News > Singapore Property Market Snapshot - March 2024

Singapore Property Market Snapshot - March 2024

15 April 2024

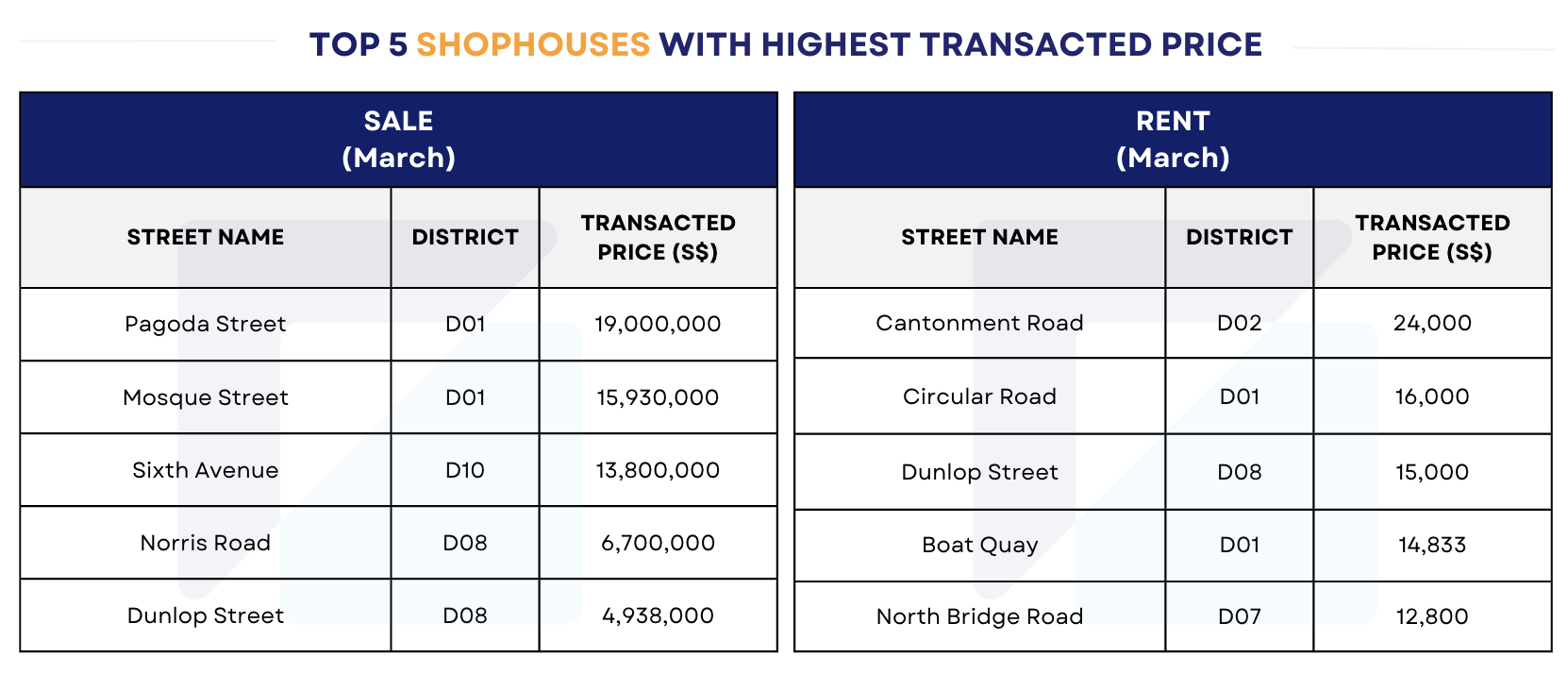

March 2024 was a remarkable month for Singapore real estate market as we saw record-breaking transactions: HDB Executive at Bishan sold for $1.5M - top 3 highest transacted million-dollar HDB in 2024Q1, Shophouse at Pagoda Street broke the record for the highest selling price of $14,504 PSF within Kreta Ayer Area, etc.

So how was the market going performing in general? Explore the market with our report below:

Hot Topics in Singapore Property Market March 2024

1. Grade A office rents grow for 12th consecutive quarter to $11.95 psf: CBRE

In 2024Q1, prime Grade-A office rents in Singapore's Core CBD area rose by 0.4%, marking the 12th consecutive quarterly increase, totaling a 14.9% rise since 2021. David McKellar from CBRE attributes this growth to limited supply, elevated interest rates, and lease renewals at higher rates. However, delayed completion of IOI Central Boulevard Towers has contributed to the low vacancy rate of 3.6%. Read more >>

2. Luxury property market stable despite GCB sales hitting record low

The market saw a historic low of only 23 transactions for good class bungalows (GCBs), the lowest since 1996, while luxury apartment sales also declined, particularly after a rise in stamp duty for foreign buyers. However, prices remained steady, with a slight uptick in the fourth quarter driven by new launches. Read more >>

3. HDB rental market to sustain growth momentum; private condo rents may face more headwinds in H2 2024

In February, while the rental price index for non-landed private housing declined for the 13th consecutive month due to a supply glut, HDB flats saw a 1% growth, reaching an all-time high of 137.5. Rental volumes for both HDB and condos dipped, primarily attributed to Chinese New Year festivities. Read more >>

