News > Singapore Property Market Snapshot - January 2024

Singapore Property Market Snapshot - January 2024

15 February 2024

In January 2024, Singapore's real estate market showed a continued slowdown from previous months. Despite facing challenges like economic uncertainty and tighter rules, the market held up reasonably well, albeit at a slower pace. The rise in million-dollar HDB deals suggests that people are willing to invest more in quality homes, even amid uncertainties. With changing consumer tastes and government policies, the real estate landscape is evolving, bringing both challenges and opportunities.

So, what's the current state of the market?

Hot Topics in Singapore Property Market January 2024

1. Private residential property rentals in Singapore fall for the first time in over three years, likely due to increased housing supply.

The Urban Redevelopment Authority reported a 2.1% decrease in private home rentals in the fourth quarter of 2023, compared to a 0.8% increase in the previous quarter. Rental momentum has eased across all market segments, and analysts predict that downward pressure on rental prices may continue. Read more >>

2 . Chinese property shares rise as government relaxes credit measures, but analysts and developers skeptical of impact.

The liquidity crisis in China has led to defaults and delayed debt payments by developers. Despite recent support measures, such as easier access to cash and cuts in mortgage rates, the market has shown little sign of stabilising. The fundamental problem of weak confidence and fragile demand from homebuyers remains a major hurdle for the real estate sector. Read more >>

3. Condo resale prices up 7.5% in 2023; 5th straight month of growth in December 2023.

In 2023, Singapore's condominium resale prices surged by 7.5%, marking five consecutive months of growth. However, resale transactions dropped by 15% compared to the previous year. Experts predict a continued slowdown in Q1 2024 due to increased competition from new condo launches, projecting a slower price increase of 3% to 5% for the year. Read more >>

4. Record-breaking sale of 5-room flat at The Peak @ Toa Payoh reflects increasing demand for premium residential units in Singapore.

The property is part of a prestigious DBSS development known for its high-quality construction and design. Toa Payoh is a highly desirable location with excellent connectivity and a range of amenities. This landmark transaction highlights the evolving real estate market in Singapore and suggests a continued appreciation of prime HDB properties. Read more >>

