News > Leasehold vs Freehold Condo: Which One is Better in Terms of Profit?

Leasehold vs Freehold Condo: Which One is Better in Terms of Profit?

7 August 2024

Leasehold vs Freehold Condo: Which one is Better and more Profitable?

It is commonly believed that freehold condos are a more desirable investment due to their perpetual ownership, which provides long-term security and stability. Investors often perceive freehold properties as having greater potential for appreciation over time, as they do not face the risk of the lease expiring. Conversely, leasehold condos are often seen as less favourable because their value may diminish as the lease term progresses.

This study aims to compare the performance between leasehold and freehold condos to provide potential investors with insights into which might be a better investment option.

Main Findings

Based on our data and analysis, we have arrived at several key findings that intriguingly challenge the conventional belief regarding the profitability of leasehold and freehold condos:

1. Leasehold condo is a better option for those looking for properties that appreciate more rapidly in value, offer better gains, and have lower entry price.

2. During Economic Downturn, Freehold condo is a safer option for investment, offering stable returns and is less volatile to market condition.

3. For younger projects (less than 20 years old), leasehold condo yields more returns (on average 3 times higher than freehold condo).

4. For older projects (more than 20 years old), leasehold and freehold condos are relatively equally profitable.

5. A leasehold en bloc yields more profit for the homeowner than a freehold en bloc.

Definitions/Meaning

Leasehold condos: The purchaser has the temporary right to use and occupy the unit for a specified period, as determined by the lease agreement (typically 99-year lease). Once the lease expires, the property reverts back to the owner or lessor.

Freehold condos: The owner has a perpetual, non-expiring right of ownership to the unit.

For the purpose of this article, we classify 999-year leasehold properties as freehold.

Methodology

The analysis is based on transaction data for leasehold and freehold condominiums in Singapore from 2014 to 2024. The data set includes both new sale and resale transactions, focusing on several key metrics such as transacted price PSF, annualised capital gain in both dollar and percentage terms.

The data in this analysis is powered by REA's real-time transaction database, offering the most up-to-date insight into the property market in Singapore. Read more about our real-time data here.

*Please be advised that the data and analysis presented are intended for reference purposes only. They do not encompass additional factors such as taxes, legal fees, and other associated expenses.

Analysis

1. Average Transacted PSF between Leasehold and Freehold Condos:

Understanding the price per square foot (PSF) trends for new sale and resale transactions can help you predict future prices and determine the best time to invest in properties.