4. Five-party consortium places 2 bids for Jurong Lake District site

It comprises CapitaLand Development, City Developments, Frasers Property, Mitsubishi Estate and Mitsui Fudosan (Asia); analysts expressed no surprise there is no other contender, given risks of mega project and long timeline. Read more >>

Price Indexes

*Index value is 1 at year 2008

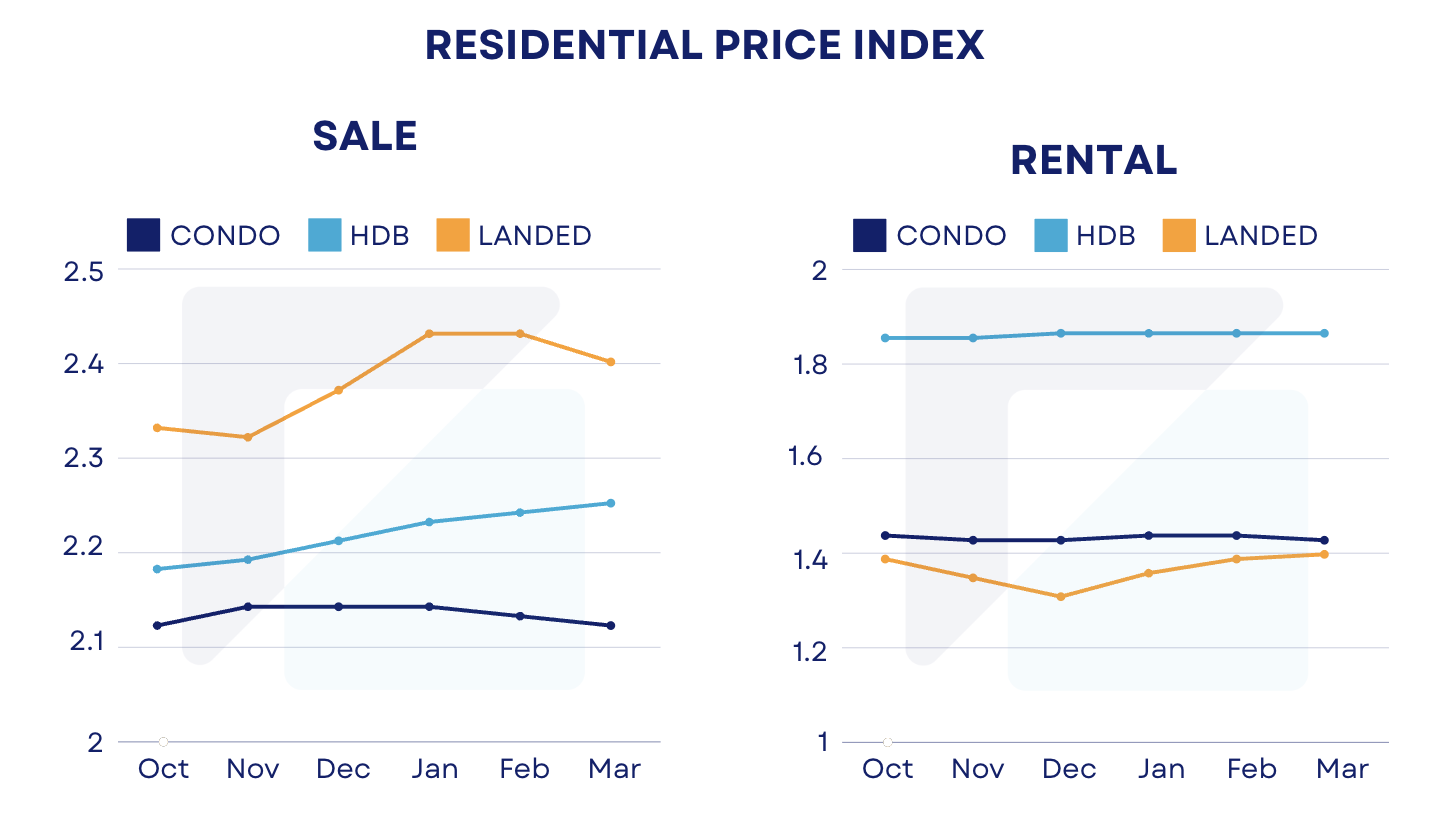

1. Residential Price Index

Sale Index for Condo and Landed saw a decline of 0.5% and 1.2% respectively between February and March 2024. In contrast, HDB Sale Index saw a slight increase of 0.5%.

Rental Index for Condo and HDB remained stable within the period. However, Landed saw a consistent upward trend since December 2023.

