News > Singapore Property Market Snapshot - April 2025

Singapore Property Market Snapshot - April 2025

15 May 2025

Explore how Singapore Property Market performed in April 2025 below:

Hot Topics in Singapore Property Market April 2025

1. GE2025: Who’s Got the Better Housing Plan? We Break Down PAP, WP, RDU, PSP And SDP Proposals.

Housing and housing affordability are topics of contention in Singapore, and will likely always be. As several party manifestos and speeches dwell on this central topic, we’ve gathered the salient points and considered how they might impact the current market. Read more >>

2. Watertown Condo's 10-Year Case Study: When Holding Period And Exit Timing Mattered More Than Buying Early

Watertown condo is an interesting case study, as buyers weren’t sure what to expect when it launched in 2012. Let’s see if the decision to sell the property at an early stage paid off, compared to those who took longer to decide. Read more >>

3. Why No Property Developers Bid For Media Circle Parcel B (And What It Means For One-North)

It seems Media Circle Parcel B won’t be doing much for the government coffers, with zero bids received. A GLS site failing to draw interest is a rare (though increasingly less uncommon) outcome. This time, the afflicted area is in the tech and media hub of One-North. Read more >>

4. Global Tensions Cloud Outlook for Singapore Housing Market: Analysts

Singapore's private residential market continued its cautious ascent in the first quarter of 2025, but industry players are warning of mounting risks from global economic tensions. According to the Urban Redevelopment Authority, private home prices rose 0.8% in Q1, slowing from the 2.3% gain seen in the previous quarter. Read more >>

