News > Singapore Property Market Snapshot - December 2024

Singapore Property Market Snapshot - December 2024

17 January 2025

Explore how Singapore Property Market performed in December 2024 below:

Hot Topics in Singapore Property Market December 2024

1. Cost of renting surges in Singapore and other global cities; Economists expect 3.6% growth for Singapore’s economy in 2024.

Rental prices globally, including in Singapore, are soaring due to high demand and limited affordable housing.Singapores economy is expected to grow by 3.6% in 2024 with strong GDP performance but contained inflation. Read more >>

2. Condo and HDB rental prices continue to surge in November 2024 despite year-end market slowdown.

Singapores rental market in November 2024 showed resilience with rising prices despite a seasonal slowdown. Condo rental prices edged up, especially in the OCR, while HDB rental prices surged by 4% year-to-date. The market is poised for growth in 2025 due to improving economic outlook and declining interest rates. With affordability driving demand, both condo and HDB segments are expected to perform well in the upcoming year. Read more >>

3. Singapore Property Market Year-End Review 2024 And 2025 Outlook.

Singapores property market in 2024 saw HDBs outperforming Condominiums in both resale and rental sectors. HDB resale prices are predicted to rise by 8.6%, while Condominium resale prices are expected to grow slower at 3.9%. HDB rents increased by 3.5% compared to a decrease in Condominium rents by 0.3%. Read more >>

4. Singapore’s new home sales more than treble in November as six projects hit the market.

Singapores private home market experiences a resurgence in November with the highest sales figures in over a decade. Developers sold 2,557 private homes, more than triple the units sold a year earlier. Analysts predict continued growth in new home sales for 2024, but caution against expecting a repeat of Novembers exceptional performance. Market stability is expected to improve with an increase in supply of new private homes in the coming year. Read more >>

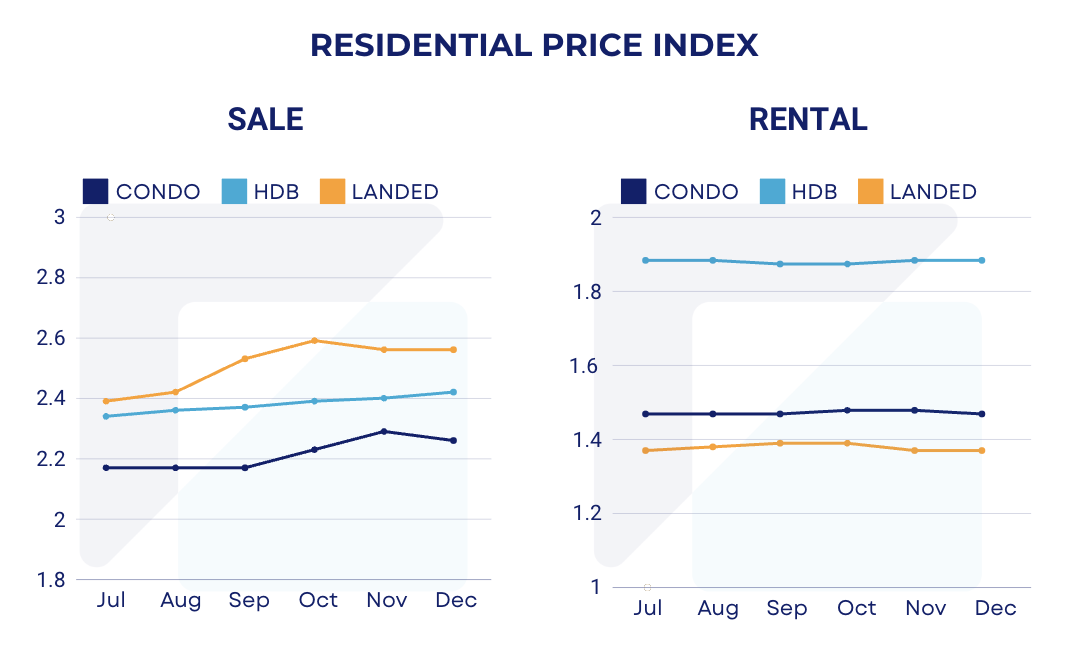

Price Indexes

*Index value is 1 at year 2008

Price Indexes shown are powered by REA Property Price Index - an accurate and objective indicator of the real estate market performance. Read more about our index here.