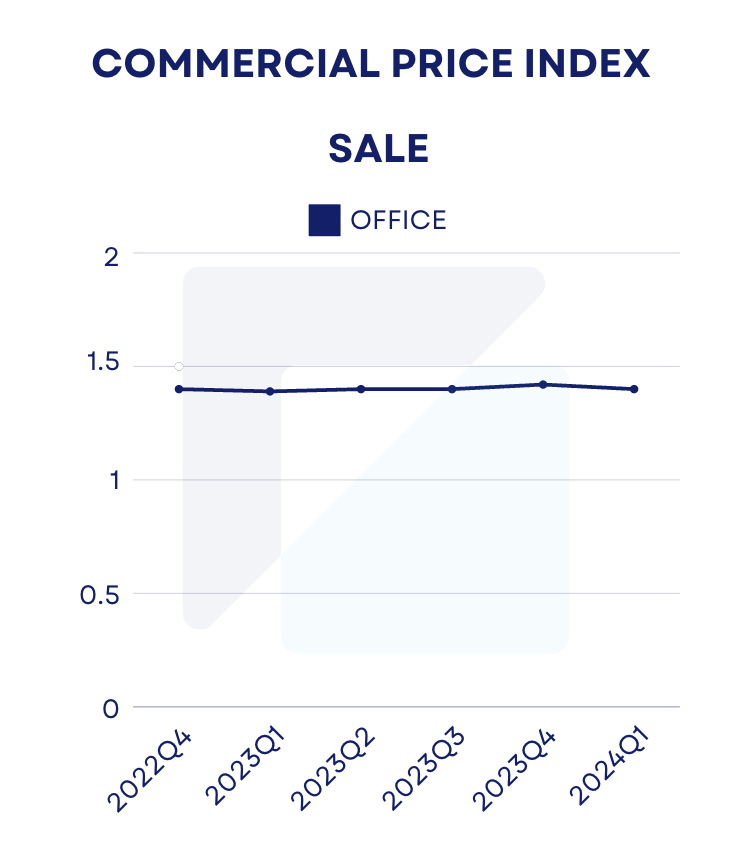

2. Commercial Price Index

Office Sale Index was down 1.5% in the first quarter of 2024 compared to 4th quarter of 2023.