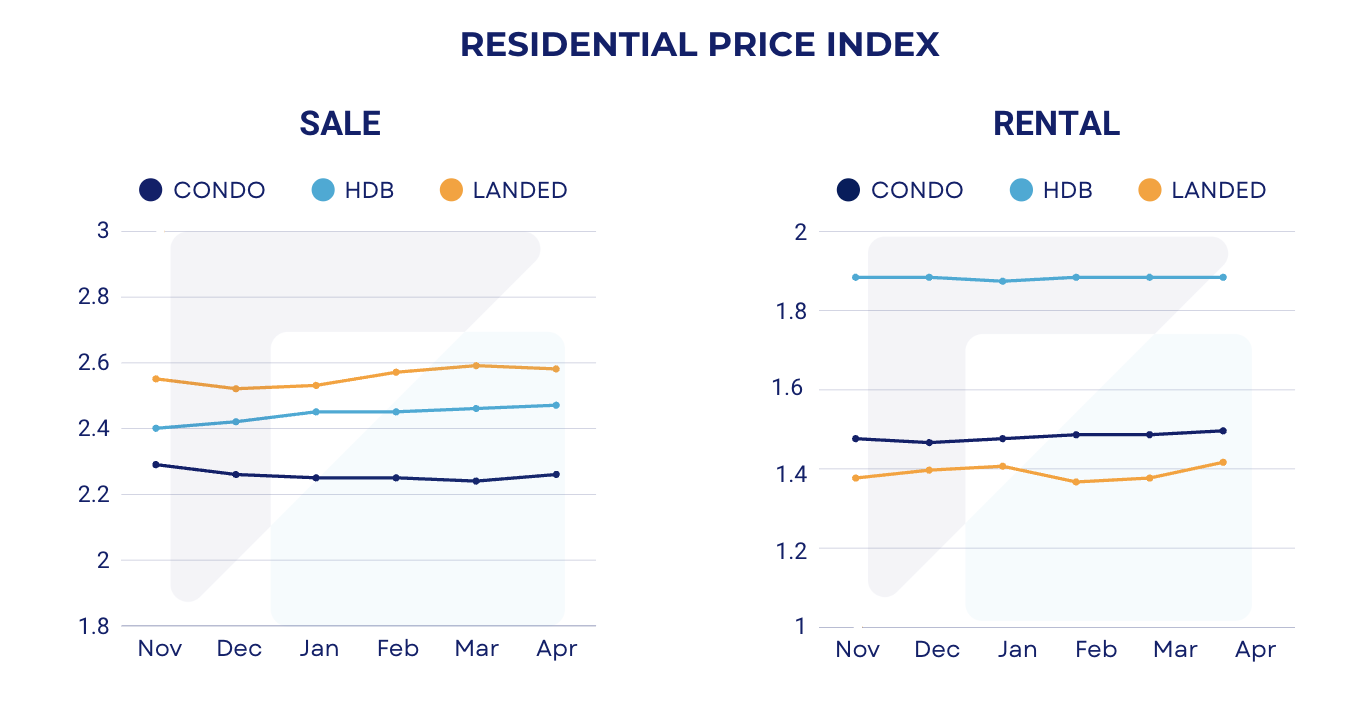

Price Indexes

*Index value is 1 at year 2008

Price Indexes shown are powered by REA Property Price Index - an accurate and objective indicator of the real estate market performance. Read more about our index here.

