News > Singapore Property Market Snapshot - November 2023

Singapore Property Market Snapshot - November 2023

8 December 2023

In November, following the pattern established in the previous month, Singapore's property market is adjusting to the current rise in interest rates, macroeconomic uncertainties, and the dynamics of market supply. These adjustments are in response to evolving global trends and the local economic climate, leading to a more intricate situation for both buyers and sellers. Take a closer look at this month's market report to see how these factors are influencing Singapore's real estate landscape.

Hot Topics in Singapore Property Market November 2023

1. Lease for Raffles Town Club in Singapore will not be renewed, land to be used for residential development.

The lease expires in 2026. The land will be used for future residential development, supporting housing demand and enhancing the precincts residential character. Read more >>

2. Singapore Government to Provide One-Off Rebate of up to 100% on Property Taxes in 2024.

This move comes in response to the upcoming property tax increase and rising cost-of-living concerns, as stated by the Ministry of Finance and the Inland Revenue Authority of Singapore. Read more >>

3. Children from rental flats in Singapore experiencing poorer hand-eye coordination due to space constraints at home.

MP Carrie Tan called for the government to study the impact of living spaces on early childhood development outcomes. Tan also highlighted overcrowding and its negative effects on health and social mobility. Read more >>

4. China’s central bank and regulators to support property sector and address local government debt risks.

Efforts to stabilise financing for the real estate sector are gaining traction, with financial institutions meeting reasonable financing needs of property firms. China will promote stable credit expansion to support economic growth and resolve debt risks. Read more >>

5. Blackstone leads race to acquire $17 billion commercial-property loan portfolio from FDICs sale of Signature Bank debt.

The FDIC has been seeking buyers for the $33 billion commercial real estate loan portfolio of failed New York lender Signature Bank since September. Other finance companies such as Starwood Capital Group and Brookfield Asset Management are also said to be involved in the bidding process. Read more >>

