News > Top 20 High-Growth RCR & OCR Condos in Singapore: Best Price Appreciation from 2014 to 2024

Top 20 High-Growth RCR & OCR Condos in Singapore: Best Price Appreciation from 2014 to 2024

22 May 2025

Over the past decade, amidst competition and major events such as Covid, Singapore’s condo market has seen significant shifts in the Rest of Central Region (RCR) and Outside Central Region (OCR). Between 2014 and 2024, several developments in these areas have delivered impressive capital gains, driven by strategic locations, competitive launch prices, and evolving urban landscapes.

Without further ado, let us look at the top performers for each region, along with why they scored top marks in their respective regions.

📈 Top RCR Condos with Exceptional Appreciation (2014–2024)

The RCR, encompassing areas just outside the city core, has been a hotspot for investors seeking growth potential. Notably, condos launched between 2015 and 2017 benefited from market troughs, leading to substantial appreciation in subsequent years.

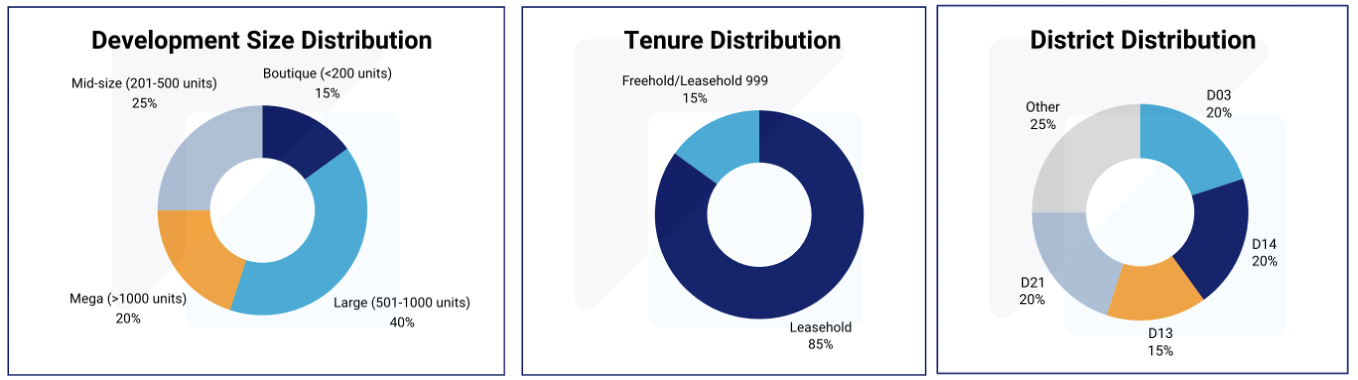

The following charts indicate the distribution of the properties by tenure, size of development and district for condos in the RCR.

Source: powered by Real Estate Analytics

The top-performing RCR districts for the past decade are:

- District 14 (Geylang, Eunos, Paya Lebar)

- District 3 (Queenstown, Alexandra, Redhill)

- District 21 (Clementi, Upper Bukit Timah)