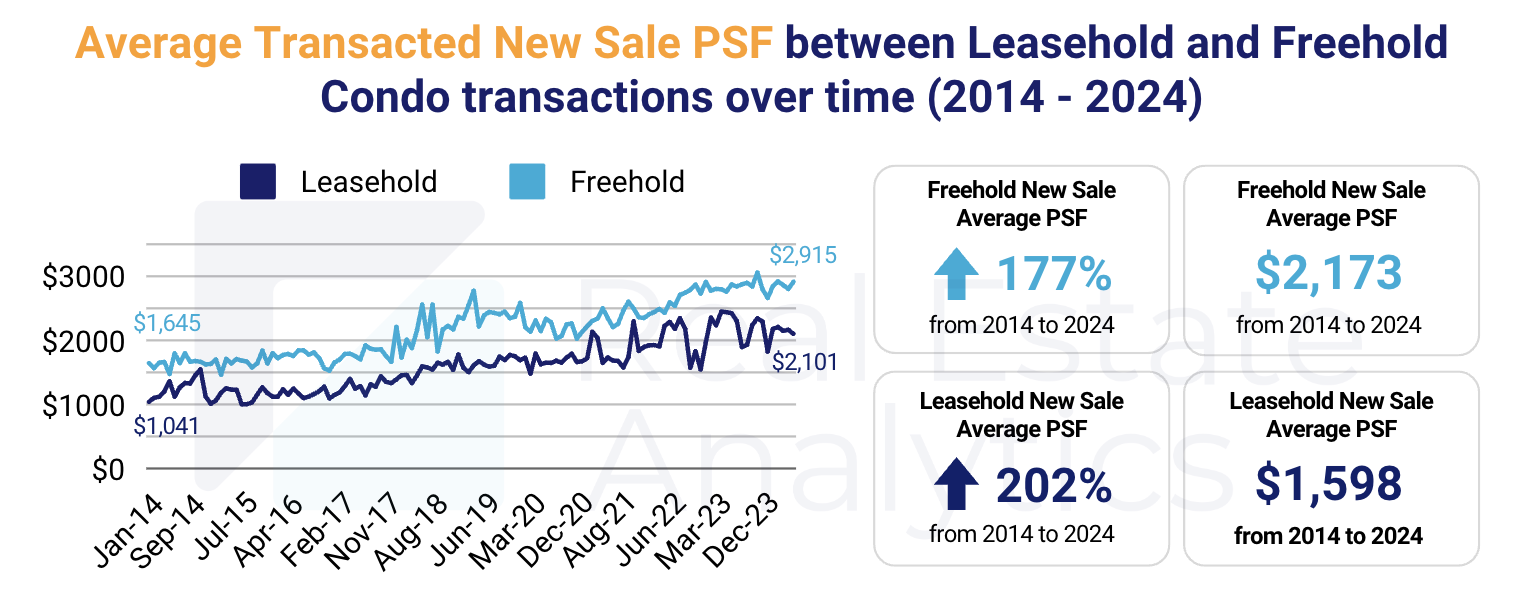

Over the past 10 years, the average PSF of leasehold new sale increased by 202%, while that of freehold increased by 177%. The average gap between the new sale PSF of leasehold and freehold condos is $575, or 38%. During the period, despite strong fluctuations, the gap has widened by $210 on average.

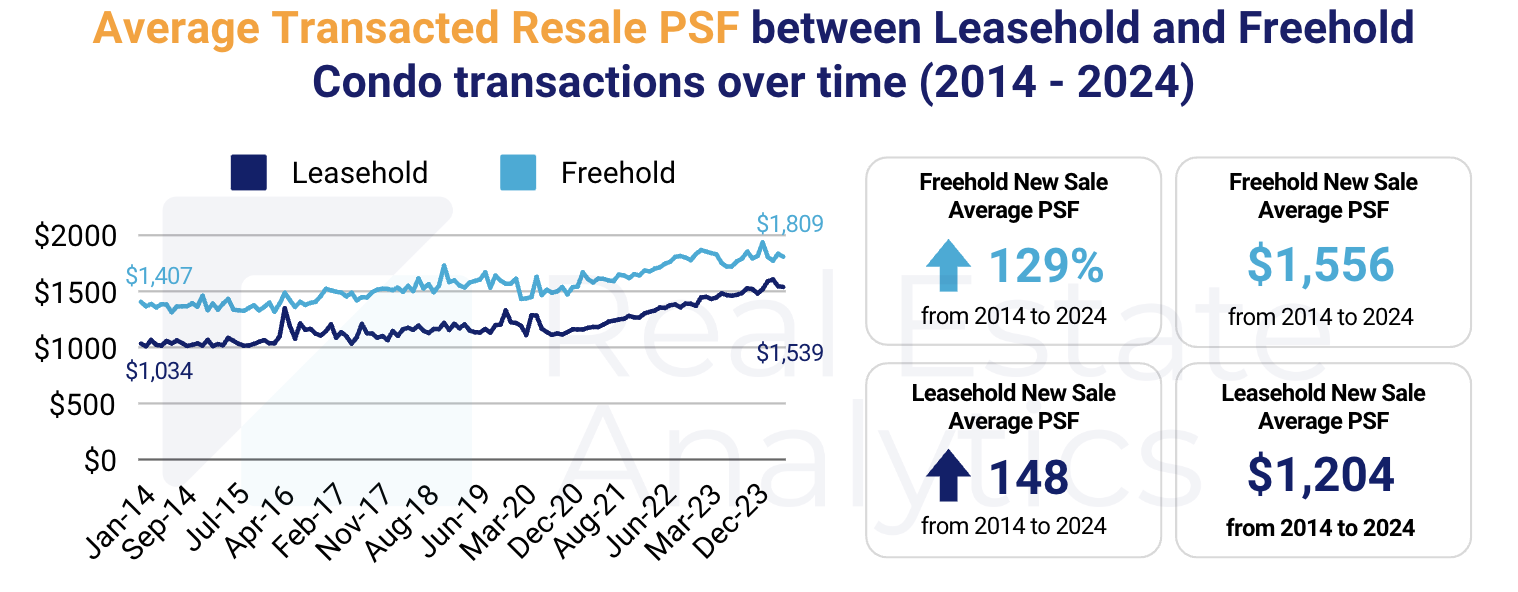

For resale transactions, the average PSF of leasehold condos increased by 148%, while that of freehold condo increased by 129%. The resale market exhibits a significant gap similar to the new sale market. The average gap of $352 PSF, or 30%, over the period indicates that leasehold condos have appreciated more rapidly. Interestingly, the gap has narrowed by $103 from 2014 to 2024.

