News > Singapore Property Market Snapshot - February 2025

Singapore Property Market Snapshot - February 2025

18 March 2025

Explore how Singapore Property Market performed in February 2025 below:

Hot Topics in Singapore Property Market February 2025

1. Frasers Property jointly secures Songjiang residential site for $152m.

Singaporean real estate giants Frasers Property Limited, Xiamen ITG Real Estate Group, and Gemdale Corporation have joined forces to acquire a residential site in Shanghai, China. The $151.9m development project will feature 189 low-rise homes with eco-friendly designs. The sites strategic location near existing projects promises a lucrative investment opportunity. Read more >>

2. Over 87% of 1,193 Parktown Residence units in Tampines sold at launch weekend.

Singapore's Parktown Residence in Tampines sees a remarkable 87% of units sold over launch weekend, with buyers attracted to its integrated lifestyle offerings. The average price achieved was $2,360 per sqft. Additionally, Elta in Clementi Avenue 1 sells 328 units post-launch weekend, showing strong interest from owner-occupiers. Both developments highlight the appeal of fully integrated projects and strategic locations in Singapores property market. Read more >>

3. ETC and OrangeTee forge strategic merger, uniting to increase market presence.

The combined entity will have over 520 staff, in addition to an agency network of 2,803 salespersons. This strategic move is expected to facilitate growth beyond Singapore, with a focus on penetrating key regional markets. Read more >>

4. More HDB flat upgraders made the leap to private housing in 2024.

HDB flat upgraders in Singapore are increasingly switching to private housing due to favourable mortgage rates and faster growth in HDB resale prices compared to private homes. The trend saw 5,420 new and resale non-landed private homes purchased by HDB address holders in 2024, marking a rebound from the previous year. With more launches expected in 2025, particularly in the suburbs, the market dynamics are shifting. Read more >>

