News > Profitable Condos in CCR: Insights into the Top Developments with Highest Price Appreciation in the Heart of Singapore

Profitable Condos in CCR: Insights into the Top Developments with Highest Price Appreciation in the Heart of Singapore

23 January 2025

The Core Central Region (CCR) of Singapore is synonymous with luxury, exclusivity, and prime investment opportunities. Despite the perception that CCR properties, with their higher entry costs, may not offer strong returns, certain developments defy the odds. This article highlights the top CCR developments with the highest price appreciation from 2014 to 2024 and their common traits.

Methodology

To identify the most profitable condos in the Core Central Region (CCR), we examined the average capital gain percentage of each development to determine their profitability. Our analysis focused on the top 50 developments with highest price appreciation by examining resale transaction data spanning January 2014 to November 2024.

The most Profitable Condos in CCR – What do they have in common?

Based on our data and analysis, the top 50 Condo Developments with highest capital gains have the following common characteristics:

- Location: 100% of the top projects are in District 09, 10 and 11.

- Tenure: 84% of the top projects are Freehold/999-year Leasehold, reinforcing their long-term appeal.

- Ideal Age: 52% of the top developments aged 16 to 30 years old.

- Development size: 92% of the top developments are boutique to mid-sized (1-500 units in total).

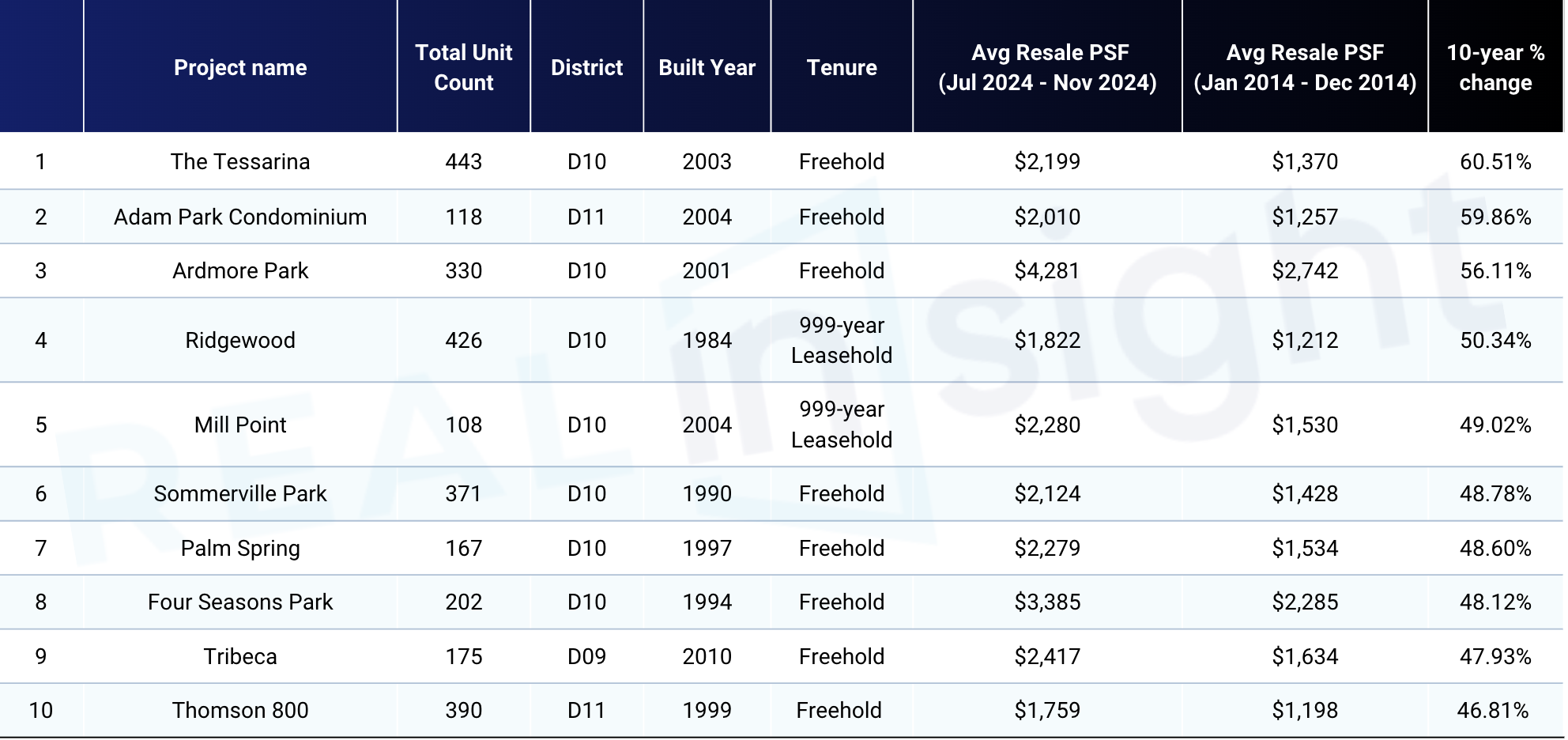

Top 10 CCR Condo Developments with the Highest Capital Gains

For a detailed list of the Top 50 CCR Developments with highest capital gain, visit: Livethere article

