News > Singapore Property Market Snapshot - February 2024

Singapore Property Market Snapshot - February 2024

12 March 2024

With the celebration of Chinese New Year, Singapore Property Market has shown slight slowdown in February compared to January. Activities for new sales also went down significantly due to the lack of new launch projects in the month.

Explore the market with our report below:

Hot Topics in Singapore Property Market February 2024

1. Latest land betterment charge rates reflect hot suburban vs cool prime condo markets.

Rates increased in some sectors while decreasing in others, impacting various property types like landed residential, hotels, and industrial spaces. Overall, the changes aim to reflect market dynamics and land values. Land Betterment Charge Act consolidates charges for land value enhancement under SLA. Read more >>

2. HDB to double supply of flats under Parenthood Provisional Housing Scheme by 2025.

The Housing & Development Board (HDB) will double the supply of flats available under the Parenthood Provisional Housing Scheme (PPHS), from 2,000 flats currently to 4,000 flats by 2025. Read more >>

3. High-profile tech and beverage families invest in Singapore real estate, showcasing the allure of non-residential properties for investors.

Wealthy individuals like Jack Ma’s wife and the Teo family make significant property acquisitions in prime locations, showcasing the allure of non-residential properties for investors. Transactions highlight the enduring appeal of shophouses and mixed-use developments in Singapores real estate market. Read more >>

4. Potential impact of new rental voucher on Singapores real estate market raises concerns about rising resale flat rental prices.

The voucher aims to ease housing crunch by allowing families to rent HDB flats in the open market, but concerns arise about potential exploitation by landlords. While the impact on rental prices remains uncertain, experts predict a possible rise in smaller HDB flat rentals. Read more >>

5. Singapore Budget 2024 introduces real estate measures to address housing needs and support specific market segments.

These include a one-year Parenthood Provisional Housing Scheme (PPHS) voucher for eligible families, a refund of additional buyers stamp duty (ABSD) for single Singaporean seniors, more flexibility for developers under the ABSD regime, and revisions to annual value bands for owner-occupier residential property tax rates. Read more >>