New Launches

1. Lumina Grand (Launched 27 January 2024)

Location: Bukit Batok West Avenue 5, D23

TOP 2027

Tenure: 99 Year

Total units: 512 units

Price range: S$ 2,800 - S$ 3,376 PSF

2. Hill Haven (Launched 20 January 2024)

Location: Hillview Rise, D23

TOP 2027

Tenure: 99 Year

Total units: 341 units

Price range: S$ 2,051 - S$ 2,081 PSF

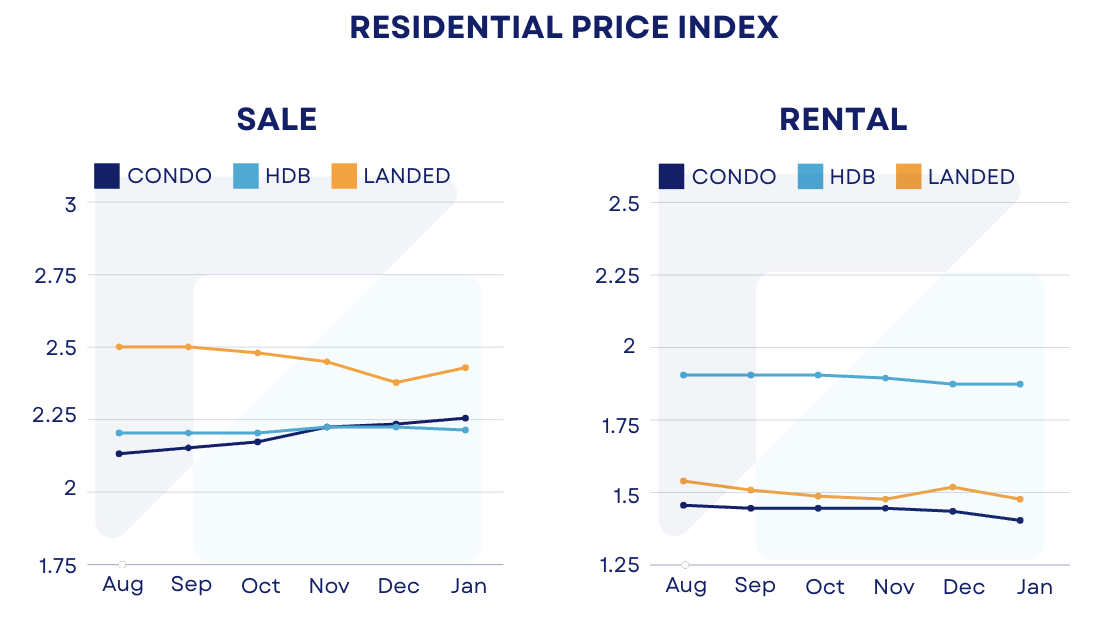

Price Indexes

*Index value is 1 at year 2008

1. Residential Price Index

2. Commercial Price Index

