News > Singapore Property Market Snapshot - August 2025

Singapore Property Market Snapshot - August 2025

19 September 2025

Explore how the Singapore Property Market performed in August 2025 below:

Hot Topics in Singapore Property Market August 2025

1. Which Resale Two-Bedroom Condos Quietly Made Buyers Six-Figure Profits In Singapore?

Due to rising prices, a greater number of buyers are turning toward two-bedders. High earners include houses in Martin Modern (33.5% ROI), Leedon Green (31.7% ROI), The Panorama (48.33% ROI), Botanique at Bartley (47.28% ROI) & The Bayshore (45.10% ROI). Read more >>

2. Whole Floor At VisionCrest Orchard Sold For $58 Mil As Strata Office Sales Heat Up

The deal was brokered by Alex Chuah, associate director of Huttons Asia, who says the buyer is a local company with global operations. Since VisionCrest Orchard was launched for strata sales in July 2024, five of the 10 strata office floors have been sold. Read more >>

3. 6 Upcoming New Condo Launches To Keep On Your Radar For 2025

Developers have started to design projects with the emphasis now on an affordable quantum, placing more emphasis on overall unit affordability. Some upcoming launches to keep your eye on in the next half of 2025 are Skye At Holland, The SEN, Zyon Grand, Faber Residence, Penrith & Newport Residences. Read more >>

4. ‘White Flats’ To Be Offered At First Mount Pleasant BTO Project In October

The future Mount Pleasant housing estate will now offer about 6,000 new flats across four projects, up from the previously announced 5,000, after “further detailed planning studies”, says the Housing and Development Board. It will be the second BTO project to offer such an open-concept layout, after Crawford Heights. Read more >>