Price Indexes

*Index value is 1 at year 2008

1. Residential Price Index

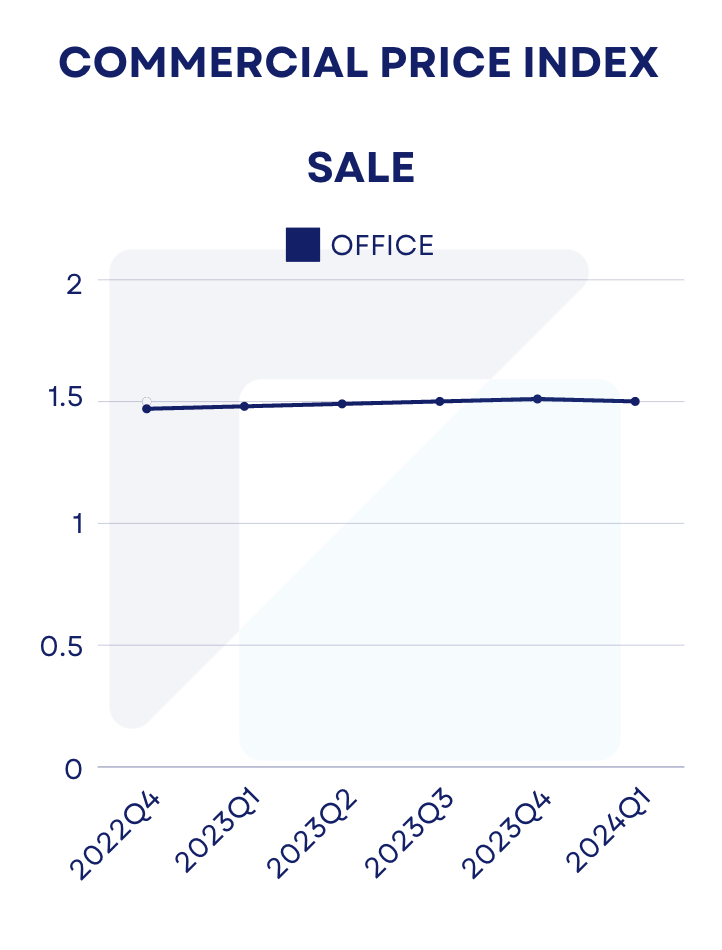

2. Commercial Price Index

Residential Snapshot

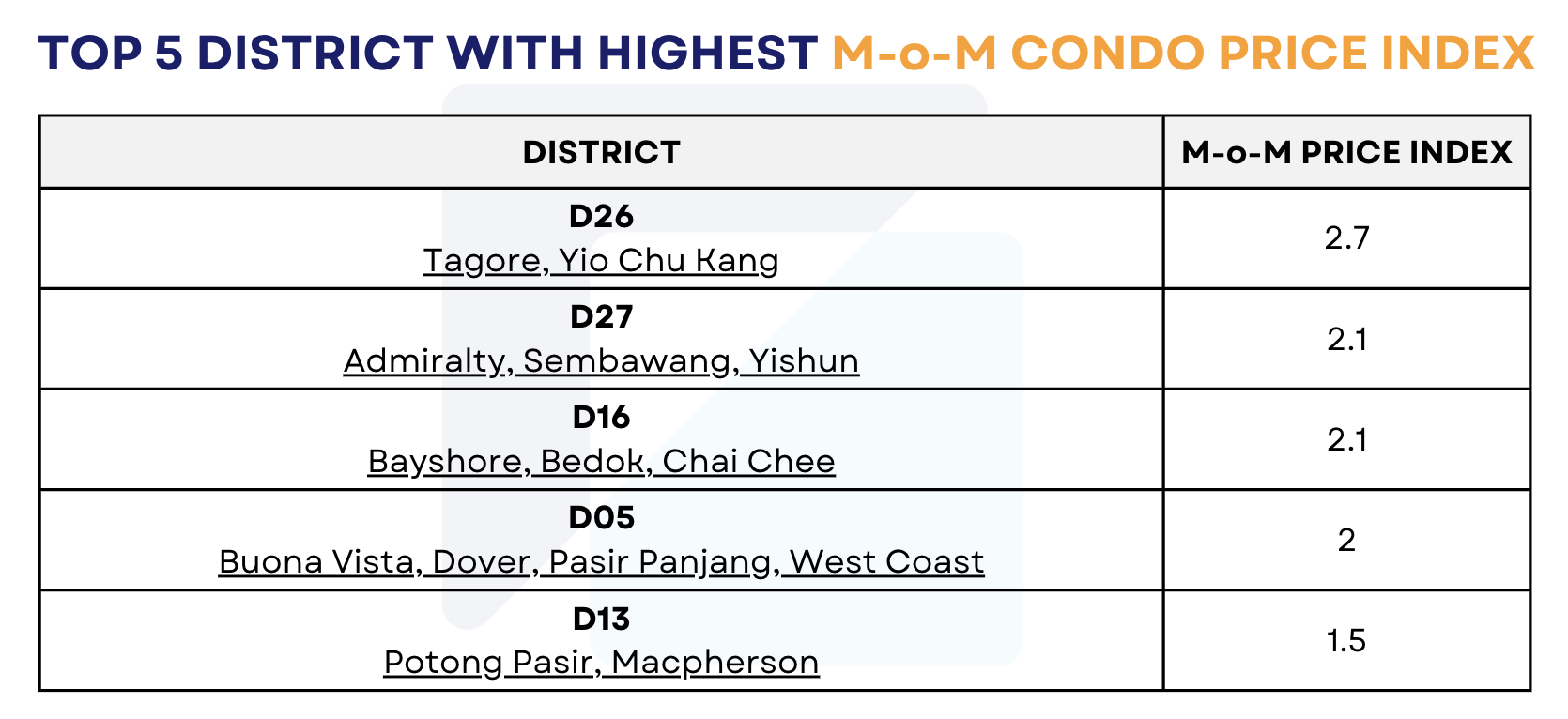

1. Top 5 Districts with highest Month on Month (M-o-M) Index

2. Top 5 most popular projects (Condo) in February 2024

*New Sale: The sale of a unit direct by a developer before the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

**Resale: The sale of a unit by a developer or subsequent purchaser after the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