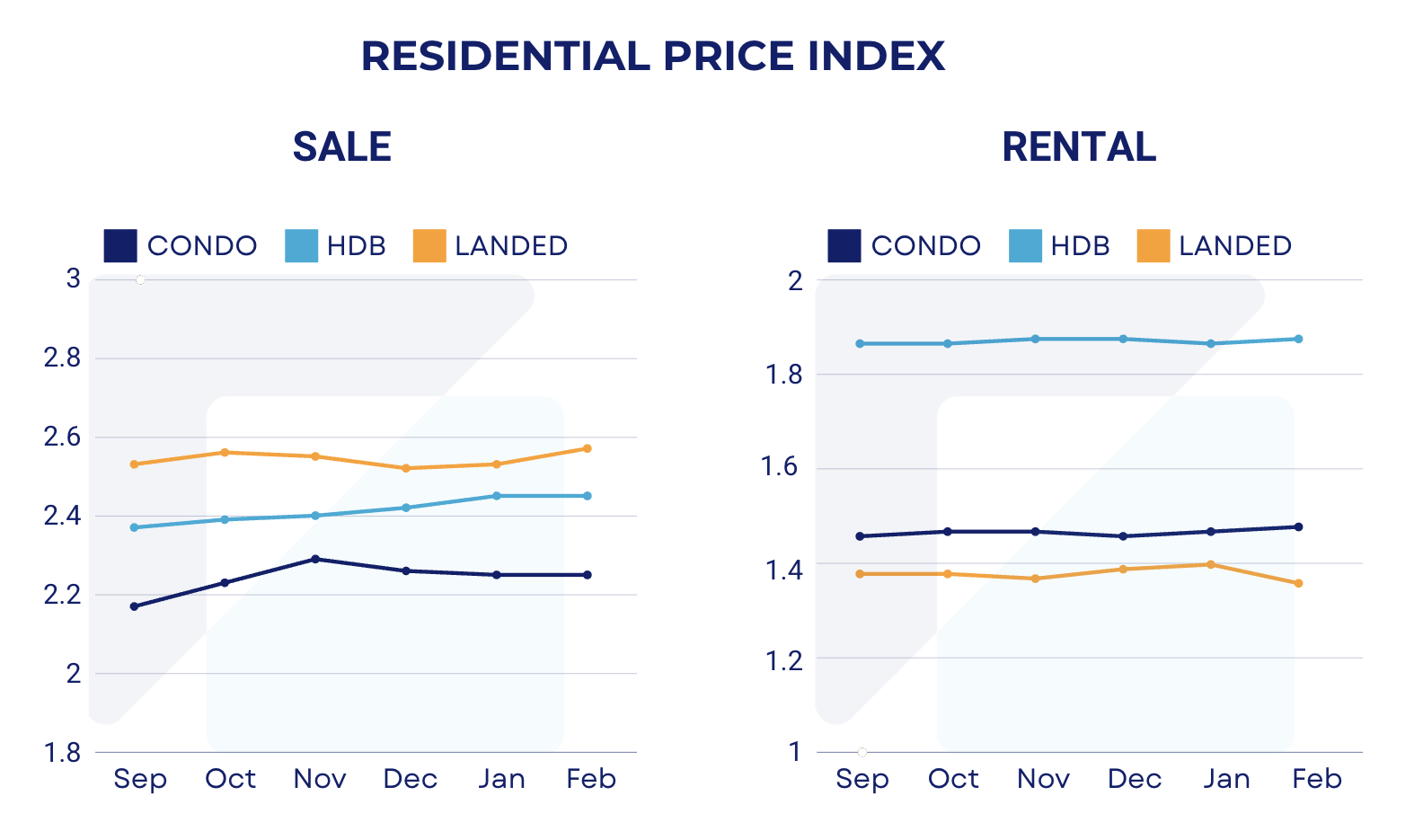

Price Indexes

*Index value is 1 at year 2008

Price Indexes shown are powered by REA Property Price Index - an accurate and objective indicator of the real estate market performance. Read more about our index here.