1. Residential Property Price Index (Condo, HDB, Landed)

2. Commercial Price Index (Office)

Residential Property Snapshot

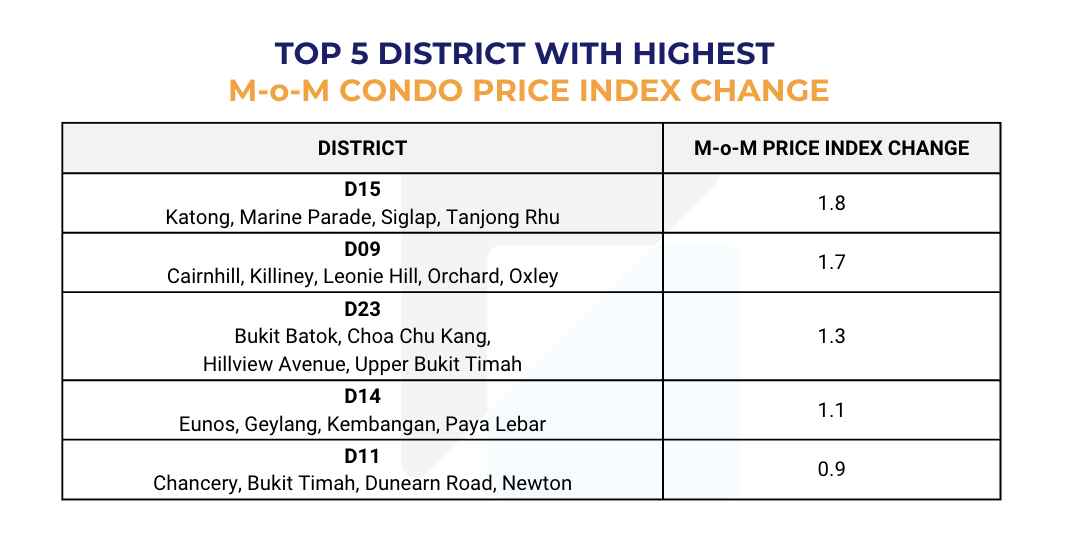

1. Top 5 Districts with highest Month on Month (M-o-M) Index Change

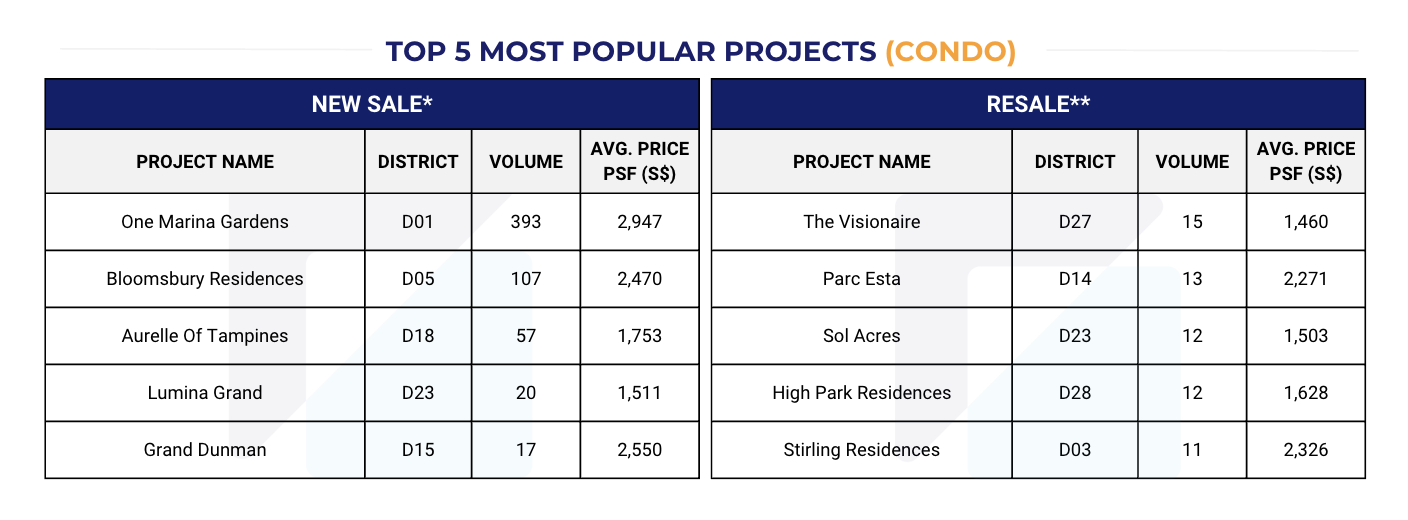

2. Top 5 most popular Condo projects in April 2025

For Condo new sale, the most popular projects with highest transaction volume in April are: One Marina Gardens, Bloomsbury Residences, Aurelle of Tampines, Lumina Grand and Grand Dunman.

For Condo resale, the most popular projects are: The Visionaire, Parc Esta, Sol Acres, High Park Residences and Stirling Residences.

*New Sale: The sale of a unit direct by a developer before the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

*Resale: The sale of a unit by a developer or subsequent purchaser after the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

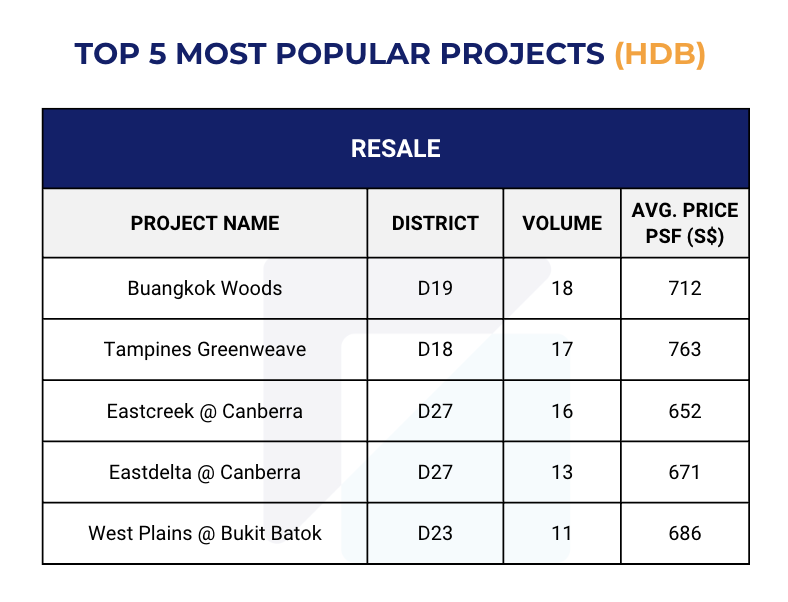

3. Top 5 most popular projects (HDB) in April 2025

The most popular HDB projects with highest transaction volume in April are: Buangkok Woods, Tampines Greenweave, Eastcreek @ Canberra, Eastdelta at Canberra and West Plains @ Bukit Batok.