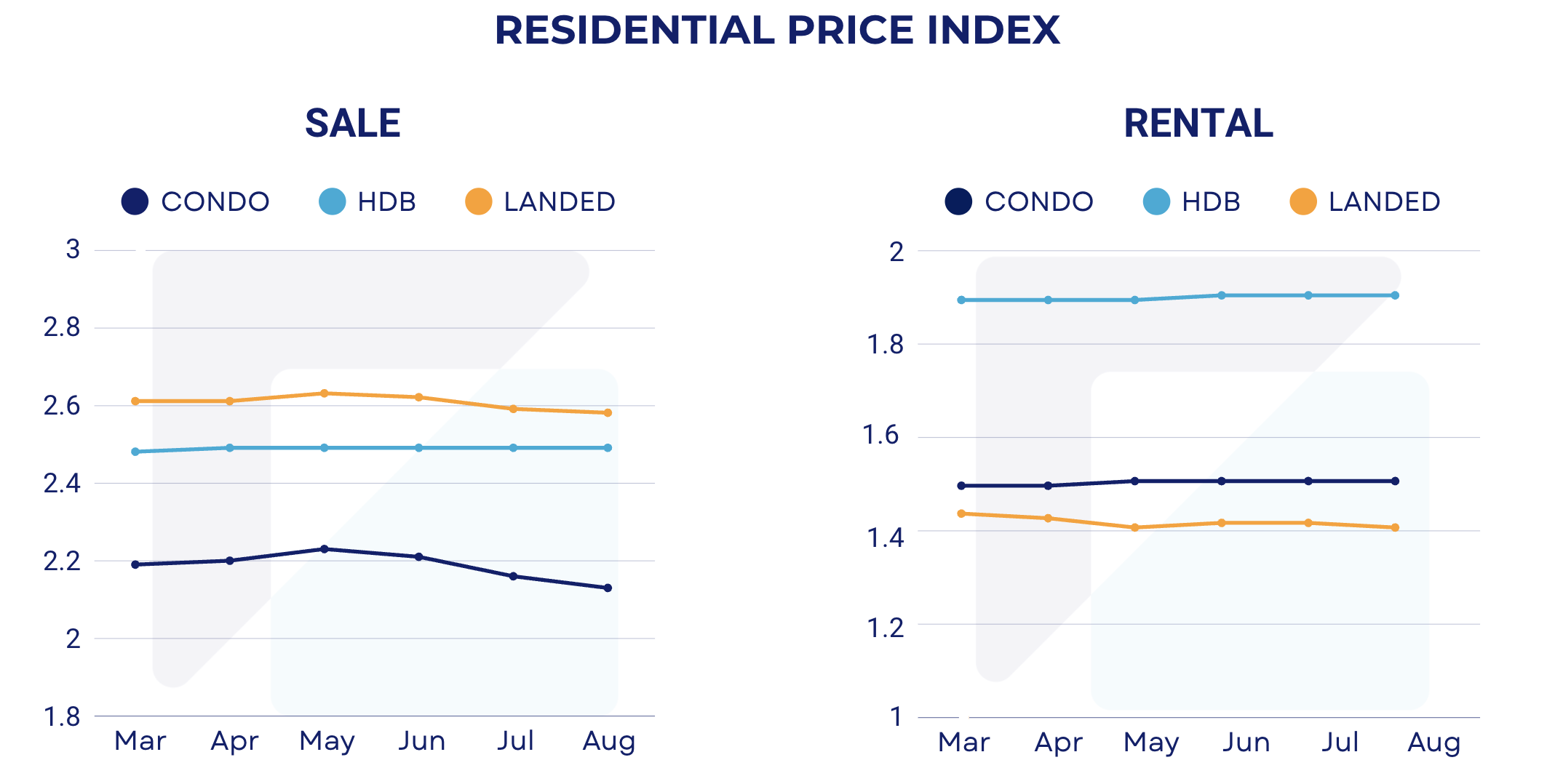

Price Indexes

*Index value is 1 at year 2008

Price Indexes shown are powered by REA Property Price Index - an accurate and objective indicator of the real estate market performance. Read more about our index here.