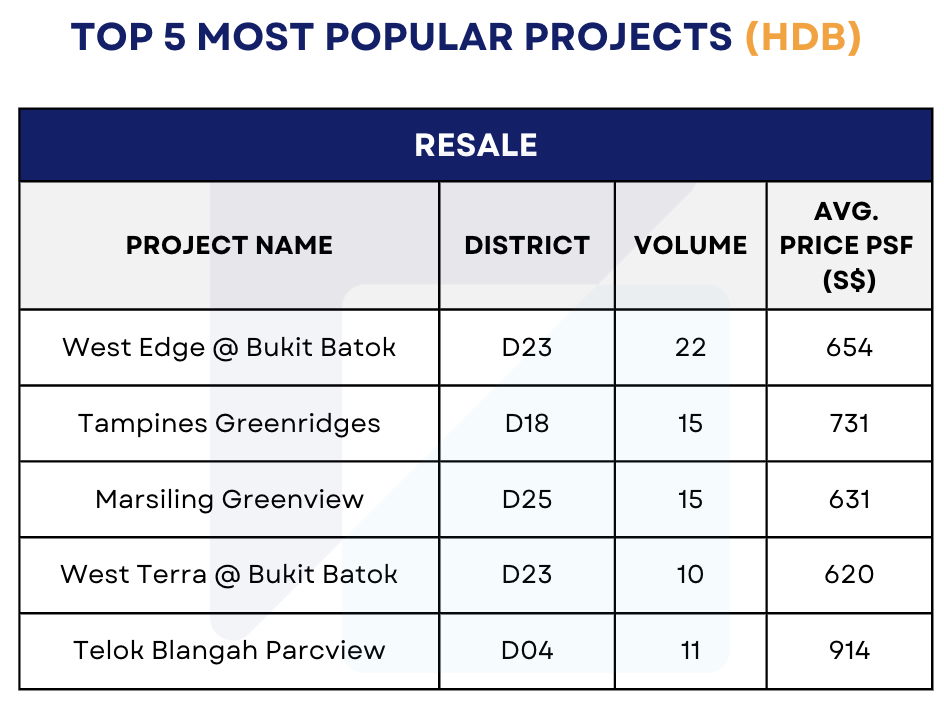

3. Top 5 most popular projects (HDB) in February 2024

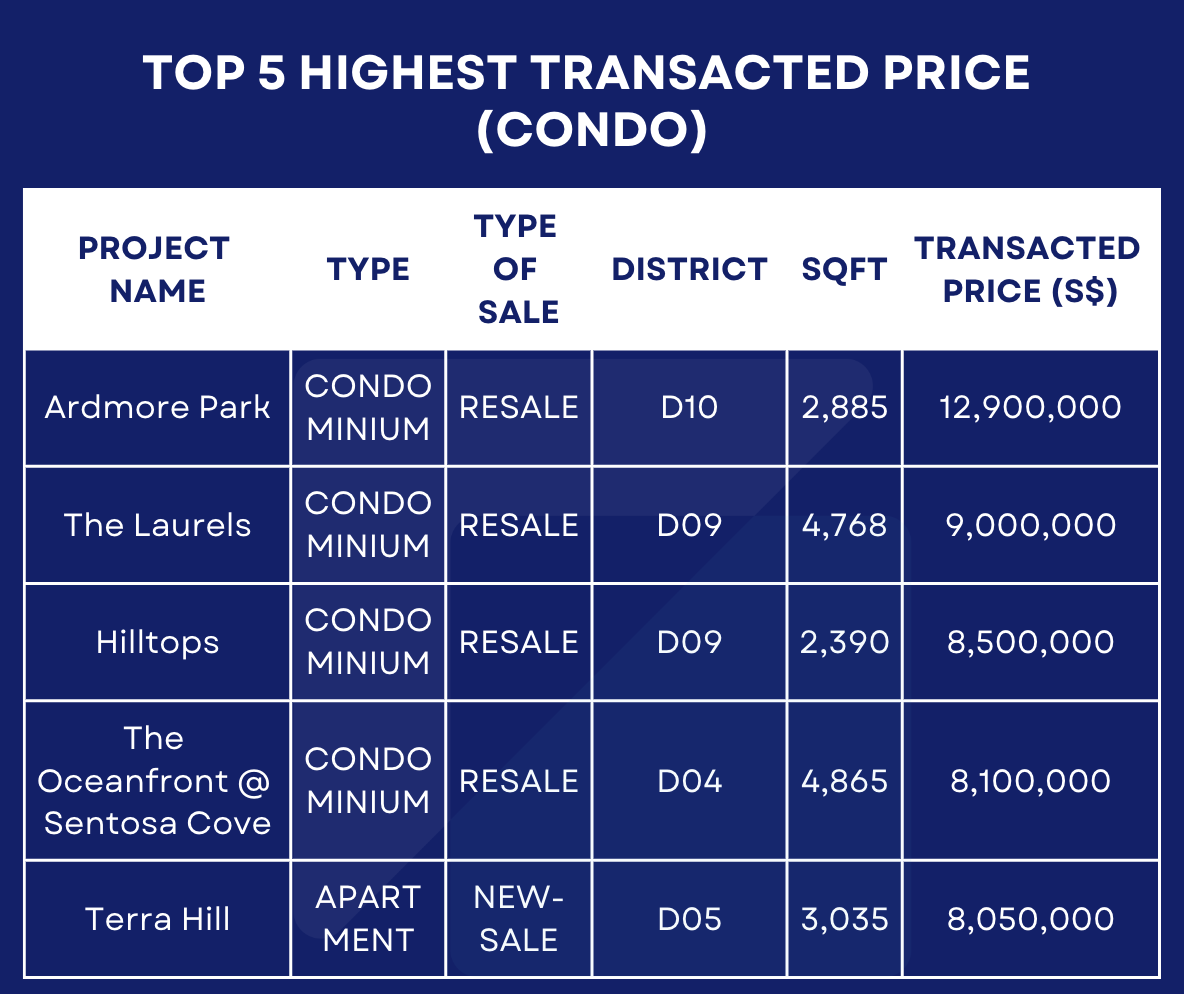