A Market on the Rise

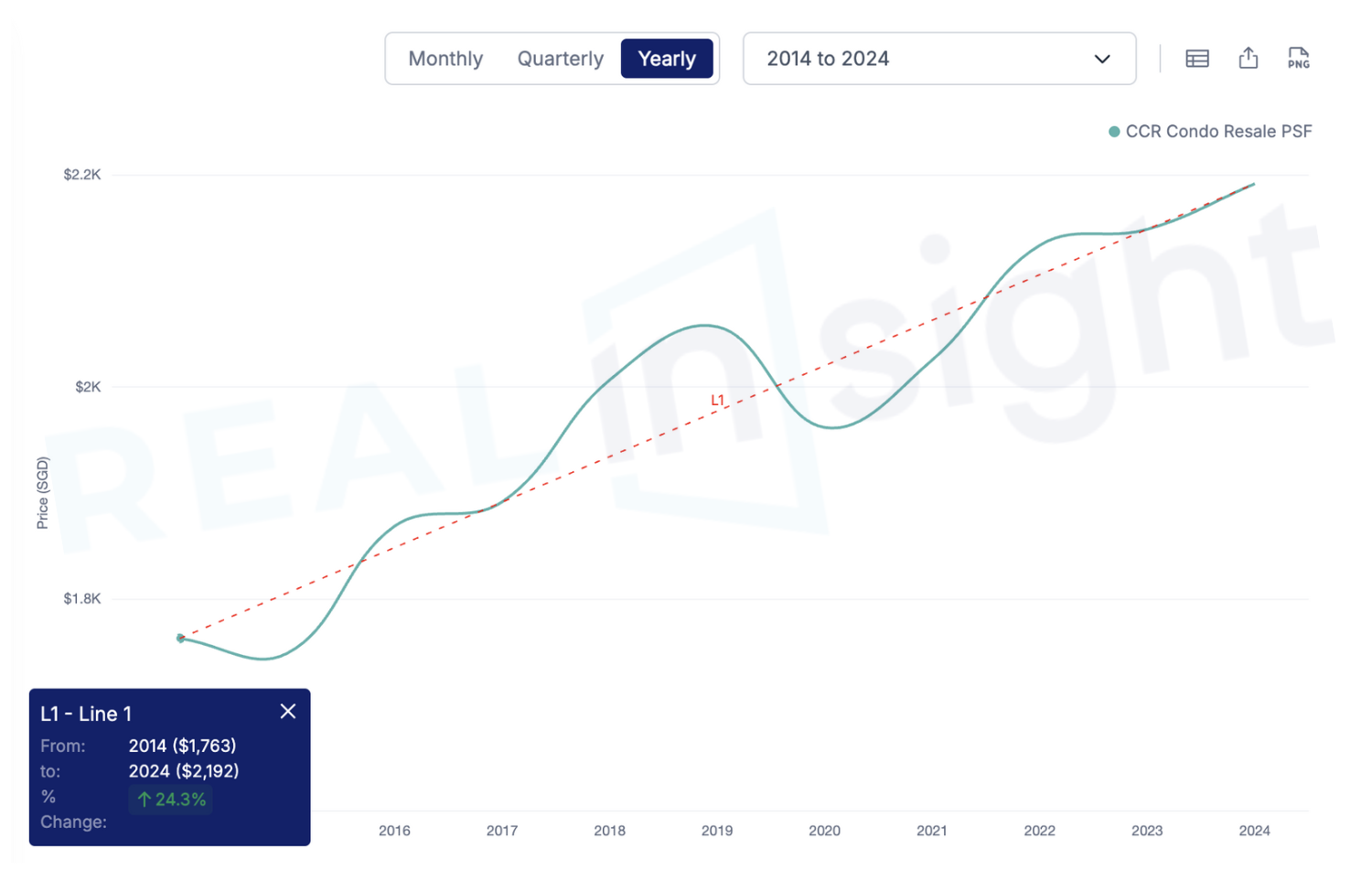

The Resale PSF for Condo in CCR reveals a consistent upward trend, reflecting resilient demand and appreciation in value. Over the past 10 years, the average transacted price for resale Condo in the CCR has increased by 24.3%, reinforcing the strength of this premium market segment.

Chart: REA’s CCR Condo Resale PSF between 2014- 2024. Source: RealInsight

This upward trend highlights the prime opportunity for sellers to capitalise on rising prices. For homeowners, this is an opportune moment to capitalize on these gains, as demand for CCR properties continues to surge.

*Data is accurate as of the published date of this article.

*Disclaimer: Our real-time database is updated every time a transaction is submitted by an agency. While we strive to maintain the accuracy and completeness of the data, please note that transactions may not always be completed, and information provided may be subject to change or error.

All analytical and visually interpreted data in this report is powered by RealInsight, a powerful tool for property developers, investors and institutions. It offers a complete solution for development planning or portfolio building by providing access to real-time data regarding properties, developers, land sales and data analytics tool for market research and reports. Find out more about RealInsight here.

To know more about our data-driven real estate solutions, contact us here.

Continue to read our other data insights articles:

New Launches in November 2024: Current Price and Sales Status

How Emerald of Katong Boosted Sales for New Launches in District 15

Profitable Condos in Singapore: What do they have in common?

Unprofitable Condos in Singapore: What do they have in common?

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics (REA), we revolutionise the real estate industry with cutting-edge AI technology. Leveraging advanced data science and machine learning, we offer tailored data solutions for real estate professionals and enthusiasts. Our products, including market insights, RealAgent suite (for agents), and RealInsight (for developers, investors, institutional clients), provide end-to-end solutions for informed decision-making. Available across Singapore, Malaysia, Hong Kong, and Australia, our offerings ensure you always stay ahead in the dynamic real estate market.

Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.