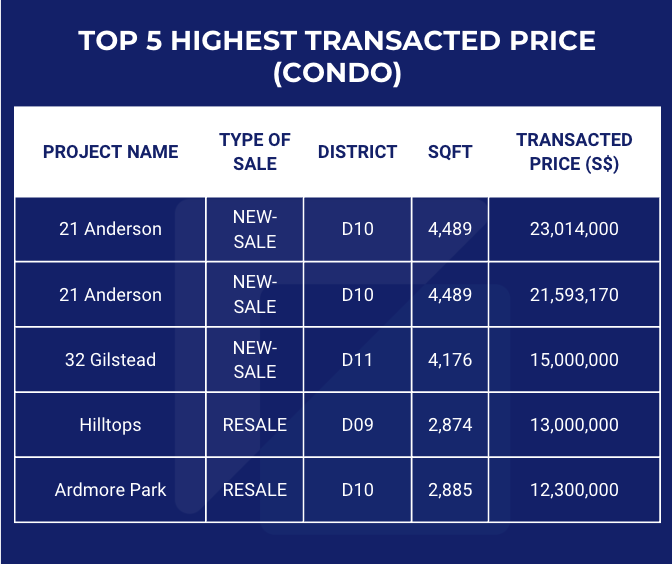

4. Top 5 highest transacted price (Condo) in April 2025

The most expensive Condo transaction in April 2025 is a 4-bedroom new unit at 21 Anderson, which was sold at $23.01 million for a total area of 4,489 sqft ($5,127 PSF).

