News > Can you make a profit from buying Million-dollar HBD Flats?

Can you make a profit from buying Million-dollar HBD Flats?

21 August 2024

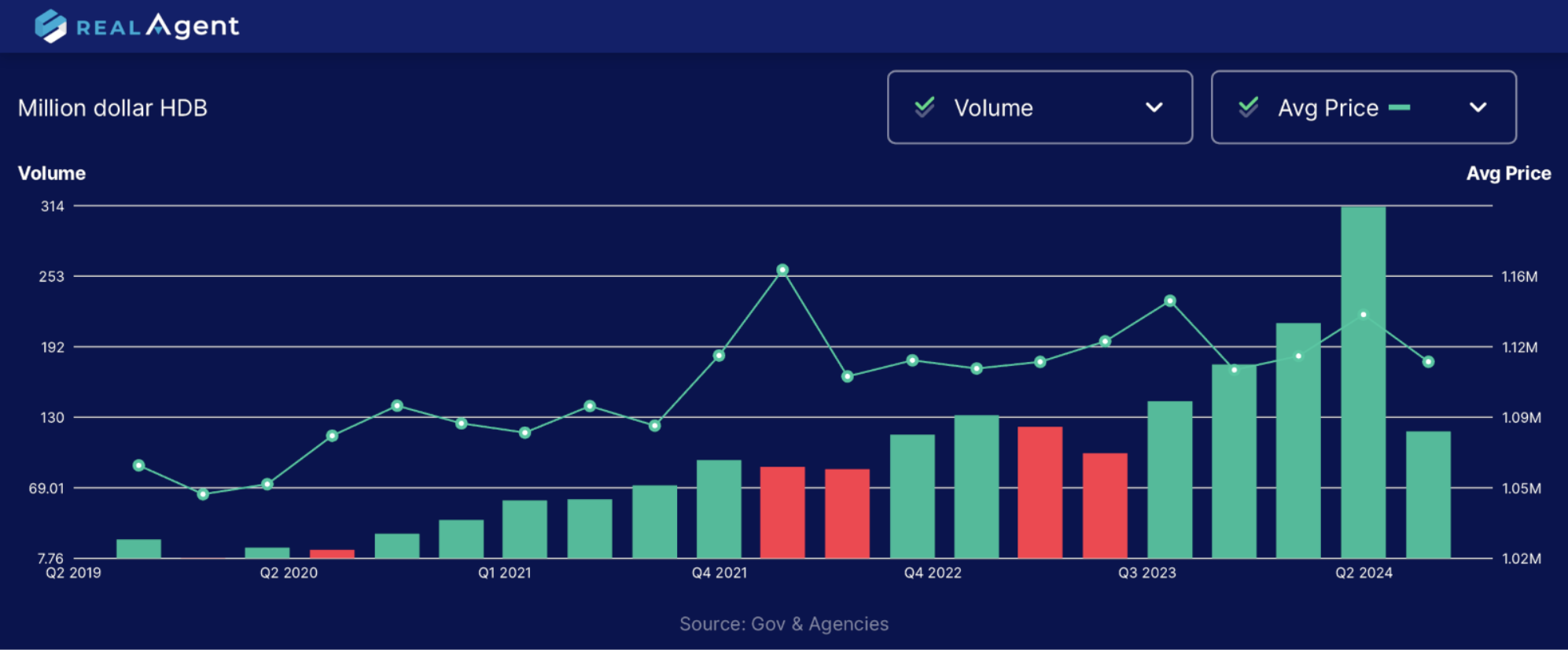

The Singaporean property market has seen a growing trend of million-dollar HDB flats, sparking interest among potential investors and homeowners alike. The number of million-dollar HDB transactions in 2024 (8 months) has already been 19% higher than that of the whole 2023.

Chart: Transaction Volume and Average Transacted Price of Million-dollar HDB Flats from 2019 - 2024. Source: RealAgent

With the recent record price of $1.73 million for a 5-room HDB flat at SkyOasis @ Dawson, this raises an essential question: Can you make a profit from buying million-dollar HDBs?