Residential Snapshot

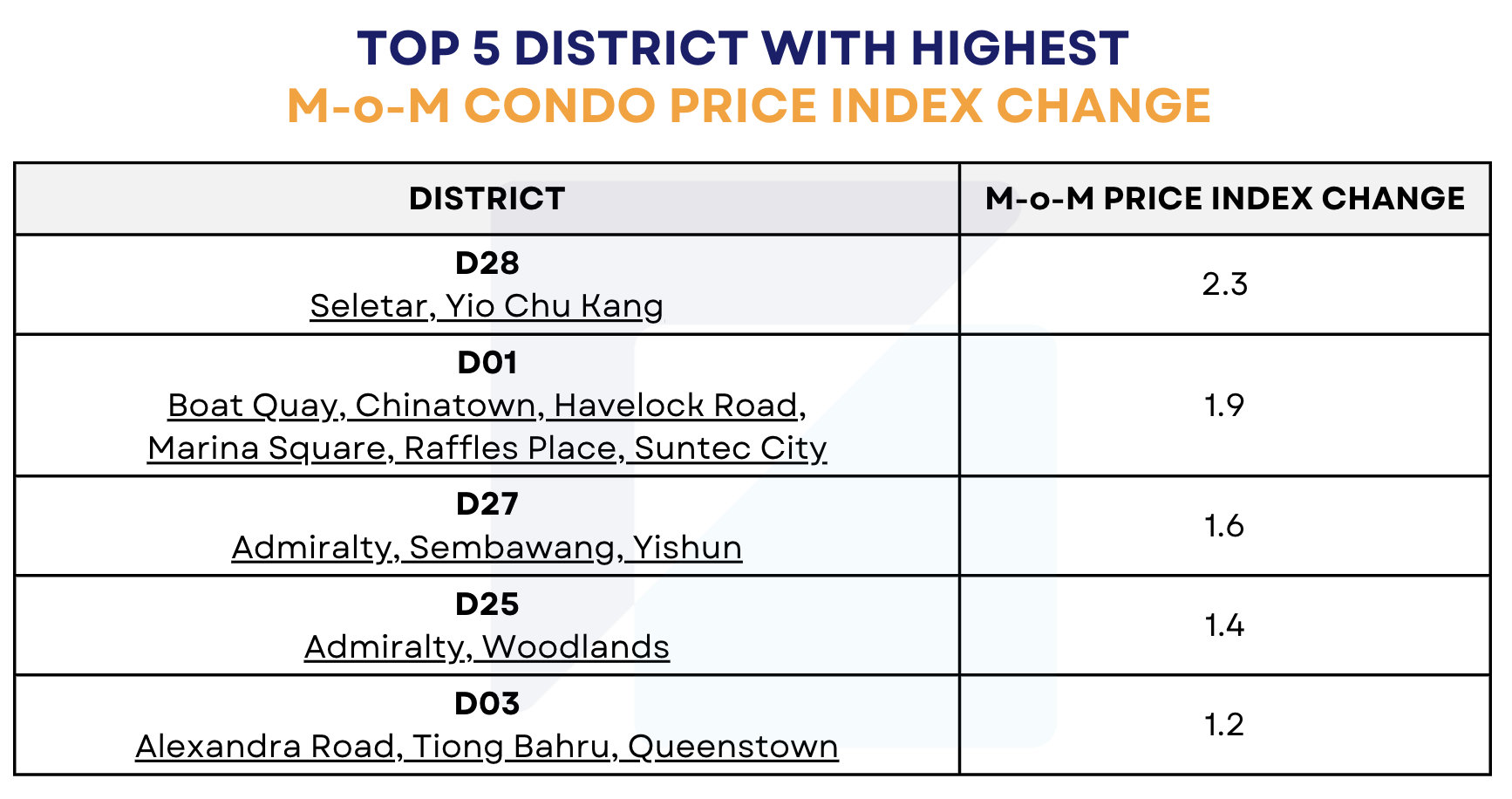

1. Top 5 Districts with highest Month on Month (M-o-M) Index Change

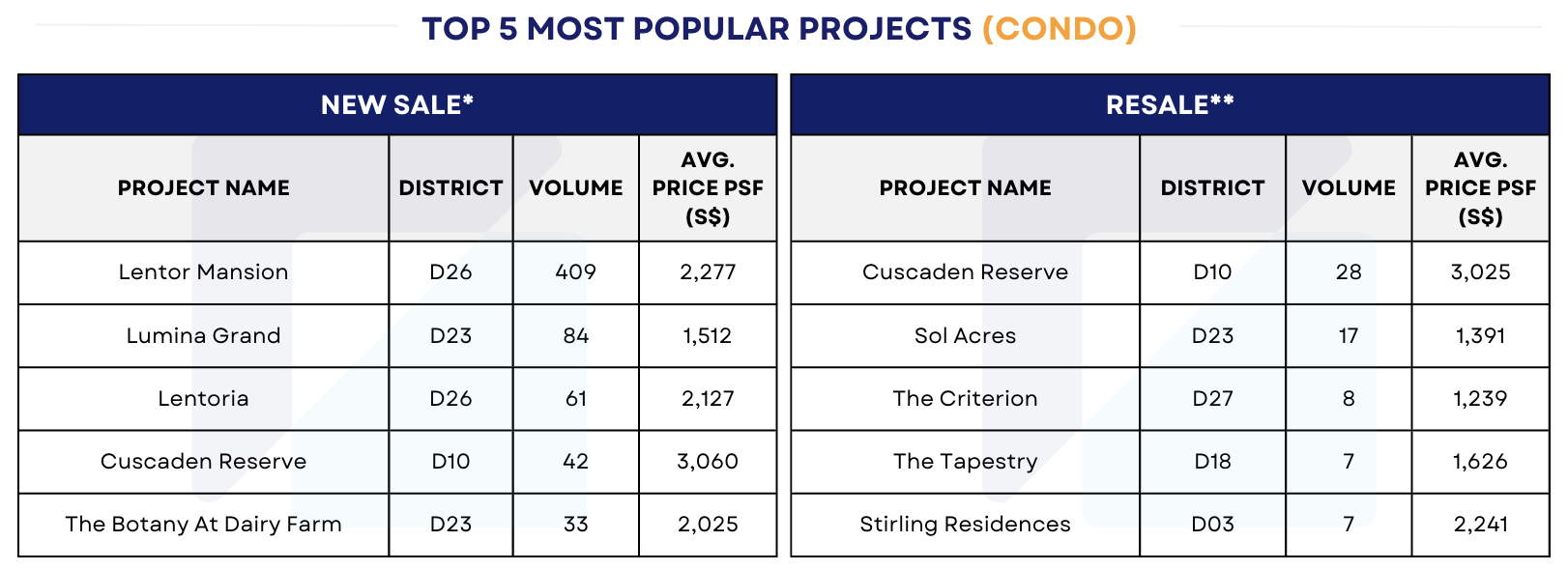

2. Top 5 most popular projects (Condo) in March 2024

*New Sale: The sale of a unit direct by a developer before the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

**Resale: The sale of a unit by a developer or subsequent purchaser after the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

