News > Singapore Property Market Snapshot - May 2024

Singapore Property Market Snapshot - May 2024

19 June 2024

Another month of remarkable performance for Singapore Real Estate Market. Several new million-dollar HDB records have been set, such as a 5-room flat at Block 96A Henderson Road that was sold for a record $1.588 million - the most expensive HDB transaction to date in 2024, or $1.568 million transaction for a 5-room flat at Bishan Natura Loft, and another $1.54 million for a 5-room unit at The Peak @ Toa Payoh.

So how was the market going performing in general? Explore the market with our report below:

Hot Topics in Singapore Property Market May 2024

1. Bukit Timah Turf City to be Transformed into Sustainable Housing Estate with Emphasis on Heritage and Nature Preservation.

The development will feature 15,000 to 20,000 new public and private homes with a focus on being car-lite and pedestrian-friendly. Retaining significant heritage buildings and ecological habitats are key aspects of the project. The area will be developed progressively over the next 20 to 30 years with input from residents and stakeholders to create an inclusive and vibrant community. Read more >>

2. Over 600 Resale Flats Listed on HDB Flat Portal Since Soft Launch.

The decision comes as a response to evolving housing needs and government measures. The sites development was delayed due to factors like lack of demand and detailed planning requirements. Analysts predict that the new estate will prioritise private housing over public flats, maintaining exclusivity in the prime location. Read more >>

3. Singapore Announces Public Housing Development in Prime Bukit Timah Location After 26-Year Wait.

Despite warnings of economic uncertainties, demand for resale flats is rising due to various factors like reduced BTO launches and completion of wait-out periods for downgrading. Rental market faces a slowdown as supply decreases and tenants shift to the private sector. Read more >>

4. More singles moving out, smaller households: URA chief on Singapore’s housing demand despite declining birth rate.

Singapore's population trends indicate a shift towards more one-person and two-person households, leading to a higher demand for smaller homes. This demographic shift is driven by rising singlehood and an aging population. The preference for smaller housing units is expected to grow, although lifestyle aspirations for larger living spaces may moderate this demand. Read more >>