Residential Snapshot

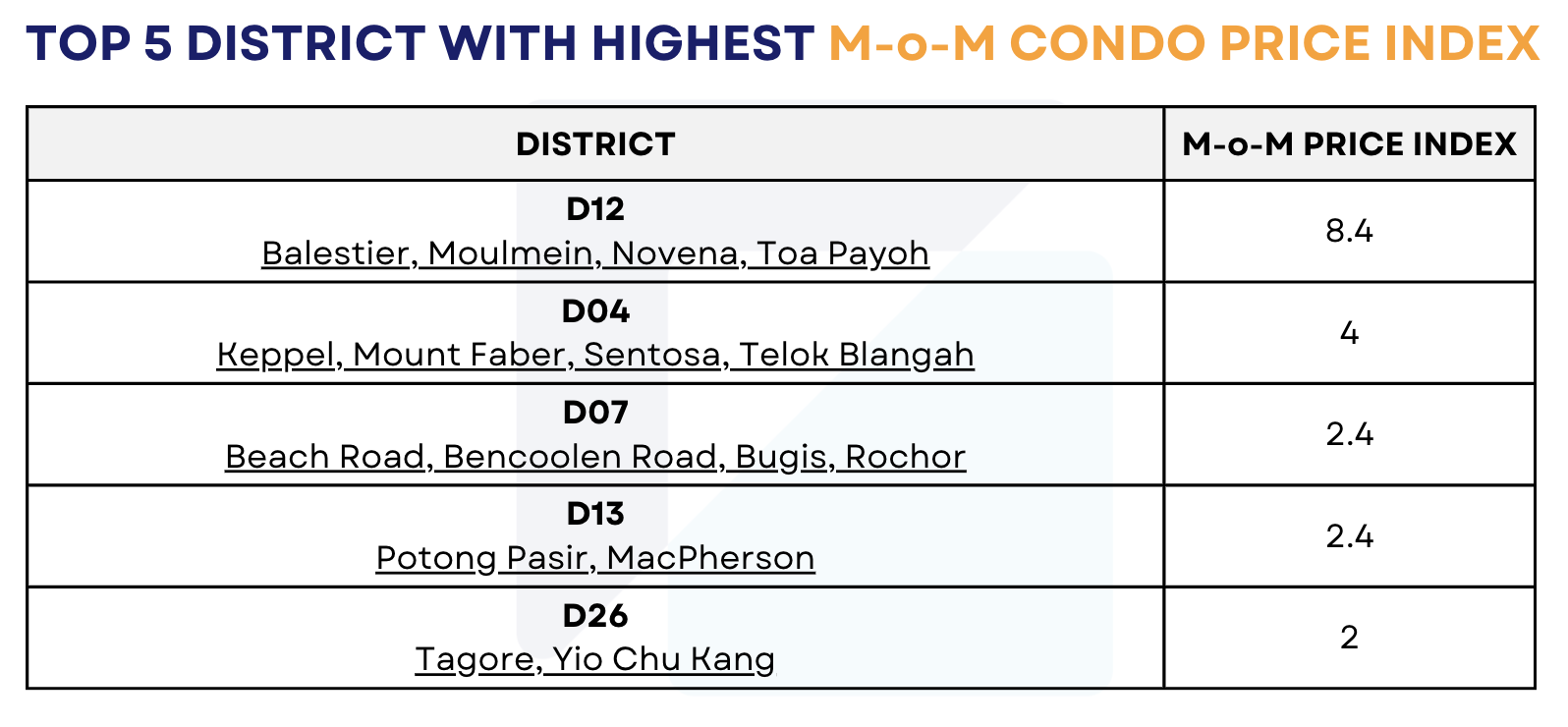

1. Top 5 Districts with highest Month on Month (M-o-M) Index

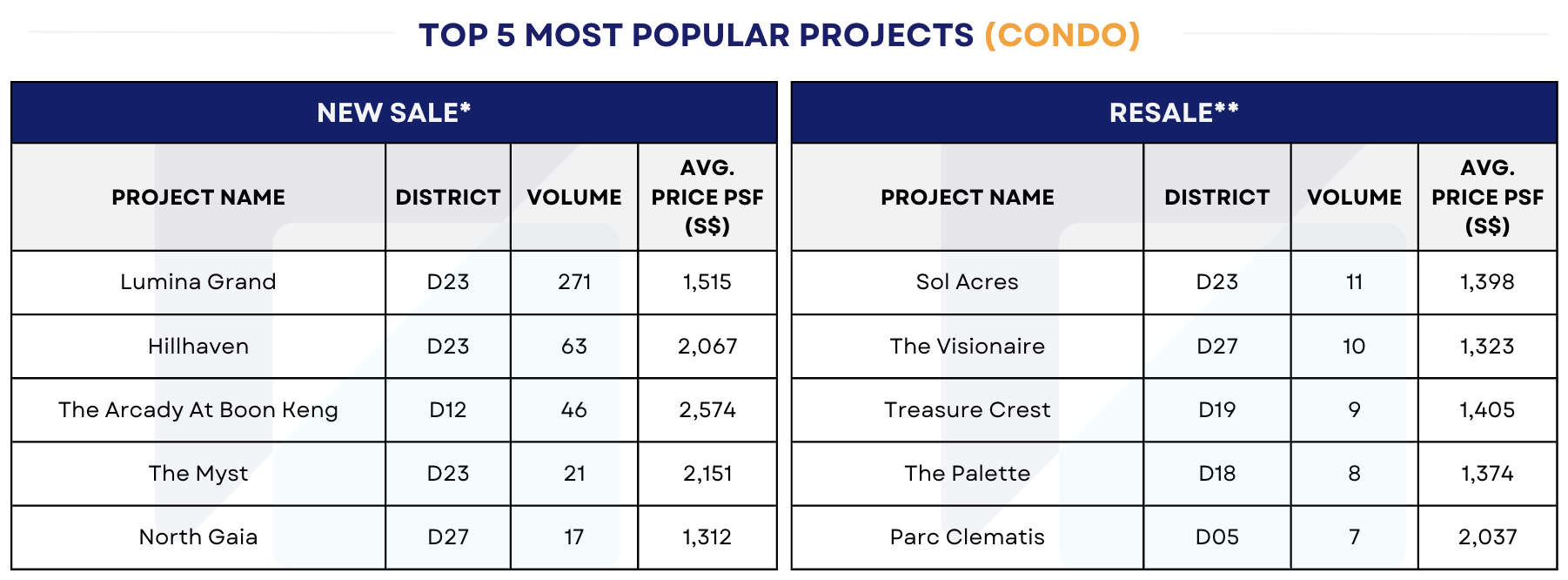

2. Top 5 most popular projects (Condo) in January 2024

*New Sale: The sale of a unit direct by a developer before the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

**Resale: The sale of a unit by a developer or subsequent purchaser after the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