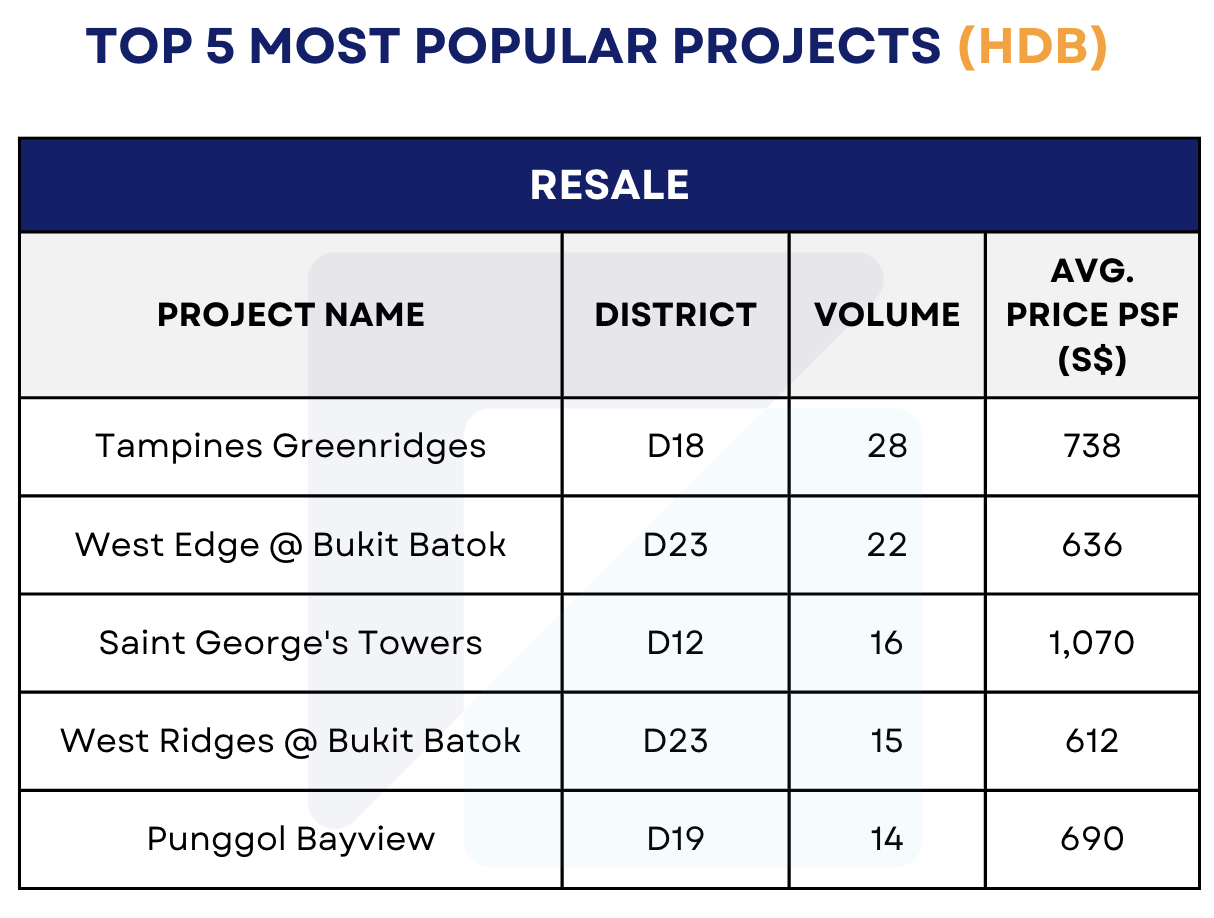

3. Top 5 most popular projects (HDB) in March 2024

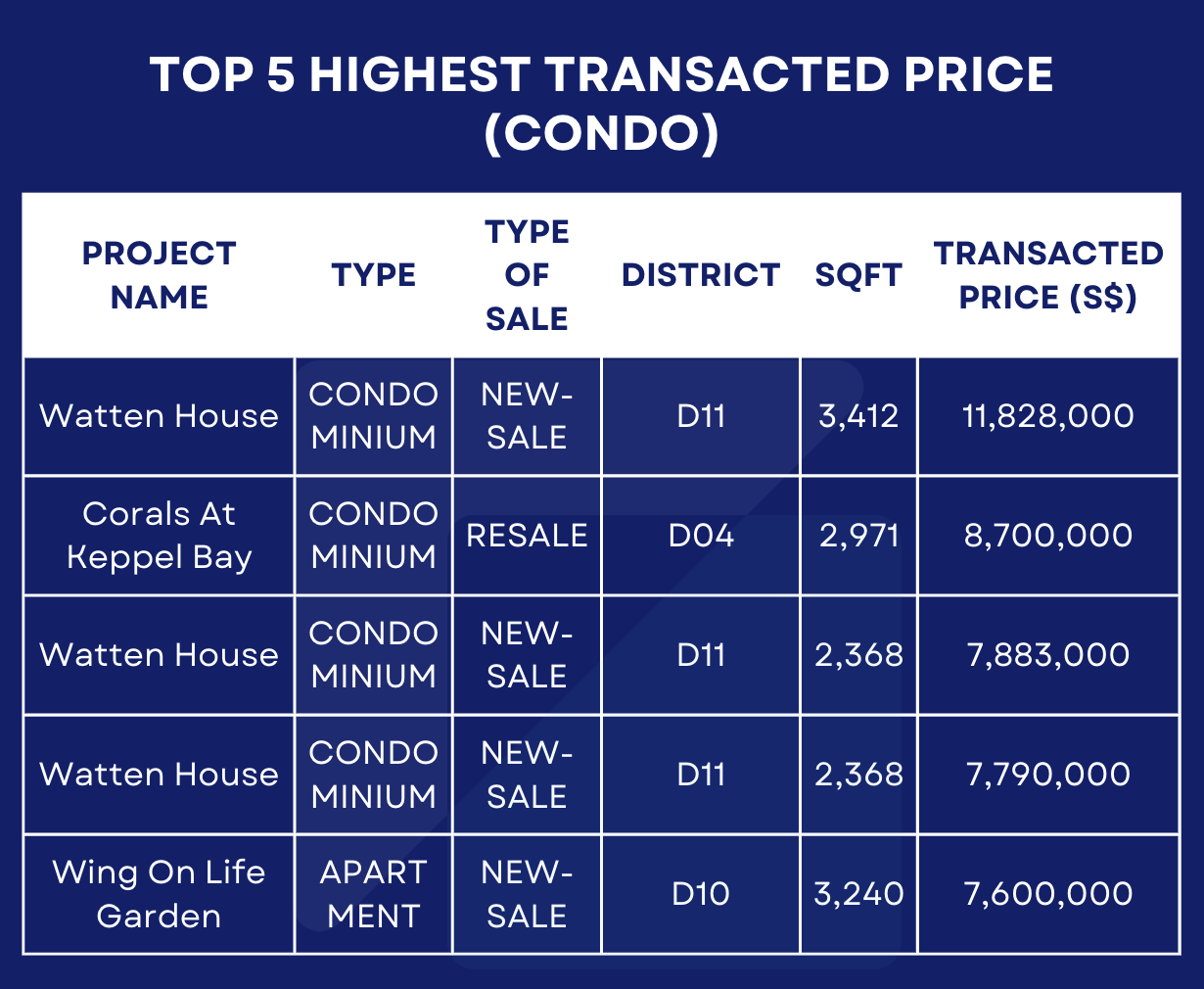

4. Top 5 highest transacted price (Condo) in March 2024

5. Top 5 Transactions by Annualised Capital Gain/Loss in March 2024

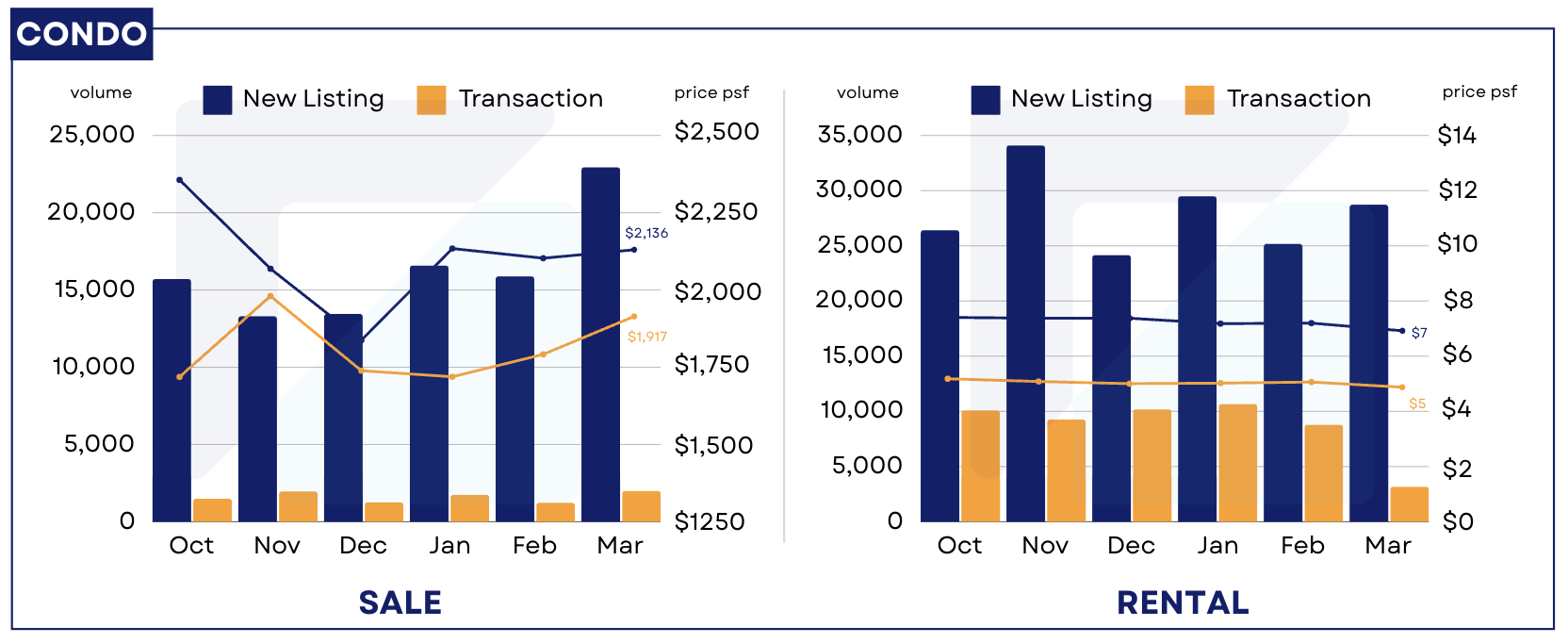