1. Residential Property Price Index (Condo, HDB, Landed)

2. Commercial Price Index (Office)

Residential Property Snapshot

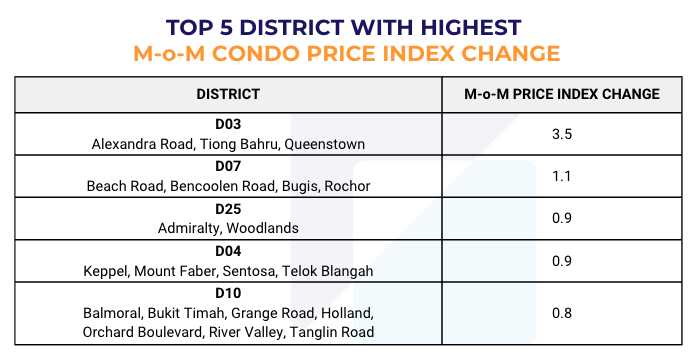

1. Top 5 Districts with Highest Month on Month (M-o-M) Index Change

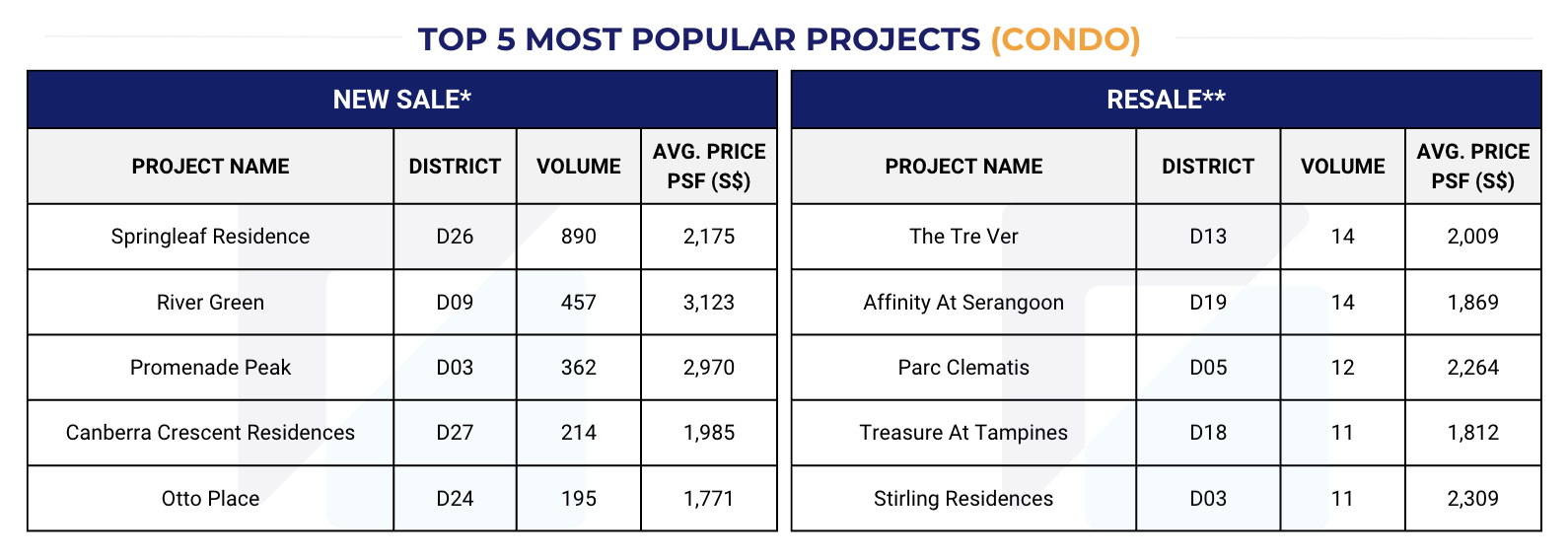

2. Top 5 Most Popular Condo Projects in August 2025

For Condo new sales, the most popular projects with highest transaction volumes in August are: Springleaf Residence, River Green, Promenade Peak, Canberra Crescent Residences & Otto Place.

For Condo resale, the most popular projects are: The Tre Ver, Affinity At Serangoon, Parc Clematis, Treasure At Tampines & Stirling Residences.

*New Sale: The sale of a unit direct by a developer before the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

*Resale: The sale of a unit by a developer or subsequent purchaser after the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

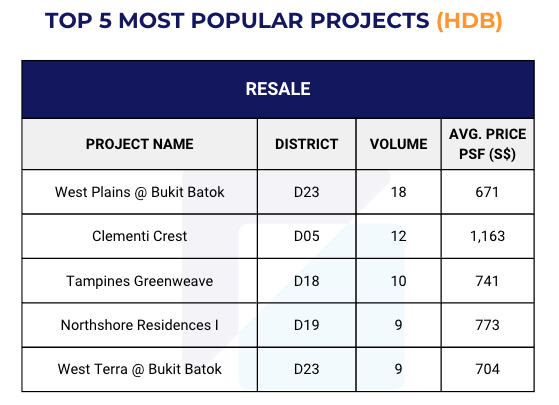

3. Top 5 Most Popular Projects (HDB) in August 2025

The most popular HDB projects with highest transaction volume in August are: West Plains @ Bukit Batok, Clementi Crest, Tampines Greenweave, Northshore Residences I & West Terra @ Bukit Batok.