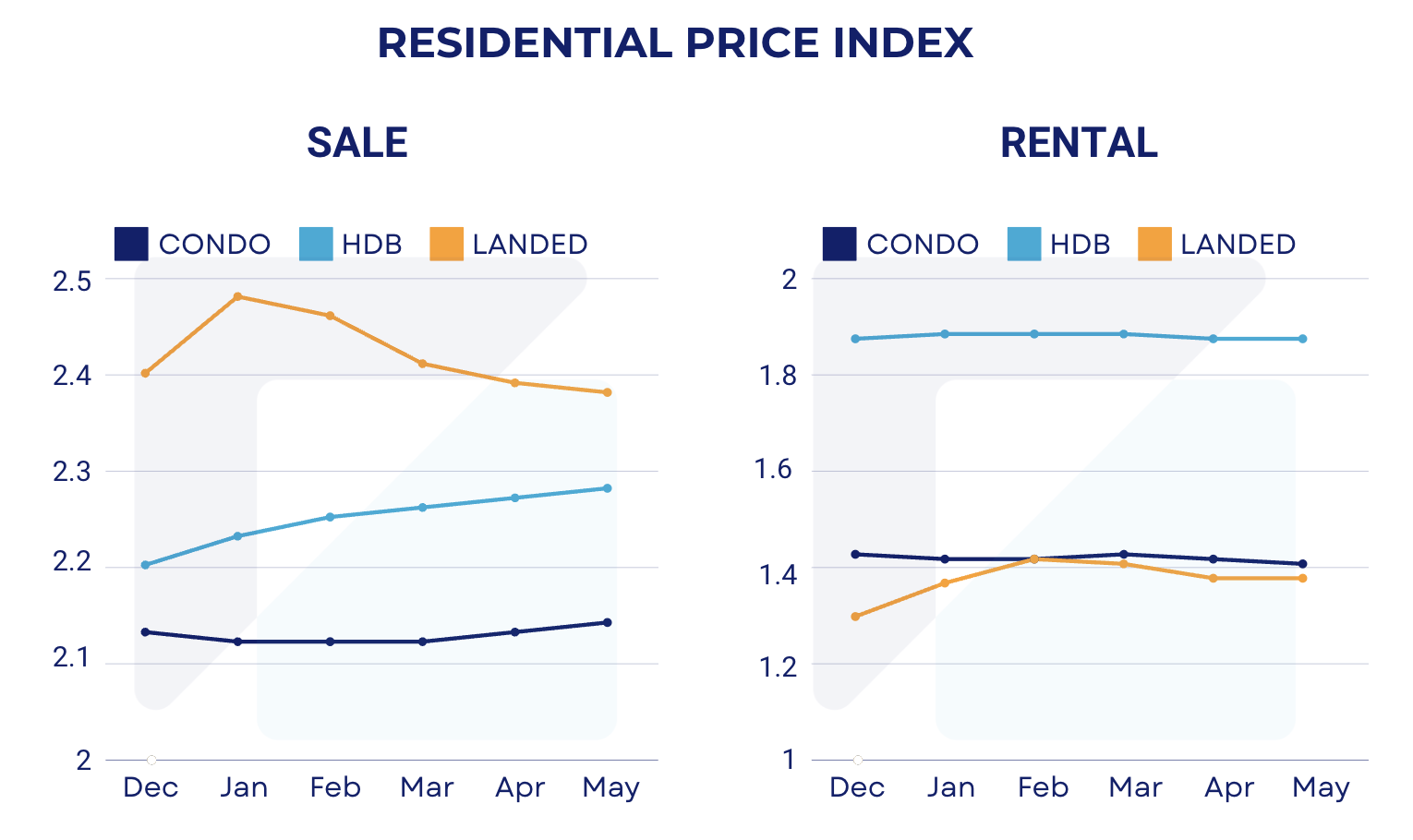

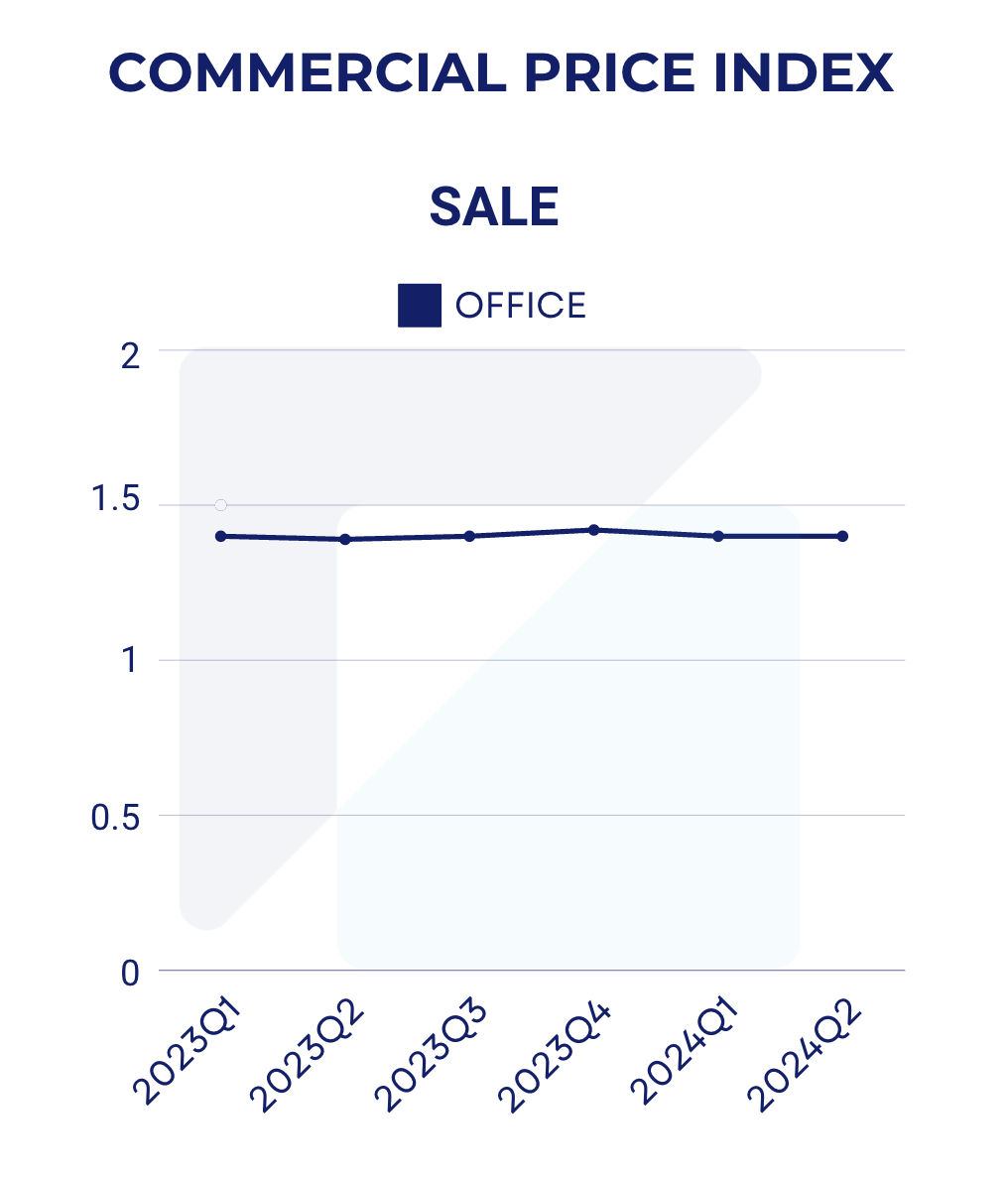

Price Indexes

*Index value is 1 at year 2008

Price Indexes shown are powered by REA Property Price Index - an accurate and objective indicator of the real estate market performance. Read more about our index here.

1. Residential Price Index

2. Commercial Price Index

New Launches in May 2024

1. Straits At Choo Chiat (Launched 11 May 2024)

Location: 305 Joo Chiat Place, D15

TOP: 2027

Tenure: Freehold

Number of units: 16

Price range: S$2,030 ~ S$2,170 PSF

(Image source: https://www.straitsatjoochiats.com.sg/)

2. Jansen House (Launched 4 May 2024)

Location: 25 Jansen Road, D19

TOP: 2026

Tenure: 999 year

Number of units: 21

Price range: S$1,926 ~ S$2,212 PSF

(Image source: https://www.jansenhouse.com.sg/)