1. Residential Property Price Index (Condo, HDB, Landed)

2. Commercial Price Index (Office)

Residential Property Snapshot

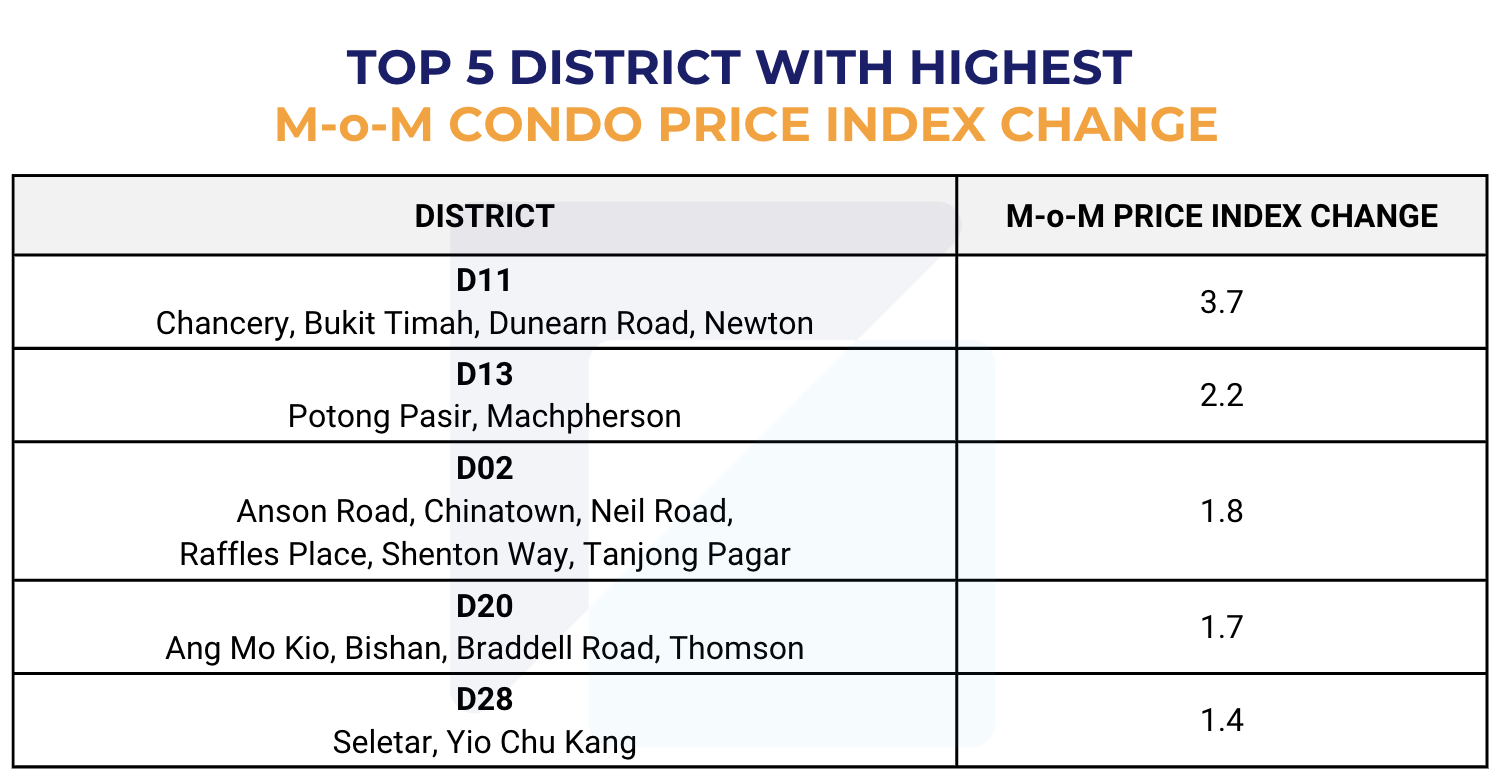

1. Top 5 Districts with highest Month on Month (M-o-M) Index Change

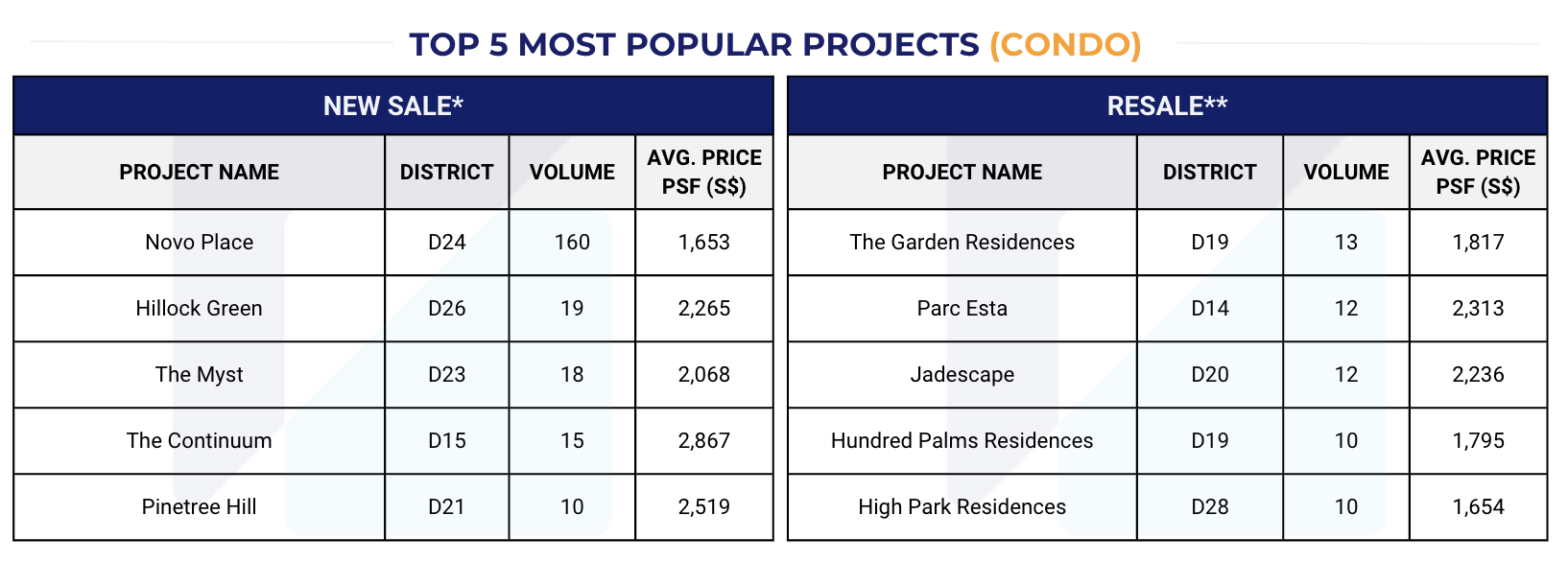

2. Top 5 most popular Condo projects in December 2024

For Condo new sale, the most popular projects with highest transaction volume in December are: Novo Place, Hillock Green, The Myst, The Continuum, and Pinetree Hill.

For Condo resale, the most popular projects are: The Garden Residences, Parc Esta, Jadescape, Hundred Palms Residences, and High Park Residences.