Price Indexes

*Index value is 1 at year 2008

1. Residential Price Index

2. Commercial Price Index

Residential Snapshot

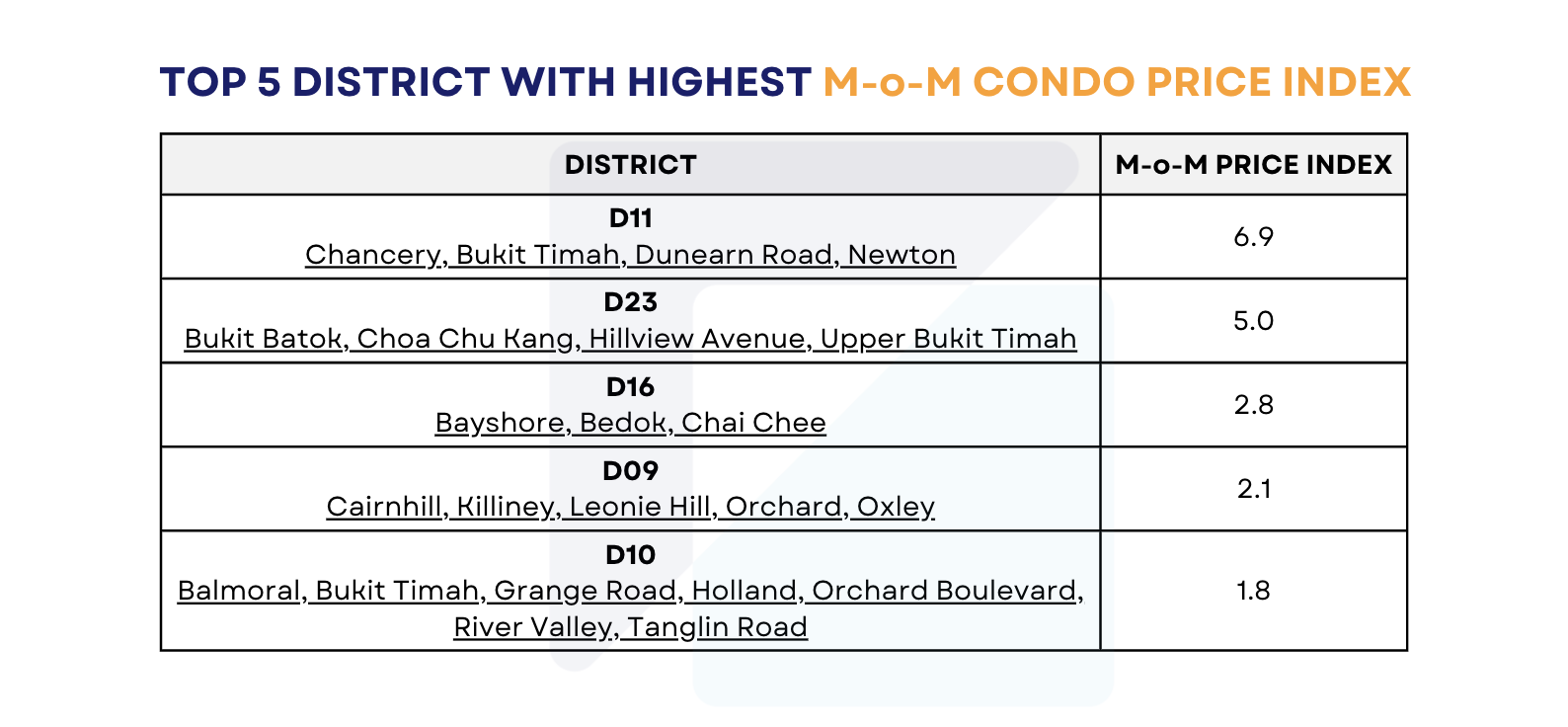

1. Top 5 Districts with highest Month on Month (M-o-M) Index

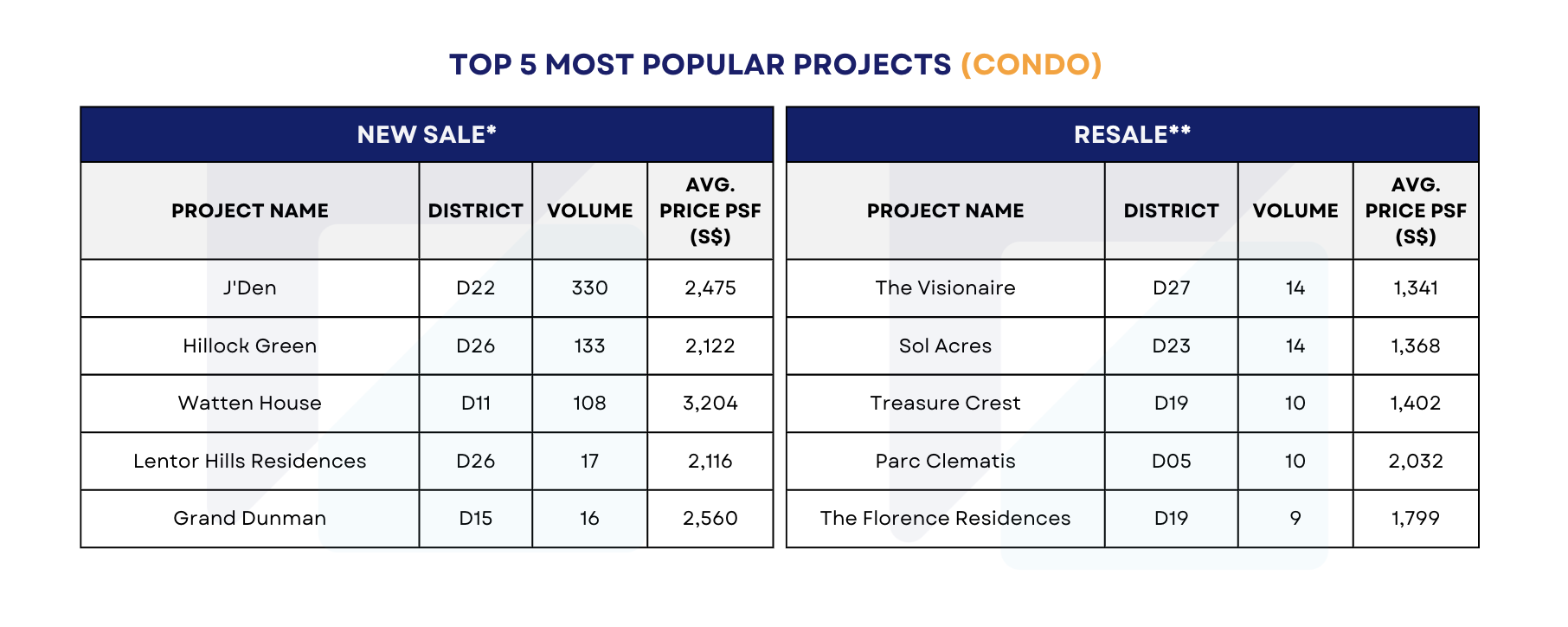

2. Top 5 most popular projects (Condo) in November 2023

J'Den - a contemporary mixed-use development situated in the lively Jurong East area of Singapore's District 22, leads as the most popular project in terms of sales volume this month thanks to its recent launch on 11 November. Following up are 2 other new launch projects - Hillock Green and Watten House. Meanwhile, Lentor Hills Residences - launched in early July 2023 - showed consistence performance by remaining in the top 5 in the past 4 months.