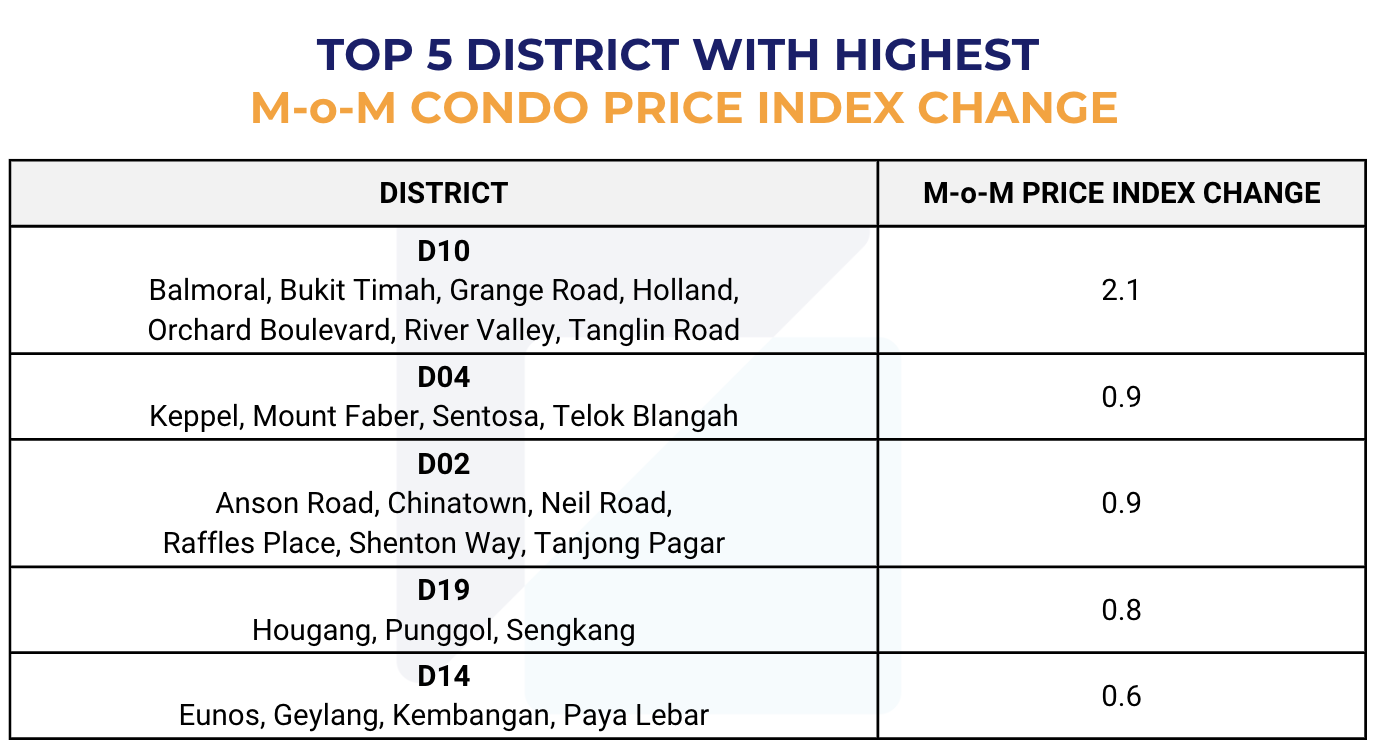

Residential Snapshot

1. Top 5 Districts with highest Month on Month (M-o-M) Index Change

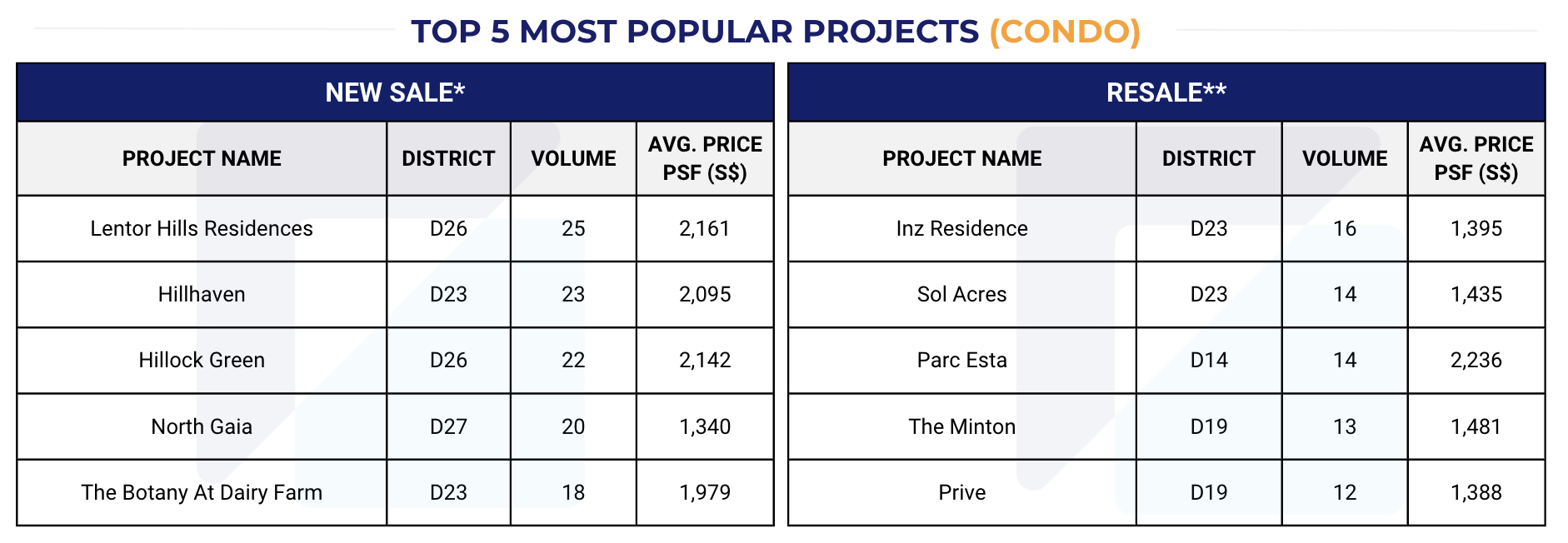

2. Top 5 most popular projects (Condo) in May 2024

*New Sale: The sale of a unit direct by a developer before the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

**Resale: The sale of a unit by a developer or subsequent purchaser after the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

