News > Singapore Property Market Snapshot - June 2024

Singapore Property Market Snapshot - June 2024

18 July 2024

How was the Singapore property market performing in June? Explore the market with our report below:

Hot Topics in Singapore Property Market June 2024

1. Ardmore Park Condo Unit Sells for $2.65 Million Profit in Under 4.5 Years, Reflecting Strong Capital Gain Trend.

Property owner sells prestigious Ardmore Park condo unit off Orchard Road for $2.65 million profit in under 4.5 years, marking a 29% capital gain. The development has seen multiple profitable resale transactions, with one penthouse sale raking in $11.65 million profit. Read more >>

2. HDB launches mixed commercial and residential site at Tampines Street 94 for public tender under 1H2024 GLS Programme.

This mixed-use development site, situated directly opposite Tampines West MRT Station, spans approximately 2.35 hectares and is expected to yield around 585 residential units, along with 10,500 square meters of commercial space. The site will also include a minimum of 650 square meters designated for a childcare centre. Read more >>

3. Minister Desmond Lee Announces Development of 10,000 New Homes in Yishuns Chencharu Area by 2040 to Meet Housing Demand.

Chencharu in Yishun will offer around 10,000 new homes by 2040, of which at least 80% will be set aside for public housing. This will provide a sizeable supply of new homes for Singaporeans, including families who wish to live near their parents in the area to provide mutual care and support. Read more >>

4. URA unveils 3 residential sites in Singapore, offering 1,915 units for sale as part of Government Land Sales Programme.

The increased supply of private housing is part of the 1H2024 Government Land Sales Programme, marking the highest supply since 2H2013. The sites at Dairy Farm Walk and Tengah Garden Avenue are on the Confirmed List, while Bayshore Road is on the Reserve List. Tenders close on January 14, 2025. Read more >>

5. Government reduces land supply for private homes in H2, aiming to prevent oversupply and stabilise market conditions.

Government trims land supply for private homes in the next half-year by 7.3%, releasing sites for 5,050 units in H2, down from 5,450 units in H1. Despite the decrease, the annual figure remains the highest since 2013. The move aims to prevent oversupply amidst cautious developer bids and stabilising market conditions. Notably, no new sites with mandatory long-stay serviced apartments are included in the latest release. Read more >>