4. Top 5 highest transacted price (Condo) in February 2024

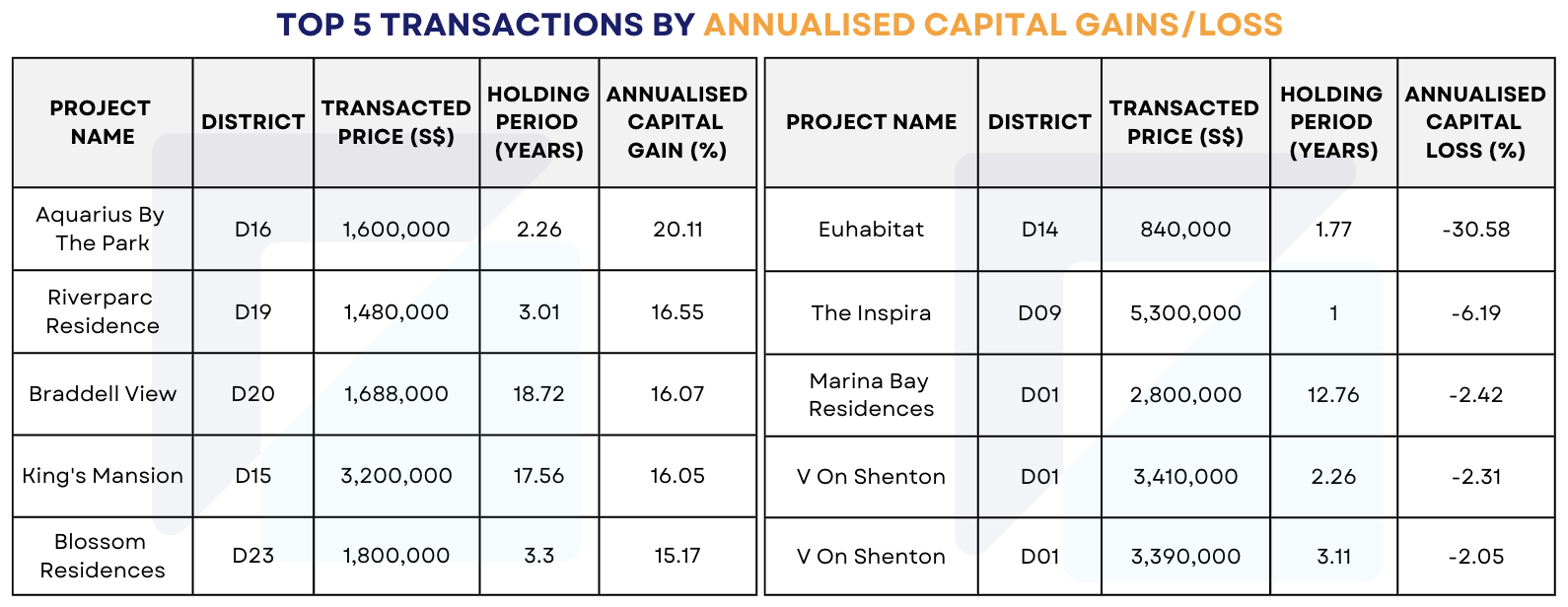

5. Top 5 Transactions by Annualised Capital