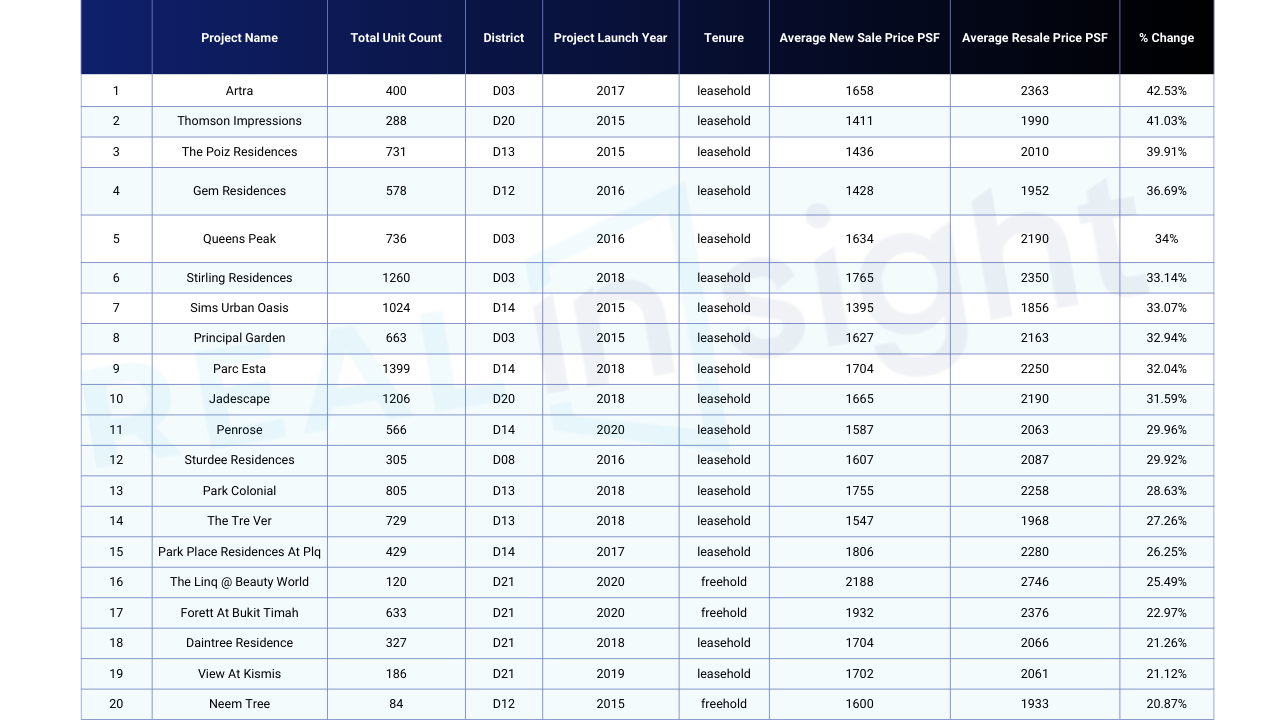

20 Best-Performing RCR Developments by Price Appreciation

Source: powered by Real Estate Analytics

Top Performers:

- Artra (District 3): Launched in 2017, this development saw a price increase from S$1,658 psf to S$2,363 psf, marking a 42.53% appreciation.

- Thomson Impressions (District 20): From its 2015 launch at S$1,411 psf, prices rose to S$1,990 psf, a 41.03% gain.

- The Poiz Residences (District 13): Achieved a 39.91% increase, with prices moving from S$1,436 psf to S$2,010 psf.

- Gem Residences (District 12): Experienced a 36.69% appreciation, from S$1,428 psf to S$1,952 psf.

- Queens Peak (District 3): Prices grew by 34%, from S$1,634 psf to S$2,190 psf.

These developments’ success can be attributed to their proximity to MRT stations, integration with commercial spaces, and alignment with urban redevelopment plans.

📈 Top OCR Condos with Exceptional Appreciation (2014–2024)

The OCR, representing Singapore’s suburban areas, has also showcased noteworthy growth, especially in large-scale developments.