*New Sale: The sale of a unit direct by a developer before the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

*Resale: The sale of a unit by a developer or subsequent purchaser after the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

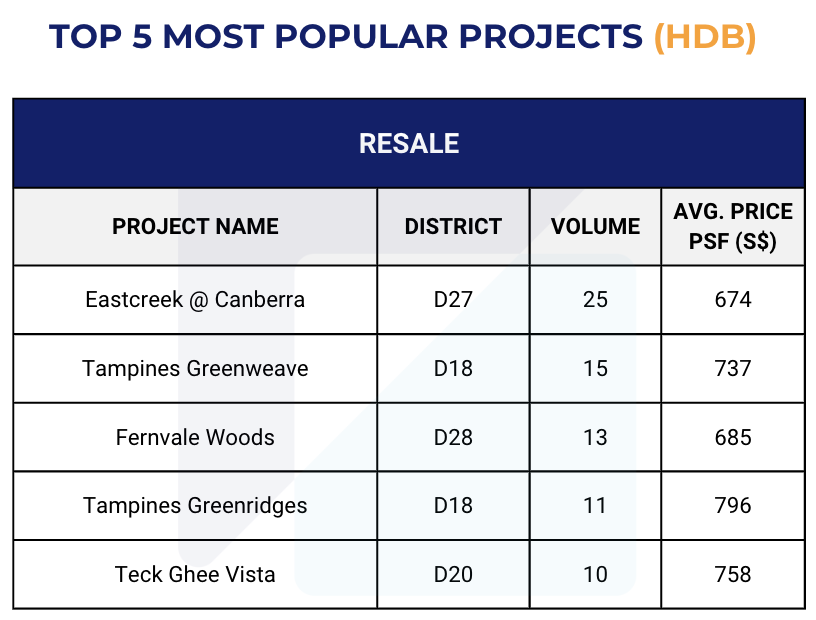

3. Top 5 most popular projects (HDB) in December 2024

The most popular HDB projects with highest transaction volume in December are: Eastcreek @ Canberra, Tampines Greenweave, Fernvale Woods, Tampines Greenridges, and Teck Ghee Vista.