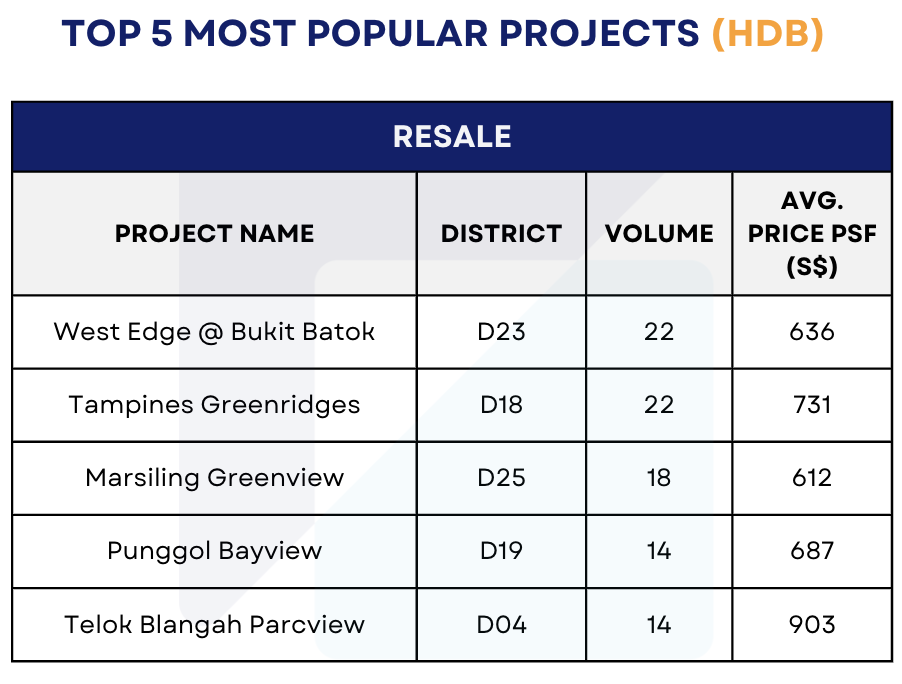

3. Top 5 most popular projects (HDB) in January 2024

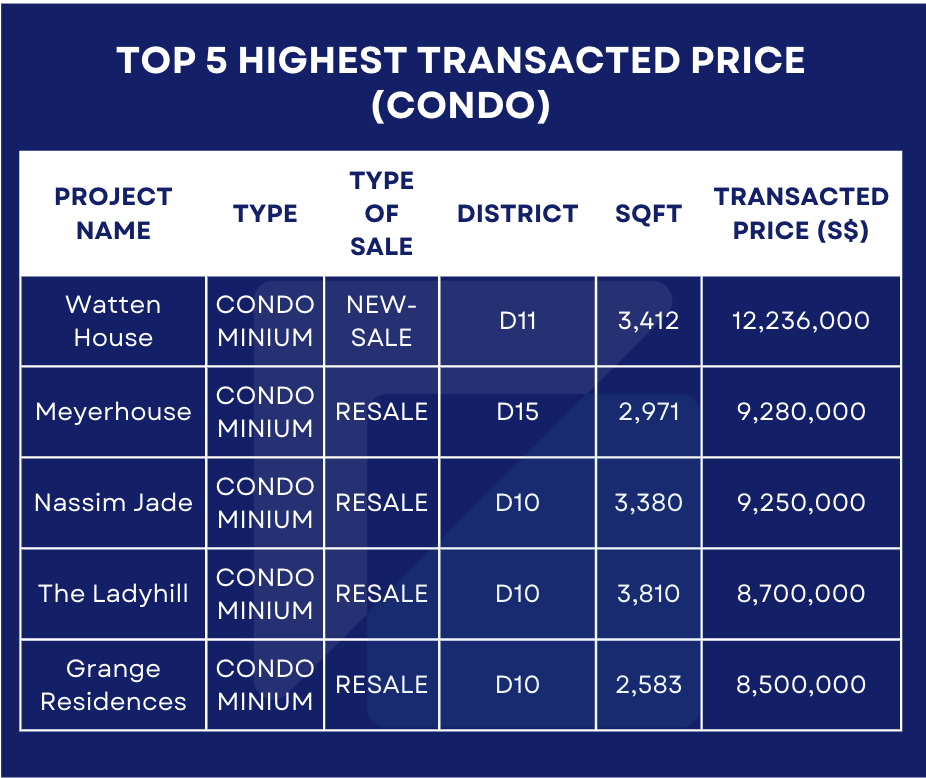

4. Top 5 highest transacted price (Condo) in January 2024