*New Sale: The sale of a unit direct by a developer before the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

**Resale: The sale of a unit by a developer or subsequent purchaser after the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

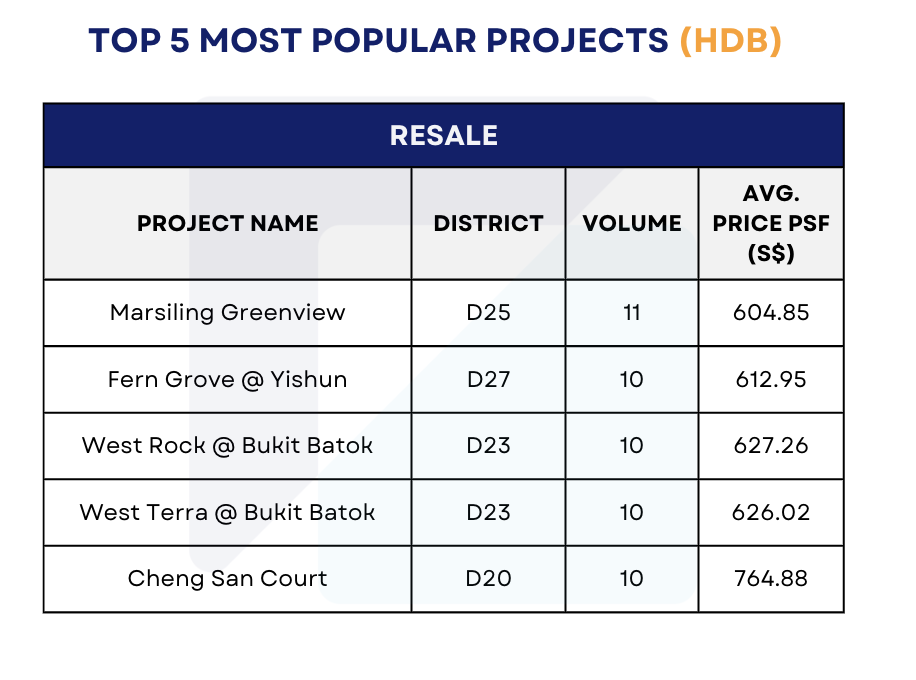

3. Top 5 most popular projects (HDB) in November 2023

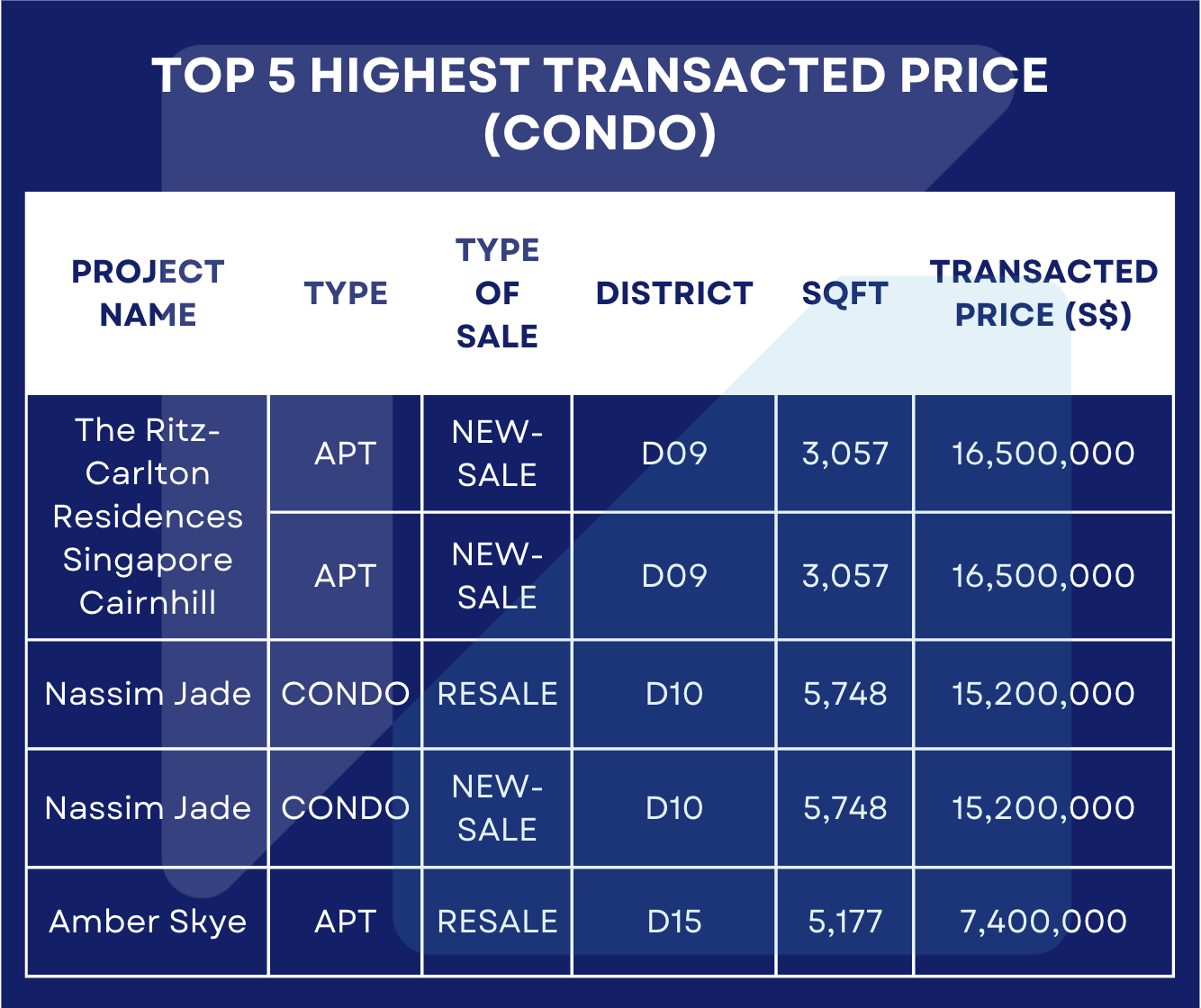

4. Top 5 highest transacted price (Condo) in November 2023