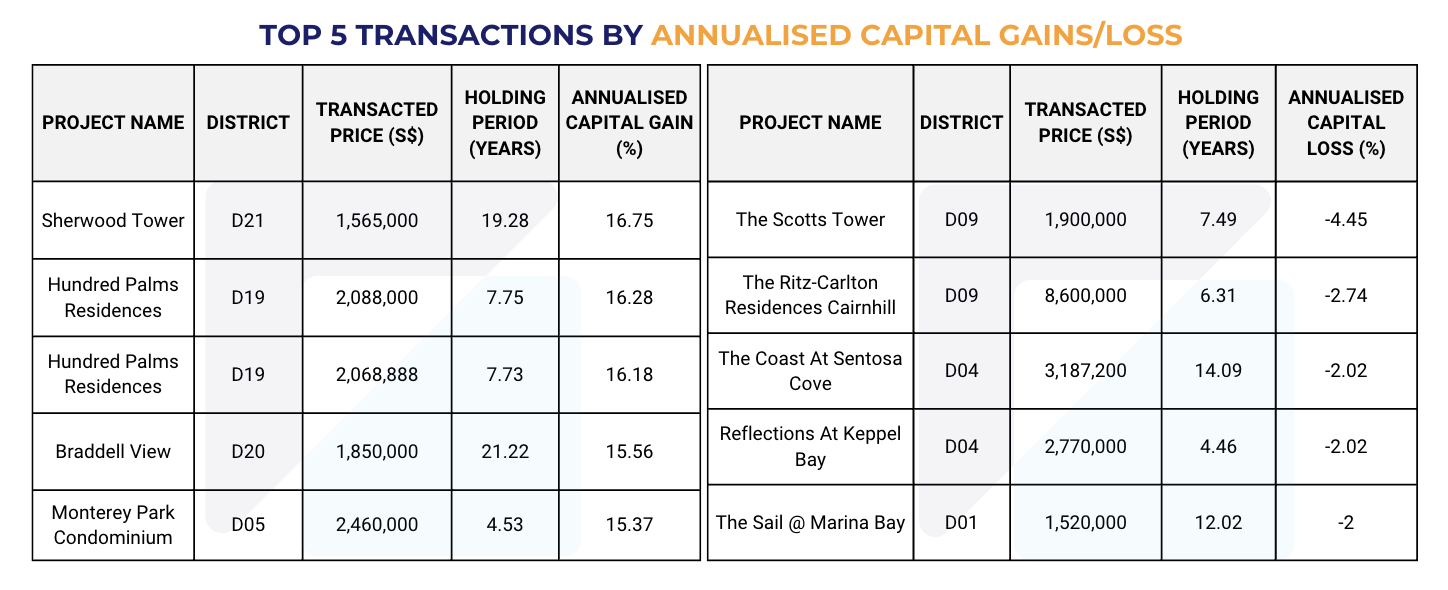

5. Top 5 Transactions by Annualised Capital Gain/Loss in April 2025

The most profitable Condo transaction in April 2025 happened at Sherwood Tower in D21 after being held for 19.28 years, recording a 16.75% annualised gain.

The highest annual loss percentage of the month was seen in a unit at The Scotts Tower in D09 after a holding period of 7.49 years, which recorded an annual loss of 4.45%.