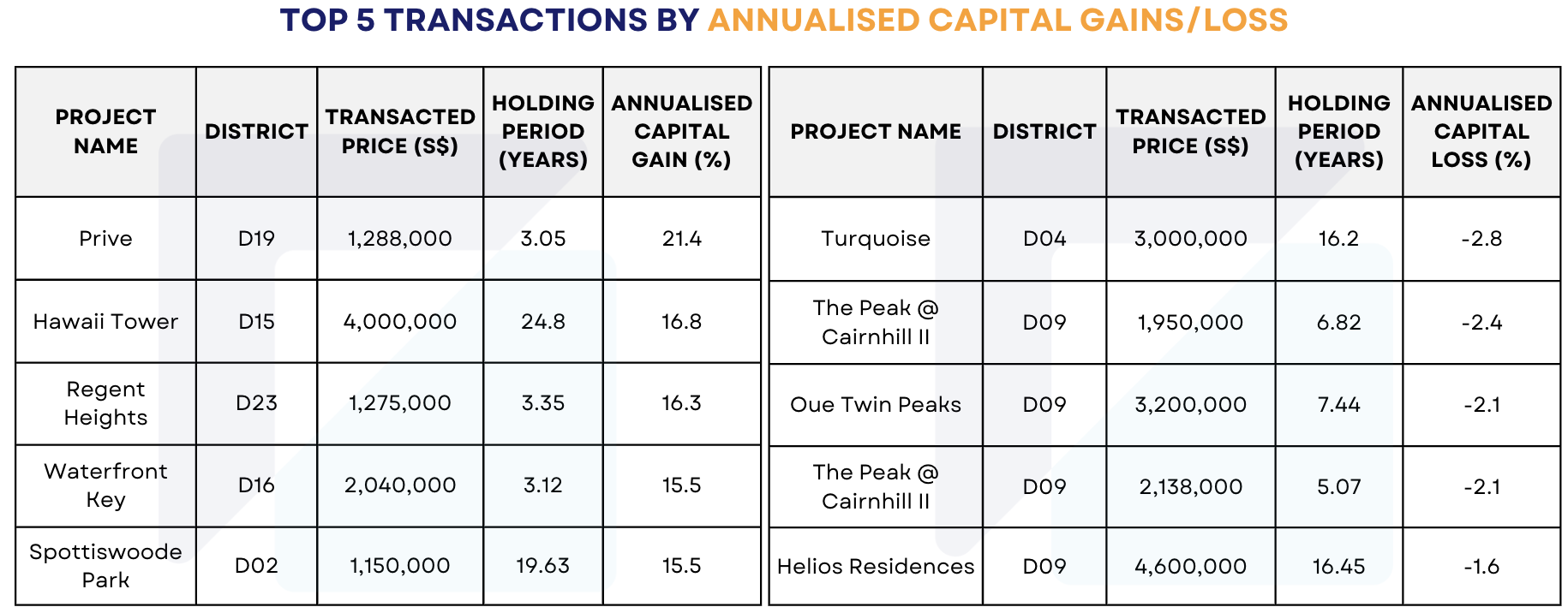

5. Top 5 Transactions by Annualised Capital Gain/Loss in January 2024

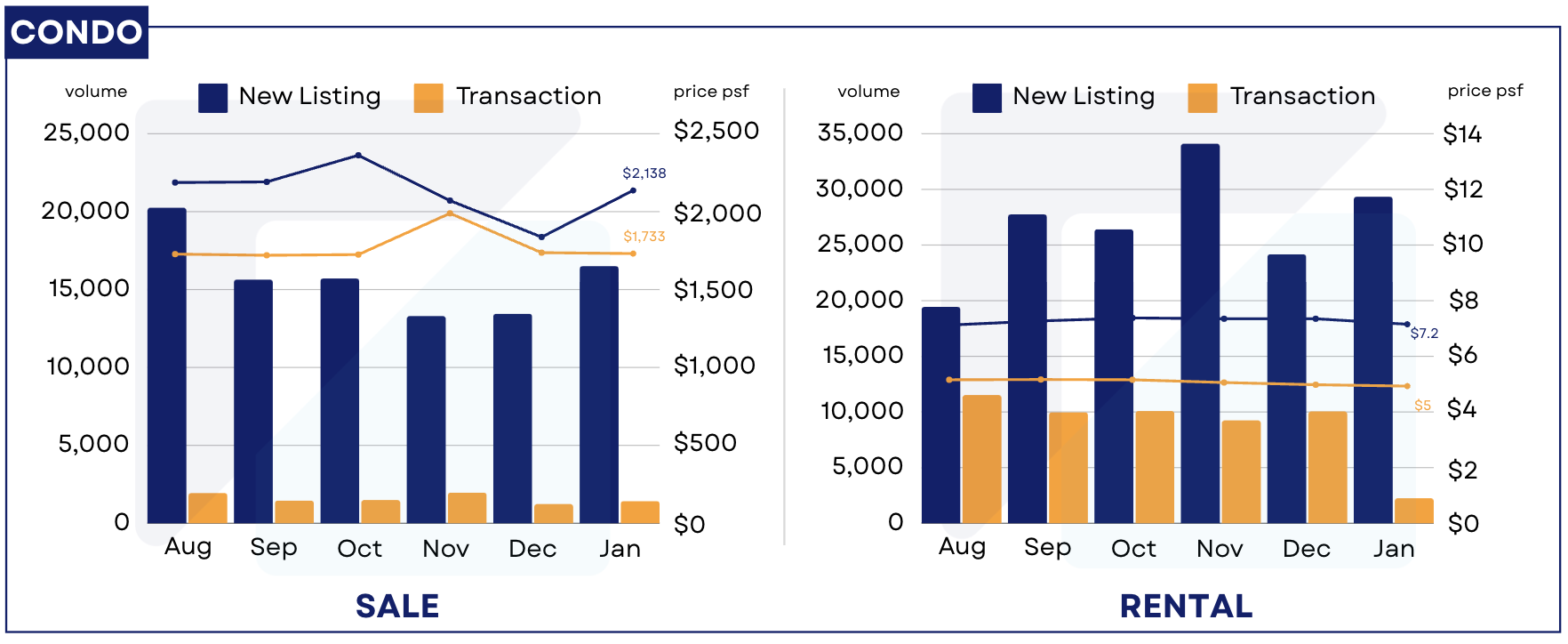

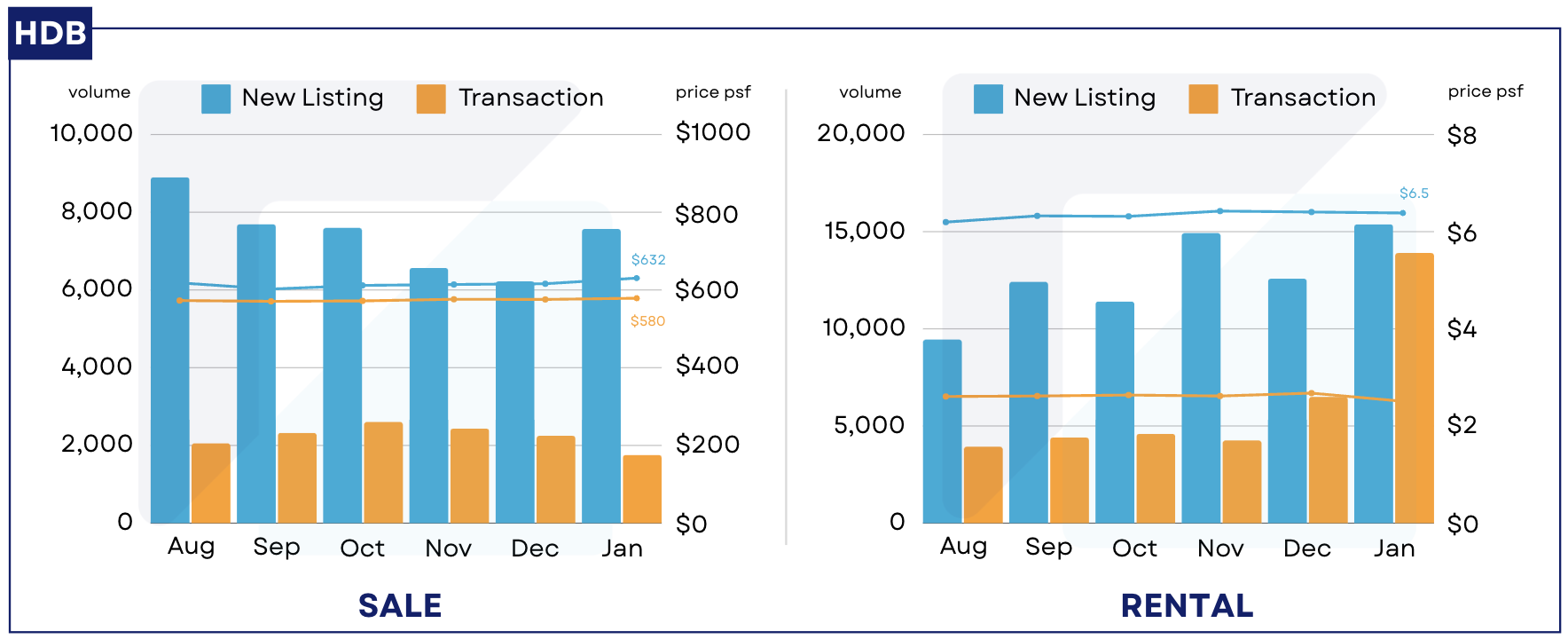