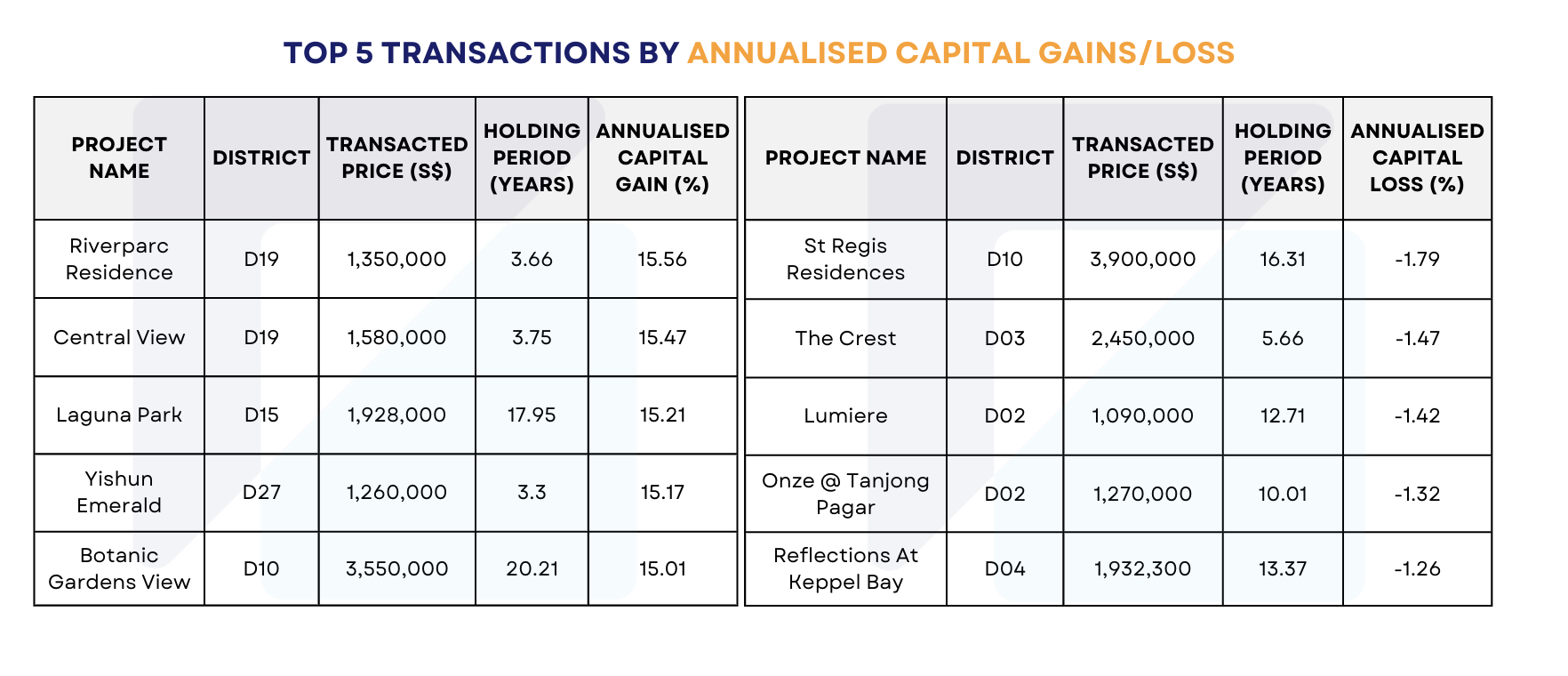

5. Top 5 Transactions by Annualised Capital Gain/Loss in November 2023

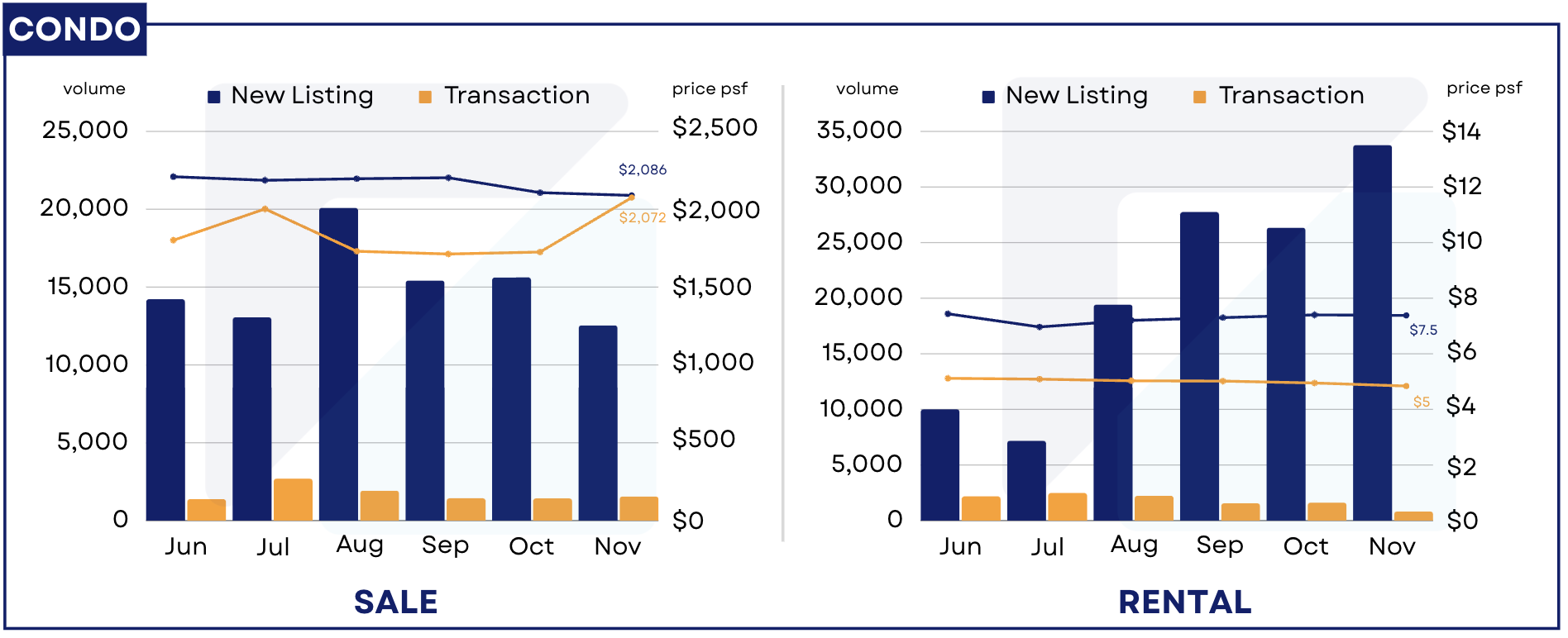

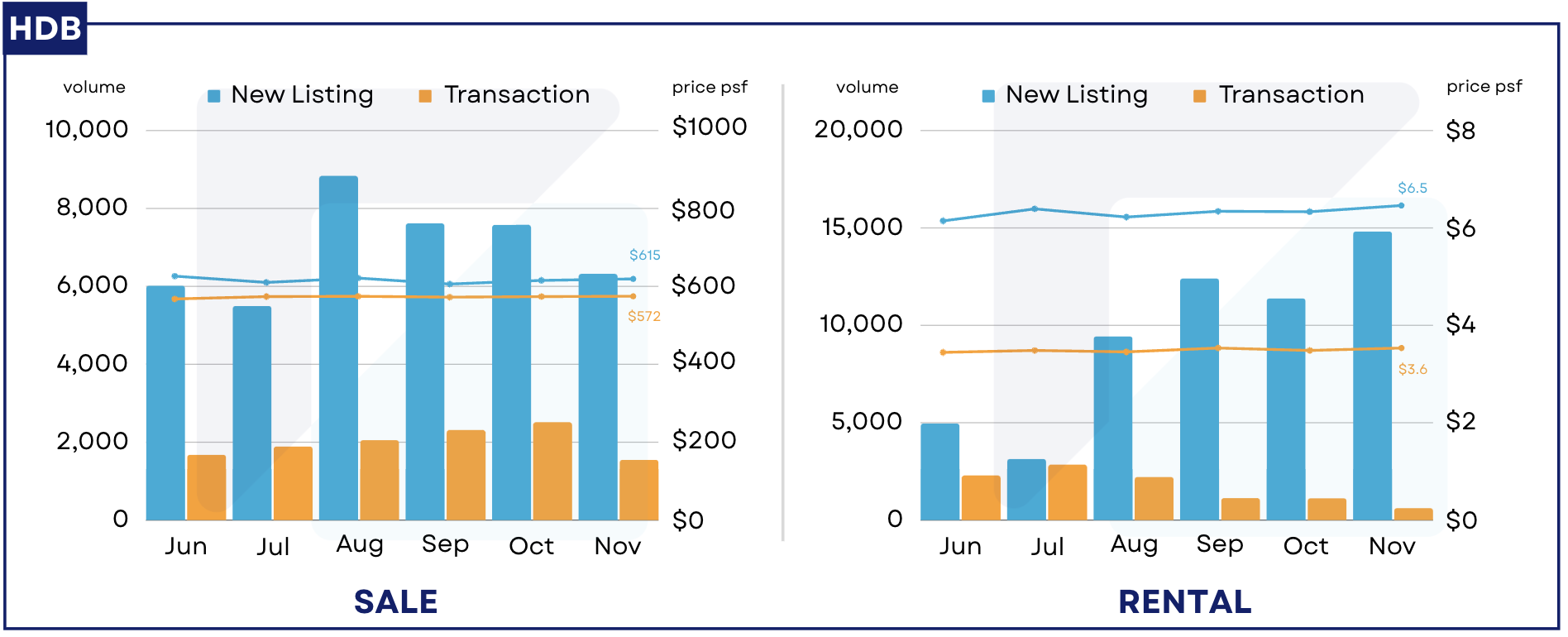