1. Residential Property Price Index (Condo, HDB, Landed)

2. Commercial Price Index (Office)

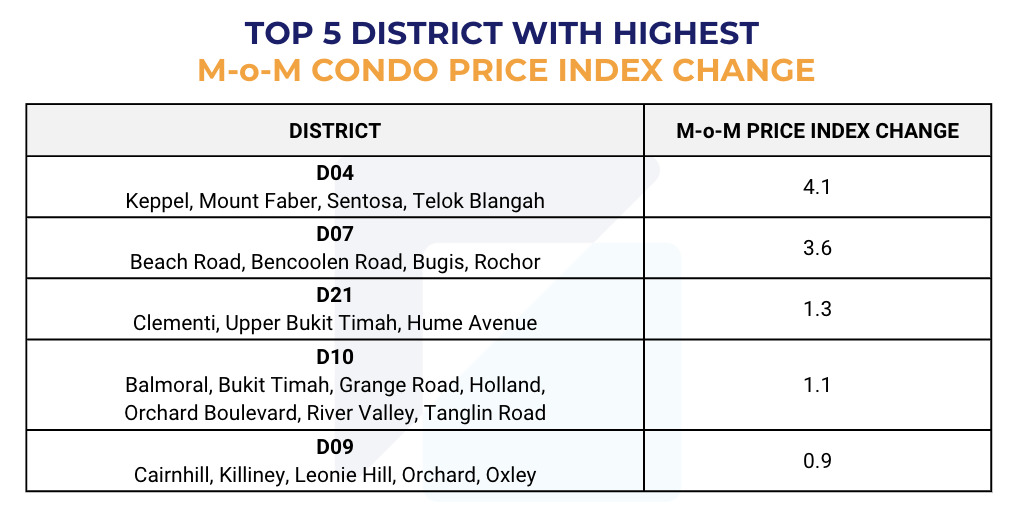

Residential Property Snapshot

1. Top 5 Districts with highest Month on Month (M-o-M) Index Change

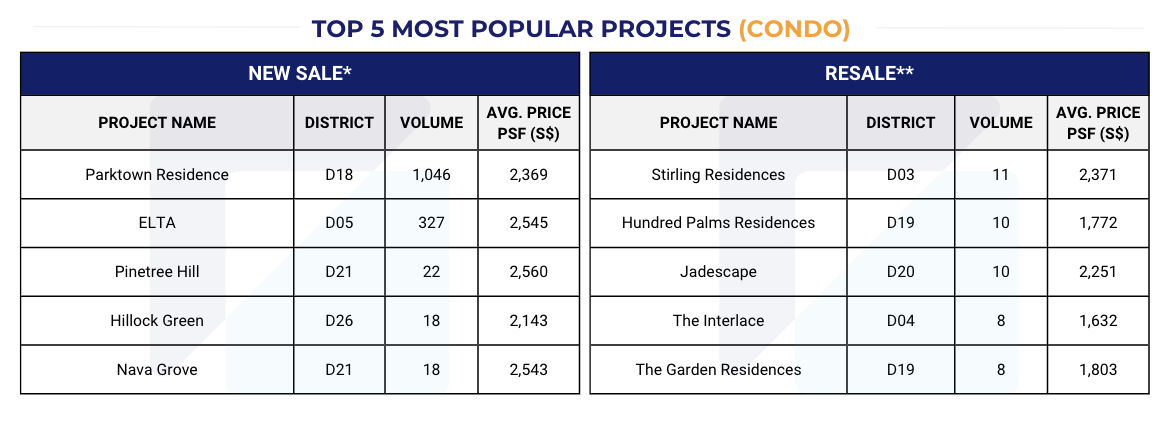

2. Top 5 most popular Condo projects in February 2025

For Condo new sale, the most popular projects with highest transaction volume in February are: Parktown Residence, ELTA, Pinetree Hill, Hillock Green and Nava Grove.

For Condo resale, the most popular projects are: Stirling Residences, Hundred Palms Residences, Jadescape, The Interlace and The Garden Residences.

*New Sale: The sale of a unit direct by a developer before the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

*Resale: The sale of a unit by a developer or subsequent purchaser after the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

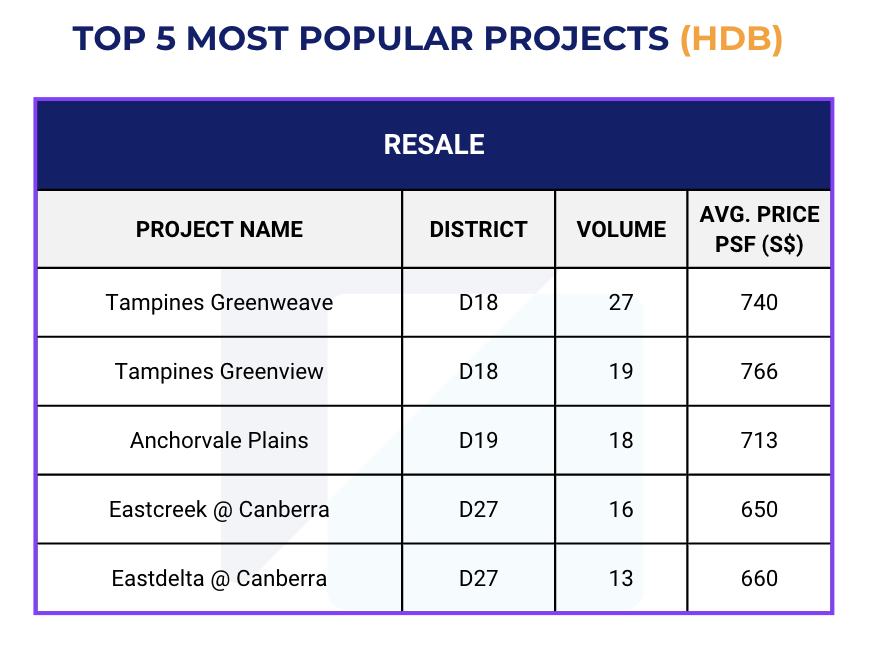

3. Top 5 most popular projects (HDB) in February 2025

The most popular HDB projects with highest transaction volume in February are: Tampines Greenweave, Tampines Greenview, Anchorvale Plains, Eastcreek @ Canberra and Eastdelta at Canberra.

4. Top 5 highest transacted price (Condo) in February 2025

The most expensive Condo transaction in February 2025 is a 2-bedroom penthouse resale unit at Yong An Park Condo, which was sold at $15 million for a total area of 6,878 sqft ($2,181 PSF).