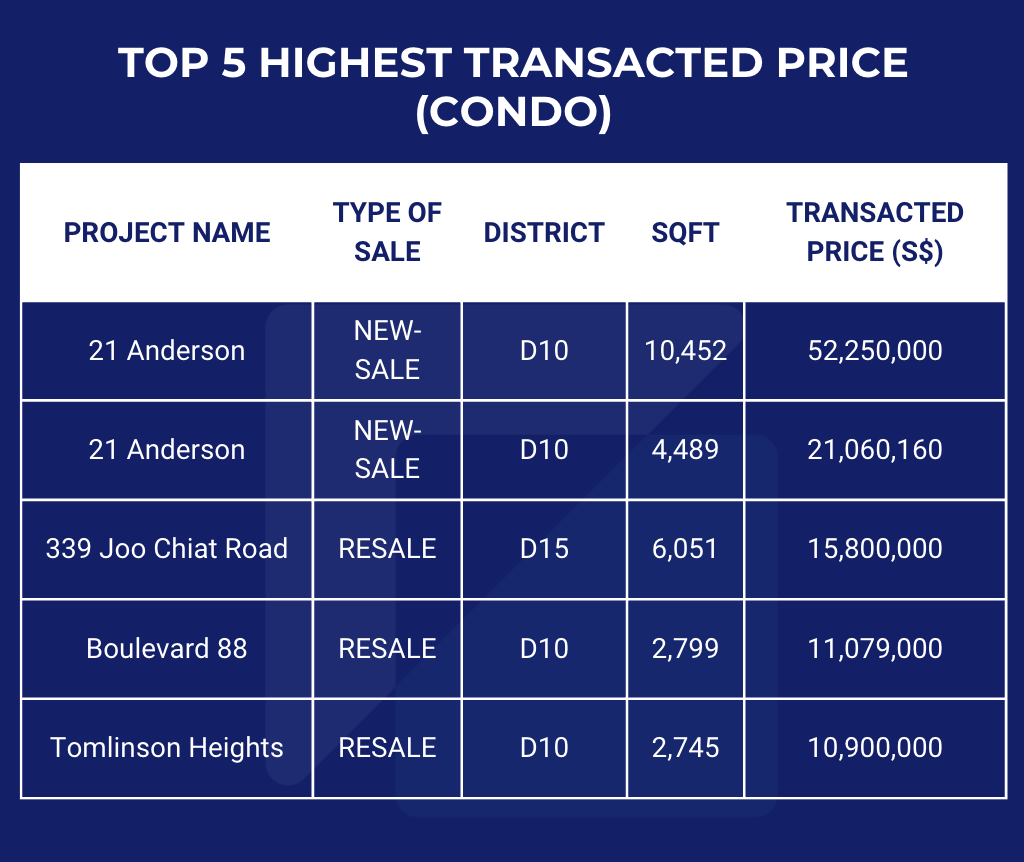

4. Top 5 Highest Transacted Price (Condo) in August 2025

The most expensive Condo transaction in August 2025 is another 5-bedroom new unit at 21 Anderson, which was sold at a gargantuan $52.25 million for a total area of 10,452 sqft ($4,999 PSF).

