News > Singapore Property Market Snapshot - September 2025

Singapore Property Market Snapshot - September 2025

21 October 2025

Explore how the Singapore Property Market performed in September 2025 below:

Hot Topics in Singapore Property Market September 2025

1. Hougang Two-Storey HDB Shop With Childcare Centre For Sale At $3.85 Mil

A two-storey HDB shop at Hougang’s Block 246 will be up for sale at SRI’s property auction on 29th October 2025. Offered as an owner’s sale, the 2,153 sqft unit has a guide price of $3.85 million ($1,788 psf). The property comprises about 1,152 sqft of commercial space on the first floor, and about 1,001 sqft of residential space on the second floor with two bedrooms and two bathrooms. Read more >>

2. Zyon Grand: CDL And Mitsui’s New 62-Storey Twin-Tower Integrated Development Competitively Priced From $2,689 psf

Scheduled for launch on 25th October 2025, The 706-unit Zyon Grand is located in two 62-storey residential towers along Kim Seng Road. The integrated development’s residential units range from one-bedroom-plus-study apartments of 474 sqft to five-bedroom supreme apartments of 1,819 sqft, topped by a five-bedroom simplex penthouse, with sizes of 2,659 sqft and 2,756 sqft. Read more >>

3. Are Singapore’s Oldest HDB Flats Finally Losing Value? A 2025 Price Update

While both older and newer flats appreciated, the gap is stark: flats above 50 years old rose by just 16.8%, compared to 47% for those below 50. This confirms that older flats are still rising in price, and may have a very high overall price or quantum compared to newer ones, but they are appreciating very slowly compared to their younger counterparts. Read more >>

4. HDB Launches Four Prime Projects In October BTO Exercise, With Highest Subsidy Clawback Of 14%

HDB launched four Prime projects for sale on 15th October in Bishan, Bukit Merah and Toa Payoh as part of its October Build-to-Order (BTO) exercise. Among the four, Berlayar Residences, located at the site of the former Keppel Club, will have a subsidy clawback rate of 14 per cent, the highest to date. Read more >>