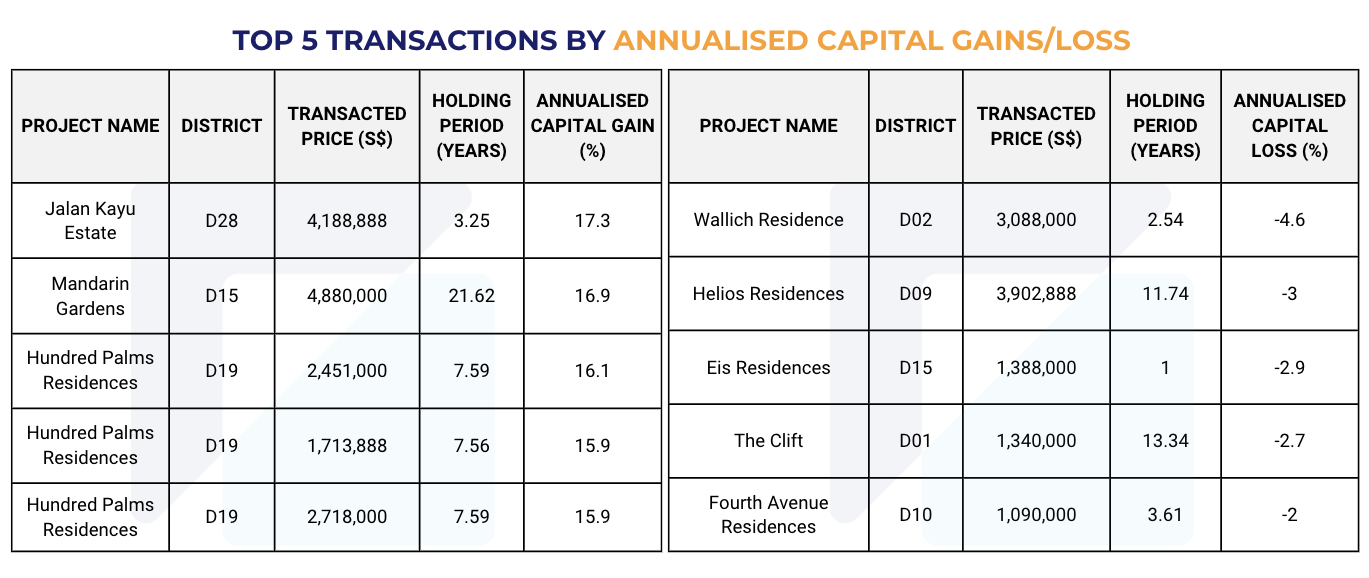

5. Top 5 Transactions by Annualised Capital Gain/Loss in February 2025

The most profitable Condo transaction in February 2025 happened at Jalan Kayu Estate in D28 after being held for a little over 3 years, recording a 17.3% annualised gain.

The highest annual loss percentage of the month was seen in a unit at Wallich Residence in D02, which recorded an annual loss of 4.6%.

