News > BTO vs Resale: Why the Price Gap Is Widening Across Mature & Non-Mature Estates

BTO vs Resale: Why the Price Gap Is Widening Across Mature & Non-Mature Estates

3 April 2025

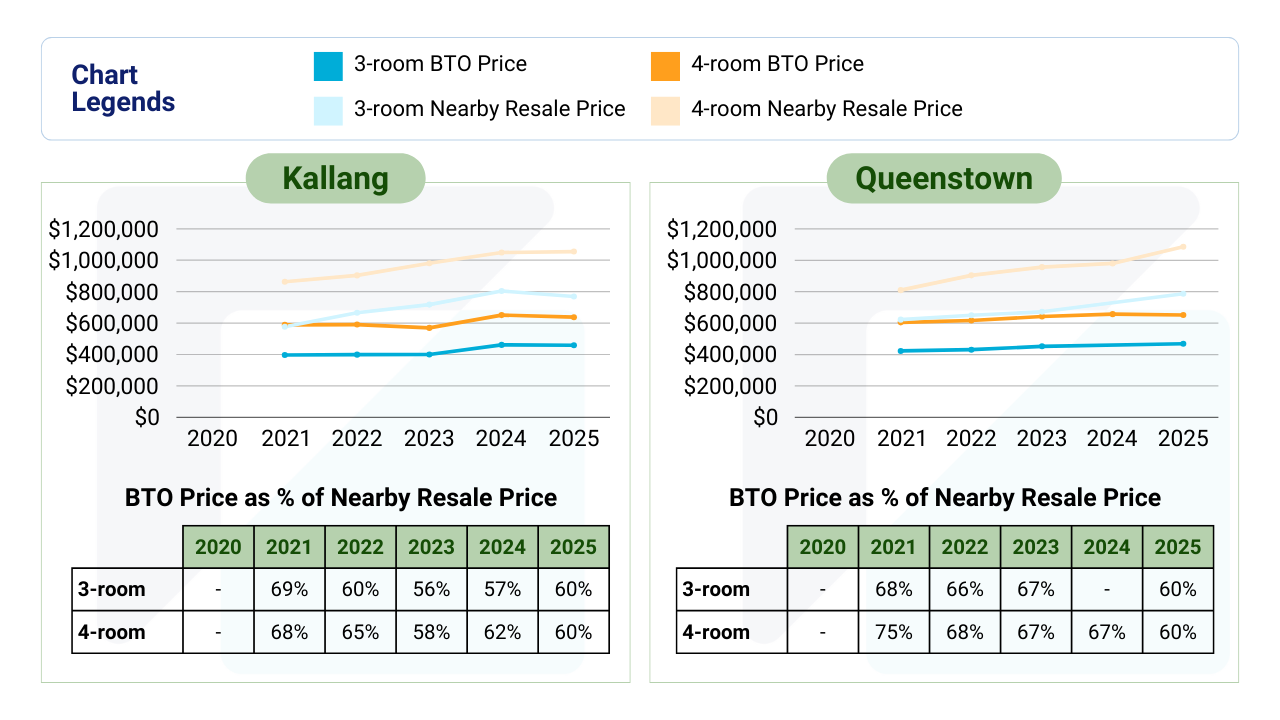

BTO (Build-To-Order) and resale prices have been rising across all estates in recent years, with resale prices growing at a faster pace, leading to a widened price gap. In mature estates, BTO prices grew by 2-3% annually, while resale prices increased at a higher rate of 5-6% annually, further widening the gap as demand for centrally located flats remains strong.