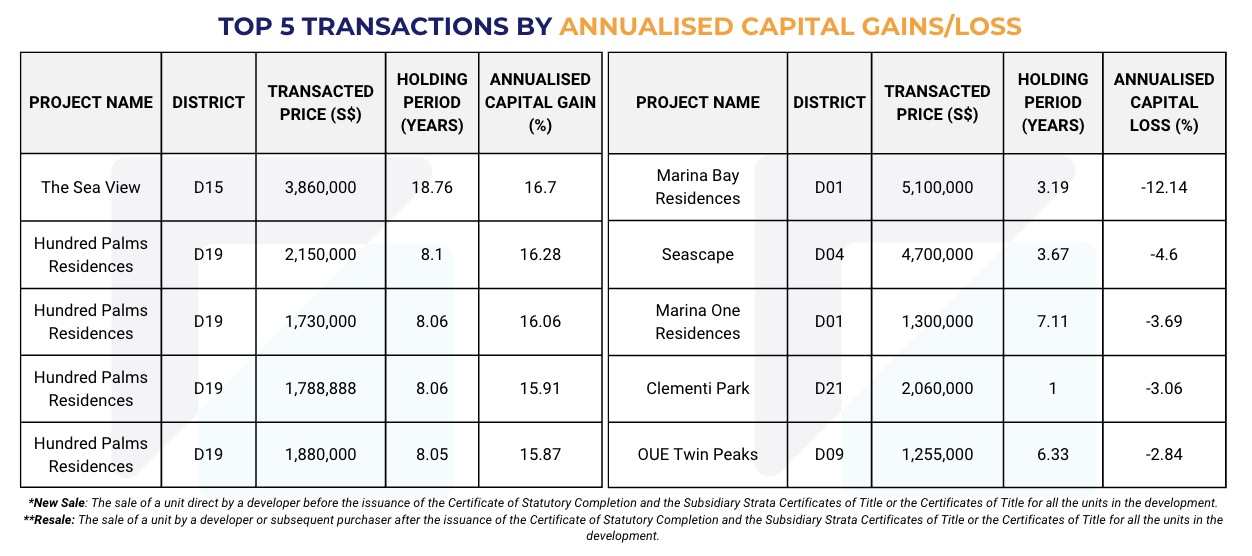

5. Top 5 Transactions by Annualised Capital Gain/Loss in August 2025

The most profitable Condo transaction in August 2025 happened at The Sea View in D15 after being held for 18.76 years, recording a 16.7% annualised capital gain.

The highest annual loss percentage of the month was seen in a unit at Marina Bay Residence in D01 after a holding period of 3.19 years, which recorded an annual loss of 12.14%.

Residential Listings (Condo, HDB, Landed) March 2025 - August 2025

*New Listing: the total number of listings that are newly added in that particular time period