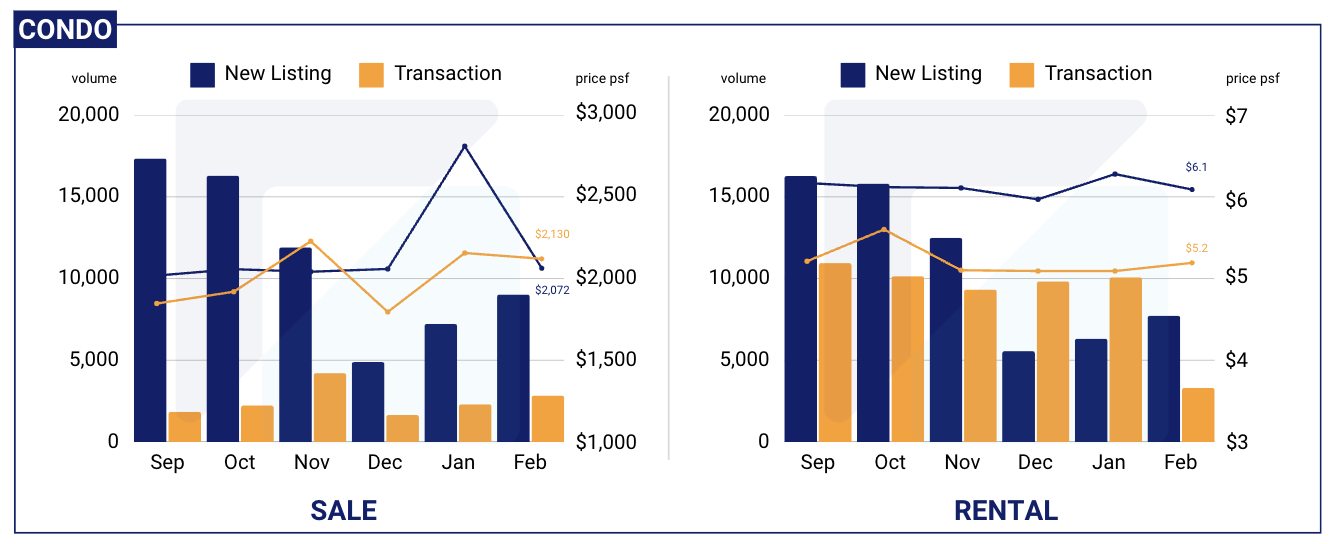

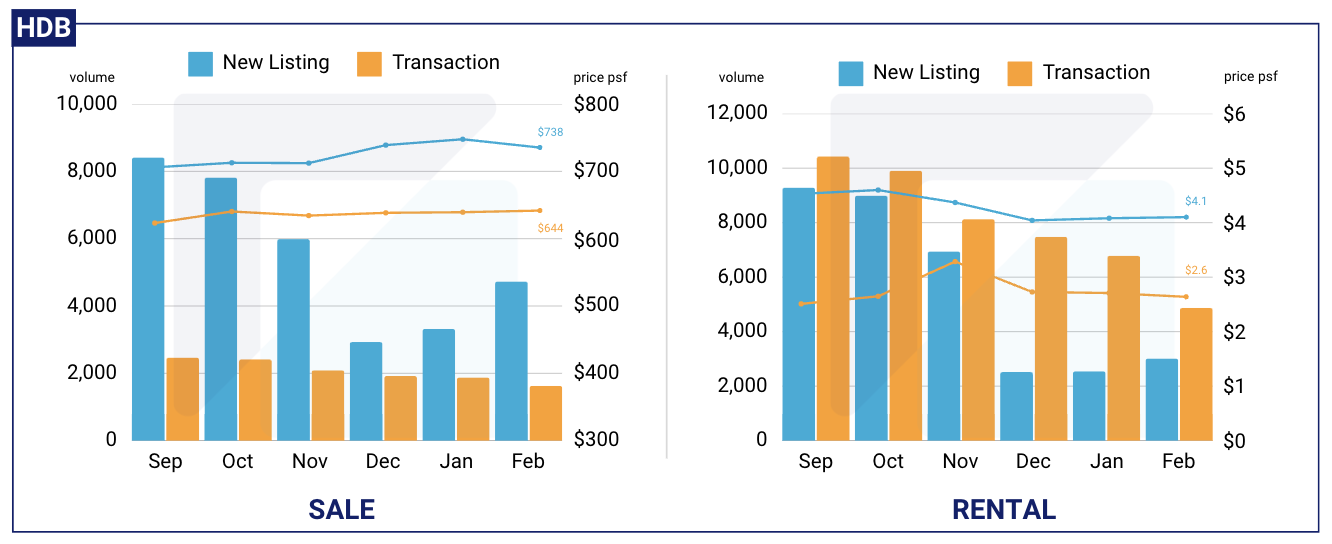

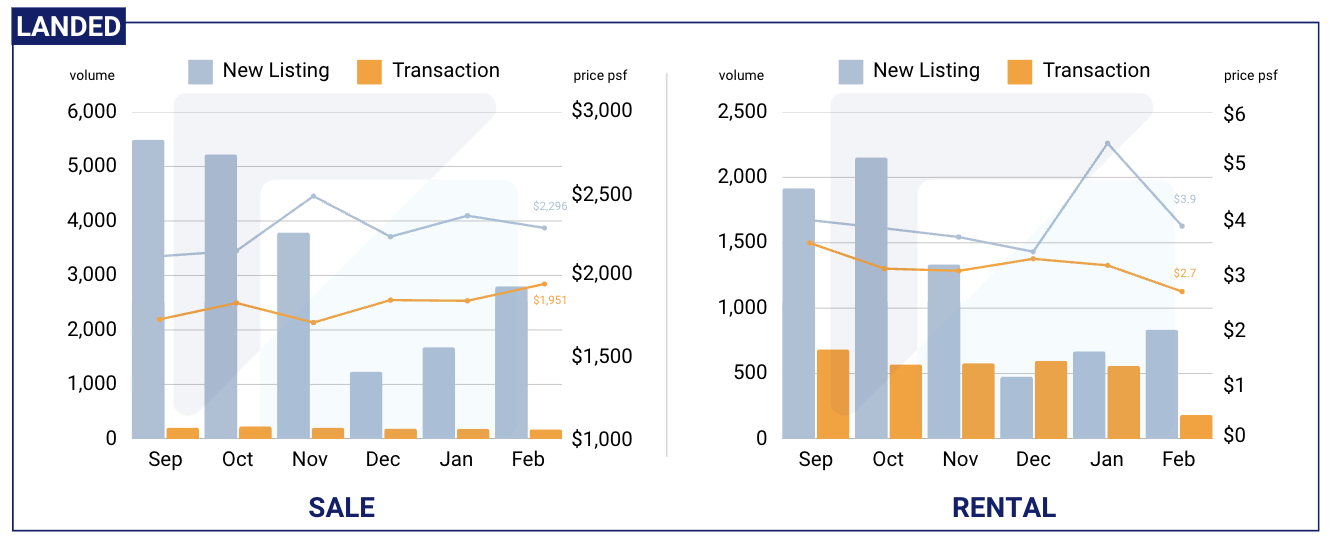

Residential Listings (Condo, HDB, Landed) September 2024 - February 2025

*New Listing: the total number of listings that are newly added in that particular time period