Over the 10-year period examined, leasehold condos have shown a remarkable potential for higher profits. For instance, if you bought a new leasehold condo in January 2014 at $1,041 PSF and resold it in June 2024 at $1,539 PSF, your profit could be as high as 48%. In comparison, buying a new freehold condo at $1,645 PSF and reselling it at $1,809 PSF during the same period would yield only a 10% profit.

Looking at transacted PSF, leasehold condo is a better option for those looking for properties that appreciate more rapidly in value, offer better gains, and have lower entry price.

2. Profitability between Leasehold and Freehold Condos

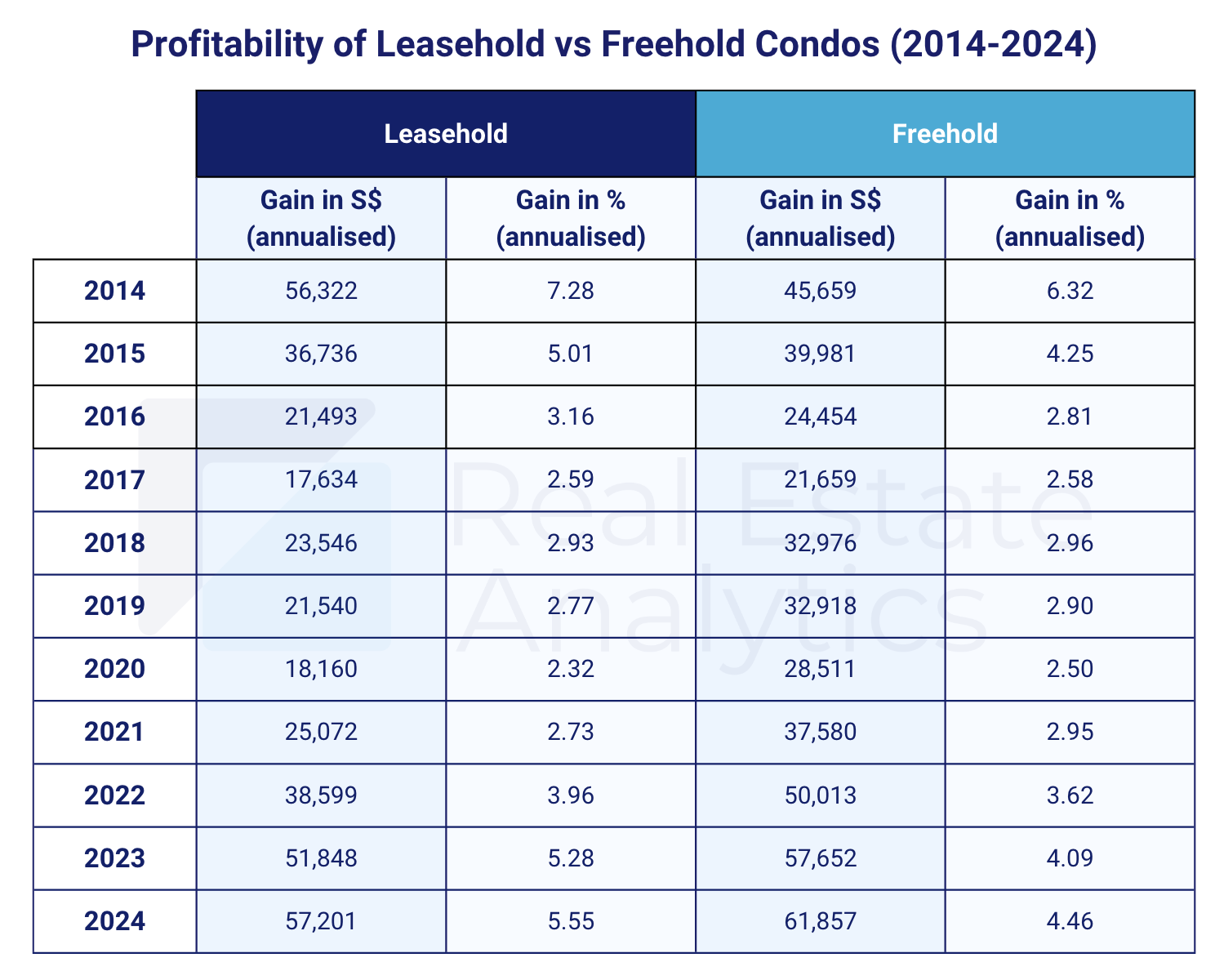

Leasehold condos generally outperformed freehold condos in terms of annualised gain percentage, averaging 0.38%. However, freehold condos offer higher gains in dollar terms, averaging 25% more than leasehold condos.