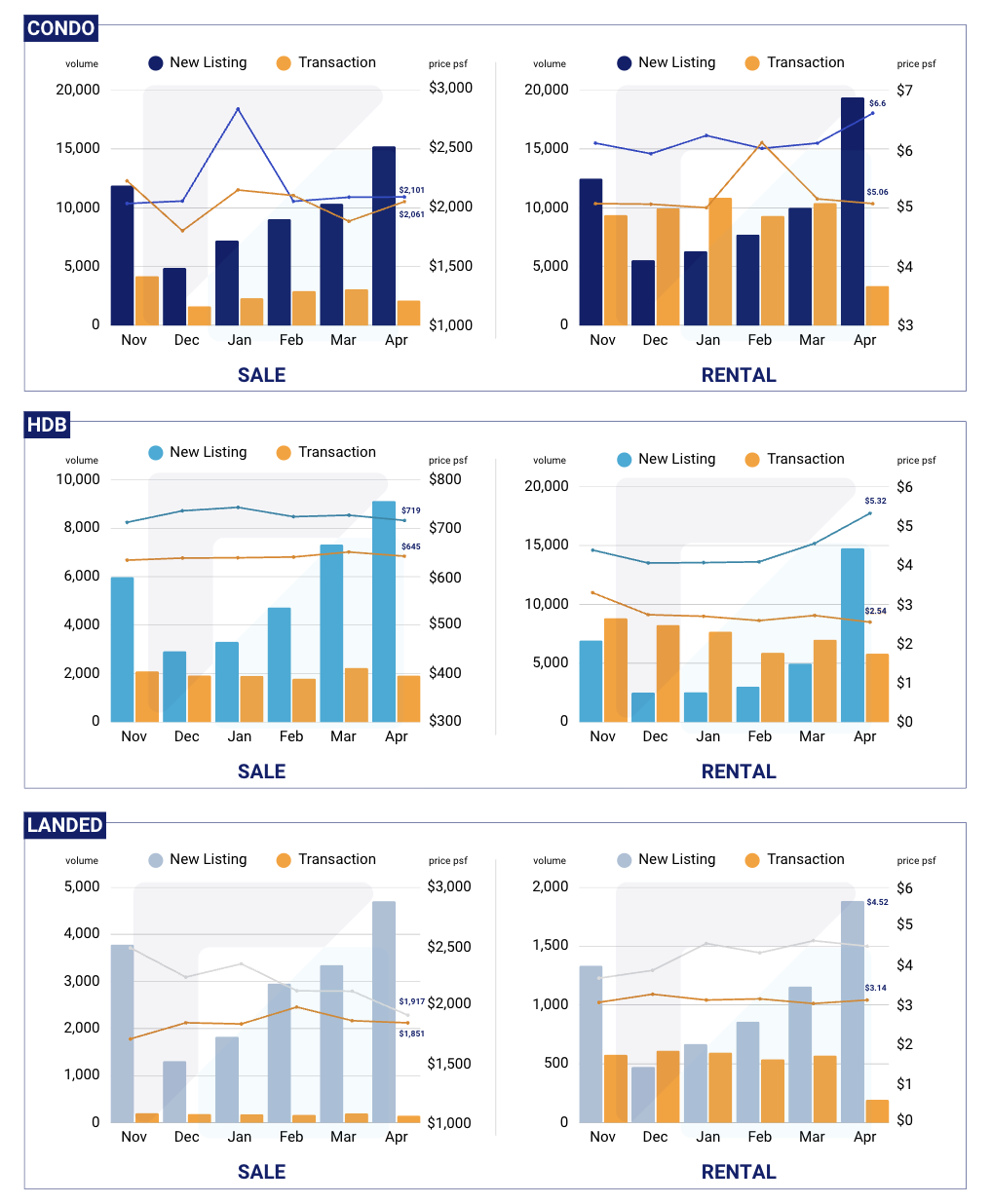

Residential Listings (Condo, HDB, Landed) November 2024 - April 2025

*New Listing: the total number of listings that are newly added in that particular time period