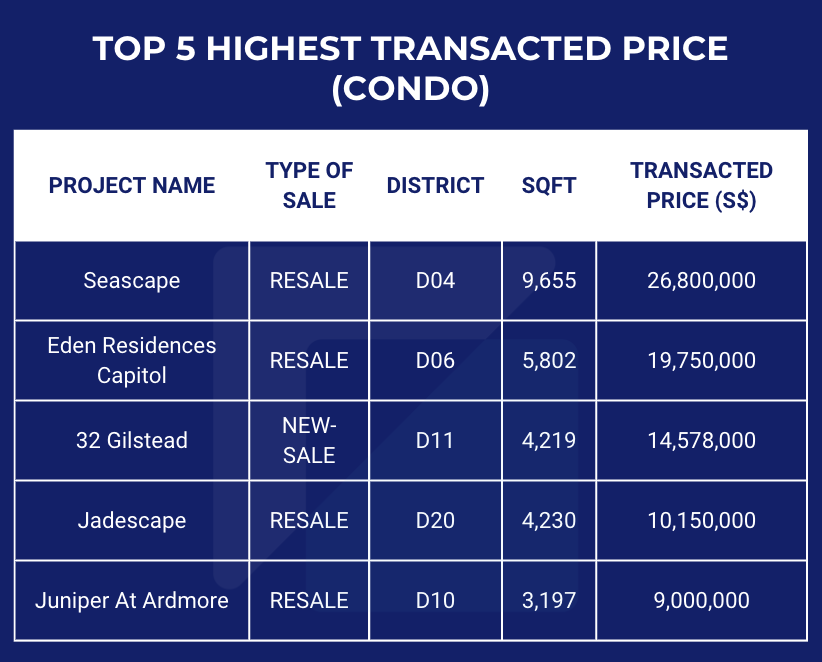

4. Top 5 highest transacted price (Condo) in December 2024

The most expensive Condo transaction in December 2024 is a 4-bedroom unit on low floor at Seascape Condo, which was sold at $26.8 million for a total area of 9,655 sqft ($2,776 PSF).

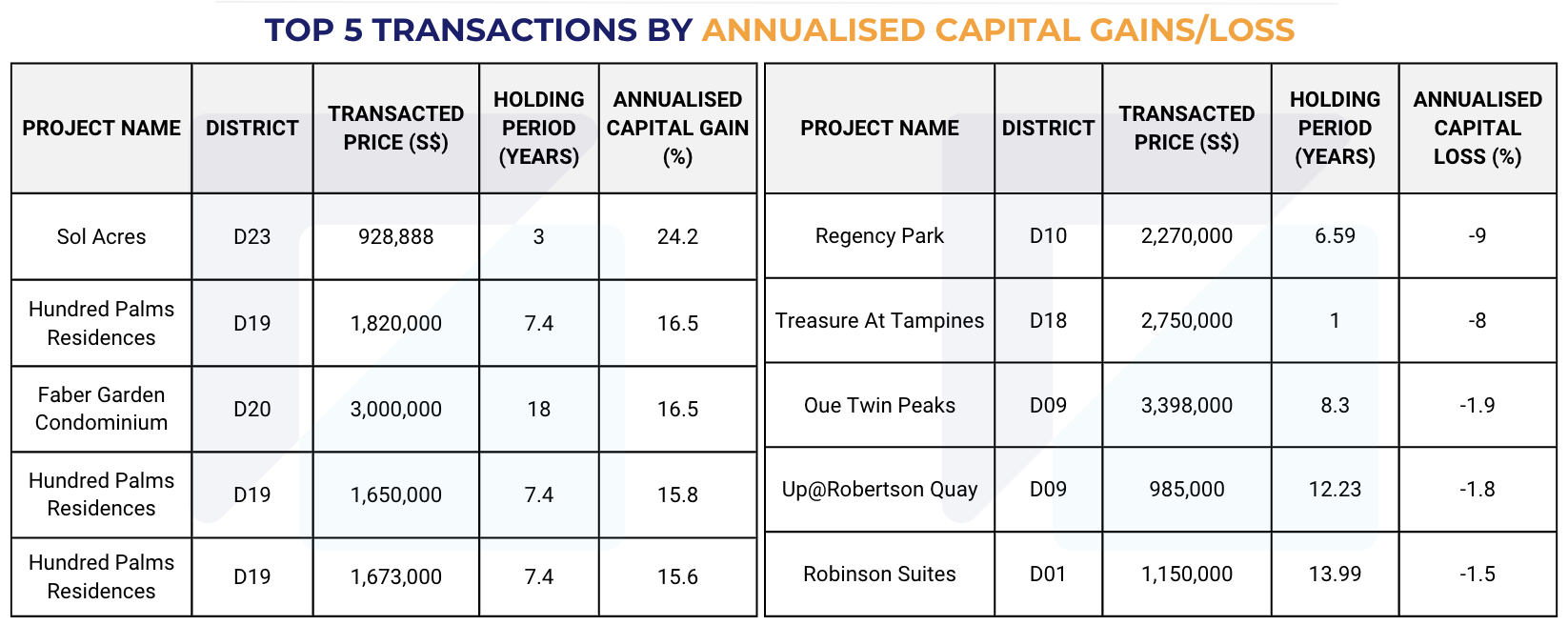

5. Top 5 Transactions by Annualised Capital Gain/Loss in December 2024

The most profitable Condo transaction in December 2024 happened at Sol Acres in D23 after being held for 3 years, recording a 24.2% annualised gain.