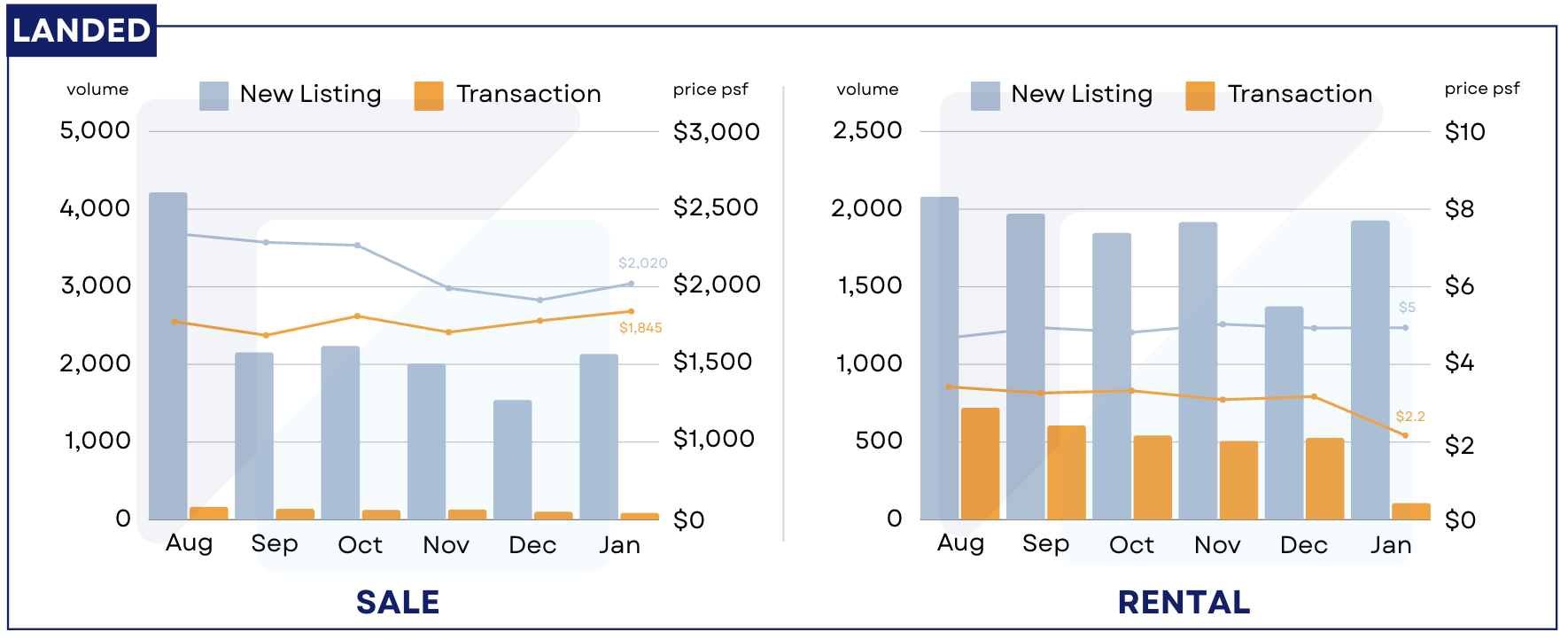

Residential Listings (Condo, HDB, Landed) August 2023 - January 2024

*New Listing: the total number of listings that are newly added in that particular time period

