News > Should you sell your condo before or after TOP? A look at the profitability of New Sale to Subsale and New Sale to Resale Transactions

Should you sell your condo before or after TOP? A look at the profitability of New Sale to Subsale and New Sale to Resale Transactions

4 March 2024

Investing in new launches has long been favoured by real estate enthusiasts. Yet, the optimal timing for selling remains a pressing dilemma: Should one wait until the project attains its Temporary Occupation Permit (TOP), or capitalise on a satisfactory price earlier?

With the recent surge in new projects slated for launch in the market, the question of optimal timing for selling becomes increasingly relevant. With this in mind, we've tapped into our extensive real-time database to provide clarity on this crucial matter.

Main Findings

- Buyers’ tendency is towards buying a new launch and selling before TOP (New Sale to Sub-sale)

- Annualised capital gains for both types of sale are similar (difference by 0.5%)

- New Sale to Sub-sale incurs half the loss quantum of New Sale to Resale transactions.

- The difference in annualised loss between the 2 sale types is insignificant.

Definitions

Temporary Occupation Permit (TOP): a temporary permit that allows homeowners to occupy their residential unit, even before all construction work is fully completed.

New Sale to Sub-sale: Transactions that were made before a project obtains TOP

New Sale to Resale: Transactions that were made after a project obtains TOP

Methodology

We've compiled sales transaction data from projects slated for completion between 2019 and 2024, focusing on transactions from 2016 onwards to ensure relevance and fairness in our analysis.

For this report, we exclusively consider transactions labeled as either New Sale to Sub-sale or New Sale to Resale.

We extracted data on return amounts and annualised return percentages, conducting a comparative analysis to assess the performance of these two sale types.

*Please be advised that the data and analysis presented are intended for reference purposes only. They do not encompass additional factors such as taxes, legal fees, and other associated expenses.

Analysis

1. How prices move before and after TOP

It is more common to look at the price trend when assessing the right time to sell a property. We have selected 2 projects: one completed before and one completed after COVID-19, to examine its impact on price and the overall movement of price before and after TOP date.