An examination of HDB resale transactions, with previous buying prices above $1 million and holding period of at least 5 years, has been conducted to shed light on this question.

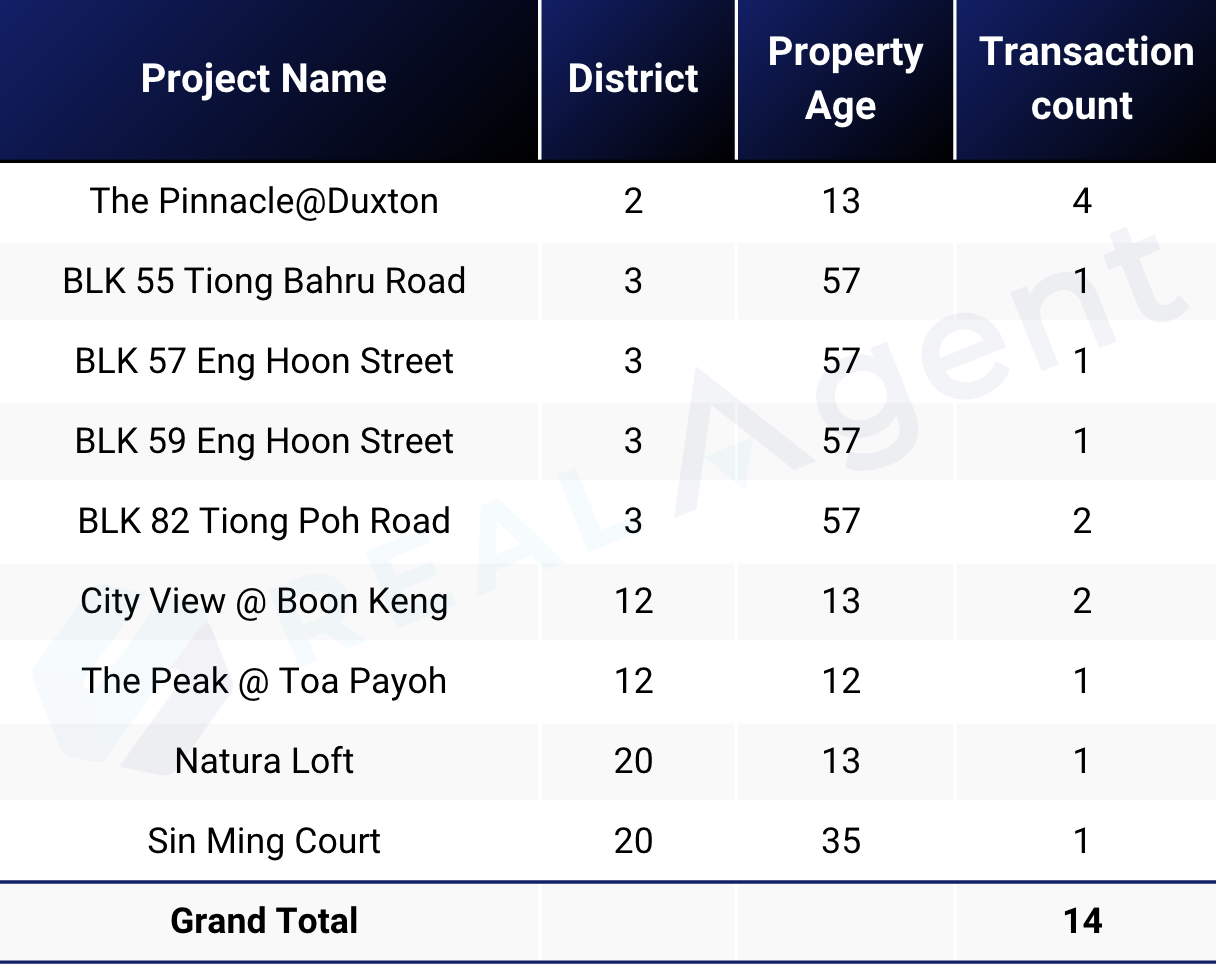

Number of Million-dollar HDB Resale Transactions

Using REA’s extensive transaction database, we have pulled out the list of resale transactions whose previous selling price is $1 million and above. In total, we have 12 such transactions, most of them happening within the central area, specifically in District 02, 03, 12 and 20 and in popular projects such as The Pinnacle@Duxton, City View @ Boon Keng, The Peak @ Toa Payoh, and Natura Loft.