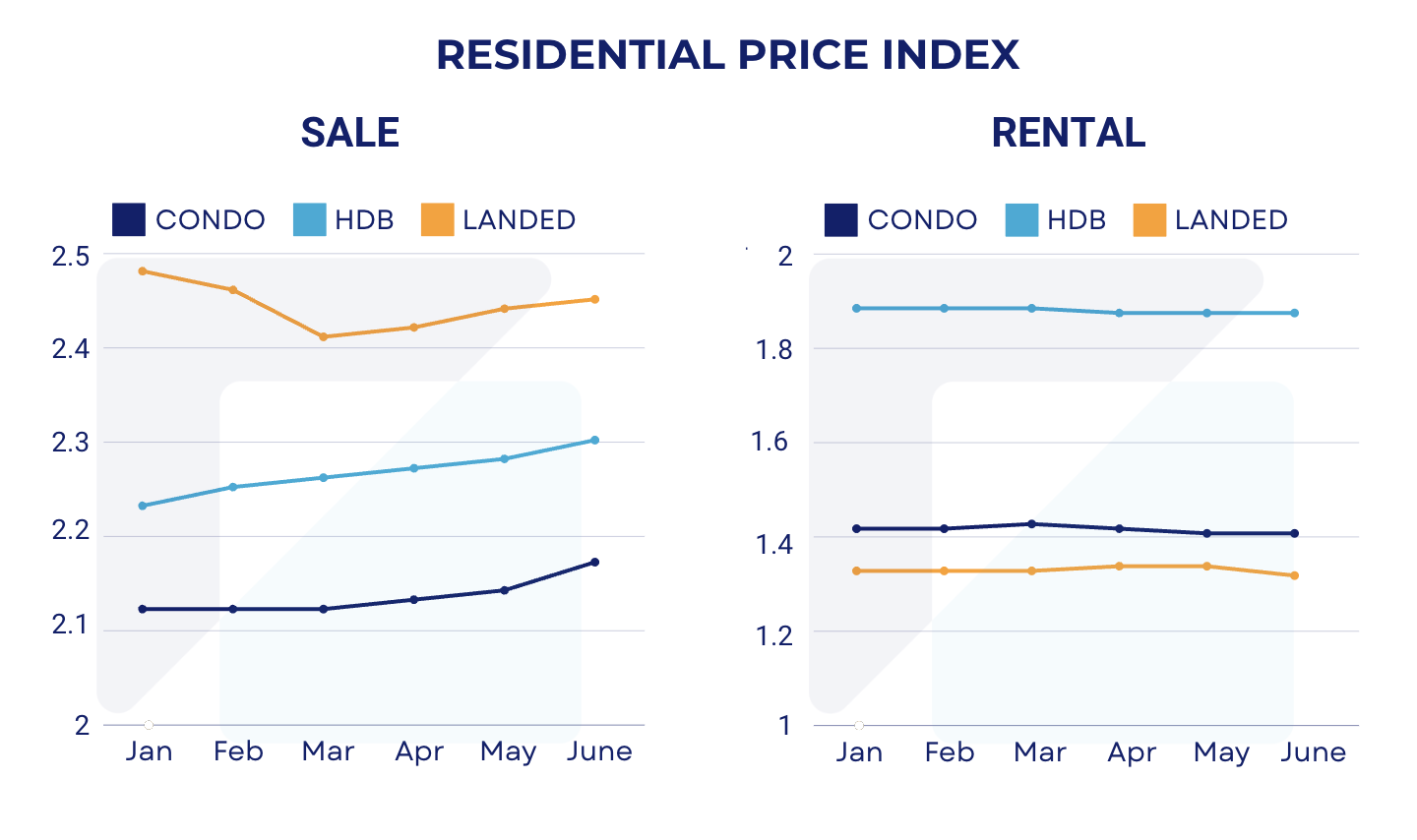

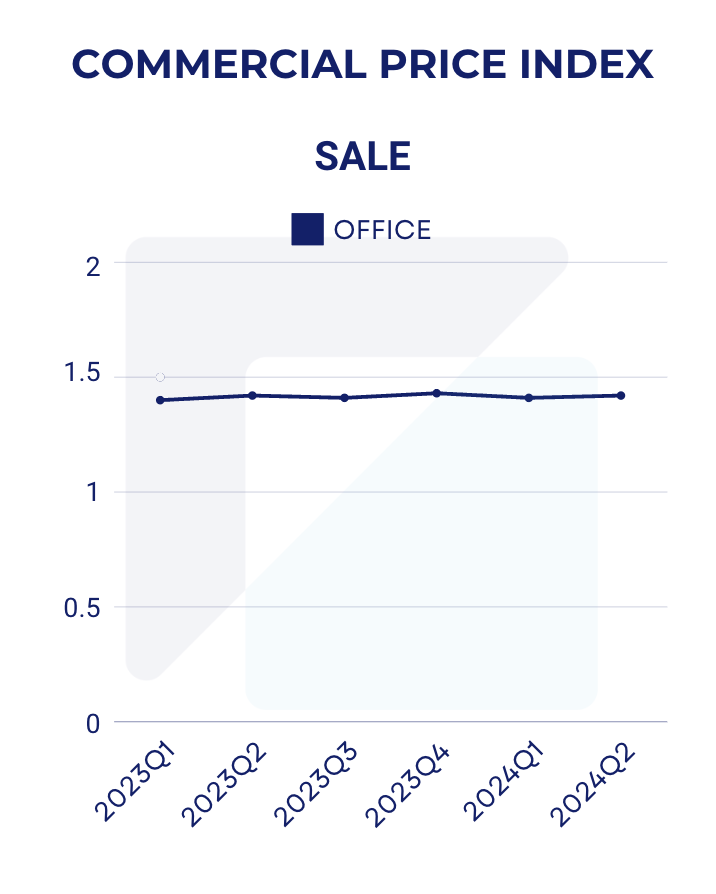

Price Indexes

*Index value is 1 at year 2008

Price Indexes shown are powered by REA Property Price Index - an accurate and objective indicator of the real estate market performance. Read more about our index here.