3. Top 5 most popular projects (HDB) in May 2024

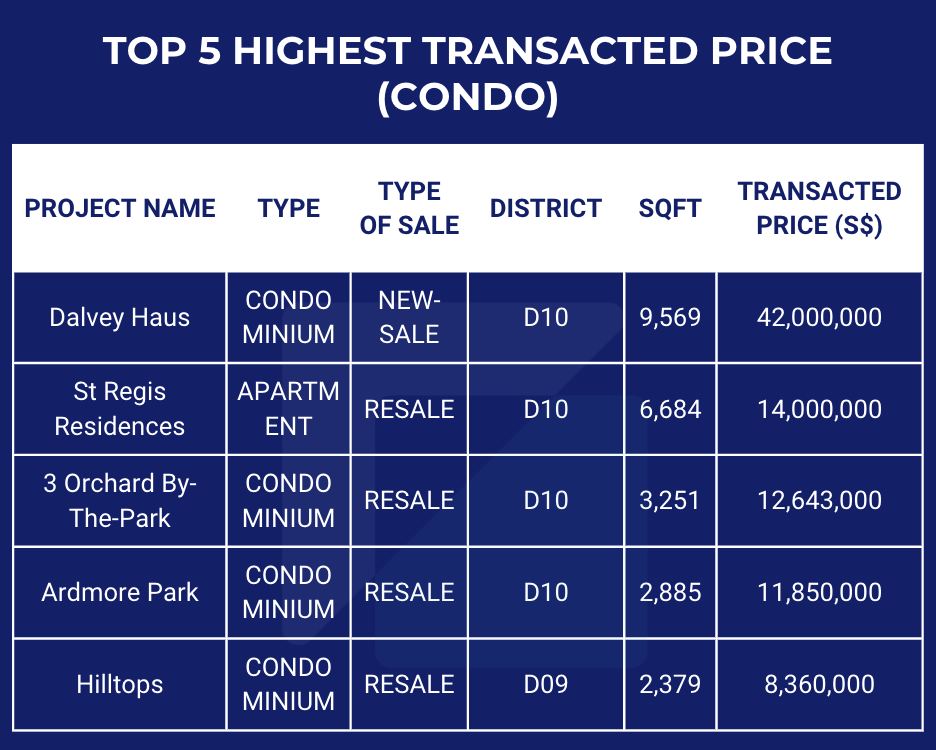

4. Top 5 highest transacted price (Condo) in May 2024

5. Top 5 Transactions by Annualised Capital Gain/Loss in May 2024

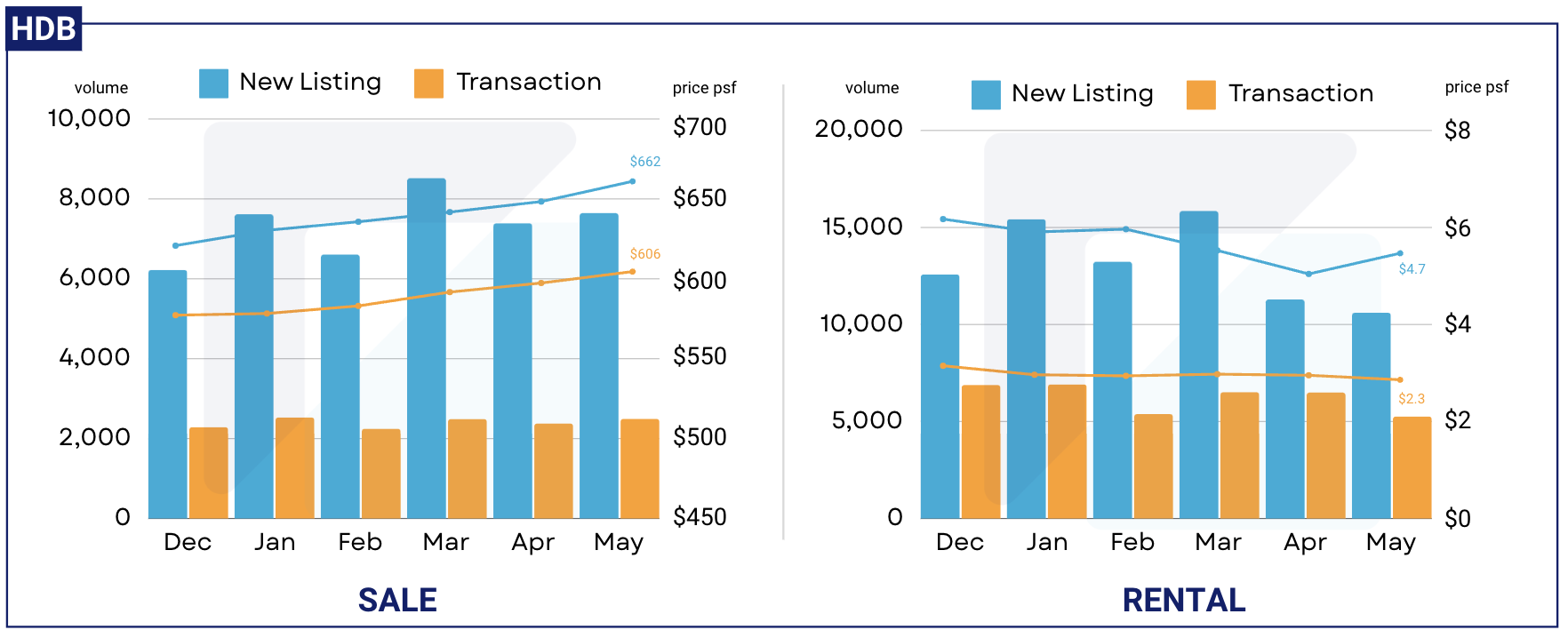

Residential Listings (Condo, HDB, Landed) December 2023 - May 2024

*New Listing: the total number of listings that are newly added in that particular time period