Commercial Snapshot

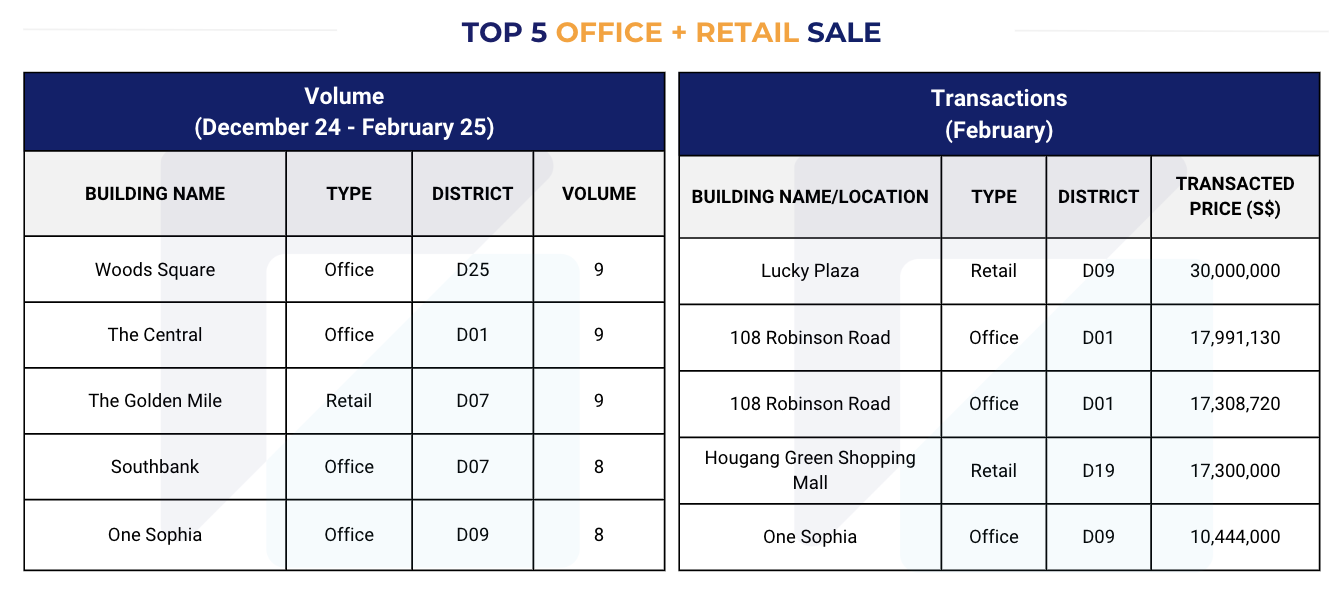

1. Top 5 Office and Retail Sale (by volume and transacted price) (December 2024 - February 2025)

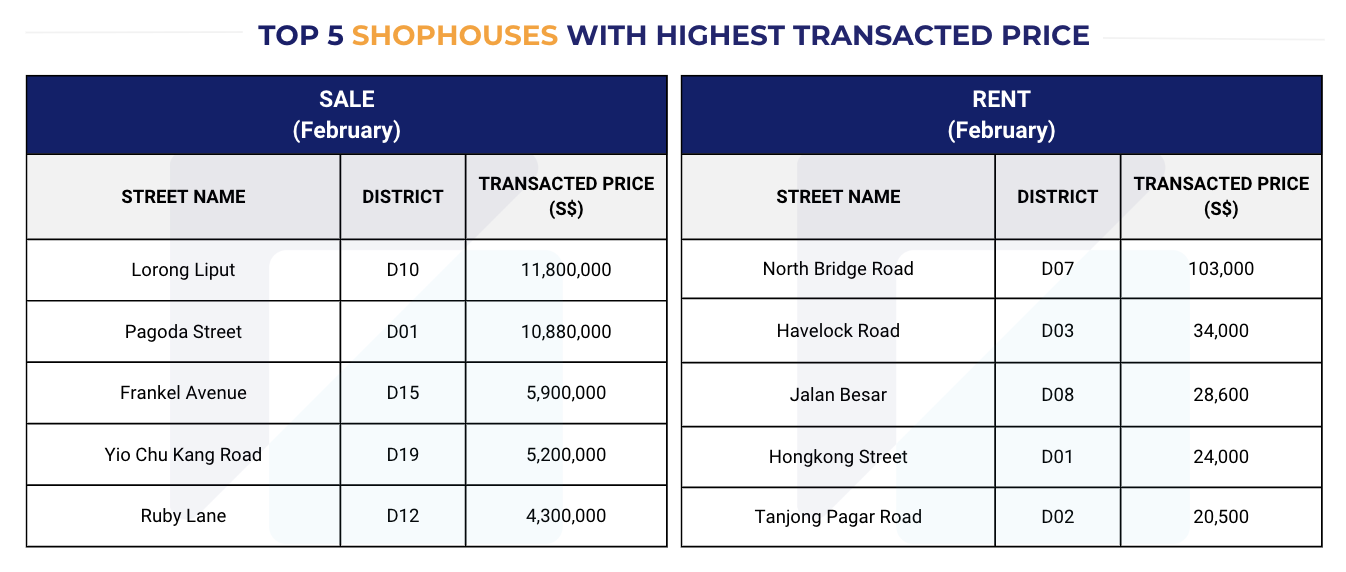

2. Top 5 Shophouses with Highest Transacted Price (Sale and Rent) in February 2025

*The data presented in this monthly report is accurate as of 18 March 2025. While we strive to provide the most up-to-date information available, it is important to note that there may be a small percentage of transactions that experience delays in reporting from the respective agencies and government sources. Therefore, the data provided should be interpreted with this in mind, and you are encouraged to verify the latest information for your specific needs.

*All analytical and visually interpreted data in this report is powered by RealAgent, a comprehensive app for real estate professionals. It offers a blend of property information, real-time transaction data, and advanced analytics, ensuring accurate and up-to-date insights for our report. Find out more about RealAgent here.

Download the full report (PDF) here.

To know more about our data-driven real estate solutions, contact us here.

Continue to read our previous monthly reports:

Singapore Property Market Snapshot - January 2025

Singapore Property Market Snapshot - December 2024

Singapore Property Market Snapshot - November 2024

Singapore Property Market Snapshot - October 2024

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics (REA), we revolutionise the real estate industry with cutting-edge AI technology. Leveraging advanced data science and machine learning, we offer tailored data solutions for real estate professionals and enthusiasts. Our products, including market insights, RealAgent suite (for agents), and RealInsight (for developers, investors, institutional clients), provide end-to-end solutions for informed decision-making. Available across Singapore, Malaysia, Hong Kong (China), and Australia, our offerings ensure you always stay ahead in the dynamic real estate market.

Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.