1. Residential Price Index

2. Commercial Price Index

Residential Snapshot

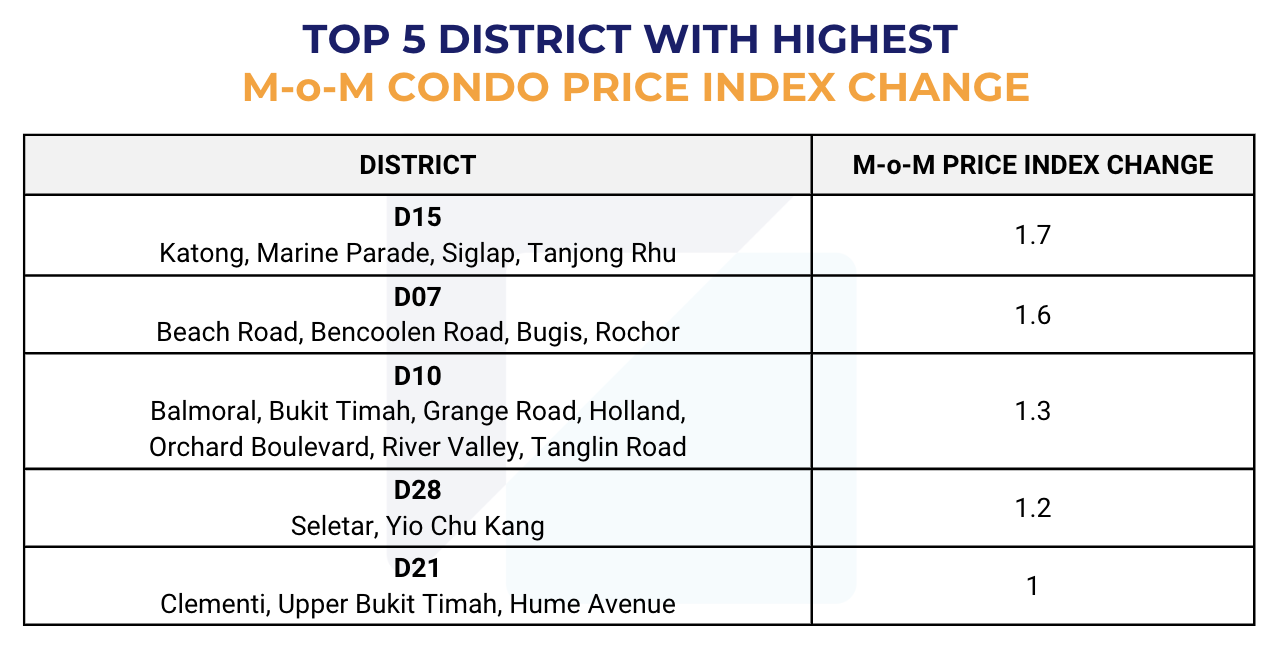

1. Top 5 Districts with highest Month on Month (M-o-M) Index Change

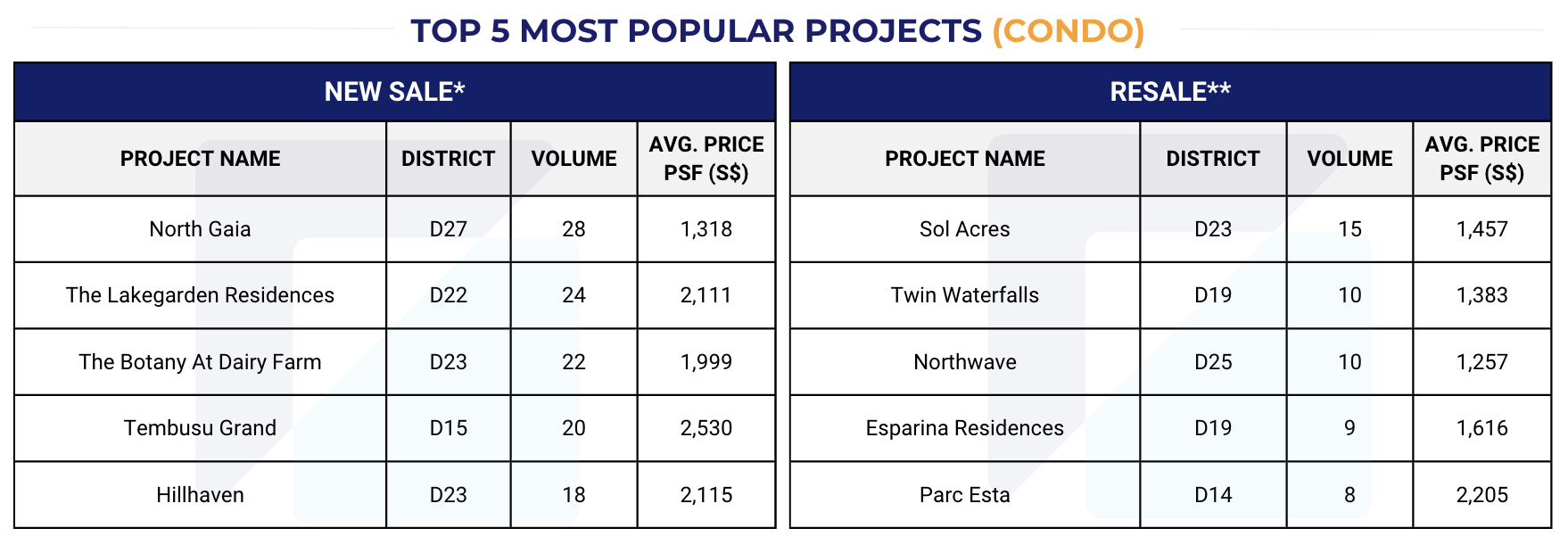

2. Top 5 most popular projects (Condo) in June 2024

*New Sale: The sale of a unit direct by a developer before the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

**Resale: The sale of a unit by a developer or subsequent purchaser after the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