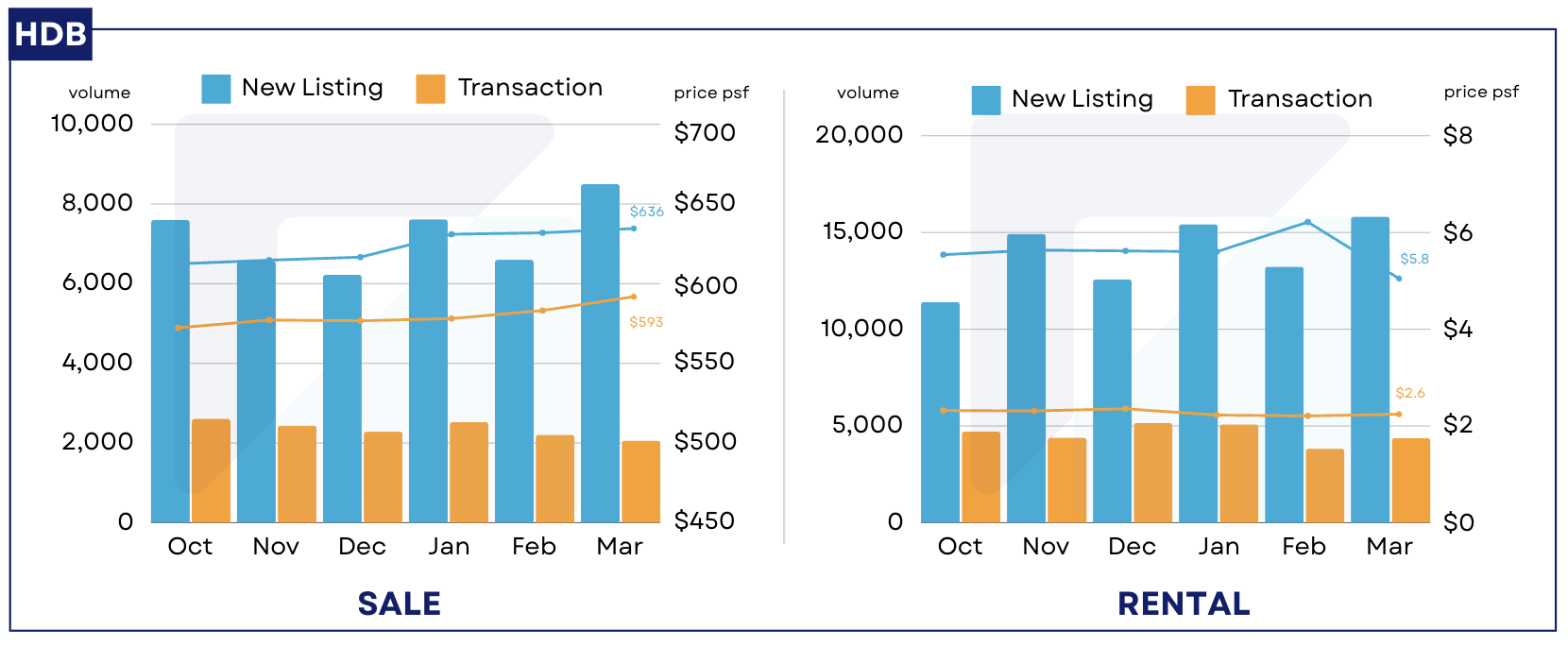

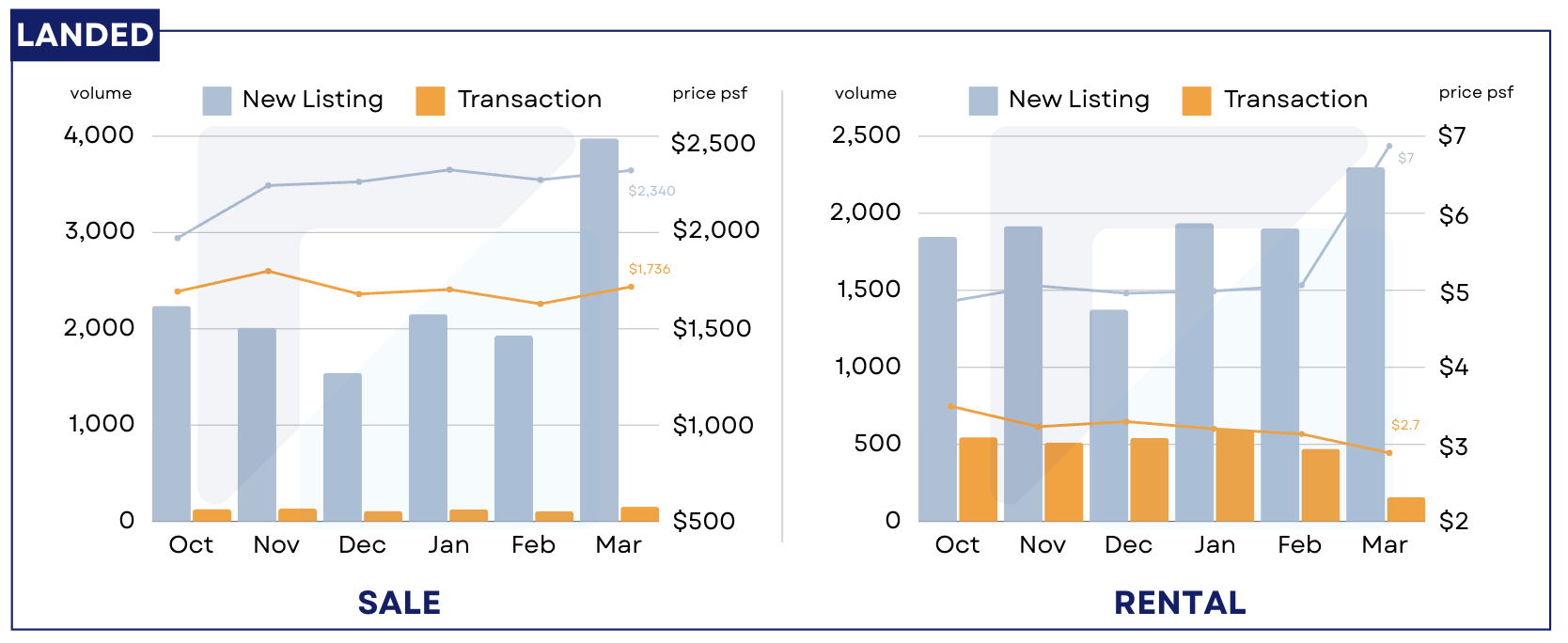

Residential Listings (Condo, HDB, Landed) October 2023 - March 2024

*New Listing: the total number of listings that are newly added in that particular time period

Sale listing volume saw a steep increase in March for all property types, specifically 44.5% for Condo, 28.8% for HDB, and 200% for Landed. Same trend was witnessed in the actual transaction volume, where Condo sale went up 62%, Landed sale went up 43%, with the exception of HDB which saw a slight decrease of 7% in volume.