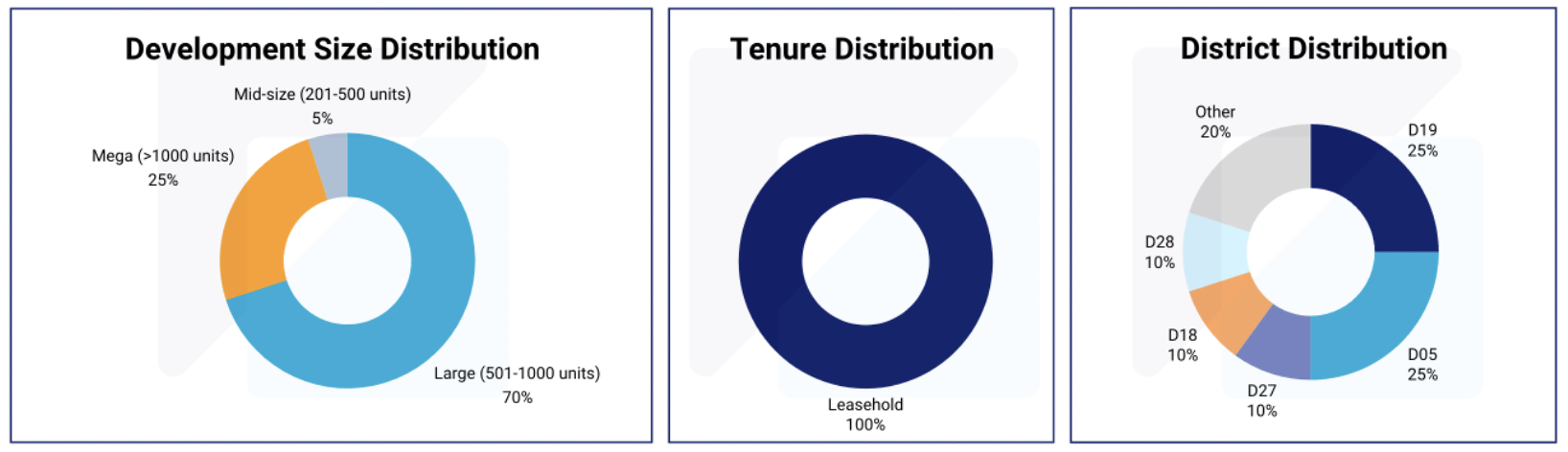

The following charts indicate the distribution of the properties by tenure, size of development and district for condos in the OCR.

Source: powered by Real Estate Analytics

The top-performing OCR districts for the past decade are:

- District 19 (Hougang, Punggol, Serangoon)

- District 05 (Buona Vista, Dover, Pasir Panjang, West Coast)

20 Best-Performing OCR Developments by Price Appreciation

Source: powered by Real Estate Analytics

Top Performers:

- High Park Residences (District 28): Launched in 2015, this development saw a price increase from S$990 psf to S$1,575 psf, marking a 59.13% appreciation.

- Botanique At Bartley (District 19): From its 2015 launch at S$1,287 psf, prices rose to S$1,891 psf, a 46.98% gain.

- Forest Woods (District 19): Achieved a 42.97% increase, with prices moving from S$1,409 psf to S$2,014 psf.

- The Clement Canopy (District 5): Experienced a 41.84% appreciation, from S$1,343 psf to S$1,904 psf.

- The Alps Residences (District 18): Prices grew by 39.55%, from S$1,084 psf to S$1,513 psf.

Bonus Standout Project:

- Treasure at Tampines (District 18): As one of the largest condo projects with 2,203 units, it recorded 197 profitable transactions in 2024, with gains ranging from S$25,000 to S$981,000.

Factors such as enhanced connectivity, proximity to amenities, and comprehensive facilities have made these OCR condos attractive to both investors and homeowners.

Key Takeaways for Investors and Homebuyers

- Timing Matters: Purchasing during market troughs, as seen with 2015–2017 launches, can lead to significant capital appreciation.

- Location and Connectivity: Developments near MRT stations and commercial hubs tend to perform better due to increased demand and convenience.

- Integrated Developments: Condos that offer a mix of residential and commercial spaces provide added value, attracting both investors and residents.

For a detailed list of the Top 35 RCR and OCR Developments with exceptional appreciation, read the full article on Livethere.

*Data is accurate as of the published date of this article.

*Disclaimer: Our real-time database is updated every time a transaction is submitted by an agency. While we strive to maintain the accuracy and completeness of the data, please note that transactions may not always be completed, and information provided may be subject to change or error.

All analytical and visually interpreted data in this report is powered by RealInsight, a powerful tool for property developers, investors and institutions. It offers a complete solution for development planning or portfolio building by providing access to real-time data regarding properties, developers, land sales and data analytics tool for market research and reports. Find out more about RealInsight here.

To know more about our data-driven real estate solutions, contact us here.

Continue to read our other data insights articles:

BTO vs Resale: Why the Price Gap Is Widening Across Mature & Non-Mature Estates

REA Estimates for 1st Quarter 2025: Singapore Residential Property Market

How Emerald of Katong Boosted Sales for New Launches in District 15

Profitable Condos in Singapore: What do they have in common?

About Us

Leading Asian Real Estate AI Provider

At Real Estate Analytics (REA), we revolutionise the real estate industry with cutting-edge AI technology. Leveraging advanced data science and machine learning, we offer tailored data solutions for real estate professionals and enthusiasts. Our products, including market insights, RealAgent suite (for agents), and RealInsight (for developers, investors, institutional clients), provide end-to-end solutions for informed decision-making. Available across Singapore, Malaysia, Hong Kong, and Australia, our offerings ensure you always stay ahead in the dynamic real estate market.

Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.