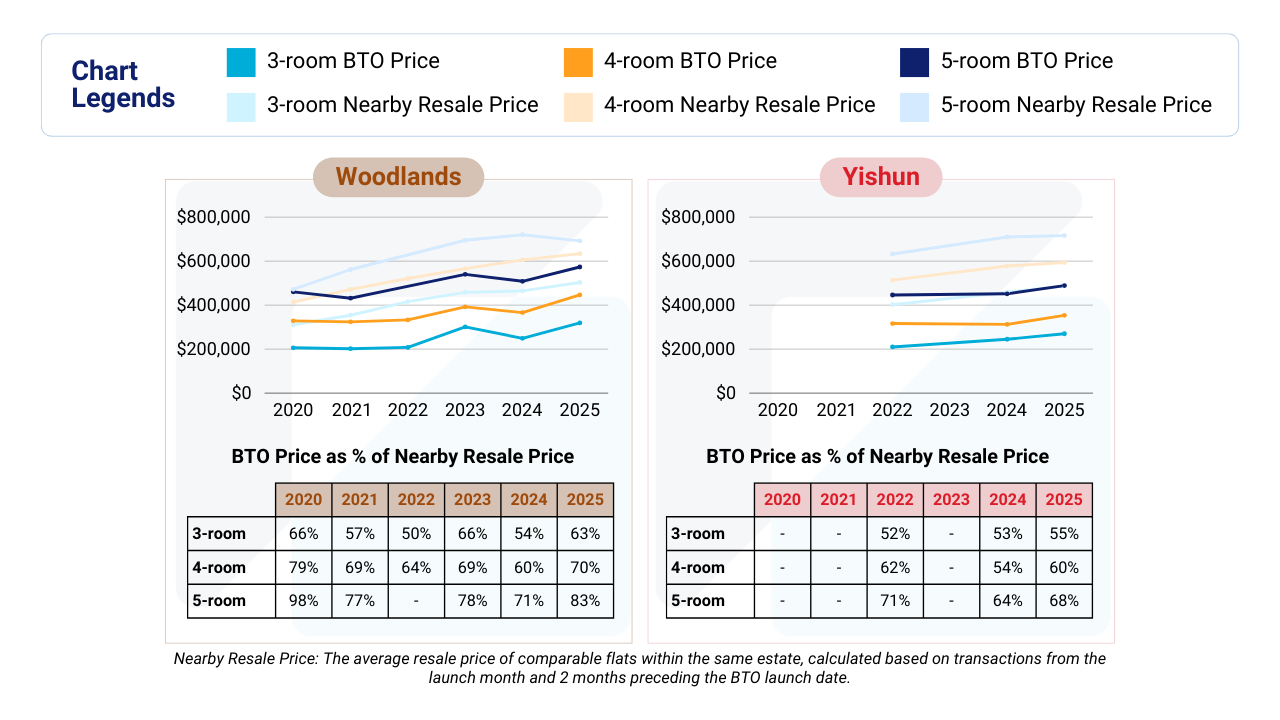

In non-mature estates, the price gap also widened over the years. Prices saw stronger growth than mature estates, with BTO price increasing at 8-9% annually, while resale prices increased by 6-10% annually.

Non-Mature Estates: Narrowing BTO vs Resale Price Gaps

Source: powered by Real Estate Analytics

In non-mature estates like Woodlands and Yishun, BTO prices have remained more affordable compared to nearby resale flats. However, the price gap has been narrowing over the years, with BTO prices increasing at a steady rate. Woodlands, for example, shows an upward trend, with 5-room BTO flats reaching 83% of nearby resale prices in 2025, indicating stronger demand.

Mature Estates: Broader Price Gaps Driven by Strong Resale Demand

Source: powered by Real Estate Analytics

In mature estates like Queenstown and Kallang, the price difference between BTO and resale flats remains significant, but BTO prices are catching up. Queenstown’s BTO prices have stayed around 60-68% of resale prices, while Kallang’s figures fluctuate between 56-67%. This suggests that despite high resale values, new launches are still priced competitively, making them an attractive option for buyers who can wait.

One key observation is that price gaps tend to be smaller in non-mature estates over time, as resale prices there grow at a slower rate. In contrast, mature estates retain a wider price gap due to their higher resale demand. This means that buyers looking for affordability may still find value in non-mature areas, while those investing in mature estates could see stronger long-term appreciation.

Source: Canva

As the property market continues to evolve, understanding the dynamics between BTO and resale prices in both mature and non-mature estates will be crucial for prospective buyers and investors looking to make informed decisions.

*The data presented in this monthly report is accurate as of 18 March 2025. While we strive to provide the most up-to-date information available, it is important to note that there may be a small percentage of transactions that experience delays in reporting from the respective agencies and government sources. Therefore, the data provided should be interpreted with this in mind, and you are encouraged to verify the latest information for your specific needs.

To know more about our data-driven real estate solutions, contact us here.

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics (REA), we revolutionise the real estate industry with cutting-edge AI technology. Leveraging advanced data science and machine learning, we offer tailored data solutions for real estate professionals and enthusiasts. Our products, including market insights, RealAgent suite (for agents), and RealInsight (for developers, investors, institutional clients), provide end-to-end solutions for informed decision-making. Available across Singapore, Malaysia, Hong Kong (China), and Australia, our offerings ensure you always stay ahead in the dynamic real estate market.

Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.