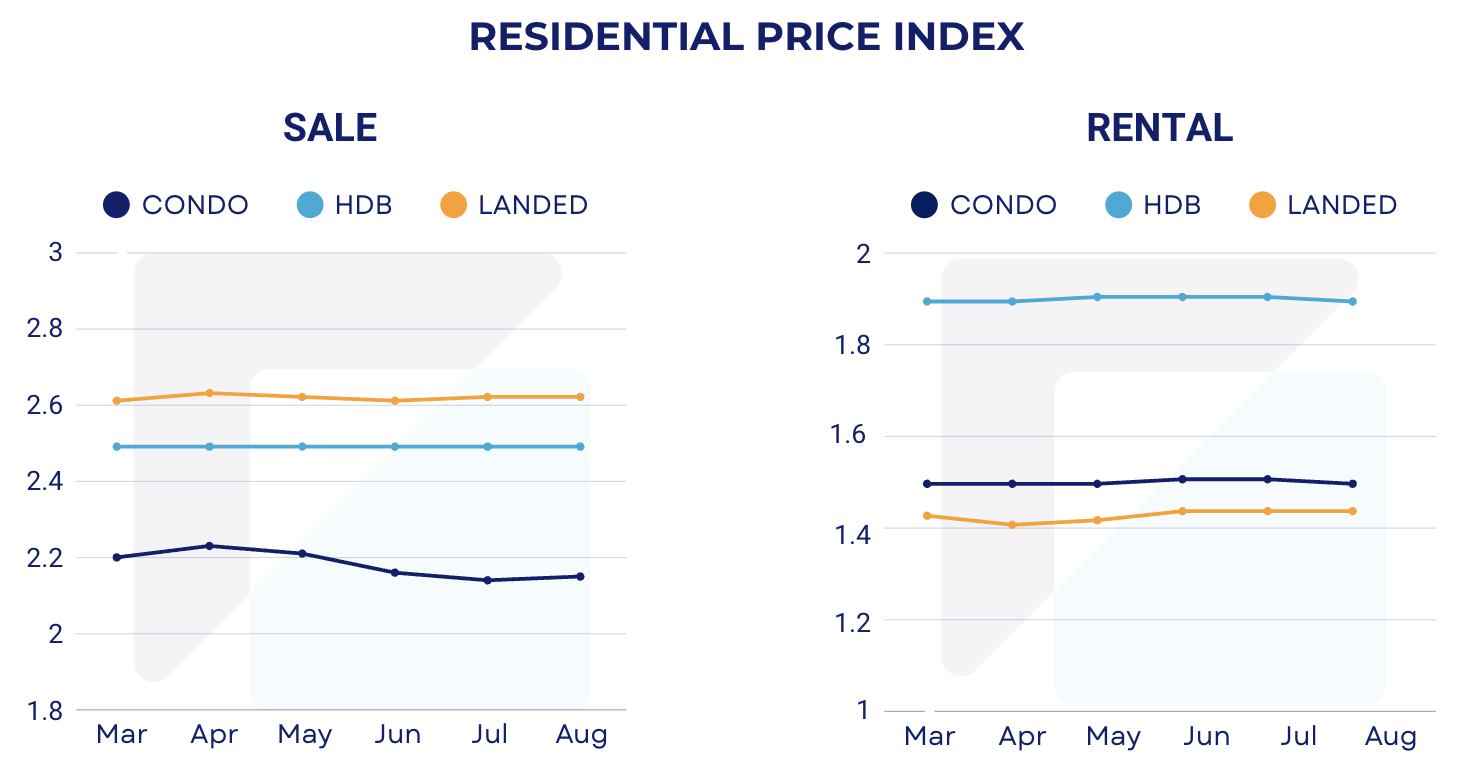

Price Indexes

*Index value is 1 at year 2008

Price Indexes shown are powered by REA Property Price Index - an accurate and objective indicator of the real estate market performance. Read more about our index here.