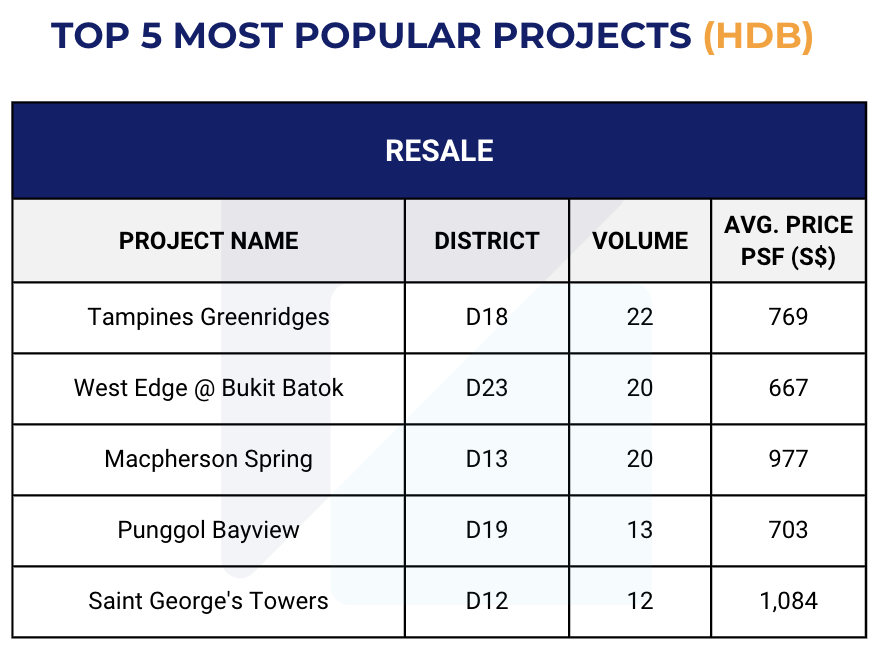

3. Top 5 most popular projects (HDB) in June 2024

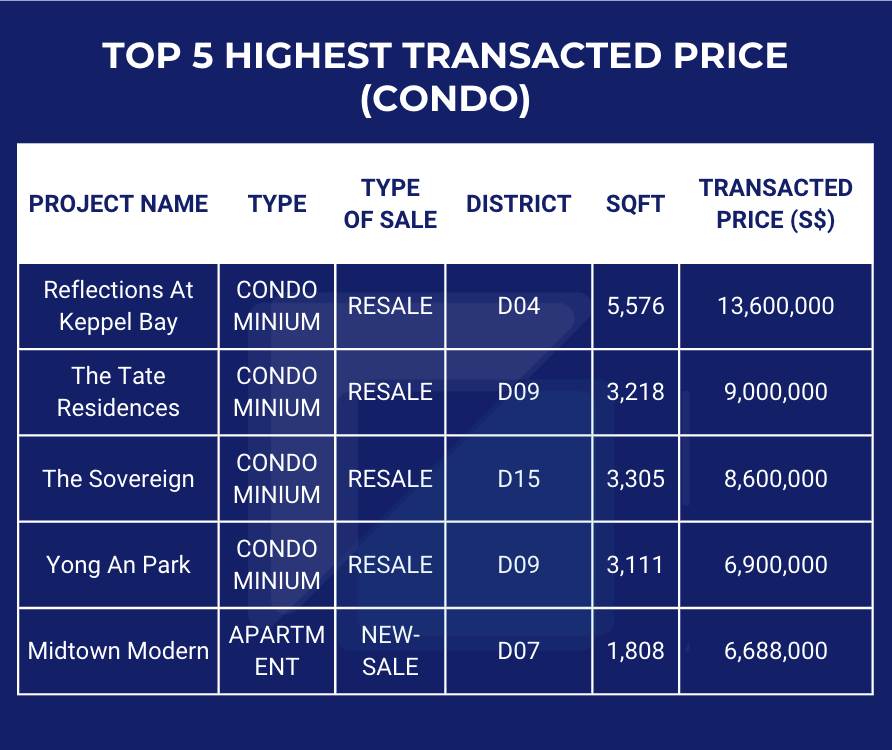

4. Top 5 highest transacted price (Condo) in June 2024