Gain/Loss in February 2024

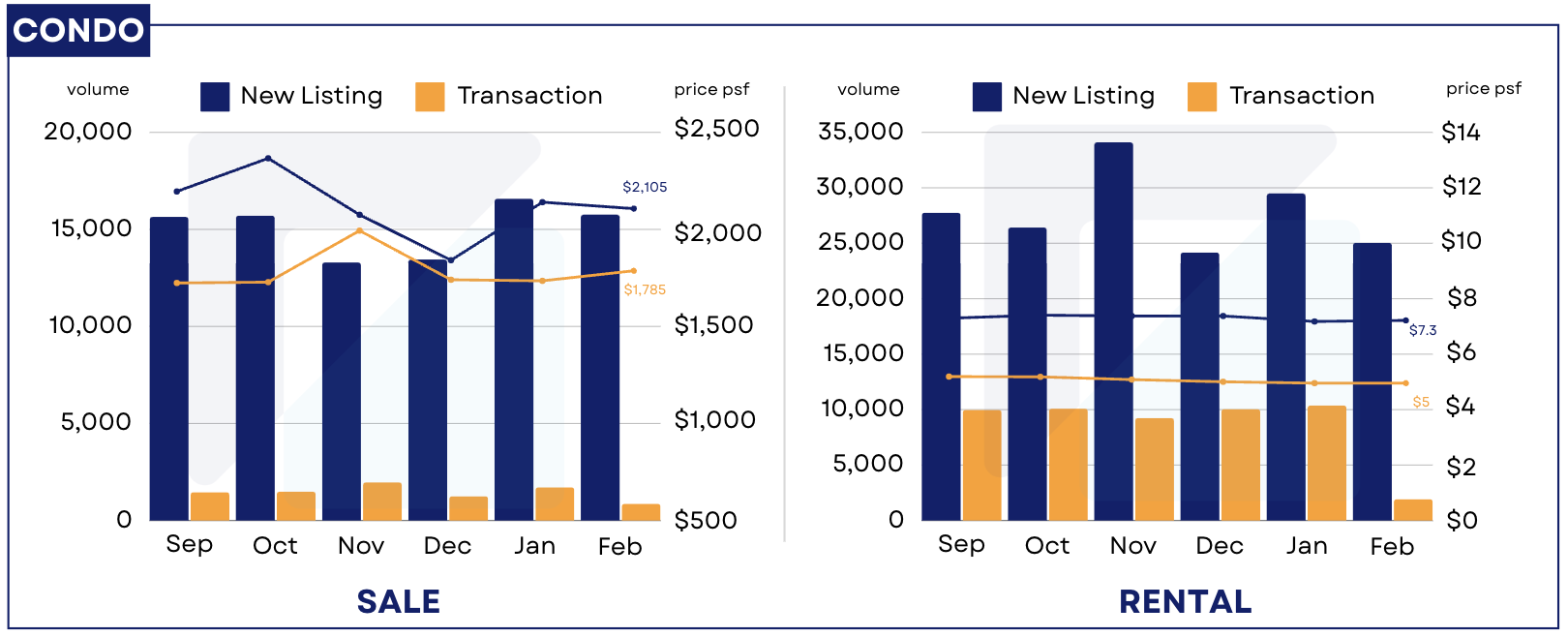

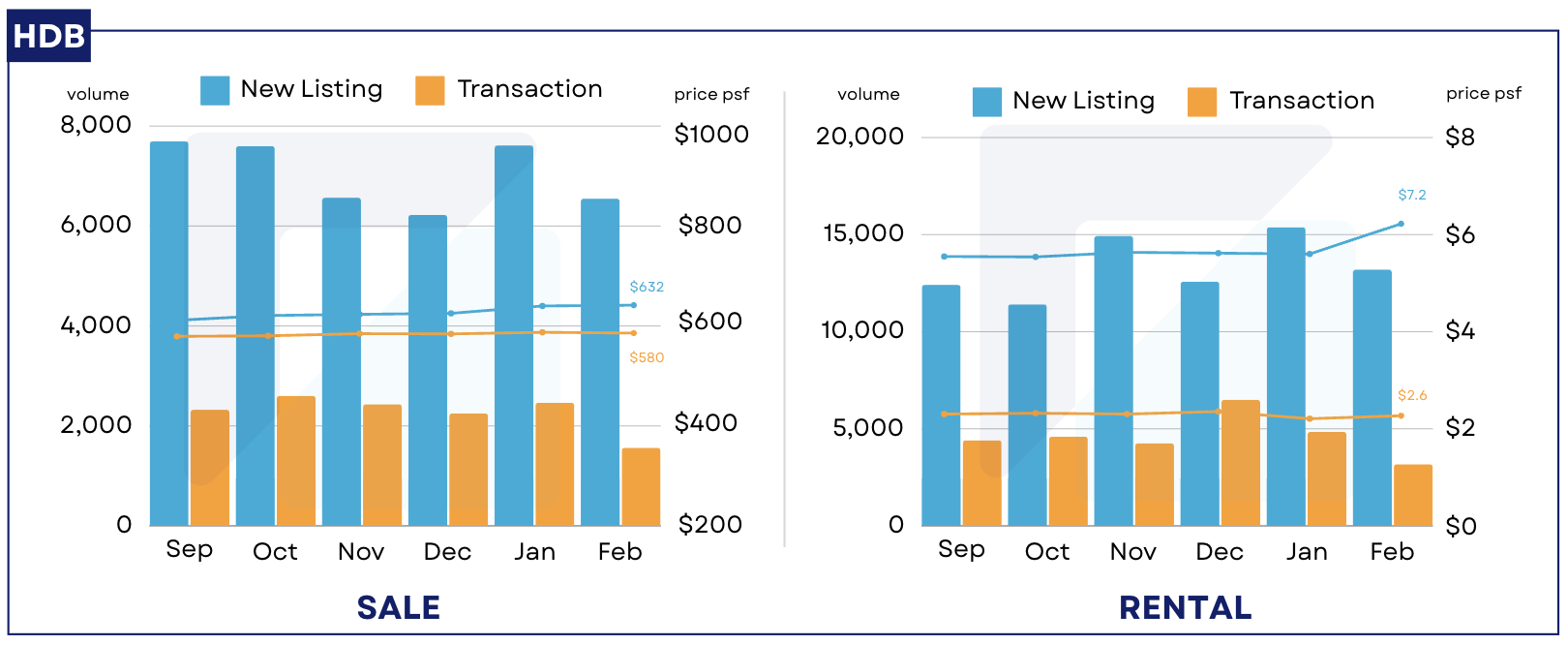

Residential Listings (Condo, HDB, Landed) September 2023 - February 2024

*New Listing: the total number of listings that are newly added in that particular time period