1. Residential Property Price Index (Condo, HDB, Landed)

2. Commercial Price Index (Office)

Residential Property Snapshot

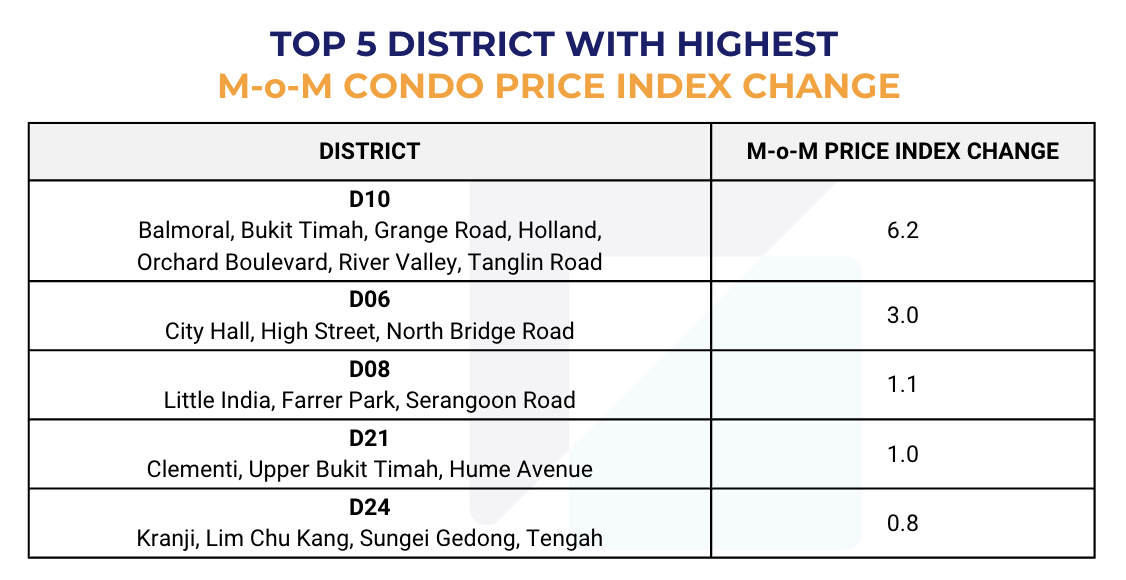

1. Top 5 Districts with Highest Month on Month (M-o-M) Index Change

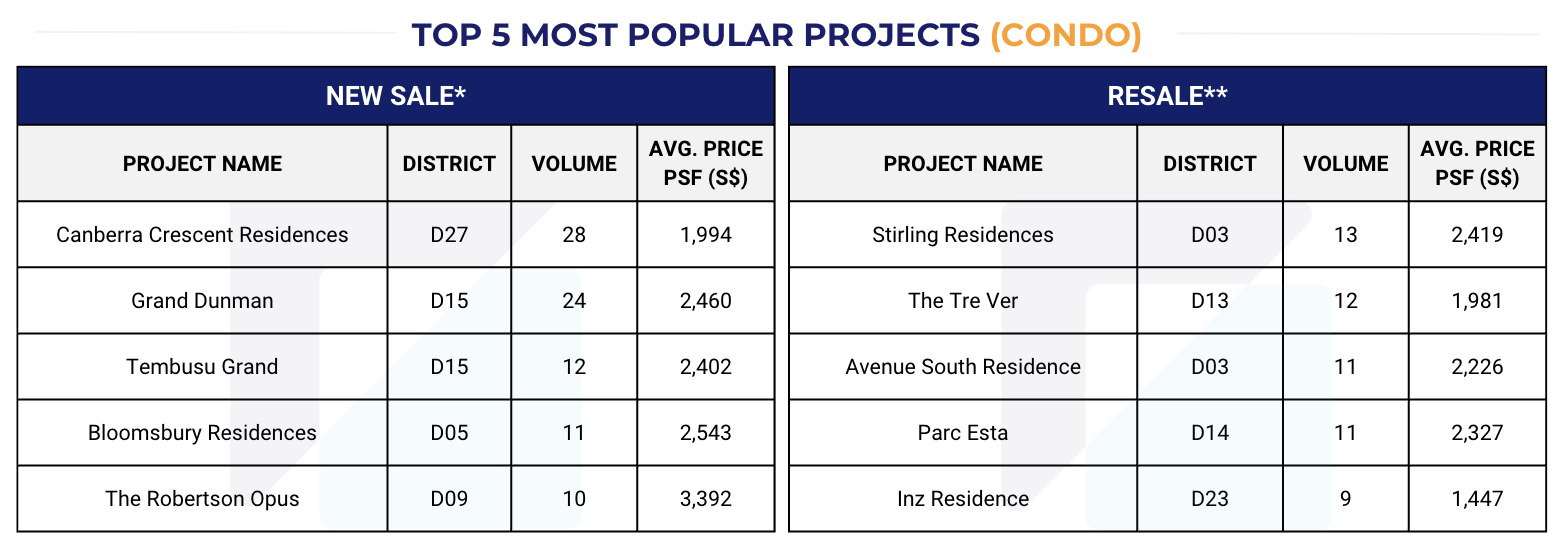

2. Top 5 Most Popular Condo Projects in September 2025

For Condo new sales, the most popular projects with highest transaction volumes in September are: Canberra Crescent Residences, Grand Dunman, Tembusu Grand, Bloomsbury Residences & The Robertson Opus.

For Condo resale, the most popular projects are: Stirling Residences, The Tre Ver, Avenue South Residence, Parc Esta & Inz Residence.

*New Sale: The sale of a unit direct by a developer before the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

*Resale: The sale of a unit by a developer or subsequent purchaser after the issuance of the Certificate of Statutory Completion and the Subsidiary Strata Certificates of Title or the Certificates of Title for all the units in the development.