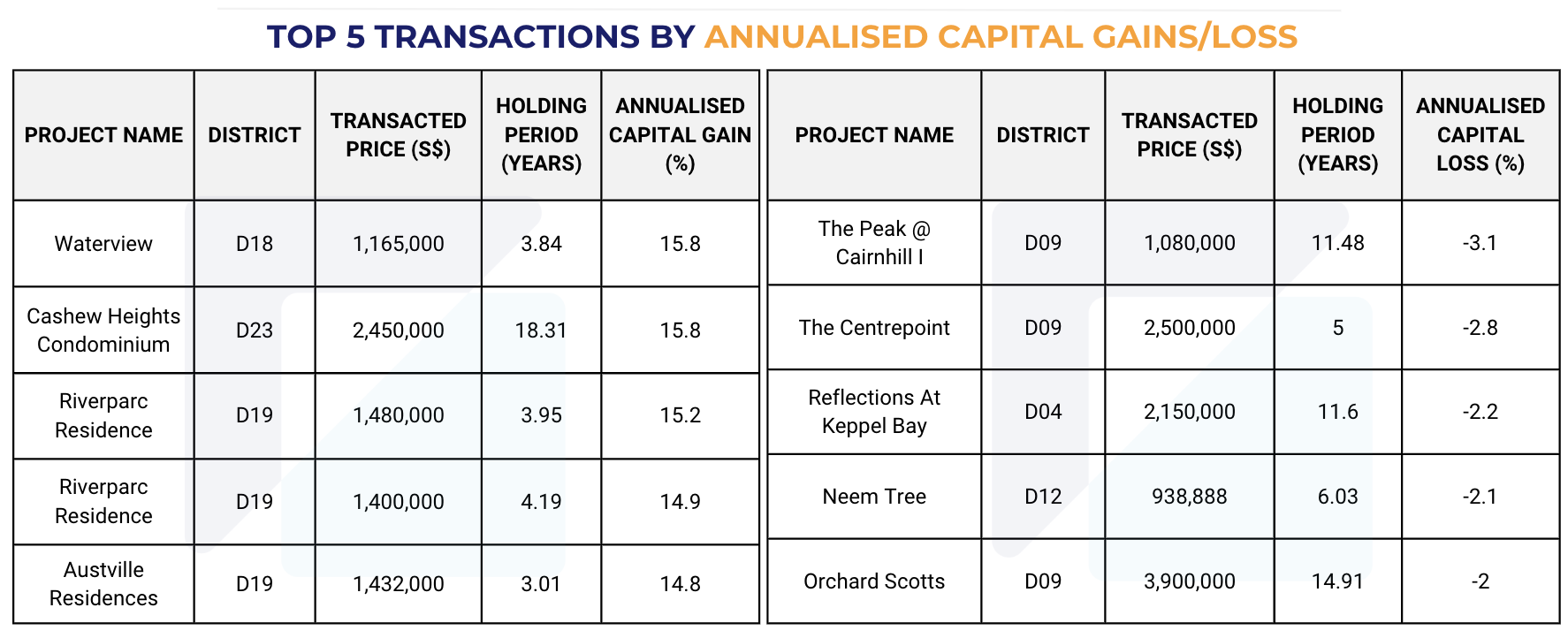

5. Top 5 Transactions by Annualised Capital Gain/Loss in June 2024

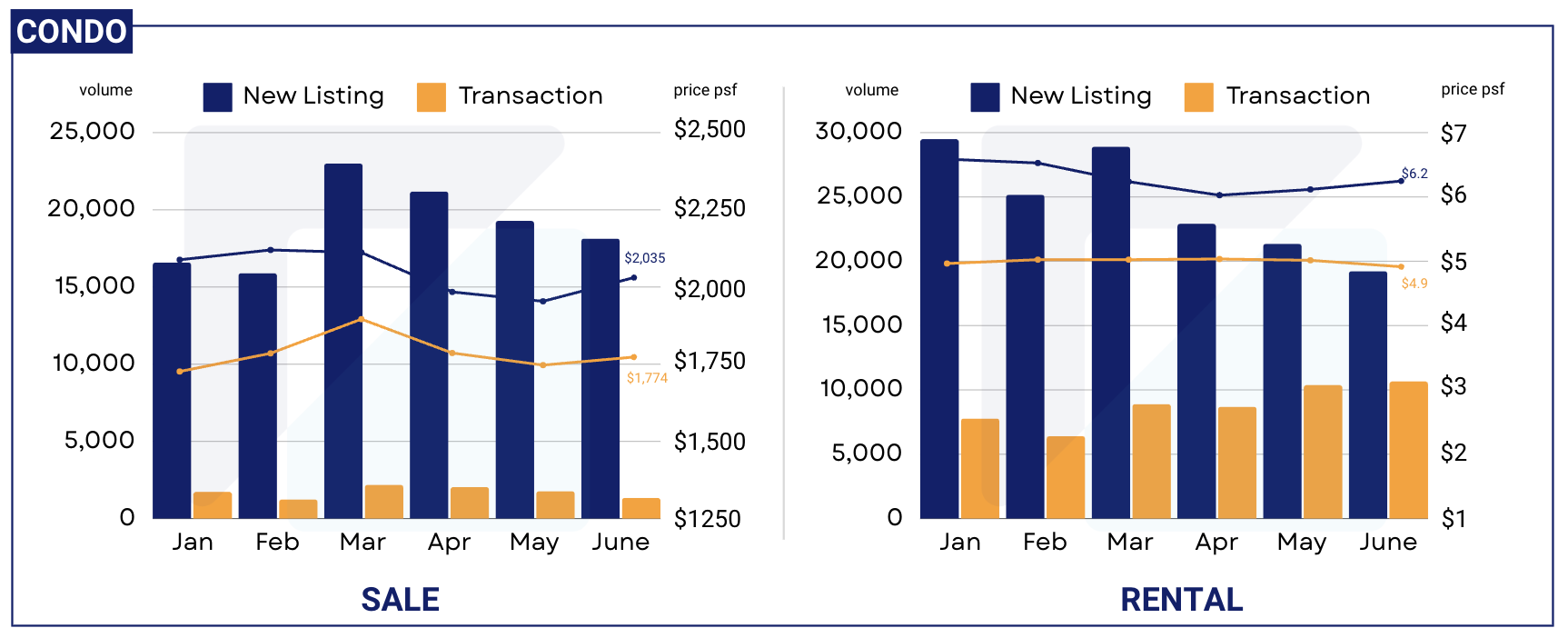

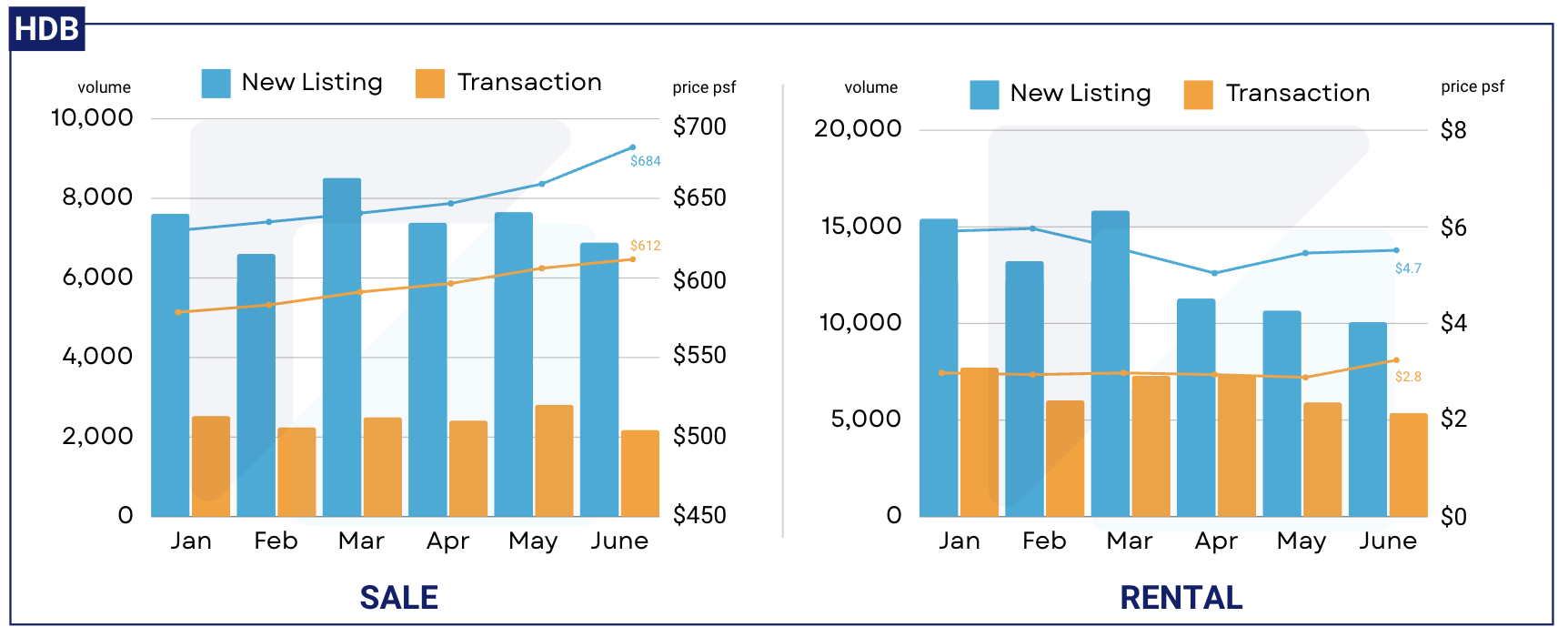