Botanique At Bartley: D19, Launched 2015, Completed 2019

Source: rea-insight.com

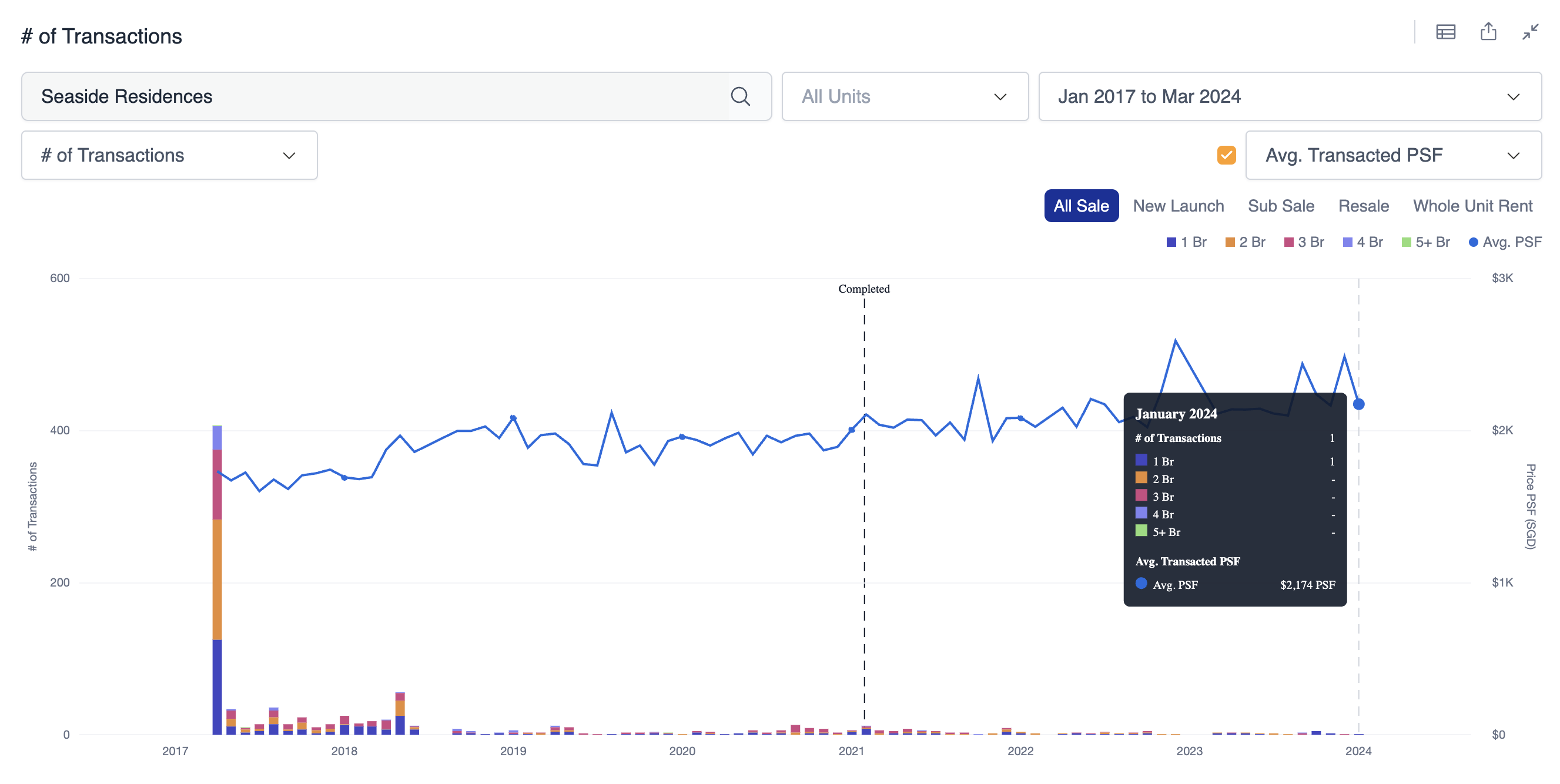

Seaside Residences: D15, Launched 2017, Completed 2021

Source: rea-insight.com

Botanique at Bartley witnessed a consistent upward trend in average price per square foot (PSF), with the most significant growth occurring after TOP date. Similarly, Seaside Residences also experienced an overall upward price trend, with stronger growth observed post-completion.

Both projects encountered a slowdown in price growth due to the COVID-19 pandemic, particularly noticeable between 2020 and 2022. However, despite this temporary setback, both maintained their upward trajectory in overall price movement.

While the 2 examples show that price moves higher after TOP date despite the impact of COVID-19, it is not sufficient to conclude selling after TOP is inherently more profitable than selling before TOP. Hence, we moved on to examine the average gains and losses between selling before and after TOP to evaluate the potential returns and risks associated with these 2 sale types.

2. ANALYSIS: Profitability

The data presented in the table indicates a tendency of buyers to sell their new launch condos before TOP, as evidenced by the transaction count of New Sale to Subsale. However, it's worth noting that the likelihood of turning a profit from selling a property before TOP is slightly lower compared to selling it after TOP.

Interestingly, investing in CCR poses a higher risk of unprofitable transactions compared to OCR and RCR, regardless of whether the sale occurs before or after TOP. This is constant to our findings in another data insight article, which showed that most of the unprofitable condos are located in the Central Area.

Data reveals that on average, the difference in gain between selling before and after TOP is not significant. Though selling before TOP might yield a slightly lower gain (by $15,000), the annualised capital gain is higher by 0.5%, suggesting higher returns per year compared to selling after TOP.

On the other hand, the average loss of selling before TOP is half that of selling after TOP. However, annualised capital loss is not significantly lower. This suggests while selling before TOP incurs lesser quantum loss, the difference in loss incurred per year for both sale types is minimal.

Investing in CCR may seem lucrative with high gains, but it yields the lowest annual returns compared to RCR and OCR. It also carries the highest average loss. In RCR, New Sale to Subsale transactions offer more favourable returns with significantly lower losses. As for OCR, although annualised gains are higher for New Sale to Subsale, losses per year are also greater by 1%.

3. ANALYSIS: by District

For New Sale to Subsale, D23 emerged as the top performer, boasting an impressive average annualised returns percentage of 8% and a substantial returns amount of S$161,000. Conversely, D18 exhibited the weakest performance with an annualised returns percentage of -4.25% and a loss amount of -S$89,000.

For New Sale to Resale, D20 took the lead with a notable annualised returns percentage of 5.69% and an impressive returns amount of S$376,000. In contrast, D09 experienced the poorest performance, with an annualised returns percentage of -1.46% and a returns amount of -S$190,000.

*All data presented in this article are powered by RealAgent and RealInsight - REA’s innovative tools that offer a blend of property information, real-time transaction data, and advanced analytics. Find out more about RealAgent here and RealInsight here .

Download the full report (PDF) here: Should you sell your condo before or after TOP - A look at the profitability of New Sale to Subsale and New Sale to Resale Transactions.pdf

To know more about our data-driven real estate solutions, contact us here.

Continue to read our other data insights articles:

$7.066M in profit recorded at Ardmore Park

The Arc At Draycott reached new high for 2-bedroom unit since 2007

Singapore Property Market Snapshot - January 2024

About Us

Leading Asia Real Estate AI Provider

At Real Estate Analytics, we're revolutionising the real estate industry with our cutting-edge AI technology. By applying advanced data science in real estate industry, and providing customised services for people with various property needs, our market trends and insights, agent enhanced tools, and REA Developer Suite deliver realistic and reliable end-to-end solutions that enables everyone can make their informed decisions. Our solutions are available across Singapore, Malaysia, Hong Kong (China), and Australia. Explore Our Seamless Data-Driven Real Estate solutions here.

Our data insights blog uses data-based evidence to examine popular trends and misconceptions in the real estate industry, providing valuable insights for informed decision-making.