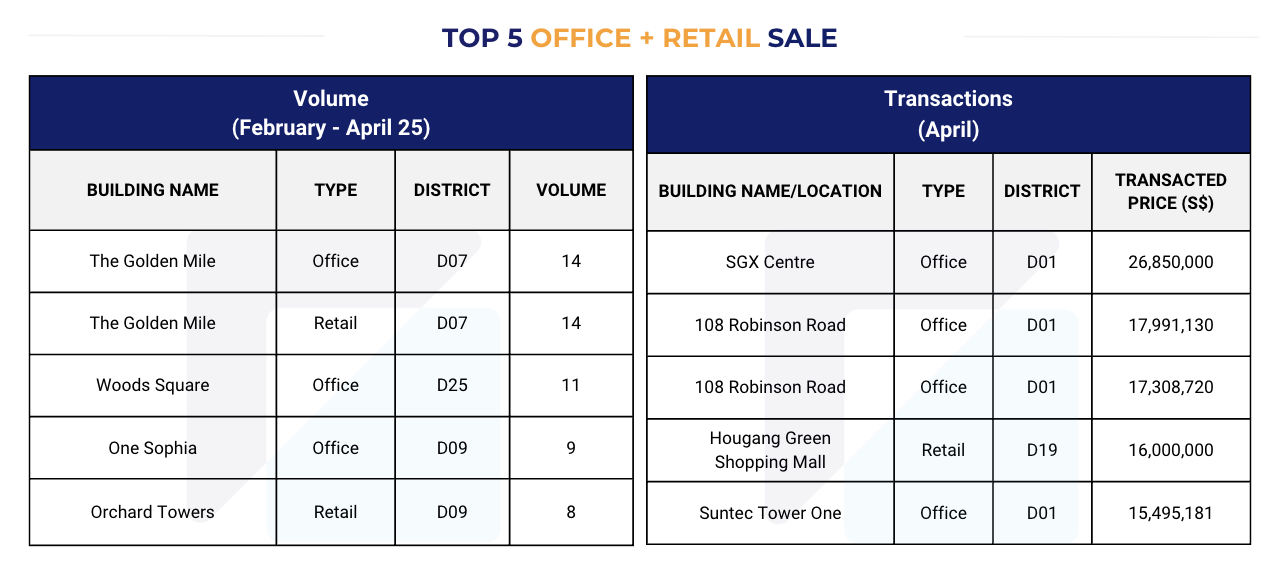

Commercial Snapshot

1. Top 5 Office and Retail Sale (by volume and transacted price) (February 2025 - April 2025)

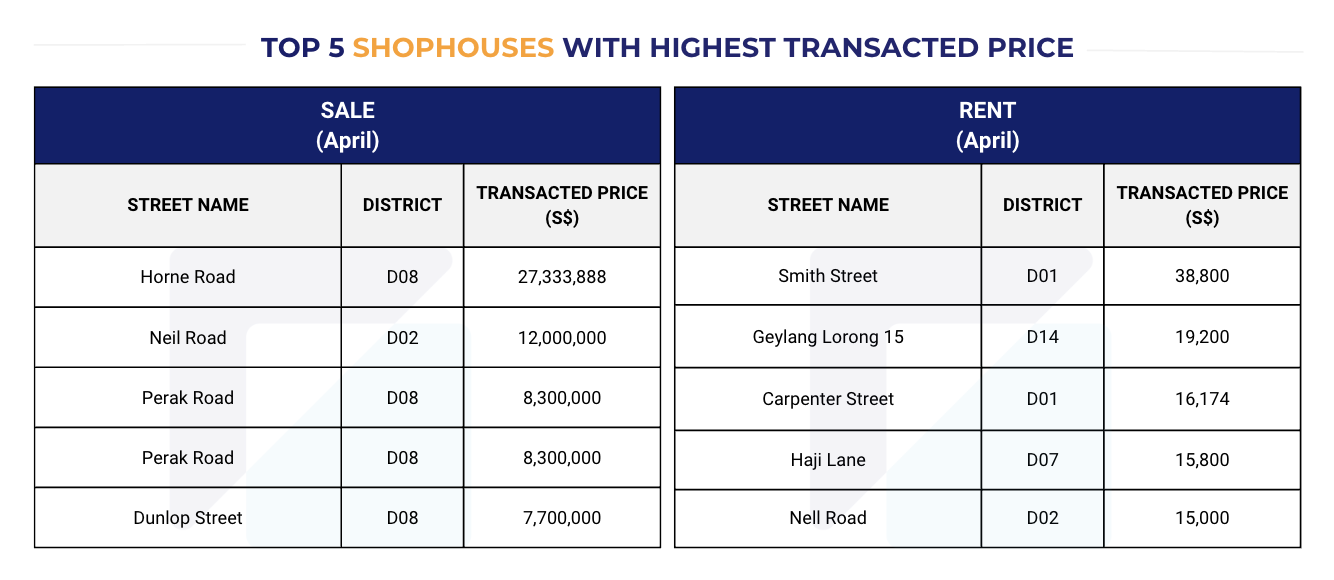

2. Top 5 Shophouses with Highest Transacted Price (Sale and Rent) in April 2025

*The data presented in this monthly report is accurate as of 15 May 2025. While we strive to provide the most up-to-date information available, it is important to note that there may be a small percentage of transactions that experience delays in reporting from the respective agencies and government sources. Therefore, the data provided should be interpreted with this in mind, and you are encouraged to verify the latest information for your specific needs.

*All analytical and visually interpreted data in this report is powered by RealAgent, a comprehensive app for real estate professionals. It offers a blend of property information, real-time transaction data, and advanced analytics, ensuring accurate and up-to-date insights for our report. Find out more about RealAgent here.

Download the full report (PDF) here.

To know more about our data-driven real estate solutions, contact us here.

Continue to read our previous monthly reports:

Singapore Property Market Snapshot - March 2025

Singapore Property Market Snapshot - February 2025

Singapore Property Market Snapshot - January 2025

Singapore Property Market Snapshot - December 2024

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics (REA), we revolutionise the real estate industry with cutting-edge AI technology. Leveraging advanced data science and machine learning, we offer tailored data solutions for real estate professionals and enthusiasts. Our products, including market insights, RealAgent suite (for agents), and RealInsight (for developers, investors, institutional clients), provide end-to-end solutions for informed decision-making. Available across Singapore, Malaysia, Hong Kong (China), and Australia, our offerings ensure you always stay ahead in the dynamic real estate market.

Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.