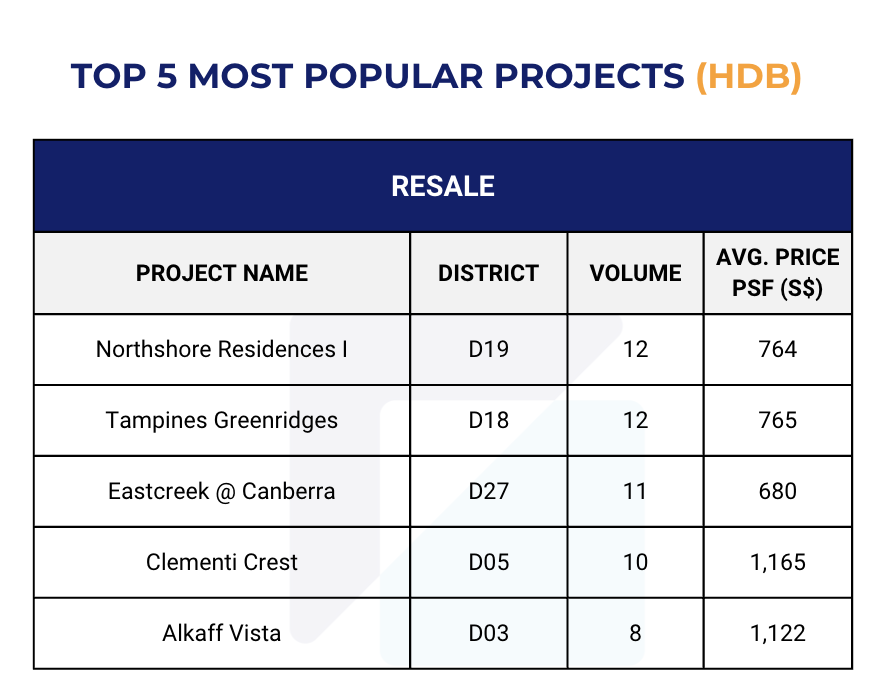

3. Top 5 Most Popular Projects (HDB) in September 2025

The most popular HDB projects with highest transaction volume in September are: Northshore Residences I, Tampines Greenridges, Eastcreek @ Canberra, Clementi Crest & Alkaff Vista.

4. Top 5 Highest Transacted Price (Condo) in September 2025

The most expensive Condo transaction in September 2025 is another unit at 21 Anderson, this time a 5-bedroom new unit which was sold at $24 million for a total area of 4,489 sqft ($5,347 PSF).

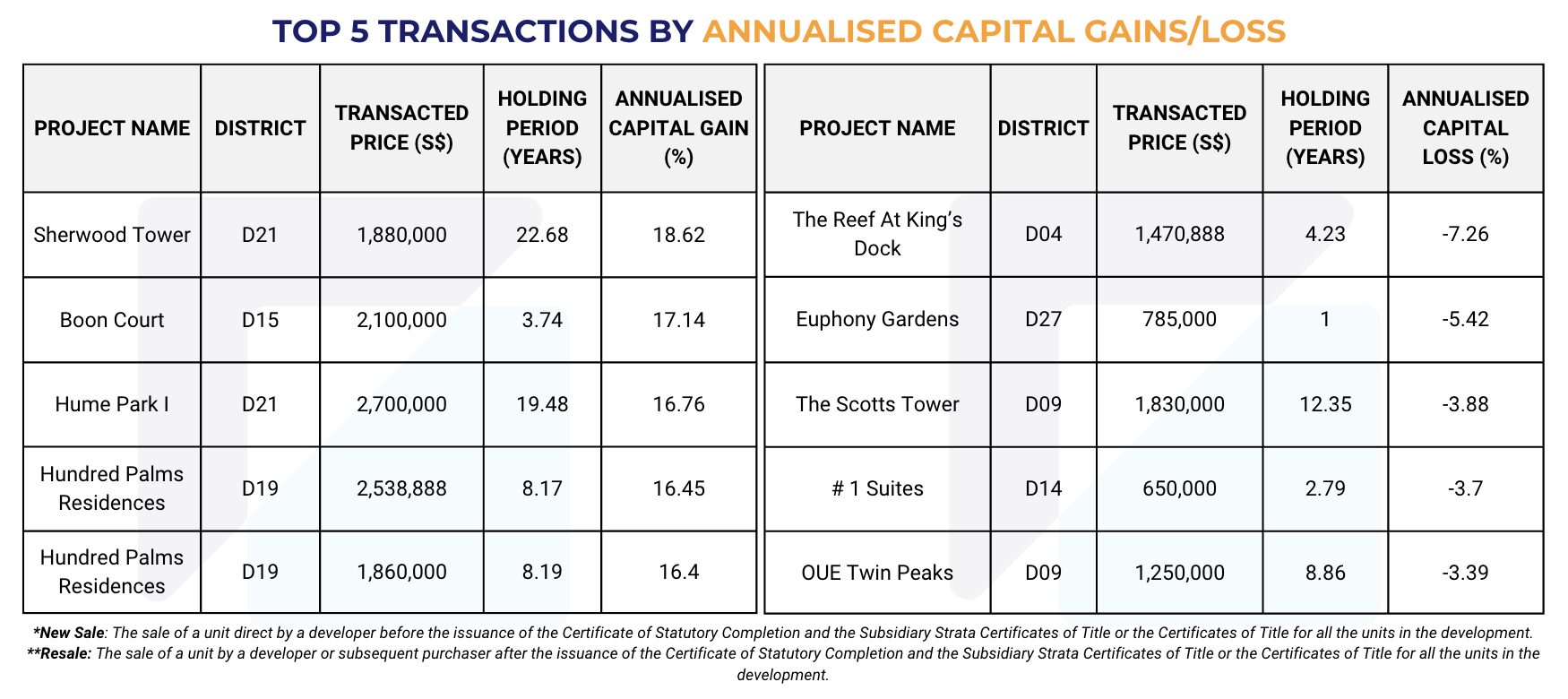

5. Top 5 Transactions by Annualised Capital Gain/Loss in September 2025

The most profitable Condo transaction in September 2025 happened at Sherwood Tower in D21 after being held for 22.68 years, recording an 18.62% annualised capital gain.