The gap between Average listing psf and Average transacted psf remained significant for all types of property: Condos are transacted at 90% of the listing price, while that for HDB and Landed are 93% and 74% respectively.

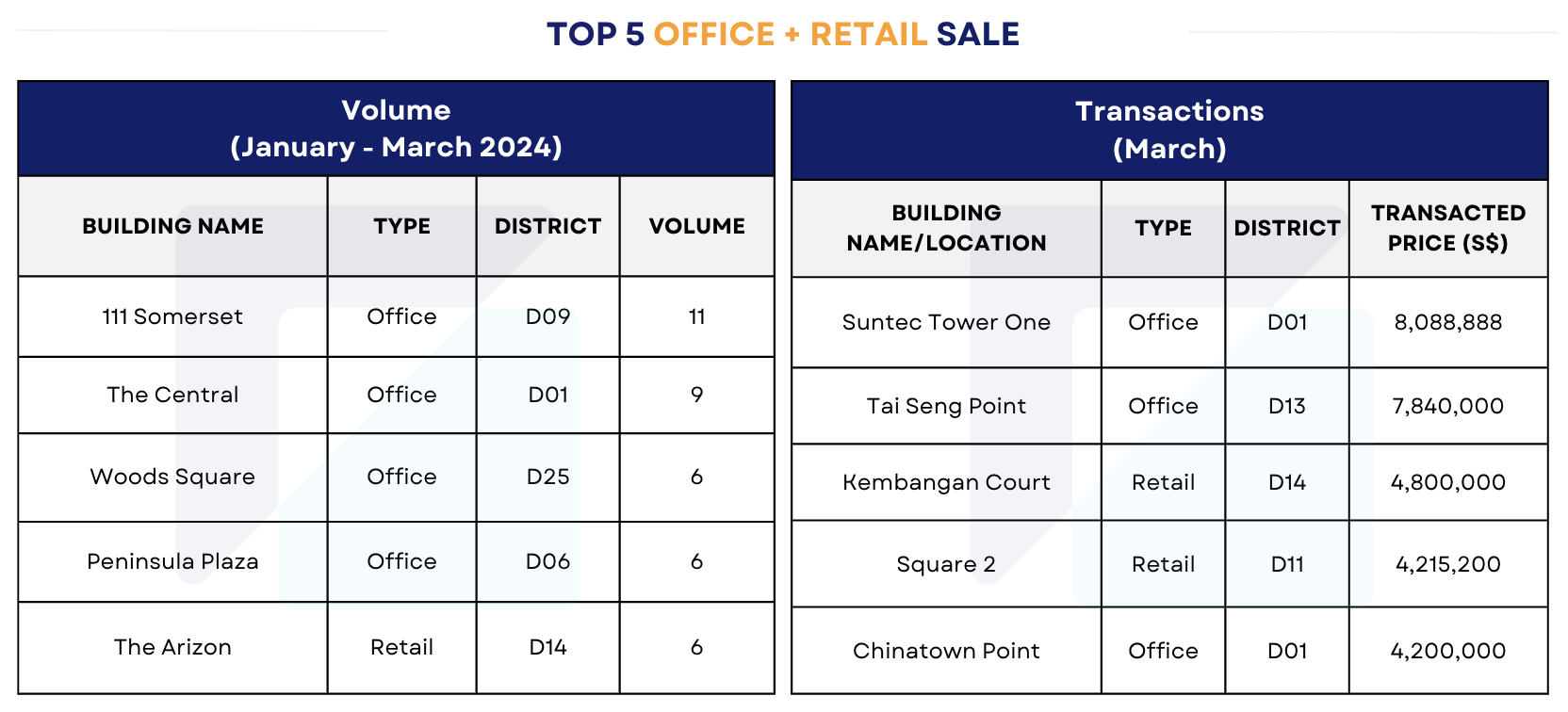

Commercial Snapshot

1. Top 5 Office and Retail Sale (by volume and transacted price) (January - March 2024)

2. Top 5 Shophouses with Highest Transacted Price (Sale and Rent) in March 2024

*The data presented in this monthly report is accurate as of 15 April 2024. While we strive to provide the most up-to-date information available, it is important to note that there may be a small percentage of transactions that experience delays in reporting from the respective agencies and government sources. Therefore, the data provided should be interpreted with this in mind, and you are encouraged to verify the latest information for their specific needs.

*All analytical and visually interpreted data in this report is powered by RealAgent, a comprehensive app for real estate professionals. It offers a blend of property information, real-time transaction data, and advanced analytics, ensuring accurate and up-to-date insights for our report. Find out more about RealAgent here.

Download the full report (PDF) here: 032024 - Singapore Property Market Snapshot.pdf

To know more about our data-driven real estate solutions, contact us here.

Continue to read our other monthly reports:

Singapore Property Market Snapshot - February 2024

Singapore Property Market Snapshot - January 2024

Singapore Property Market Snapshot - December 2023

Singapore Property Market Snapshot - November 2023

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics, we're revolutionising the real estate industry with our cutting-edge AI technology. By applying advanced data science in real estate industry, and providing customised services for people with various property needs, our market trends and insights, agent enhanced tools, and REA Developer Suite deliver realistic and reliable end-to-end solutions that enables everyone can make their informed decisions. Our solutions are available across Singapore, Malaysia, Hong Kong (China), Indonesia and Australia. Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.