The highest annual loss percentage of the month was seen in a unit at Regency Park Condo, which recorded an annual loss of 9%.

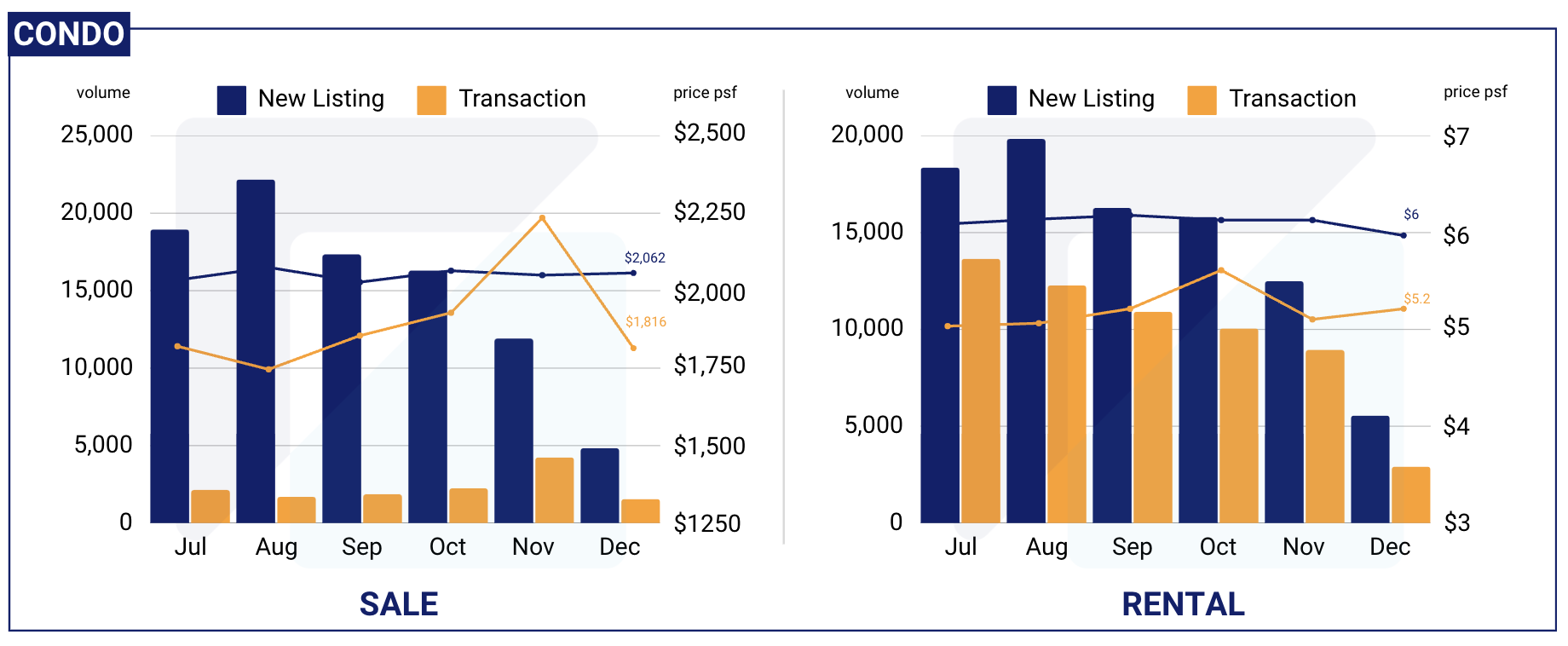

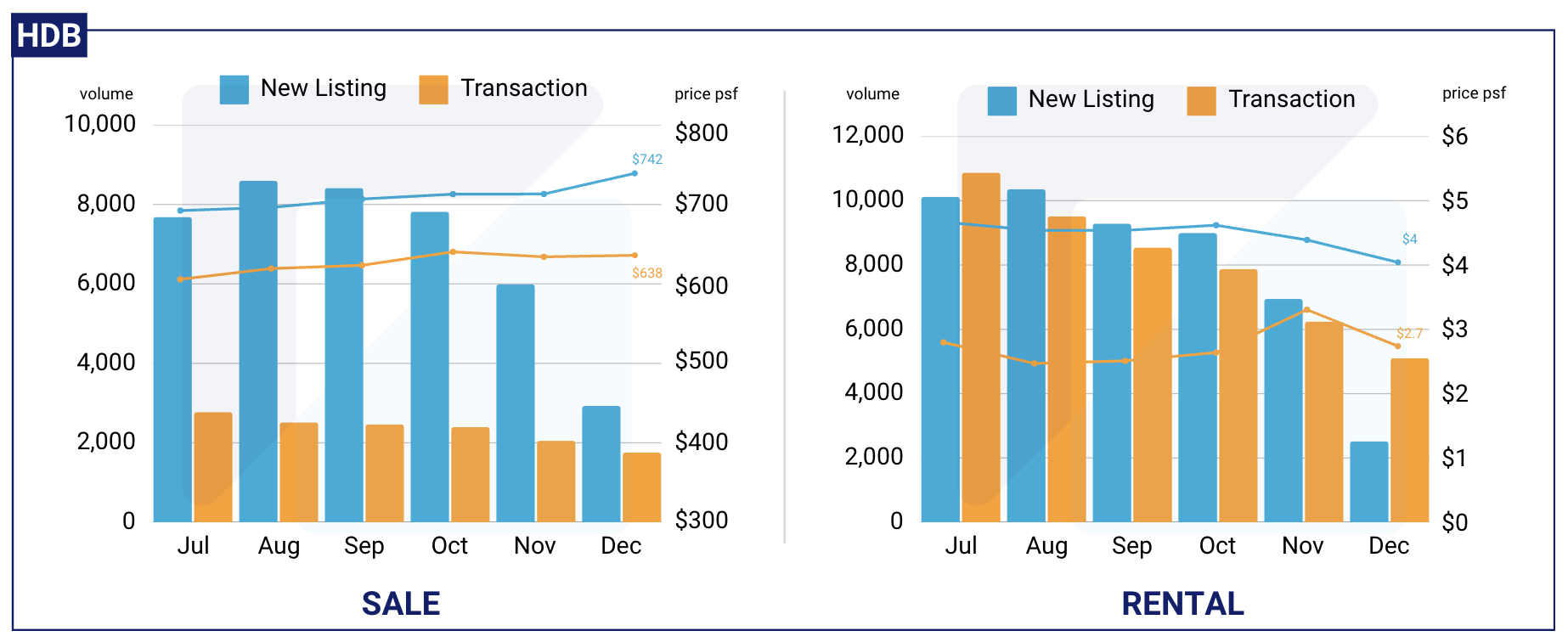