Table 1: List of Projects with Million-dollar HDB Resale Transactions. Source: RealAgent

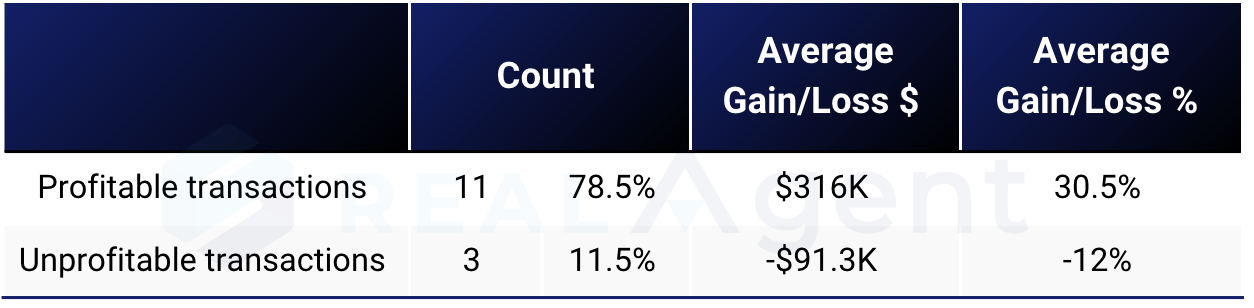

Out of the 14 transactions, 11 were profitable. This suggests that buying million-dollar HDB flats can indeed be a profitable investment, with an average gain of $316,000. However, not all transactions were profitable. There were 3 transactions that recorded a loss, averaging $91,300.

Table 2: Average Gain and Loss of Million-dollar HDB Resale Transactions. Source: RealAgent

On average, profitable transactions have a lower average buying price of $1.033 million, a shorter holding period of 5.8 years. These units also saw a significant increase in value upon resale. On the other hand, unprofitable transactions involve a higher average buying price of $1.201 million and a longer holding period of 7.8 years.

Table 3: Average Buying Price, Selling Price and Holding Period of Million-dollar HDB Resale Transactions. Source: RealAgent

Profitable Transactions

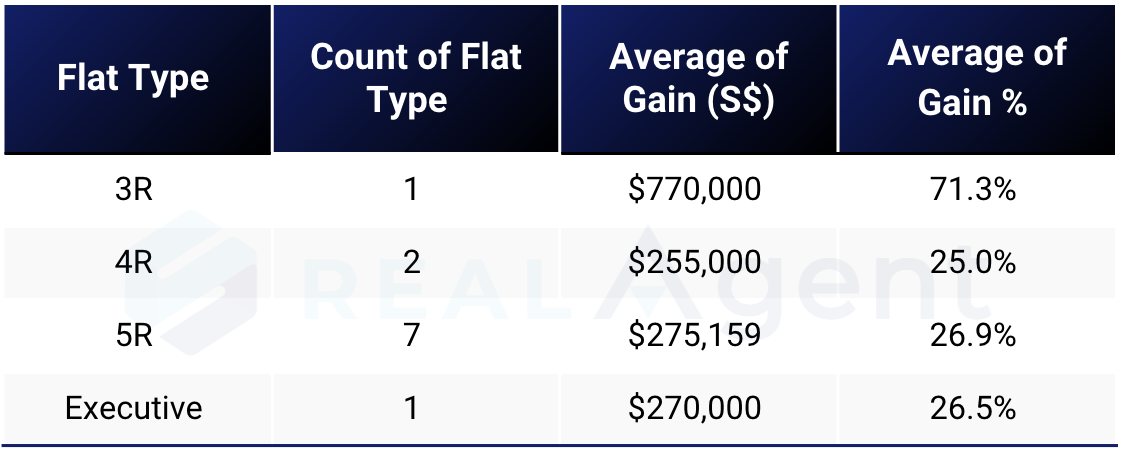

Most profitable transactions involved 5-room flats, which are popular among families for their larger living spaces.