Commercial Snapshot

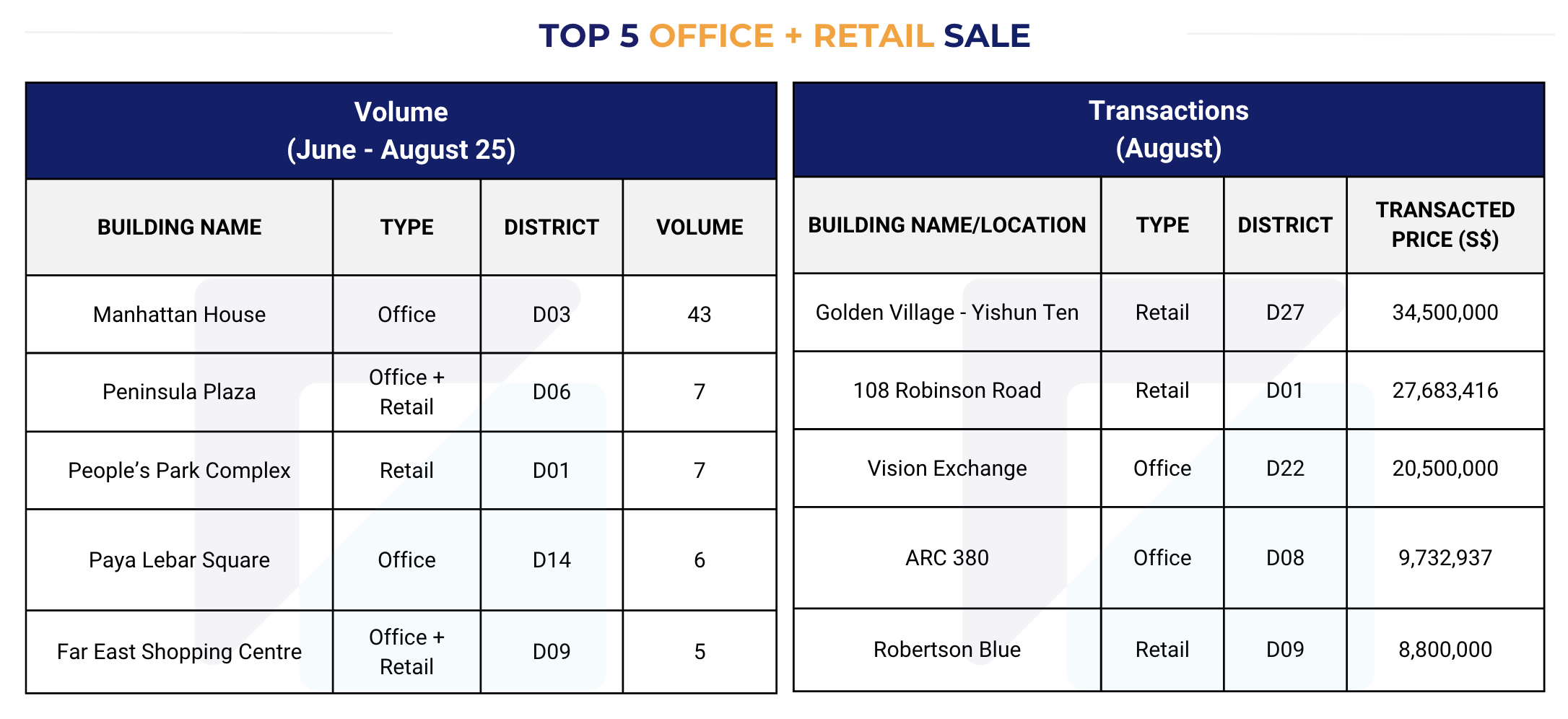

1. Top 5 Office and Retail Sale (by volume and transacted price) (June 2025 - August 2025)

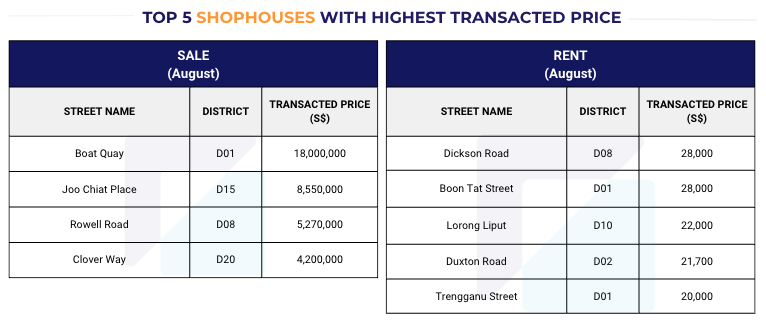

2. Top 5 Shophouses with Highest Transacted Price (Sale and Rent) in August 2025

*The data presented in this monthly report is accurate as of 22 September 2025. While we strive to provide the most up-to-date information available, it is important to note that there may be a small percentage of transactions that experience delays in reporting from the respective agencies and government sources. Therefore, the data provided should be interpreted with this in mind, and you are encouraged to verify the latest information for your specific needs.

*All analytical and visually interpreted data in this report is powered by RealAgent, a comprehensive app for real estate professionals. It offers a blend of property information, real-time transaction data, and advanced analytics, ensuring accurate and up-to-date insights for our report. Find out more about RealAgent here.

Download the full report (PDF) here.

To know more about our data-driven real estate solutions, contact us here.

Continue to read our previous monthly reports:

Singapore Property Market Snapshot - July 2025

Singapore Property Market Snapshot - June 2025

Singapore Property Market Snapshot - May 2025

Singapore Property Market Snapshot - April 2025

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics (REA), we revolutionise the real estate industry with cutting-edge AI technology. Leveraging advanced data science and machine learning, we offer tailored data solutions for real estate professionals and enthusiasts. Our products, including market insights, RealAgent suite (for agents), and RealInsight (for developers, investors, institutional clients), provide end-to-end solutions for informed decision-making. Available across Singapore, Malaysia, Hong Kong (China), and Australia, our offerings ensure you always stay ahead in the dynamic real estate market.

Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.