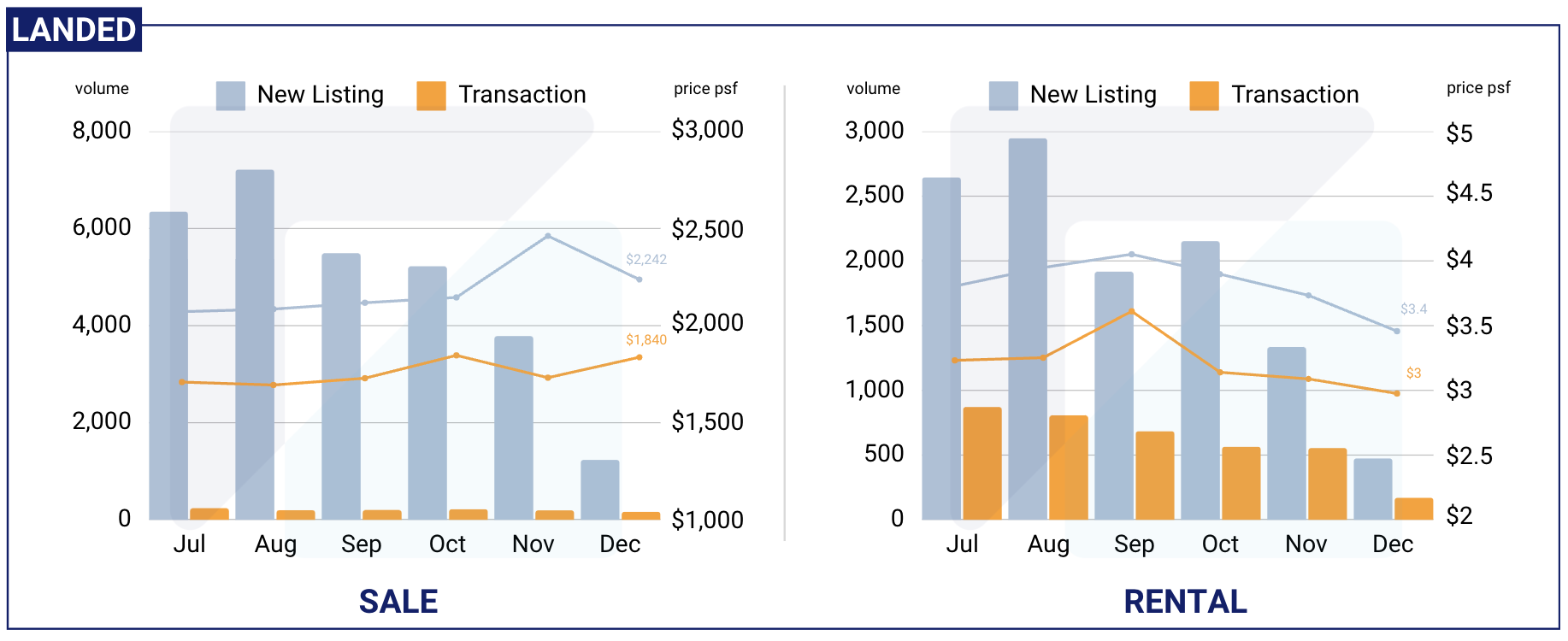

Residential Listings (Condo, HDB, Landed) July - December 2024

*New Listing: the total number of listings that are newly added in that particular time period