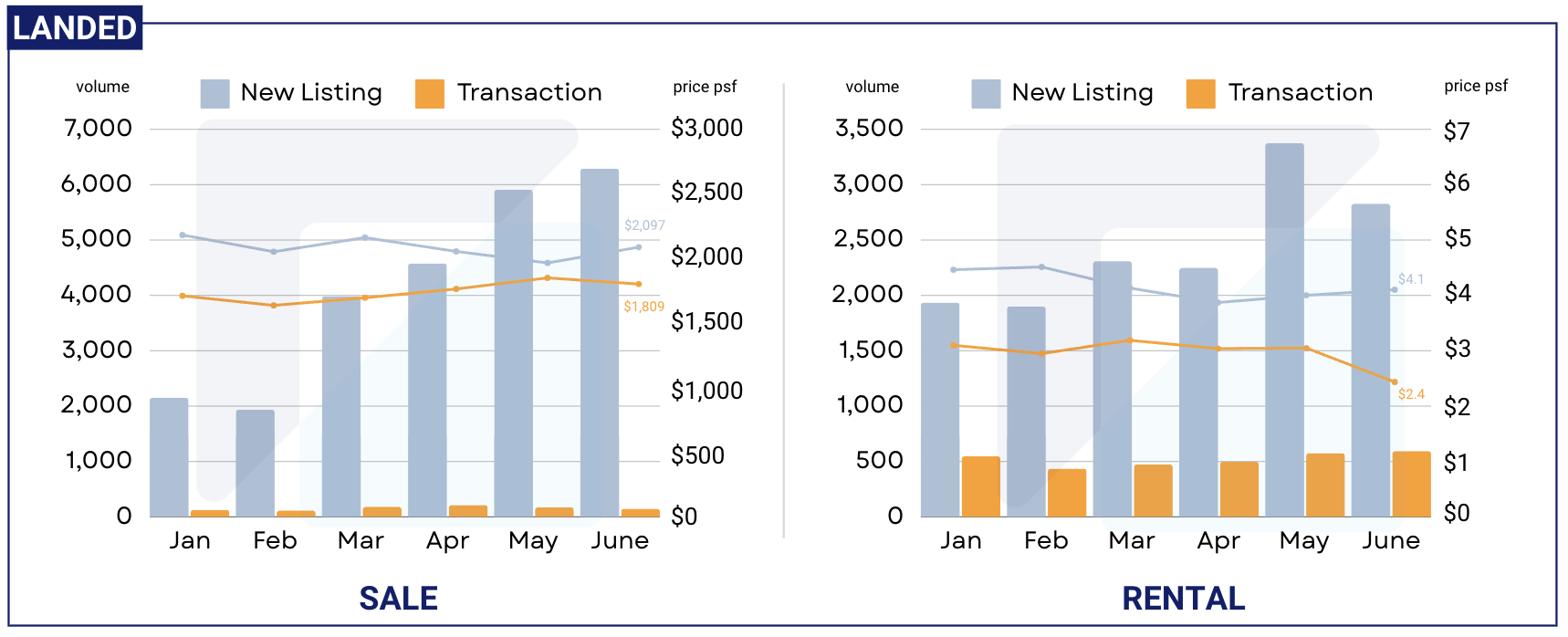

Residential Listings (Condo, HDB, Landed) January - June 2024

*New Listing: the total number of listings that are newly added in that particular time period