Commercial Snapshot

1. Top 5 Office and Retail Sale (by volume and transacted price) (December 2023 - February 2024)

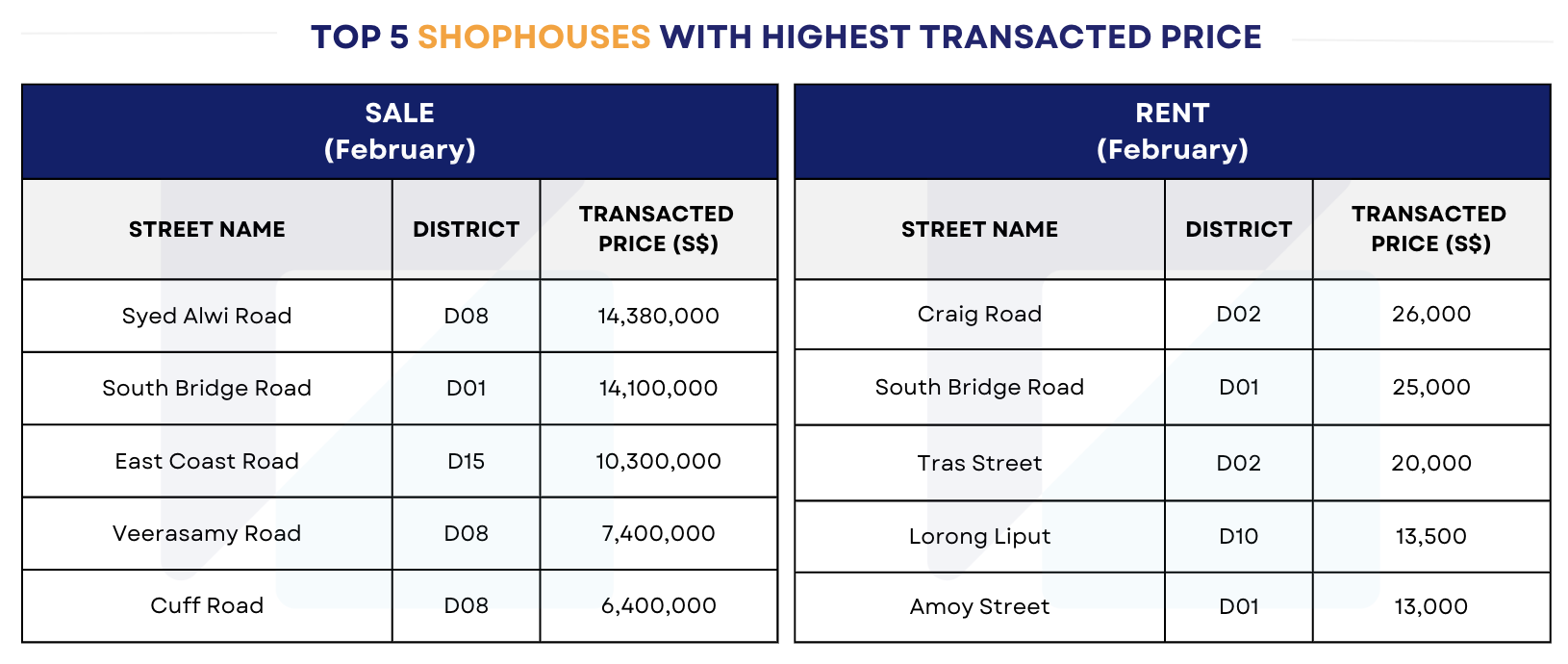

2. Top 5 Shophouses with Highest Transacted Price (Sale and Rent) in February 2024

*The data presented in this monthly report is accurate as of 12 March 2024. While we strive to provide the most up-to-date information available, it is important to note that there may be a small percentage of transactions that experience delays in reporting from the respective agencies and government sources. Therefore, the data provided should be interpreted with this in mind, and you are encouraged to verify the latest information for their specific needs.

*All analytical and visually interpreted data in this report is powered by RealAgent, a comprehensive app for real estate professionals. It offers a blend of property information, real-time transaction data, and advanced analytics, ensuring accurate and up-to-date insights for our report. Find out more about RealAgent here.

Download the full report (PDF) here: 022024 - Singapore Property Market Snapshot.pdf

To know more about our data-driven real estate solutions, contact us here.

Continue to read our other data insights articles:

Singapore Property Market Snapshot - January 2024

Singapore Property Market Snapshot - December 2023

Singapore Property Market Snapshot - November 2023

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics, we're revolutionising the real estate industry with our cutting-edge AI technology. By applying advanced data science in real estate industry, and providing customised services for people with various property needs, our market trends and insights, agent enhanced tools, and REA Developer Suite deliver realistic and reliable end-to-end solutions that enables everyone can make their informed decisions. Our solutions are available across Singapore, Malaysia, Hong Kong (China), Indonesia and Australia. Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.