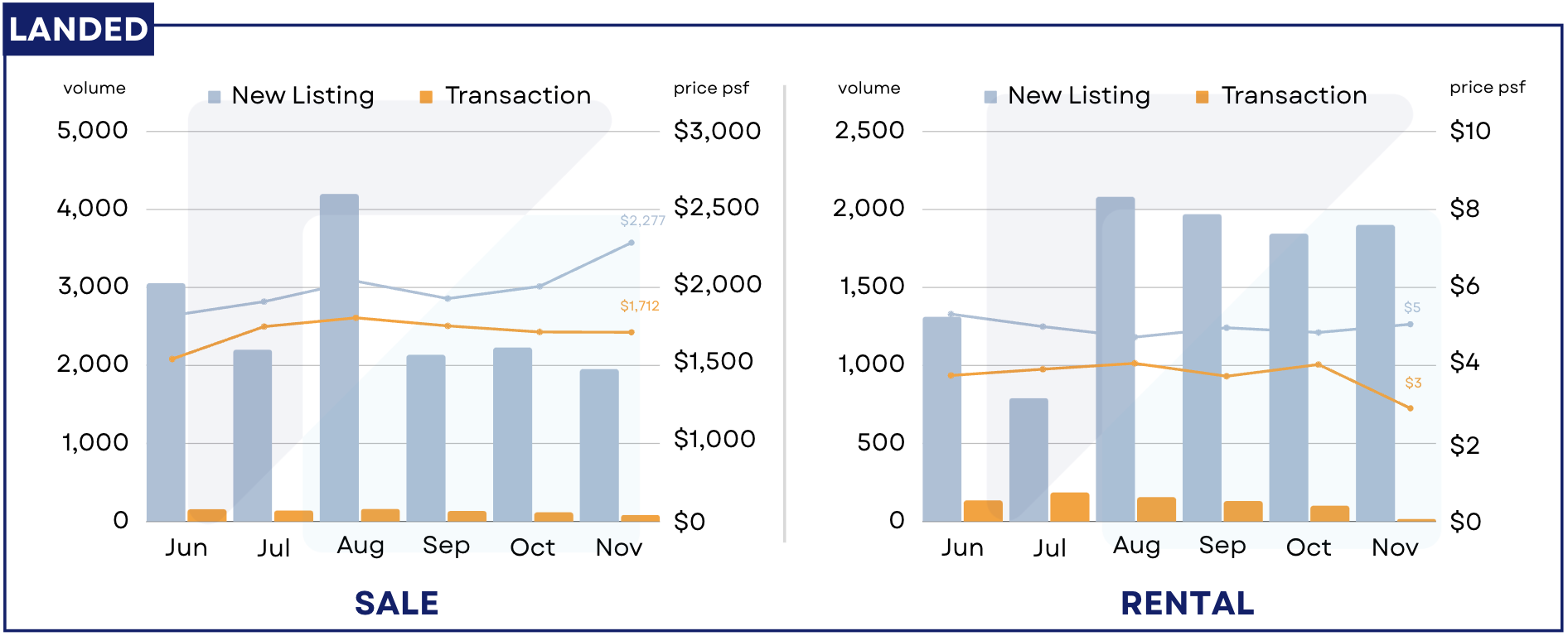

Residential Listings (Condo, HDB, Landed) June - November 2023

*New Listing: the total number of listings that are newly added in that particular time period