In favourable economic conditions (e.g., 2014, 2023-2024), leasehold condos tend to provide higher annual returns in percentage terms. However, during challenging times such as the economic slowdown from 2015-2017 and the COVID-19 pandemic from 2019-2021, leasehold condos experienced more significant drops in gains. This volatility suggests that freehold condos are a safer investment, especially during market downturns, offering more stable returns.

3. Profitability between Leasehold and Freehold Condos by age

For younger projects (1-20 years), leasehold condo resales tend to generate more favourable returns. This is especially true for projects less than 10 years old, where leasehold condos yield 3 times higher gains compared to freehold condos. The higher starting price of freehold condos means it takes longer for sellers to break even and start realising gains.

As a condo reaches the 20-year mark, the profitability in percentage terms of freehold condos increases substantially and starts to catch up with leasehold condos.

For projects older than 30 years, the gain for freehold condos surpasses that of leasehold condos. However, the difference in return between the two types are not significant, indicating that older leasehold condos perform just as well as freehold condos and can be equally profitable. This contrasts with the normal belief that leasehold condos lose value as they age due to lease decay.

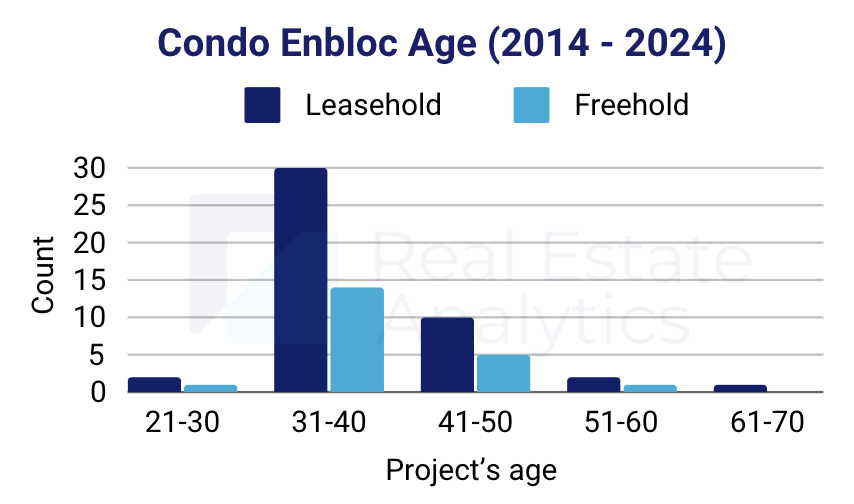

It’s important to note that not all condos will last until the end of their lease period or indefinitely, as they might undergo an enbloc sale. Typically, most condos go enbloc at 31-40 years old, with leasehold condos having a higher chance to have an en bloc sale compared to freehold condos.

Based on past data, leasehold en-blocs generally yield higher gains for homeowners compared to freehold en-blocs. Older leasehold projects tend to yield greater returns. However, this comes with higher risk, as the likelihood of an en-bloc sale decreases as the project ages, which can affect their attractiveness as an investment option.

*Data is accurate as of the published date of this article.

* Disclaimer: Our real-time database is updated every time a transaction is submitted by an agency. While we strive to maintain the accuracy and completeness of the data, please note that transactions may not always be completed, and information provided may be subject to change or error.

Download the full report (PDF) here: Leasehold vs Freehold Condo: Which one is better in terms of profit?.pdf

To know more about our data-driven real estate solutions, contact us here.

Continue to read our other data insights articles:

$1.54M for a 5-room HDB flat at The Pinnacle@Duxton – setting new high

A 5-room HDB flat sold for record-breaking $1.73 million at Skyoasis @ Dawson (39A Margaret Drive)

$2.2 million in profit after 15 years for a 3-bedroom unit at The Dairy Farm Condo

184% and 199% Gain recorded at Windy Heights and Thomson 800 condos

$4 million in profit at The Sovereign and 150% gain at The Calrose Condos

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics (REA), we revolutionise the real estate industry with cutting-edge AI technology. Leveraging advanced data science and machine learning, we offer tailored data solutions for real estate professionals and enthusiasts. Our products, including market insights, RealAgent suite (for agents), and RealInsight (for developers, investors, institutional clients), provide end-to-end solutions for informed decision-making. Available across Singapore, Malaysia, Hong Kong (China), and Australia, our offerings ensure you always stay ahead in the dynamic real estate market.

Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.