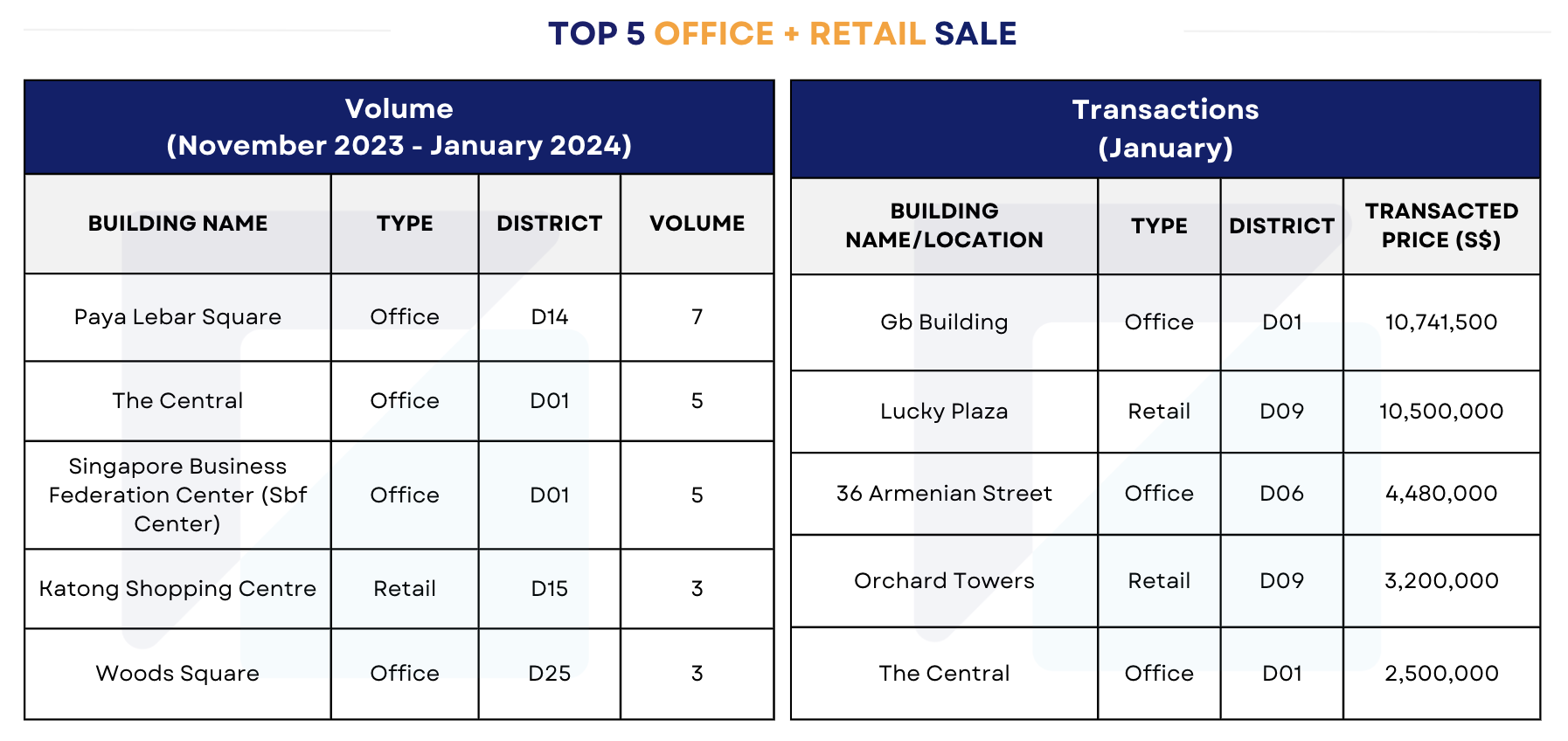

Commercial Snapshot

1. Top 5 Office and Retail Sale (by volume and transacted price) (November 2023 - January 2024)

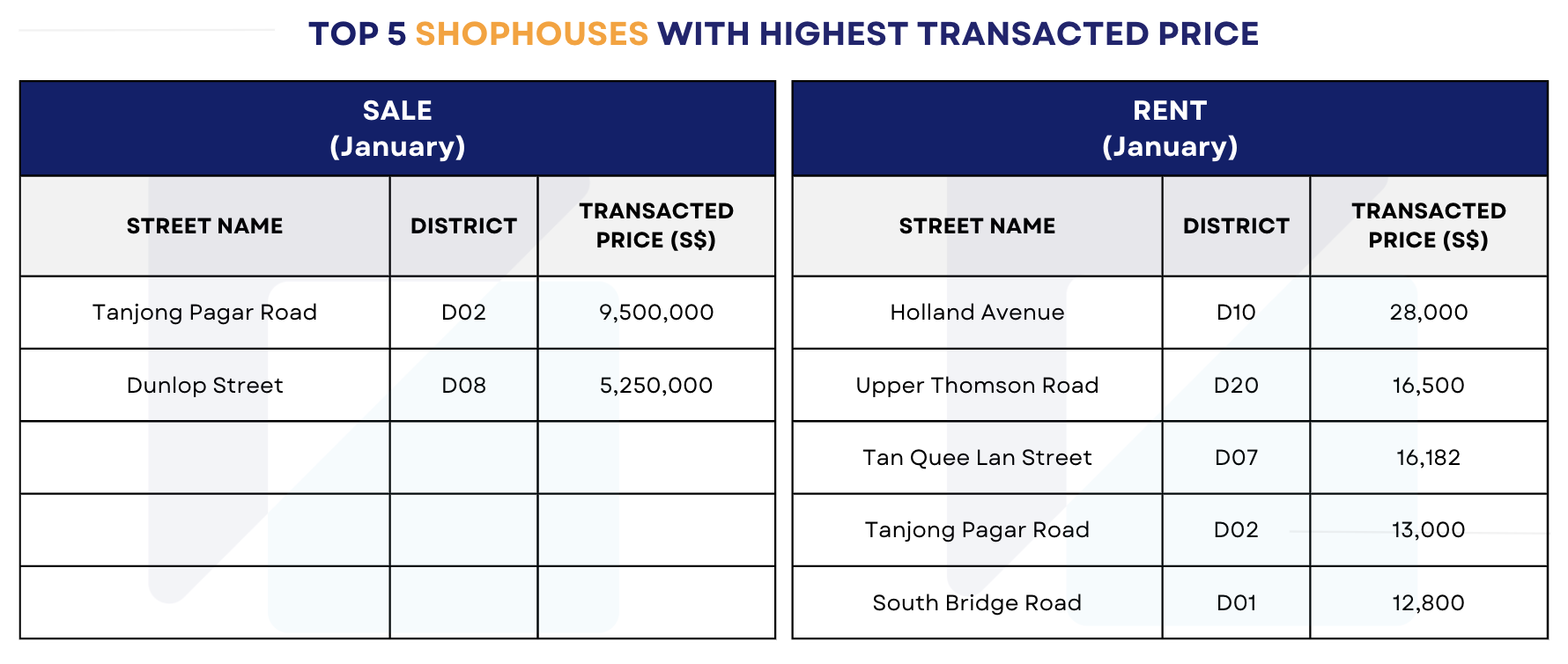

2. Top 5 Shophouses with Highest Transacted Price (Sale and Rent) in January 2024

All analytical and visually interpreted data in this report is powered by RealAgent , a comprehensive app for real estate professionals. It offers a blend of property information, real-time transaction data, and advanced analytics, ensuring accurate and up-to-date insights for our report. Find out more about RealAgent here .

Download the full report (PDF) here: January 2024 - Singapore Property Market Snapshot.pdf

To know more about our data-driven real estate solutions, contact us here .

Continue to read our other data insights articles:

A unit in Tanglin Regency reached record high for capital gain

Another million-dollar HDB transaction made in Tampines Street 12

Another unit at The Peak @ Toa Payoh sold for $1.540M

3-bedder in The Waterina saw record 226% in profit

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics, we're revolutionising the real estate industry with our cutting-edge AI technology. By applying advanced data science in real estate industry, and providing customised services for people with various property needs, our market trends and insights, agent enhanced tools, and REA Developer Suite deliver realistic and reliable end-to-end solutions that enables everyone can make their informed decisions. Our solutions are available across Singapore, Malaysia, Hong Kong (China), Indonesia and Australia. Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.