Table 4: Average Gain by Flat Types of Profitable Million-dollar HDB Resale Transactions. Source: RealAgent

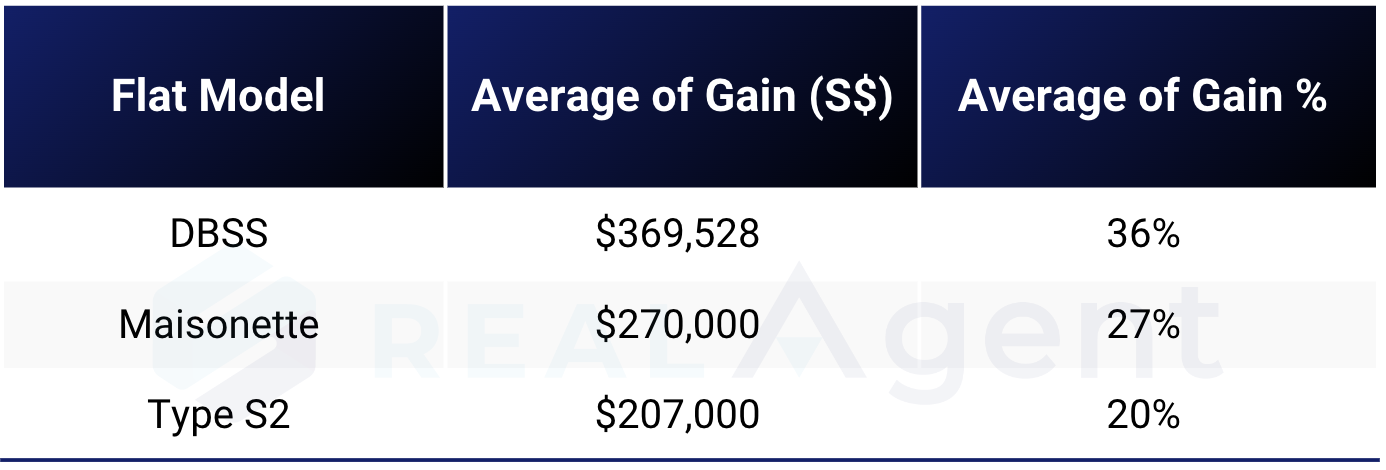

The analysis of flat models shows that DBSS (Design, Build and Sell Scheme) flats are particularly profitable (average gain of approximately $370,000), followed by Executive Maisonettes ($270,000 in gain). Type S2 flats, however, show slightly lower returns at $207,000.

Table 5: Average Gain by Flat Models of Profitable Million-dollar HDB Resale Transactions. Source: RealAgent