The highest annual loss percentage of the month was seen in a unit at The Reef At King's Dock in D04 after a holding period of 4.23 years, which recorded an annual loss of 7.26%.

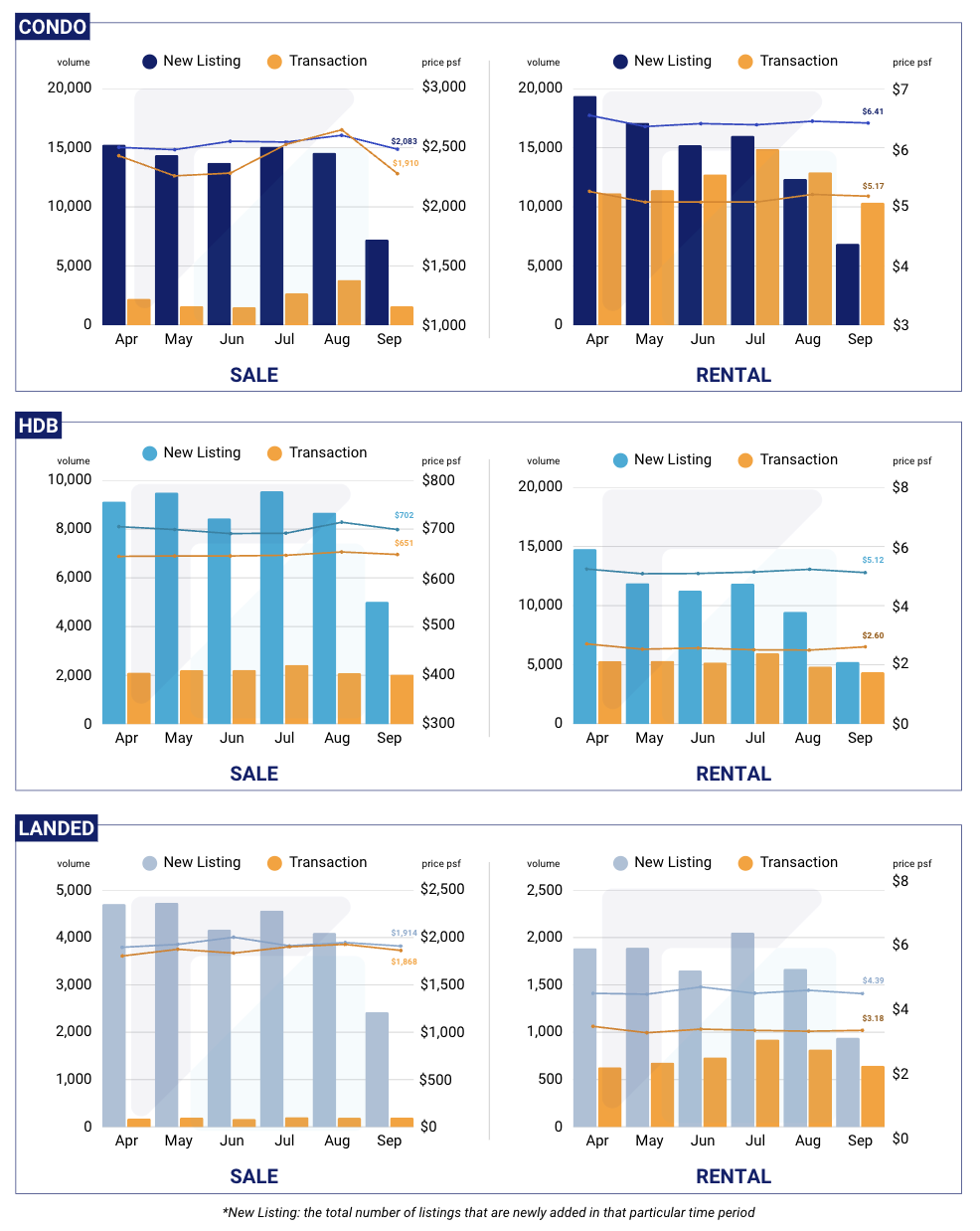

Residential Listings (Condo, HDB, Landed) April 2025 - September 2025

*New Listing: the total number of listings that are newly added in that particular time period