Commercial Snapshot

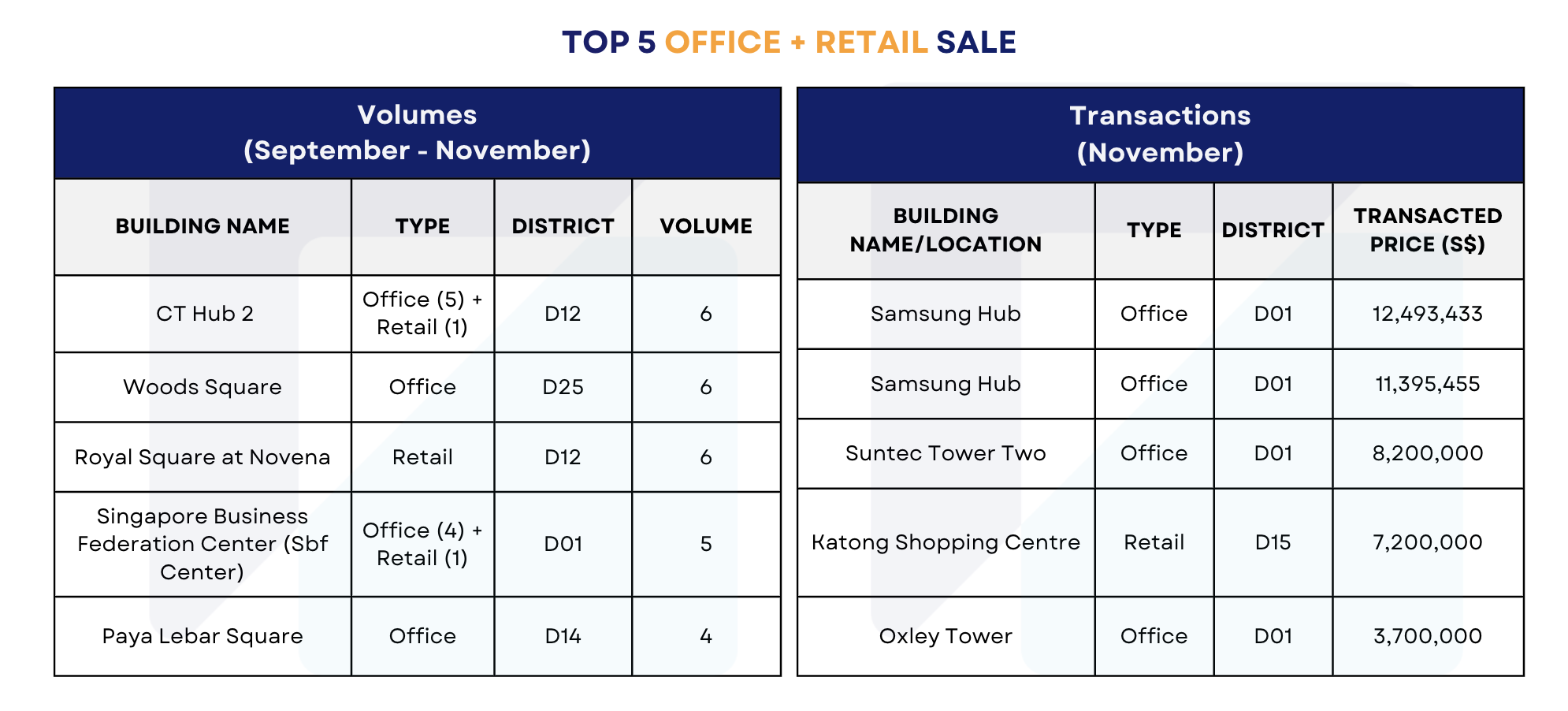

1. Top 5 Office and Retail Sale (by volume and transacted price) (September - November)

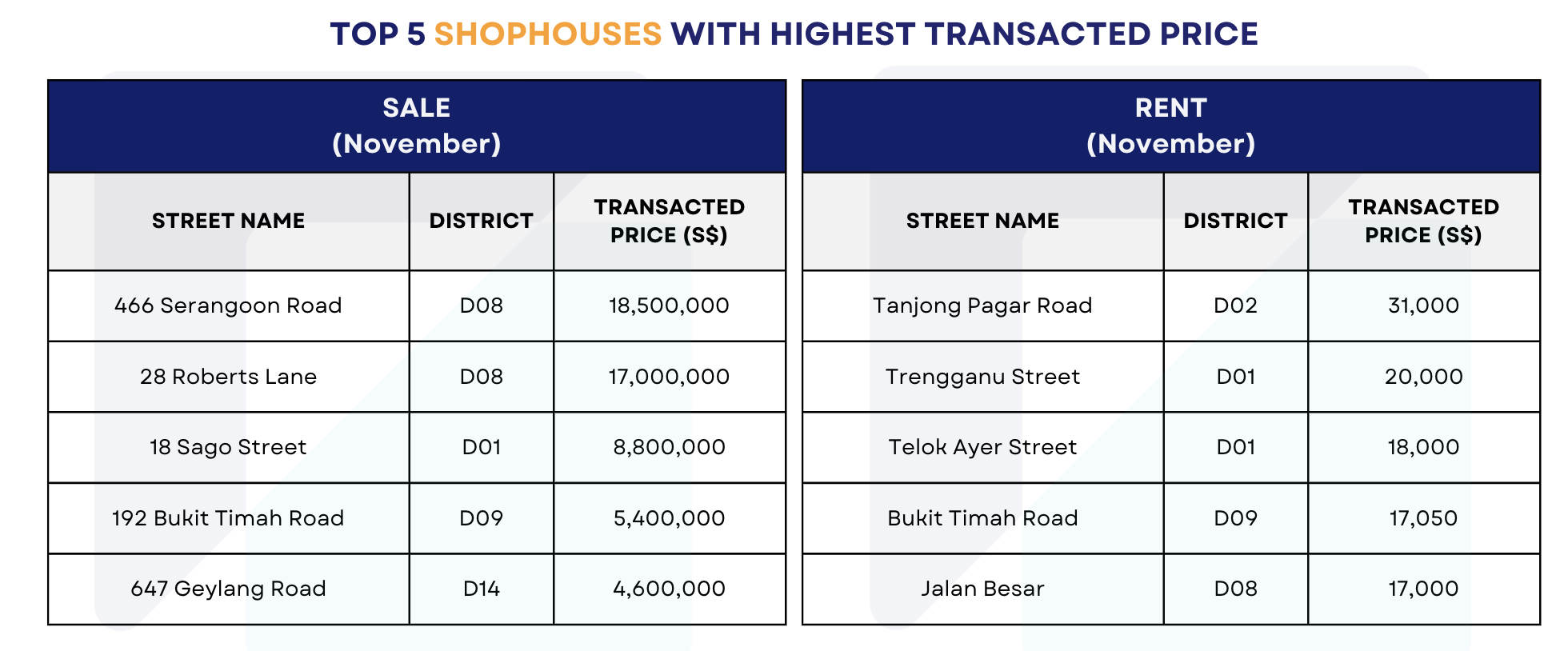

2. Top 5 Shophouses with Highest Transacted Price (Sale and Rent) in November 2023

All analytical and visually interpreted data in this a is powered by RealAgent, a comprehensive app for real estate professionals. It offers a blend of property information, real-time transaction data, and advanced analytics, ensuring accurate and up-to-date insights for our report. Find out more about RealAgent here.

Download the full report (PDF) here: November 2023 - Singapore Property Market Snapshot.pdf

To know more about our data-driven real estate solutions, contact us here.

Continue to read our other data insights articles:

Less Space, More Cost: Have Condos become Smaller yet Pricier?

Singapore Property Market Snapshot - October 2023

Singapore Property Market Snapshot - September 2023

Unprofitable Condos in Singapore: What do they have in common?

Million dollar HDB in August 2023 - A different story told by real-time data

The new 2023 cooling measures' impact: Home sellers are selling at a loss

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics, we're revolutionising the real estate industry with our cutting-edge AI technology. By applying advanced data science in real estate industry, and providing customised services for people with various property needs, our market trends and insights, agent enhanced tools, and REA Developer Suite deliver realistic and reliable end-to-end solutions that enables everyone can make their informed decisions. Our solutions are available across Singapore, Malaysia, Hong Kong (China), Indonesia and Australia. Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.