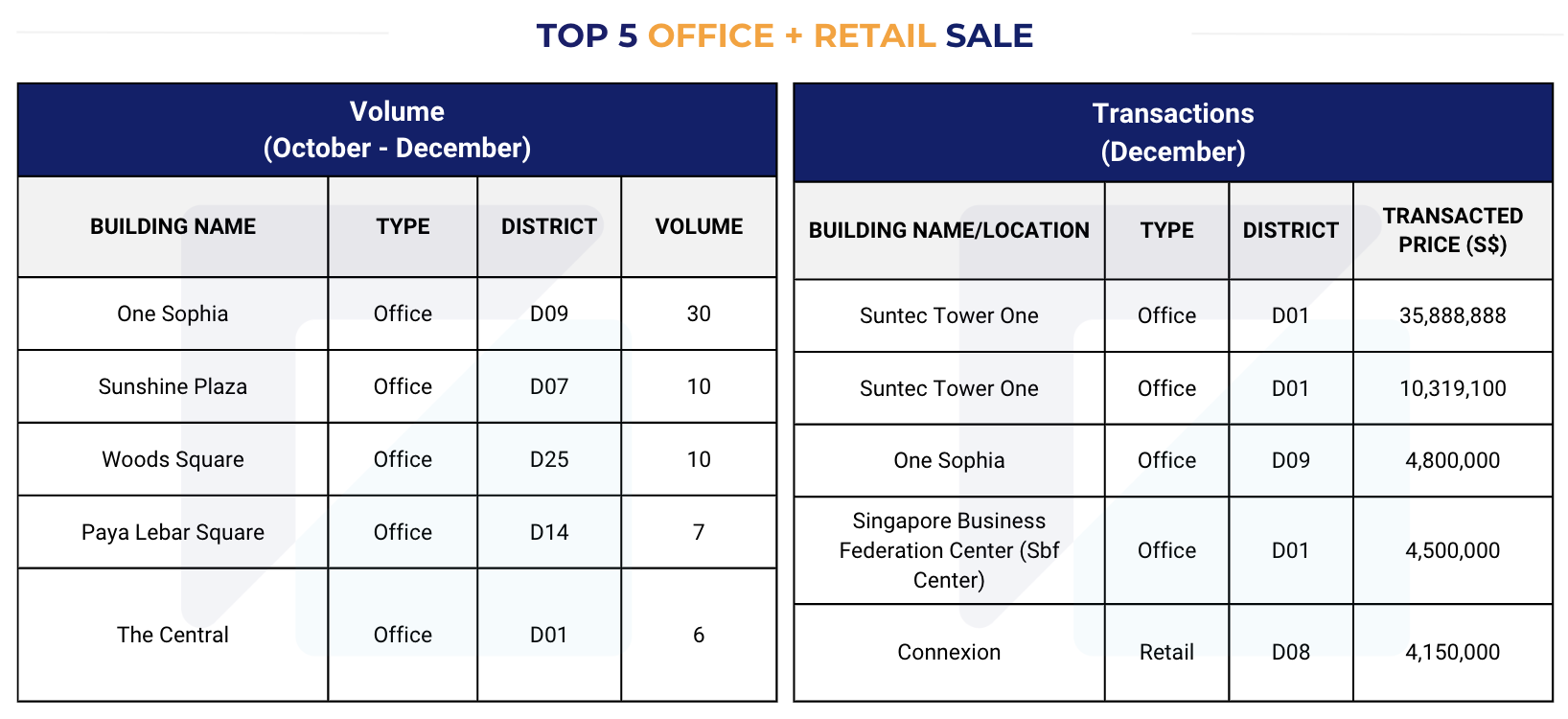

Commercial Snapshot

1. Top 5 Office and Retail Sale (by volume and transacted price) (October - December 2024)

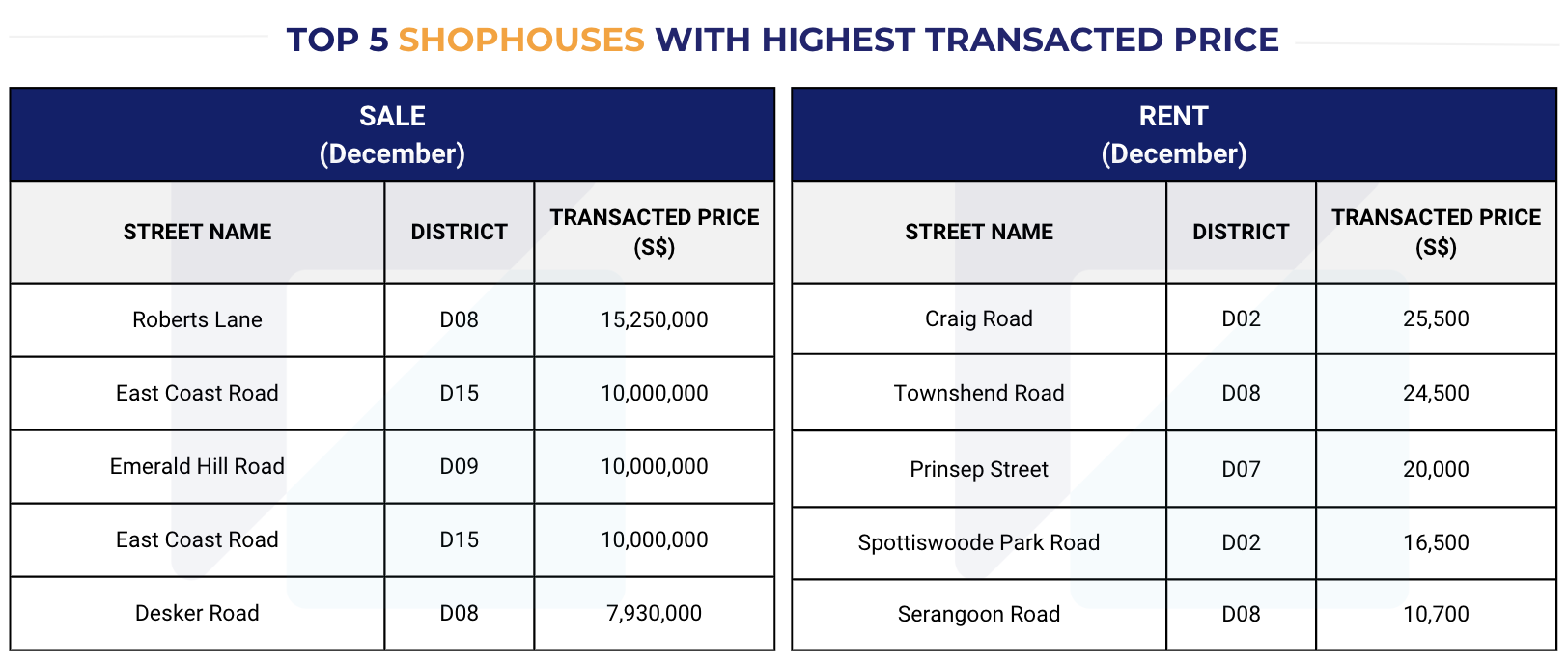

2. Top 5 Shophouses with Highest Transacted Price (Sale and Rent) in December 2024

*The data presented in this monthly report is accurate as of 17 January 2025. While we strive to provide the most up-to-date information available, it is important to note that there may be a small percentage of transactions that experience delays in reporting from the respective agencies and government sources. Therefore, the data provided should be interpreted with this in mind, and you are encouraged to verify the latest information for your specific needs.

*All analytical and visually interpreted data in this report is powered by RealAgent, a comprehensive app for real estate professionals. It offers a blend of property information, real-time transaction data, and advanced analytics, ensuring accurate and up-to-date insights for our report. Find out more about RealAgent here.

Download the full report (PDF) here: 122024 - Singapore Property Market Snapshot.pdf

To know more about our data-driven real estate solutions, contact us here.

Continue to read our previous monthly reports:

Singapore Property Market Snapshot - November 2024

Singapore Property Market Snapshot - October 2024

Singapore Property Market Snapshot - September 2024

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics (REA), we revolutionise the real estate industry with cutting-edge AI technology. Leveraging advanced data science and machine learning, we offer tailored data solutions for real estate professionals and enthusiasts. Our products, including market insights, RealAgent suite (for agents), and RealInsight (for developers, investors, institutional clients), provide end-to-end solutions for informed decision-making. Available across Singapore, Malaysia, Hong Kong, and Australia, our offerings ensure you always stay ahead in the dynamic real estate market.

Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.