Commercial Snapshot

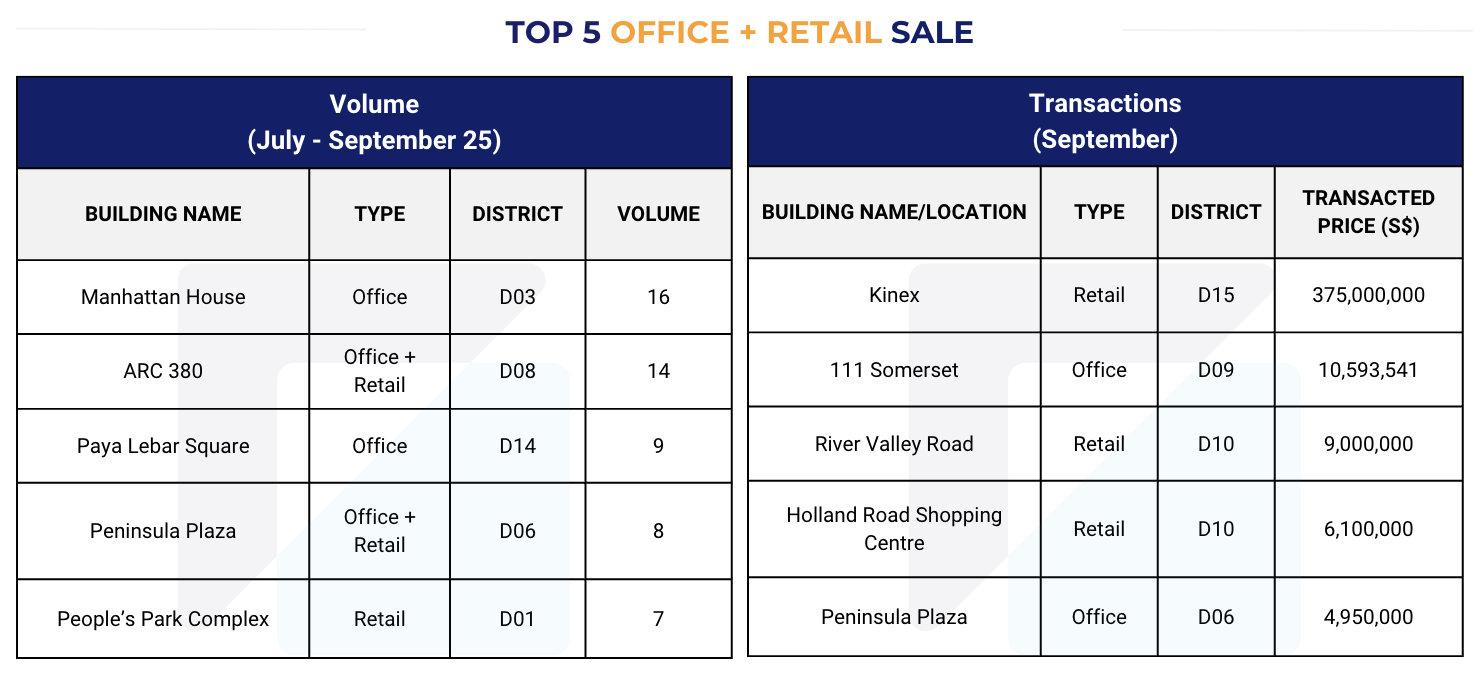

1. Top 5 Office and Retail Sale (by volume and transacted price) (July 2025 - September 2025)

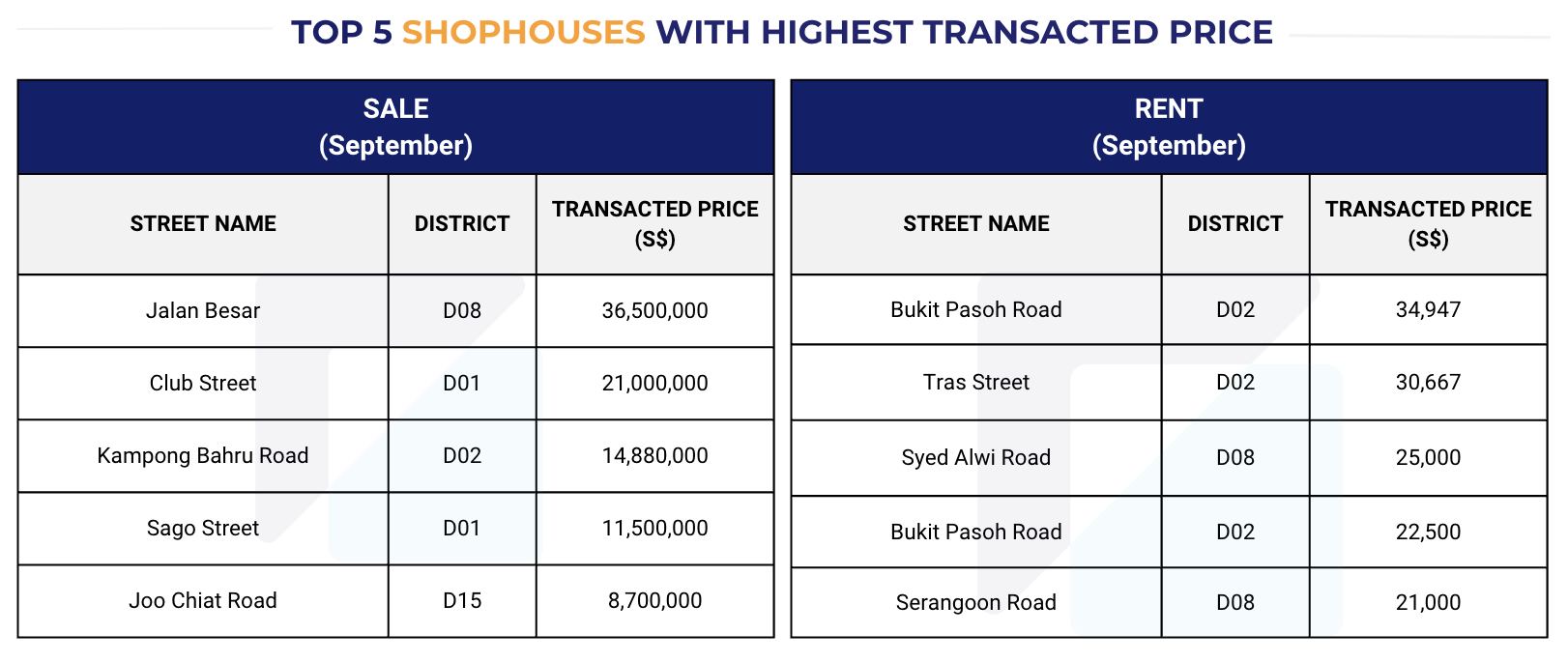

2. Top 5 Shophouses with Highest Transacted Price (Sale and Rent) in September 2025

*The data presented in this monthly report is accurate as of 17 October 2025. While we strive to provide the most up-to-date information available, it is important to note that there may be a small percentage of transactions that experience delays in reporting from the respective agencies and government sources. Therefore, the data provided should be interpreted with this in mind, and you are encouraged to verify the latest information for your specific needs.

*All analytical and visually interpreted data in this report is powered by RealAgent, a comprehensive app for real estate professionals. It offers a blend of property information, real-time transaction data, and advanced analytics, ensuring accurate and up-to-date insights for our report. Find out more about RealAgent here.

Download the full report (PDF) here.

To know more about our data-driven real estate solutions, contact us here.

Continue to read our previous monthly reports:

Singapore Property Market Snapshot - August 2025

Singapore Property Market Snapshot - July 2025

Singapore Property Market Snapshot - June 2025

Singapore Property Market Snapshot - May 2025

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics (REA), we revolutionise the real estate industry with cutting-edge AI technology. Leveraging advanced data science and machine learning, we offer tailored data solutions for real estate professionals and enthusiasts. Our products, including market insights, RealAgent suite (for agents), and RealInsight (for developers, investors, institutional clients), provide end-to-end solutions for informed decision-making. Available across Singapore, Malaysia, Hong Kong (China), and Australia, our offerings ensure you always stay ahead in the dynamic real estate market.

Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.