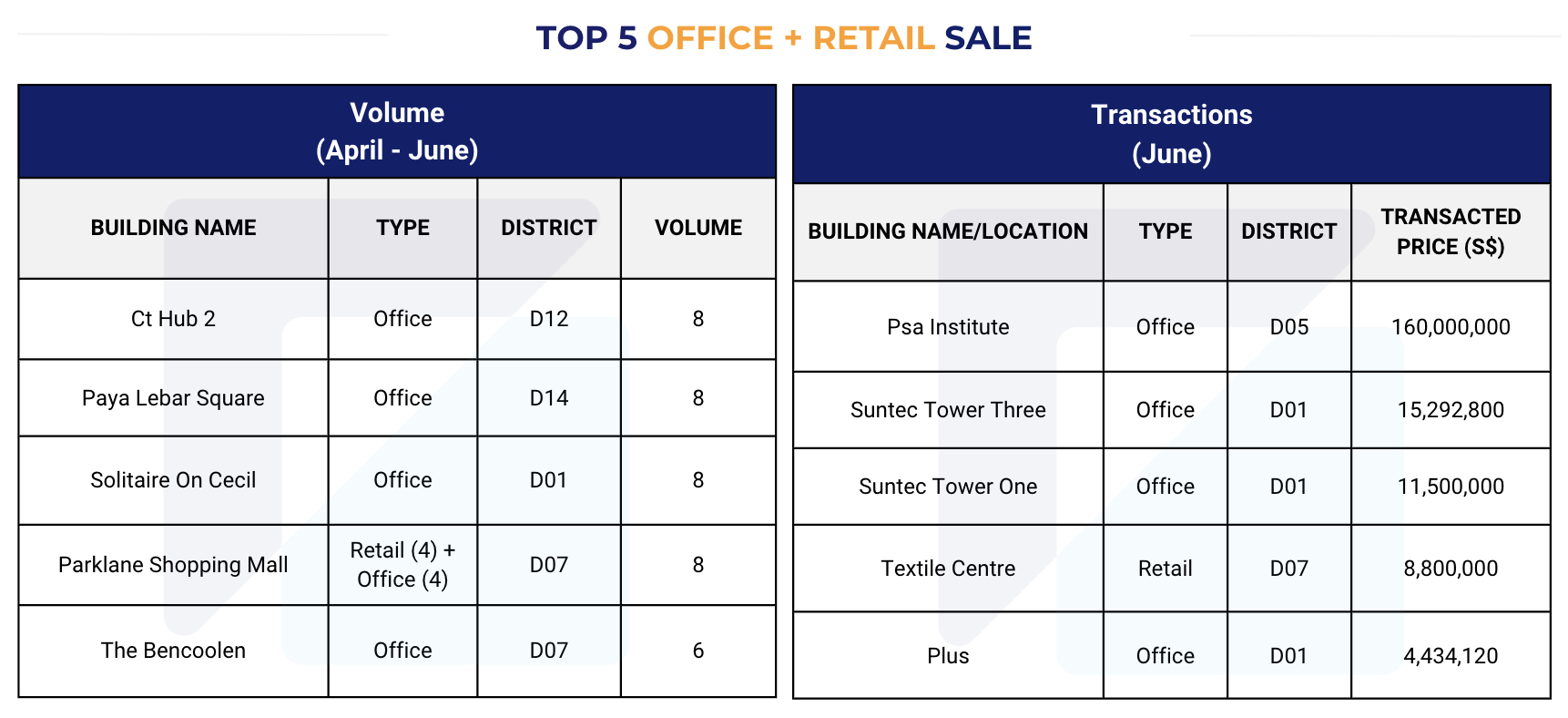

Commercial Snapshot

1. Top 5 Office and Retail Sale (by volume and transacted price) (April - June 2024)

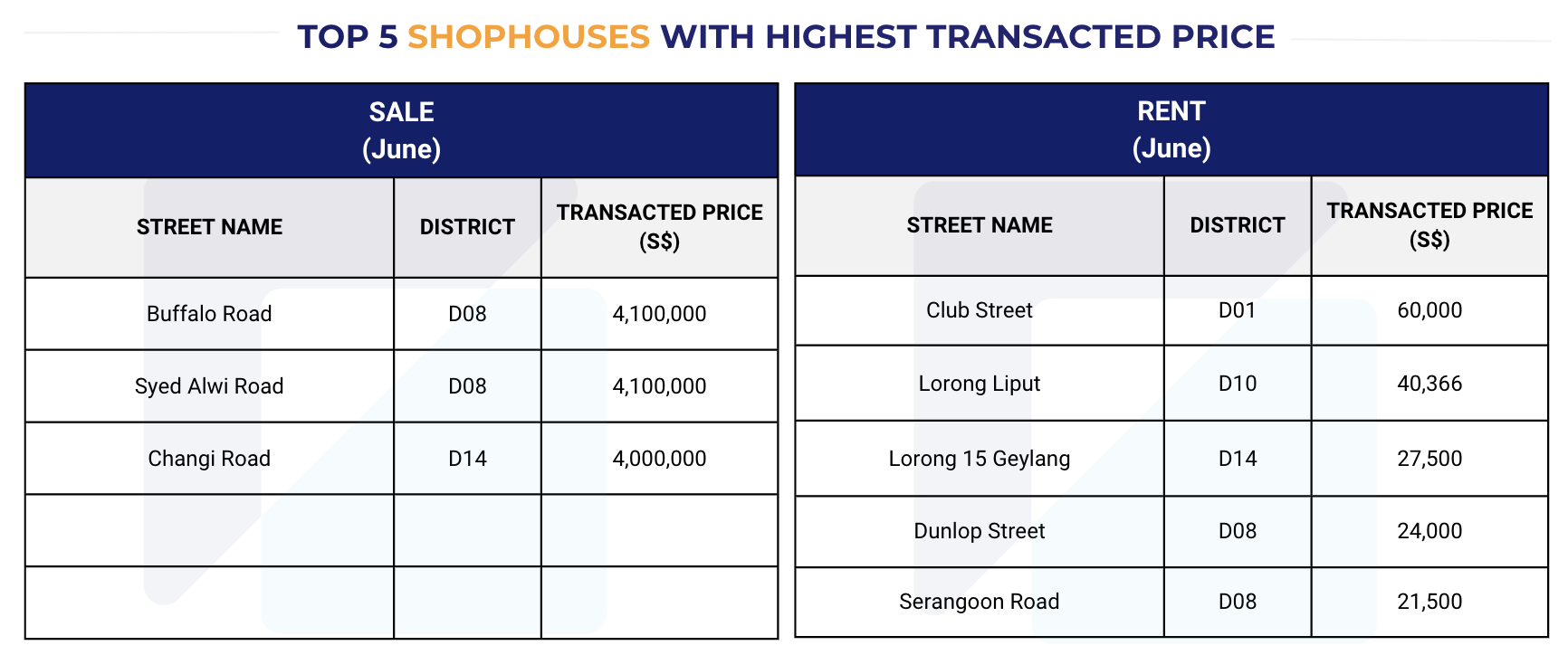

2. Top 5 Shophouses with Highest Transacted Price (Sale and Rent) in June 2024

*The data presented in this monthly report is accurate as of 18 July 2024. While we strive to provide the most up-to-date information available, it is important to note that there may be a small percentage of transactions that experience delays in reporting from the respective agencies and government sources. Therefore, the data provided should be interpreted with this in mind, and you are encouraged to verify the latest information for your specific needs.

*All analytical and visually interpreted data in this report is powered by RealAgent, a comprehensive app for real estate professionals. It offers a blend of property information, real-time transaction data, and advanced analytics, ensuring accurate and up-to-date insights for our report. Find out more about RealAgent here.

Download the full report (PDF) here: 062024 - Singapore Property Market Snapshot.pdf

To know more about our data-driven real estate solutions, contact us here.

Continue to read our previous monthly reports:

Singapore Property Market Snapshot - May 2024

Singapore Property Market Snapshot - April 2024

Singapore Property Market Snapshot - March 2024

Singapore Property Market Snapshot - February 2024

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics (REA), we revolutionise the real estate industry with cutting-edge AI technology. Leveraging advanced data science and machine learning, we offer tailored data solutions for real estate professionals and enthusiasts. Our products, including market insights, RealAgent suite (for agents), and RealInsight (for developers, investors, institutional clients), provide end-to-end solutions for informed decision-making. Available across Singapore, Malaysia, Hong Kong (China), and Australia, our offerings ensure you always stay ahead in the dynamic real estate market.

Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.