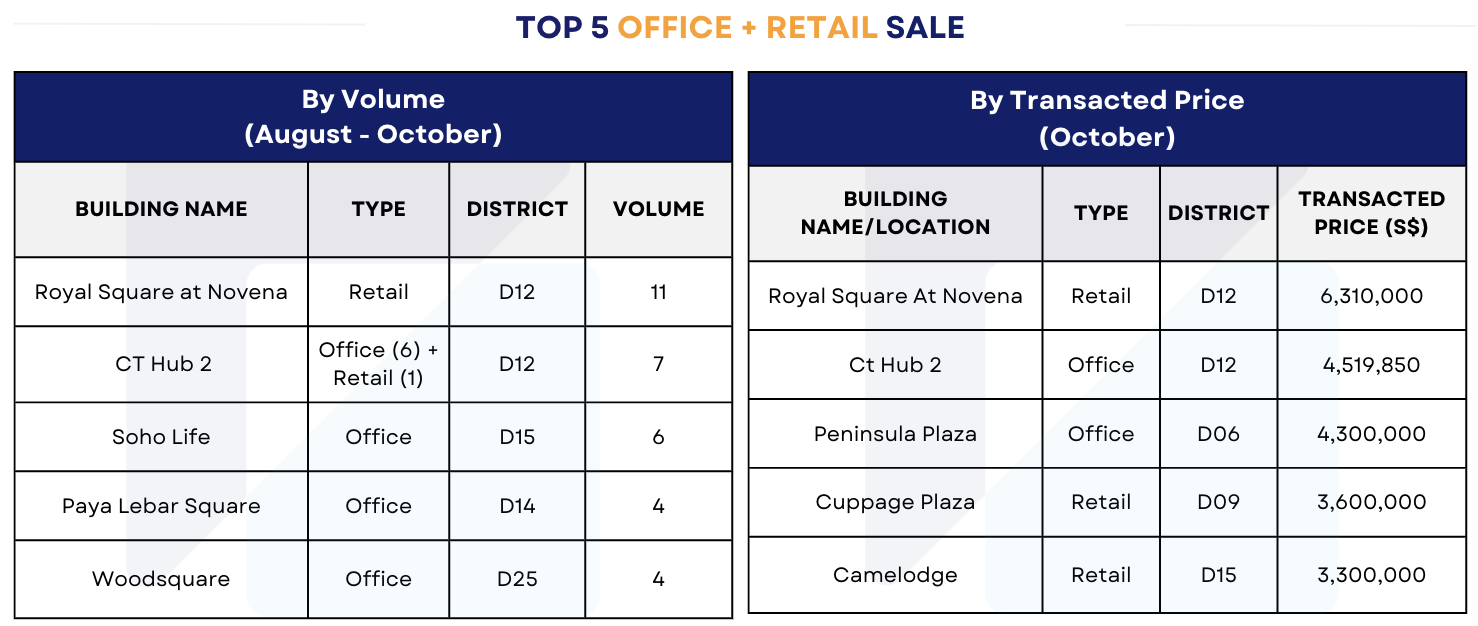

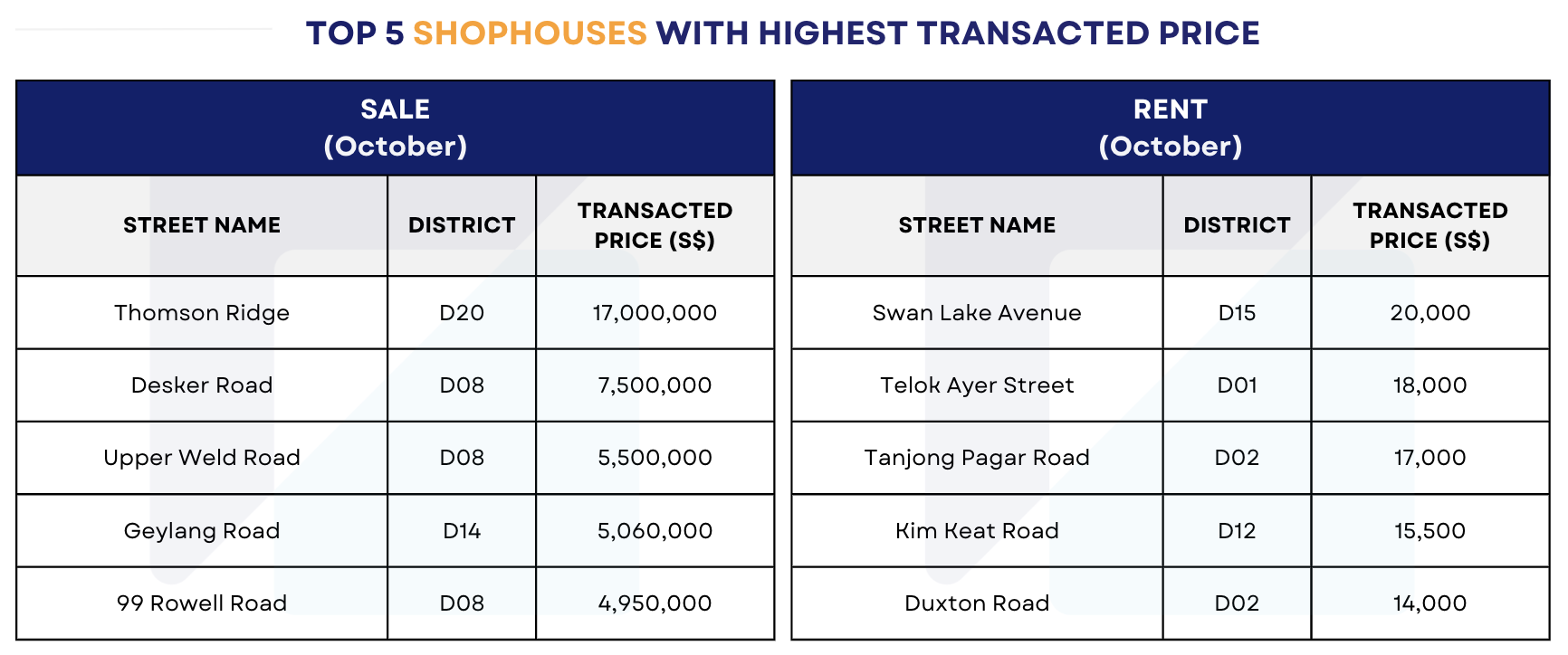

Commercial Snapshot

1. Top 5 Office and Retail Sale (by volume and transacted price) (August - October)

2. Top 5 Shophouses with Highest Transacted Price (Sale and Rent) in October 2023

All analytical and visually interpreted data in this a is powered by RealAgent, a comprehensive app for real estate professionals. It offers a blend of property information, real-time transaction data, and advanced analytics, ensuring accurate and up-to-date insights for our report. Find out more about RealAgent here.

Download the full report (PDF) here: October 2023 - Singapore Property Market Snapshot.pdf

To know more about our data-driven real estate solutions, contact us here.

Continue to read our other data insights articles:

Less Space, More Cost: Have Condos become Smaller yet Pricier?

Singapore Property Market Snapshot - September 2023

Unprofitable Condos in Singapore: What do they have in common?

Million dollar HDB in August 2023 - A different story told by real-time data

Singapore Property Market Snapshot - August 2023

The new 2023 cooling measures' impact: Home sellers are selling at a loss

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics, we're revolutionising the real estate industry with our cutting-edge AI technology. By applying advanced data science in real estate industry, and providing customised services for people with various property needs, our market trends and insights, agent enhanced tools, and REA Developer Suite deliver realistic and reliable end-to-end solutions that enables everyone can make their informed decisions. Our solutions are available across Singapore, Malaysia, Hong Kong (China), Indonesia and Australia. Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.