Commercial Snapshot

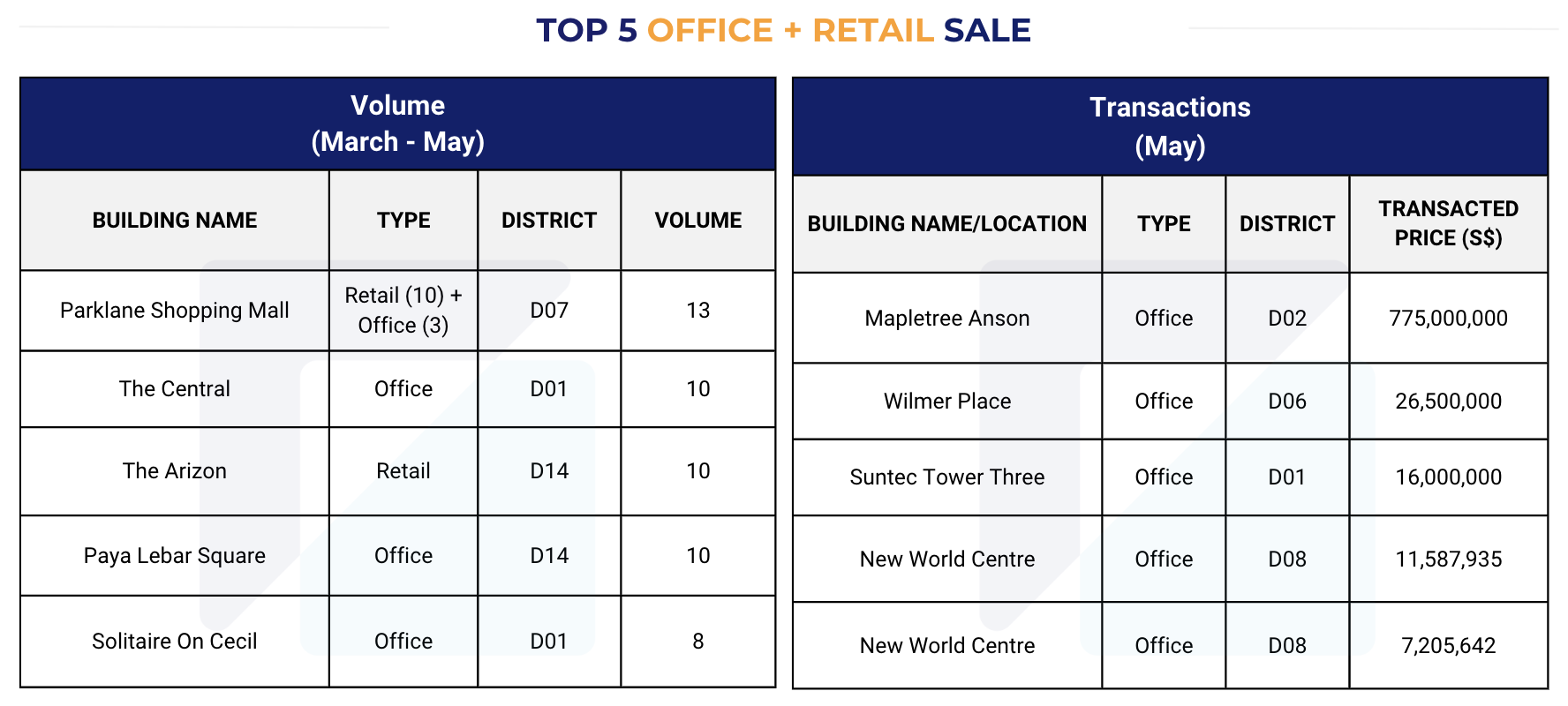

1. Top 5 Office and Retail Sale (by volume and transacted price) (March - May 2024)

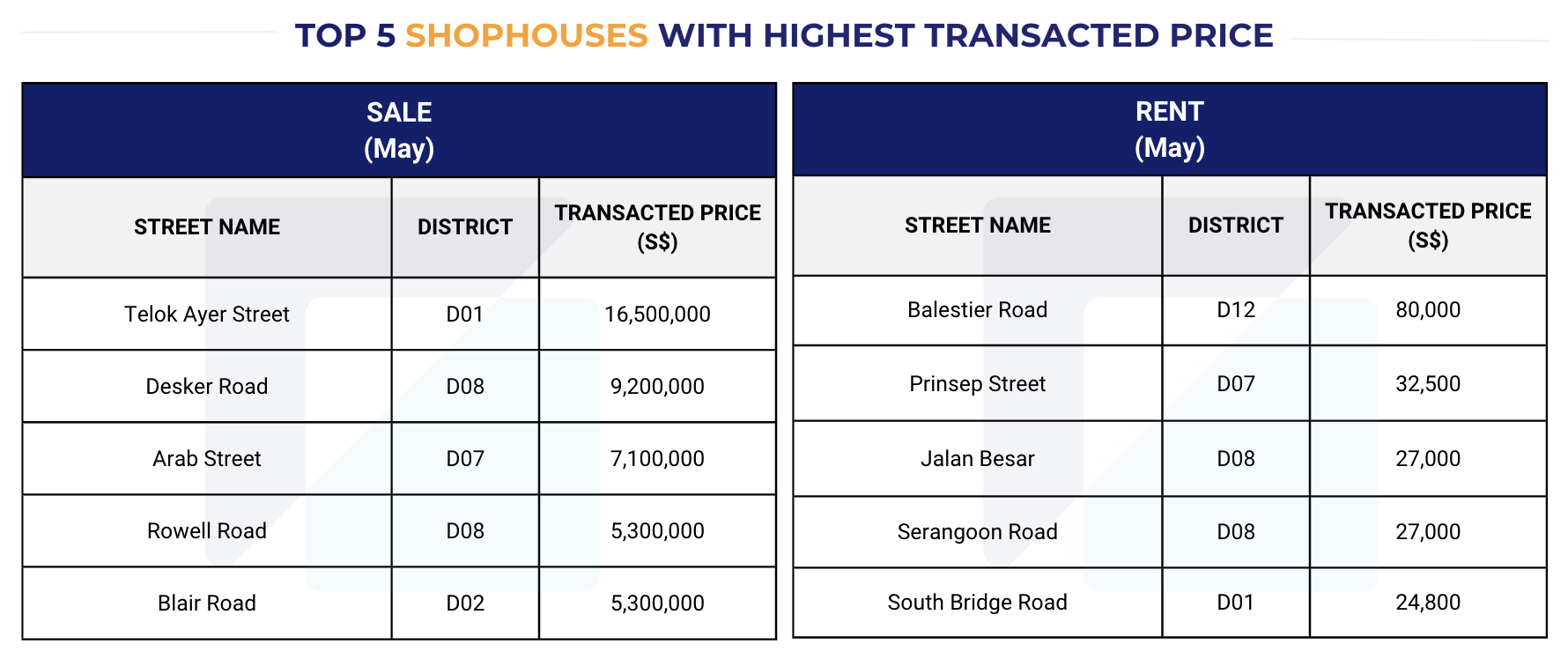

2. Top 5 Shophouses with Highest Transacted Price (Sale and Rent) in May 2024

*The data presented in this monthly report is accurate as of 19 June 2024. While we strive to provide the most up-to-date information available, it is important to note that there may be a small percentage of transactions that experience delays in reporting from the respective agencies and government sources. Therefore, the data provided should be interpreted with this in mind, and you are encouraged to verify the latest information for your specific needs.

*All analytical and visually interpreted data in this report is powered by RealAgent, a comprehensive app for real estate professionals. It offers a blend of property information, real-time transaction data, and advanced analytics, ensuring accurate and up-to-date insights for our report. Find out more about RealAgent here.

Download the full report (PDF) here: 052024 - Singapore Property Market Snapshot.pdf

To know more about our data-driven real estate solutions, contact us here.

Continue to read our previous monthly reports:

Singapore Property Market Snapshot - April 2024

Singapore Property Market Snapshot - March 2024

Singapore Property Market Snapshot - February 2024

Singapore Property Market Snapshot - January 2024

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics (REA), we revolutionise the real estate industry with cutting-edge AI technology. Leveraging advanced data science and machine learning, we offer tailored data solutions for real estate professionals and enthusiasts. Our products, including market insights, RealAgent suite (for agents), and RealInsight (for developers, investors, institutional clients), provide end-to-end solutions for informed decision-making. Available across Singapore, Malaysia, Hong Kong (China), and Australia, our offerings ensure you always stay ahead in the dynamic real estate market.

Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.