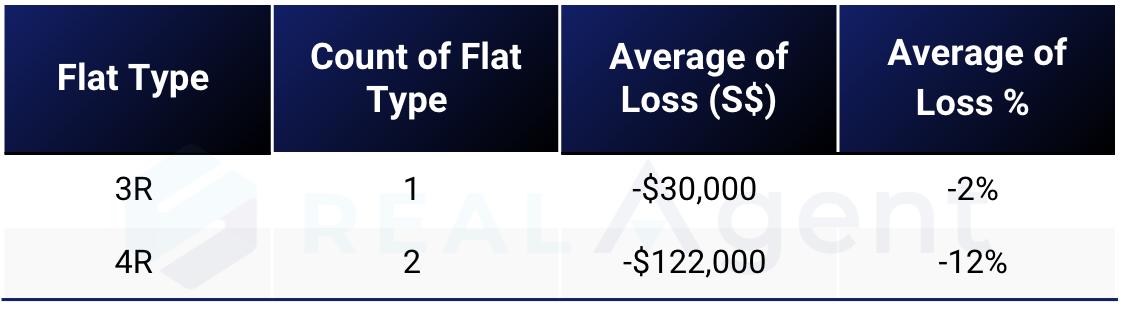

Unprofitable Transactions

While most million-dollar HDB transactions are profitable, some do incur losses. Notably, most unprofitable transactions involve 4-room flats in District 3, within the old estate that is 57 years old at the point of this article, with average loss of $122,000.

Table 6: Average Loss by Flat Types of Unprofitable Million-dollar HDB Resale Transactions. Source: RealAgent

District Analysis

The profitability of million-dollar HDB transactions varies significantly depending on the district in which the property is located. An analysis of the resale transactions highlights the following key trends across different districts:

District 20 (covering areas like Bishan and Ang Mo Kio) has the most profitable transactions, with an average gain of $385,000 (38%), particularly benefiting DBSS flats and maisonettes. District 12, which includes Toa Payoh, also shows strong returns with an average gain of $326,037 (32%), especially for DBSS units. Meanwhile, District 2 (central locations like Tanjong Pagar) offers moderate returns at $149,333 (20%) despite its centrality. District 3, covering areas like Tiong Bahru, presents a mixed picture: while it is profitable with an average gain of $125,200 (12%), it also has a higher risk of loss due to its older properties.

Table 7: Average Gain by District of Million-dollar HDB Resale Transactions. Source: RealAgent

Final Thoughts

The analysis of million-dollar HDB resale transactions provides a clear answer to the question “Can you make money from buying million-dollar HDB flats?”: Yes, you can make a profit from purchasing million-dollar HDB flats. In fact, most of the transactions are profitable, and the gain can go as high as $500K after a holding period of only 6 years. However, success is highly contingent on several factors, including the type of flat, its model, the district it’s located in, and the holding period.

Key Takeaways:

- Flat Type and Model matter : The most profitable transactions generally involved 5-room flats, particularly those under the DBSS scheme. Executive Maisonettes also showed strong returns, while other models like the Improved flat type were less profitable and sometimes incurred losses.

- Location is crucial : Districts 12 and 20 emerged as the most lucrative areas, with DBSS flats and Executive Maisonettes yielding the highest gains. On the other hand, even central locations like District 3, with prestigious heritage developments, did not always guarantee high returns.

*Data is accurate as of the published date of this article.

*Disclaimer: Our real-time database is updated every time a transaction is submitted by an agency. While we strive to maintain the accuracy and completeness of the data, please note that transactions may not always be completed, and information provided may be subject to change or error.

*All analytical and visually interpreted data in this report is powered by RealAgent, a comprehensive app for real estate professionals. It offers a blend of property information, real-time transaction data, and advanced analytics, ensuring accurate and up-to-date insights for our report. Find out more about RealAgent here.

To know more about our data-driven real estate solutions, contact us here.

Continue to read our other data insights articles:

An Executive Flat at Toh Yi Gardens HDB sold for $1.37M

Million-Dollar Resale Flats at Bidadari Alkaff Vista HDB: The First 2 Transactions Right After MOP

$2.83M in profit for a 4 bedder at Grange Heights Condo, setting new high

4 bedder at City Square Residences recorded 199% gain

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics (REA), we revolutionise the real estate industry with cutting-edge AI technology. Leveraging advanced data science and machine learning, we offer tailored data solutions for real estate professionals and enthusiasts. Our products, including market insights, RealAgent suite (for agents), and RealInsight (for developers, investors, institutional clients), provide end-to-end solutions for informed decision-making. Available across Singapore, Malaysia, Hong Kong (China), and Australia, our offerings ensure you always stay ahead in the dynamic real estate market.

Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.